Bessent believes that Trump will soon discuss trade issues with Xi.

China’s manufacturing PMI shows slight improvement, but contraction continues; non-manufacturing sector remains in expansion despite cautious sentiment

Underwhelming Momentum in Manufacturing

Looking at the May numbers from the National Bureau of Statistics, we see a mix of small improvements but an overall lackluster performance. The manufacturing PMI stands at 49.5, an improvement from April’s 49.0, but it still indicates the sector is contracting, just at a slower pace. A PMI below 50 shows a decline in general activity. Notably, large companies reported growth with readings above 50, while medium and smaller firms struggled. This gap creates complicated signals across production levels and demand. The production sub-index increased to 50.7, giving a hint of optimism, yet new industrial orders rose only slightly to 49.8. While this represents some improvement, it does not signal a full return of demand. Employment remains a challenge. With a figure of 48.1, job losses are still occurring, though the decline is less severe than in the previous month. Stronger hiring would signal a more consistent recovery. In the non-manufacturing sector, there are signs of growth, but it’s not particularly impressive. The PMI at 50.3 shows slight expansion but falls short of expectations. When forecasts were for 50.6, a number just above the break-even point suggests weaker service momentum than policymakers envisioned. The decline in construction activity to 51.0 does not provide much reassurance, especially given the sector’s importance in past recovery efforts.Divergence in the Service Sector

Examining the service sector further reveals a split between declining and thriving categories. Transport and tech-related areas, such as air, rail, IT, and postal services, are performing well with scores in the mid-50s, indicating strong activity. Meanwhile, real estate and financial services, especially capital markets, are still contracting and struggling even before any new credit or fiscal policy is announced. New orders in the service and construction sectors increased slightly, but at 46.1, they indicate customers are still hesitant. Demand is not robust, and any improvements seem inconsistent. Input and selling prices are also decreasing, but the decline is slowing down. This ongoing price deflation may indicate softer consumption or reluctance to restock materials, a trend to keep an eye on. Workforce numbers remain concerning in the service sector as well. A reading of 45.5 is weak and shows that businesses are not hiring. Even if intentions are steady, actions have not followed through. Despite this, future expectations remain high, suggesting that companies are hopeful but not yet ready to act. A score of 55.9 reflects confidence, but unless new policies lead to real changes, this optimism may not hold much weight. Overall, the key takeaway is the gap between sentiment and actual performance. There is clear anticipation for government support, with further measures expected in mid-June. This might involve coordination with monetary or lending policies. Until those measures are in place, traders should focus on actual data rather than just forecasts. Market responses in equities and rates may remain subdued until we see significant improvements in investment and consumption numbers. Recent months hint at a fragile recovery, but not one that is reliable yet. For now, fluctuations in certain futures contracts suggest that traders are being cautious until stimulus plans are clearly defined and implemented. It’s important to watch for updates on infrastructure spending, measures supporting private businesses, and incentives aimed at boosting consumer demand. Keeping an eye on sector-specific performance—especially in real estate, services, and logistics—will provide the best short-term insights. Changes are happening at a gradual pace, but they remain uneven; trading strategies should reflect this reality. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 30 ,2025

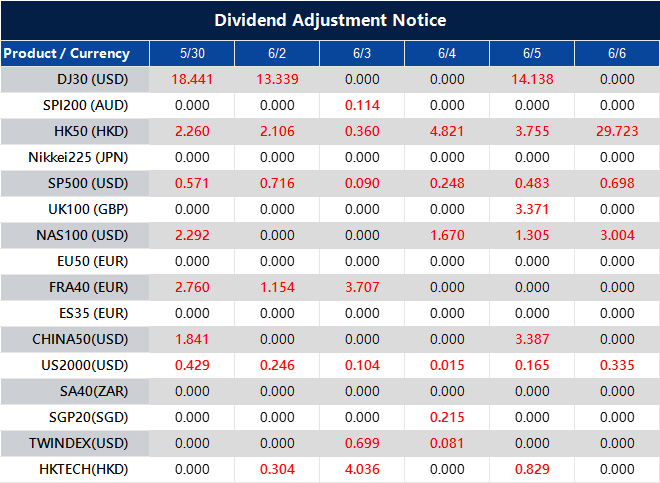

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Notification of Trading Adjustment in Holiday – May 29 ,2025

Dear Client,

Affected by international holidays, the trading hours of some VT Markets products will be adjusted. Please check the following link for the affected products:

Notification of Trading Adjustment in Holiday

Note: The dash sign (-) indicates normal trading hours.

Friendly Reminder:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

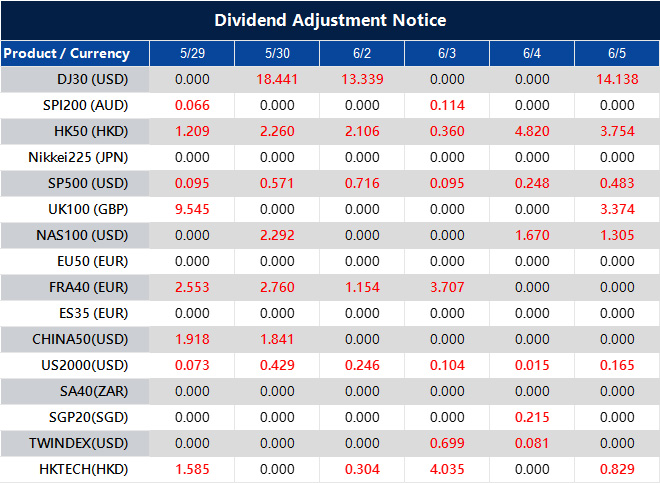

Dividend Adjustment Notice – May 29 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

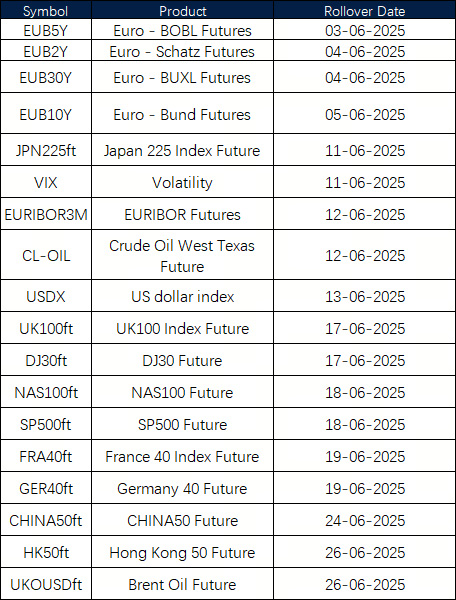

June Futures Rollover Announcement – May 29 ,2025

Dear Client,

New contracts will automatically be rolled over as follows:

Please note:

• The rollover will be automatic, and any existing open positions will remain open.

• Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.

• To avoid CFD rollovers, clients can choose to close any open CFD positions prior to the expiration date.

• Please ensure that all take-profit and stop-loss settings are adjusted before the rollover occurs.

• All internal transfers for accounts under the same name will be prohibited during the first and last 30 minutes of the trading hours on the rollover dates.

If you’d like more information, please don’t hesitate to contact [email protected].

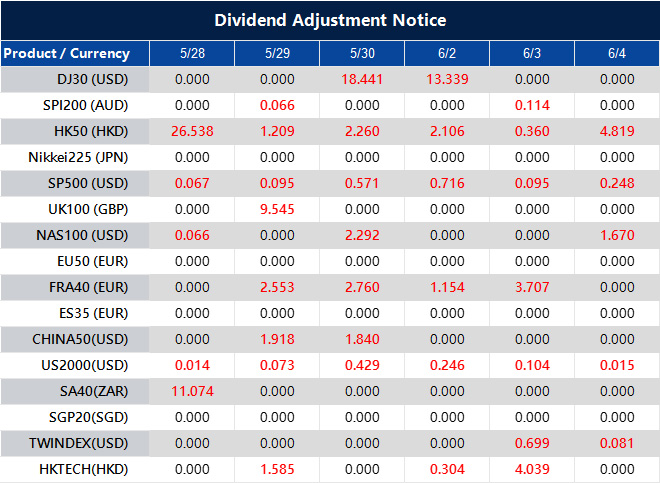

Dividend Adjustment Notice – May 28 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

S&P 500 Holds Ground As Market Awaits Nvidia Results

The S&P 500 hovered just under the 5930 level on Wednesday, trading sideways after bouncing back from a session low of 5855.05. Market participants remained cautious ahead of Nvidia’s eagerly awaited earnings release. A glance at the 15-minute chart reveals that price movements have narrowed into a tight band between 5922 and 5934, with momentum indicators such as the MACD suggesting a waning bullish impulse.

Following Tuesday’s rally, which saw Nvidia’s share price surge more than 4% on optimism surrounding AI-related revenue growth, market sentiment has turned more restrained. Traders are now looking for confirmation that Nvidia can meet the lofty expectations. According to LSEG estimates, the company is forecast to post a 66.2% increase in first-quarter revenue, reaching $43.28 billion.

In the broader macro landscape, US consumer confidence figures came in stronger than expected, lending support to the US dollar and putting a cap on equity valuations as bond yields steadied. The dollar index climbed a further 0.25%, building on Tuesday’s 0.6% advance, while the euro dipped to $1.1304. Yields on longer-dated US Treasuries paused after recent gains, offering temporary respite to equity investors wary of valuation pressure.

Technical Analysis

The SP500 rebounded sharply from the 5855.05 low on 27 May, surging over 80 points to test resistance near 5934.70 in early 28 May trading. The recovery was driven by strong bullish candles with price action lifting above all three moving averages (5, 10, 30), signalling short-term bullish momentum. However, the rally stalled near the prior peak, with the price now consolidating just below resistance.

The MACD shows waning bullish momentum, with histogram bars shrinking and the MACD line approaching a potential bearish crossover. If support at 5920 holds, a second leg higher is possible. Otherwise, a break below the 30-MA could expose the 5900–5890 region for a retest.

Measured Outlook

The next decisive move in the S&P 500 will likely be determined by Nvidia’s results. A strong earnings beat could ignite a rally toward the 5950–5970 region, whereas a disappointment might prompt a drop below the 5900 mark.

With bond market volatility easing and key economic data remaining resilient, the downside risk appears contained in the short term, but a clear catalyst is needed for further upside. For now, the mood remains one of cautious optimism.

Open a live trading account with VT Markets today and take advantage of market opportunities.