China’s Premier Li Qiang discusses new policy tools in Jakarta amidst economic and trade challenges

Amid lower US-EU trade tensions, WTI oil stays above $61.50, continuing its upward trend

Geopolitical Tensions Affecting Oil Prices

Geopolitical tensions are also supporting oil prices as Israel plans military action in Gaza. Worries about increased Iranian oil supply have decreased due to stalled US-Iran nuclear negotiations. However, an increase in oil output could limit price increases. OPEC+ may raise output by 411,000 barrels per day in July and might reverse its 2.2 million bpd production cut by the end of October. WTI Oil, a type of light and sweet crude oil mainly produced in the US, is affected by supply and demand, political instability, and OPEC decisions. Weekly API and EIA inventory reports also influence oil prices by indicating shifts in supply and demand. With WTI near $61.50 per barrel, recent market strength has largely resulted from reduced fears over transatlantic tariffs. The US decision to delay a significant 50% tariff on EU goods until July has eased risk sentiment. Investors are now hopeful for renewed discussions. Von der Leyen’s comments indicate that Brussels is open to trade talks if given more time, providing a temporary boost to market expectations.Short Term Trading Strategies

Nevertheless, postponing tariffs does not eliminate the threat. Resumed tensions in early July could create volatility, particularly if initial trade discussions fail. For energy contracts, any long positions should be approached with caution after the first week of July, especially with fresh data from EIA and API regarding inventory levels. Any calm sentiment could change quickly if rhetoric escalates or timelines slip without concrete outcomes. Geopolitical risks continue to influence market support. Israel’s strong statements about operations in Gaza highlight ongoing instability in the Middle East, but current disruptions in oil supply have not yet occurred. However, shifts in regional dynamics could tighten trading sentiment. Concerns about Iran boosting oil output have somewhat faded. US-Iran talks remain stalled, which reassures traders who were worried about oversupply earlier in the year. Iran’s lack of involvement in meaningful negotiations means Iranian oil remains sidelined, easing some downward pressure on crude prices. Nevertheless, this relief may be temporary. Production remains a concern. OPEC+ has indicated a 411,000 bpd output increase for July but is prepared to reverse the larger 2.2 million bpd cut by late Q3. Traders need to stay alert and track compliance and production updates, which can lead to significant market shifts. If OPEC+ accelerates its production plans, it could greatly affect spot prices and future contracts. The recent price increases are precarious—bolstered by diplomatic delays and temporary stability but vulnerable to supply decisions and sudden tensions. US inventory data will remain a key reference point as it often hints at discrepancies in expected versus actual demand. For short-term strategies, we are focusing on option premiums and implied volatility across contracts due to expire in late summer. The current backwardation isn’t severe, but new inventory builds or insights from OPEC ministers could widen intramonth spreads. Watching the Brent-WTI spread is also important, as it indicates transatlantic flows and export balance changes. Risk management involves being cautious with long or short positions, selectively adding protection or exposure based on shifting price drivers. Every change in geopolitical tone, inventory trends, and production quotas can weigh on positions. We are aligning closely with key data releases and real policy changes rather than just rhetoric. Create your live VT Markets account and start trading now.Neel Kashkari highlights the importance of uncertainty for US businesses and the Fed in a Tokyo speech

Currency Movements

The US Dollar Index showed a slight rebound but was still down 0.30% for the day at 98.82. Over the past week, the US Dollar weakened against several major currencies, with the biggest drop against the New Zealand Dollar. EUR/USD stayed above 1.1400, supported by the ongoing weakness of the US Dollar. Meanwhile, GBP/USD was near a three-year high, benefiting from a weak Dollar, despite cautious market sentiment. Gold prices pulled back slightly from a recent two-week high. Kashkari’s statements highlight how policy choices beyond interest rates are increasingly affecting long-term expectations. When he mentions the stagflationary impact of tariffs, he refers to a troubling combination of slower economic growth and rising prices, which complicates monetary policy. Tariffs increase the cost of imported goods, putting pressure on consumers and raising input costs for businesses, potentially discouraging future investment due to uncertainty. He also indicated that we’ll have to wait until at least September for clearer economic data, suggesting that any policy decisions before then might be premature. The lack of clarity in trade talks encourages a cautious approach. Markets are very responsive to even small changes in negotiations, as tariffs influence both inflation and production, pulling monetary policy in opposing directions.Focus on Immigration Policy

Kashkari’s attention to immigration policy is noteworthy, as it’s not typically a key topic in monetary discussions. A reduced labor supply, especially in sectors already facing shortages, forces employers to either raise wages or limit operations. This situation puts pressure on inflation and can hinder growth if companies scale back. Kashkari’s comments suggest that businesses are already hesitating to build new factories or expand operations, which is an important point to consider. Examining how the markets are reacting, the US Dollar showed a slight increase but did not recover from its recent decline. A 0.30% drop today and broad weakness against major currencies indicate that market sentiment is driven more by overall uncertainty than short-term data. The NZD was the biggest gainer, reflecting regional confidence and the market’s tendency to move away from the Dollar when prompted. The EUR/USD remaining solid above 1.1400 is significant. Its strength is more about the weakness of the Dollar than the strength of the Euro. The same goes for GBP/USD, which is close to three-year highs. Although traders in sterling are cautious due to political uncertainties, they are still reacting quickly to soft Dollar flows. The recent dip in gold prices doesn’t signify a change in trend but is rather a natural cooldown after reaching two-week highs. Commodity responses often lag, and gold’s movements appear to follow shifts in Fed expectations. If market sentiment deteriorates or inflation increases again, gold prices could rise quickly. Given this backdrop, pursuing shorter-term strategies and revisiting hedging approaches makes sense. Options traders should keep an eye on implied volatilities, as periods of low data won’t last long. With September identified as a potential decision point by Kashkari, it seems reasonable to price in a premium for early to mid-autumn. Additionally, any directional trades should incorporate the expectation of slower capital spending by firms and higher price pressures, especially if key policy risks remain unresolved. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 26 ,2025

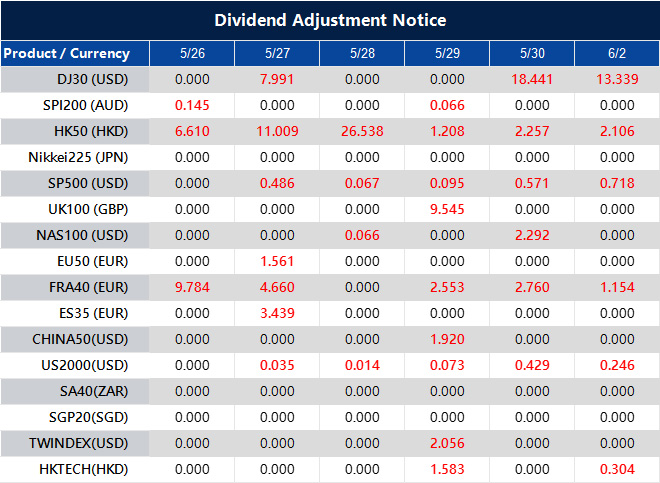

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].