Low-tier data is expected during the European session, but it’s unlikely to have a significant impact. In the American session, the second GDP estimate and jobless claims will be released, with jobless claims potentially influencing the market. Initial claims are projected to be 230K, and continuing claims are expected at 1,970K. The labor market may become more active after previous stagnation, as regional surveys show improved activity.

September Effect In The Stock Market

If you ask a trader when’s a good time to be in the US stock market, you’ll hear plenty of answers.

Some will say earnings season, when big tech names release their numbers and volatility is at its peak. Others might point to the weeks following a Fed rate cut, when optimism floods risk assets. Or even late in the year, when the so-called Santa Claus rally tends to lift equities.

But flip the question around. When’s the worst time to enter the market?

Most traders, new or seasoned, will land on the same answer: September.

What Is The September Effect?

The ‘September Effect’ is one of those quirks of the market that has turned into almost folklore. It refers to the tendency of stocks, especially US indices like the S&P 500, to underperform in September compared to other months. Unlike other seasonal patterns that come and go, this one has persisted for decades.

What makes it so interesting is that it isn’t tied to one specific event, like earnings or Fed decisions. Instead, it’s a mix of psychology, portfolio moves, and calendar quirks that seem to create a drag on equities every year.

The Historical Background Of The September Effect

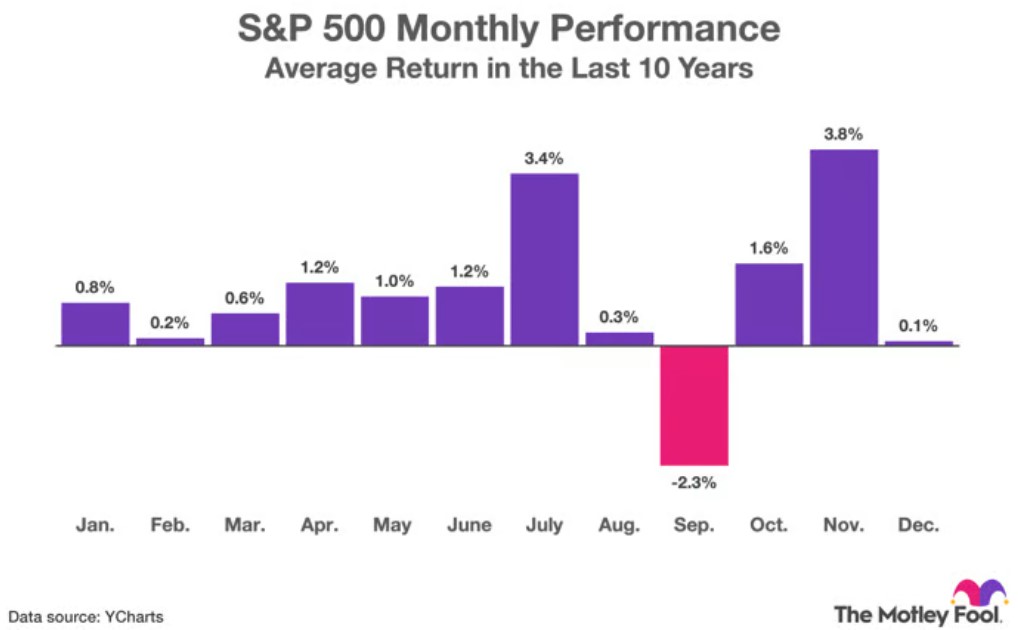

If you plot the S&P 500’s average monthly returns since the last decade, one thing jumps out: September sits at the bottom of the pile. According to historical data, the S&P 500 dropped by an average of 2.3% during September, making it the weakest month on record.

By contrast, most other months show at least modest gains. Not every September ends in red, of course. There are exceptions, like 2010 and 2020, when markets rallied.

But the weight of history is hard to ignore.

It’s why many traders approach September with caution. For some, it’s not about predicting doom but about recognising that probabilities lean towards more turbulence than usual.

Why Does It Happen?

So why does September seem to weigh on stocks more than other months? There isn’t one neat answer. Instead, investors and analysts have pieced together a set of explanations, each carrying some weight but none fully conclusive.

1. Fiscal Deadlines And Policy Jitters

September marks the end of the US government’s fiscal year, which often sparks budget showdowns and debt-ceiling debates. Add in the possibility of Federal Reserve interest-rate moves, and investors tend to tread cautiously. Uncertainty rarely fuels rallies.

2. Corporate Profit-Taking

After summer rallies, both investors and corporations sometimes cash in their chips. For companies, selling assets or shares can help shore up balance sheets before the quarter closes. For traders, it’s simply about locking in gains before any bad news hits.

3. Portfolio Rebalancing

Big institutions, like mutual funds, pensions, and hedge funds, often rebalance quarterly. If their models call for shifting weight toward bonds or alternative assets, September becomes the month to trim equity positions. That steady reallocation can push stocks lower, even if fundamentals haven’t changed.

4. Tax-Loss Harvesting

September also acts as a prelude to year-end tax planning. Investors start shedding underperformers early, using losses to offset gains elsewhere. While perfectly rational, the practice adds another layer of selling pressure at exactly the wrong time.

5. Post-Summer Scrutiny

Markets are quieter in July and August, but September brings everyone back from vacation. That renewed attention often means hard questions about earnings, economic data, and policy, leading to more cautious trading and, at times, selloffs.

6. Reduced Consumer Spending

Summer splurges on travel and leisure taper off once fall routines return. Retailers feel the pinch, and investors, expecting softer revenues, tend to sell off stocks in consumer-driven sectors, pulling indices lower in the process.

7. Herd Mentality

Sometimes the effect feeds on itself. If enough traders believe September will be weak, they sell early. That collective caution creates the very downturn they were trying to avoid.

How To Navigate September Without Losing Sleep

So what should investors and traders do in September? Sit out entirely?

Not necessarily. A few practical steps can help blunt the downside:

– Diversify broadly so that weakness in one pocket of the market doesn’t derail your portfolio.

– Check your allocations and rebalance if needed. September pullbacks can skew weightings quickly.

– Keep some cash handy to scoop up bargains if the dip materialises.

– Lean on quality. Companies with solid balance sheets and reliable cash flow usually ride out turbulence better than speculative names.

– Revisit tax planning, since September volatility can present opportunities to harvest losses.

None of these strategies guarantees you’ll sidestep the chop, but they can at least soften the blow.

Final Thoughts: A Month To Respect, Not Fear

The September Effect isn’t magic, and it’s not fate. It’s part history, part psychology, and part mechanics of the market.

The data may not doom every September to red ink, but the odds of bumpier trading are high enough that investors ignore it at their own risk.

Rather than hunting for big wins, September might be better treated as a defensive month, a time to protect capital, manage exposure, and get positioned for opportunities later in the year.

By October and November, the tone of the market often shifts. But until then, being a little more cautious in September is usually the wiser trade.