In January, Sweden’s Producer Price Index (PPI) increased from 0.1% to 1.7%. This change reflects a notable rise in production costs within the economy.

The PPI measures the average change in prices received by domestic producers for their output. An increase in the index can indicate rising inflationary pressures in the economy.

Market participants often analyse this data to gauge economic trends. Such price movements can influence monetary policies and economic forecasts moving forward.

A rise from 0.1% to 1.7% in the Producer Price Index is not something to gloss over. It shows that production costs have been climbing at a much faster rate than before. This doesn’t just affect Sweden’s domestic producers—it ripples through the wider economy.

When businesses face higher costs, that often translates to higher prices for consumers. Inflationary pressures become harder to ignore. Central banks usually take note of this because it can influence decisions on interest rates. If inflation is running hotter than expected, policymakers may feel compelled to adjust their approach. Higher borrowing costs could follow.

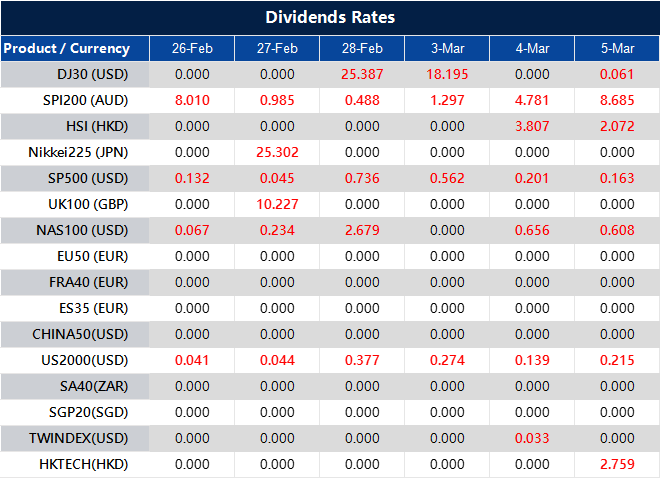

For those trading derivatives, these shifts matter. A rising PPI can influence interest rate expectations, which can impact bond prices, currency valuations, and stock movements. Volatility tends to increase when market participants adjust their positions based on changing economic signals.

Analysts have been keeping an eye on these numbers alongside monetary policy decisions elsewhere. Earlier in the month, Anna noted how inflationary trends could shape future rate moves. Her assessment pointed towards growing concerns over cost pressures in the region. Now, with the latest PPI data, her earlier observations seem even more relevant.

Johan had mentioned that traders should consider how central banks might react to unexpected inflation spikes. His argument was that if inflation picks up pace, future monetary policy adjustments could come sooner than previously thought. The January PPI figures add weight to that possibility.

From our perspective, the current landscape presents new factors to weigh up. If producer prices continue climbing, expectations around policy tightening could shift yet again. That could mean fluctuations in bond yields, shifts in currency valuations, or changing equity market trends.

For now, the focus will be on whether this is a one-off spike or part of a larger trend. Upcoming inflation reports will be particularly telling. A higher-than-expected Consumer Price Index (CPI) could reinforce the idea that inflation remains persistent. If that happens, central bankers might respond with policy changes that traders will need to factor into their strategies.

Time will tell how this plays out, but what’s clear is that inflation-related data remains essential reading—especially for those making decisions based on market expectations.