Interest rate expectations before important US data show different probabilities among central banks and countries.

GBP/USD fluctuates as UK yields increase while traders watch for US labor market data

Preliminary CPI in the Eurozone for August rises to 2.1%, while core CPI eases to 2.3%

ECB Meeting Predictions

With overall inflation rising to 2.1% and core inflation easing to 2.3%, the ECB has little reason to change its current policy. We expect the ECB to keep interest rates steady at its meeting next week. This could lead to a period of lower volatility in short-term interest rates. Traders should think about strategies that benefit from this anticipated stability, like selling volatility on near-term interest rate futures. Current market pricing in €STR futures shows a low chance of a rate change before the end of 2025, reinforcing this view. Since July 2025, implied volatility on three-month EURIBOR options has dropped by nearly 15%. For equity derivative traders, a steady ECB suggests that markets for indices like the Euro Stoxx 50 will remain within a range. Without a major catalyst for a breakout, using strategies like iron condors to sell premium could work well. The VSTOXX index, which measures Euro Stoxx 50 volatility, has fallen to 14.5, indicating this low-conviction environment.Services Inflation Watch

The biggest risk to this outlook is the persistent services inflation, which is still high at 3.1%. Considering the stubborn inflation trends from 2023-2024, ongoing services inflation could lead the central bank to delay easing its policy longer than the market expects. This is a key area to monitor for signs of a rebound. Given this persistent services inflation, betting on aggressive rate cuts in early 2026 may be too soon. A cautious strategy would be to use calendar spreads in rate futures, capturing the expected lack of movement in the coming weeks while remaining open to potential policy changes later on. Create your live VT Markets account and start trading now.Šimkus from the ECB discusses current rate stability and potential future cuts due to risks

UK long-term yields rise due to increasing debt concerns; higher rates may be a global solution

Higher Interest Rates As A Solution

Higher interest rates might unexpectedly solve this issue. Central banks may need to rethink their strategies and consider raising rates. For the UK, the current situation may be hard to reverse, and long-term rates might only drop through a tough recession that leads to contractionary policies. Increasing rates could lower long-term yields by predicting an economic slowdown, higher unemployment, and reduced inflation. This situation goes against central banks’ goal of a smooth landing, which they had hoped would allow inflation to decrease gradually. The only other option might be a sharp economic downturn. The UK’s 30-year gilt yield is now at 5.5%, a level not seen since 1998. This signals that the market is responding strongly. This comes shortly after last week’s news showed UK government borrowing forecasts went up by another £20 billion and inflation in August unexpectedly rose to 4.1%. The Bank of England’s rate cut in July, when inflation was still far above its target, is now seen as a major policy mistake. For derivatives traders, this suggests a time of ongoing volatility, especially in UK assets. We should think about buying volatility through options on the FTSE 100 index or on the pound. The market is reacting to a policy blunder, and the VFTSE index, which measures FTSE volatility, has surged from 18 to 25 in the last month, indicating more turbulence ahead.Divergence In Central Bank Policies

The gap between a relaxed Bank of England and a more cautious US Federal Reserve makes shorting the pound an appealing option. Although the US 10-year Treasury yield has risen to 4.8%, the Fed has not hinted at rate cuts, which weakens the pound. We are preparing for the pound to retest the 1.18 level against the dollar, akin to the lows experienced during the market turmoil in 2022. The main idea is that only a harsh economic downturn can address this issue, suggesting we should brace for a recession to lower long-term yields. This leads us to consider trades that would benefit from economic hardship, like buying put options on UK banking and consumer-discretionary stocks. It may also be time to start anticipating aggressive rate cuts in the future, perhaps in late 2026, once the anticipated slowdown sets in. This situation is not solely a UK concern; it represents a broader global loss of faith in central banks’ commitment to combatting inflation. This is also why gold has surpassed $2,600 per ounce, as it serves as a safeguard against these policy choices. We see value in maintaining long positions in gold derivatives as a key part of our portfolio to protect against this widespread central bank complacency. Create your live VT Markets account and start trading now.Traders flock to the dollar as yields rise, leading to turbulence and declines in the broader market.

Major Currency Movements

EUR/USD has decreased by 0.6% to 1.1640, while USD/JPY has risen by 1% to 148.60. GBP/USD is down 1% to 1.3405, and USD/CHF is up 0.3% to 0.8030. This shift is impacting risk currencies like AUD/USD, which has fallen 0.7% to 0.6505. Even though markets are under pressure, it’s crucial to stay calm. If long-term yields keep rising, corrections in equities may follow. The steepening of the US yield curve could hint at a policy error by the Fed, which might weaken the dollar in the future amid political challenges. Gold, despite some recent losses, could attract renewed interest as conditions shift. Buyers may see opportunities in this evolving landscape. The surge in government bond yields is now affecting all markets, leading to a major reassessment of risk. The US 10-year Treasury yield has surpassed 5.0%, a level known to cause market stress after the August 2025 inflation report unexpectedly hit 3.9%. With borrowing costs rising, investors are selling stocks and seeking the safety of cash.Equity and Currency Strategies

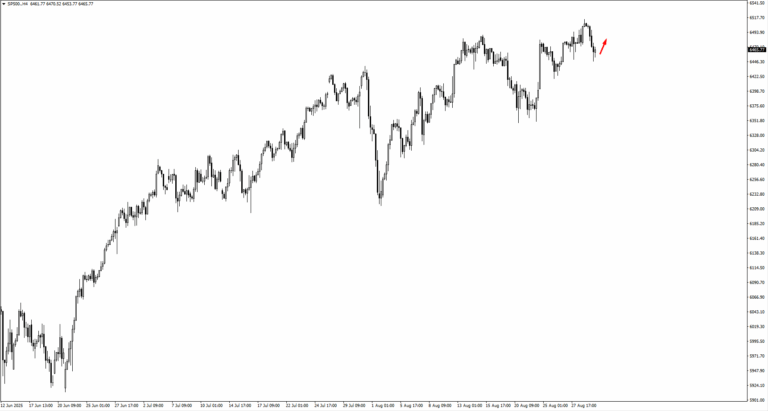

This rise in fear is creating clear opportunities in the equity options market. The S&P 500 has already fallen 4% from its August highs, and the VIX volatility index has jumped from 14 to over 22. It may be wise to buy put options on major indices like the SPX for protection against a deeper correction if long-term yields continue to climb. In currency markets, the immediate response has been a strong rally in the US dollar, with the Dollar Index (DXY) hitting a 10-month high of 107.50. While this dollar strength is hurting other currencies, we should be cautious about how long it will last. The rapid steepening of the US yield curve has occasionally indicated a central bank policy error, which could damage the dollar’s credibility in the future. For those doubtful about the dollar’s long-term strength, using options provides a way to manage risk. Instead of shorting the dollar directly, we can buy medium-term call options on currencies like the Australian dollar or the euro. This allows traders to bet on a rebound when the current panic subsides without taking on the high risk of a spot position. Finally, we’re keeping a close eye on gold, even as it initially struggles against the strong dollar. The current high-yield and stock market uncertainty mirrors the challenges seen in 2022, when gold eventually performed well as a safe haven. Traders should look for signs of a bottoming pattern and consider using call options on gold ETFs to prepare for a rebound as investors seek safety from bond and equity volatility. Create your live VT Markets account and start trading now.Week Ahead: Bitcoin Ends August Bruised But Still Standing

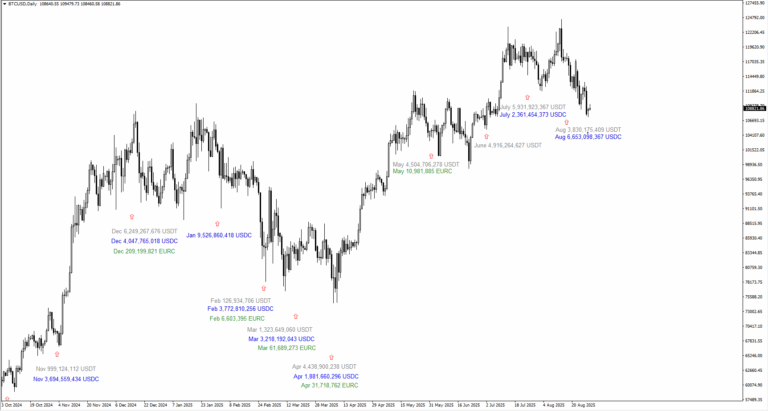

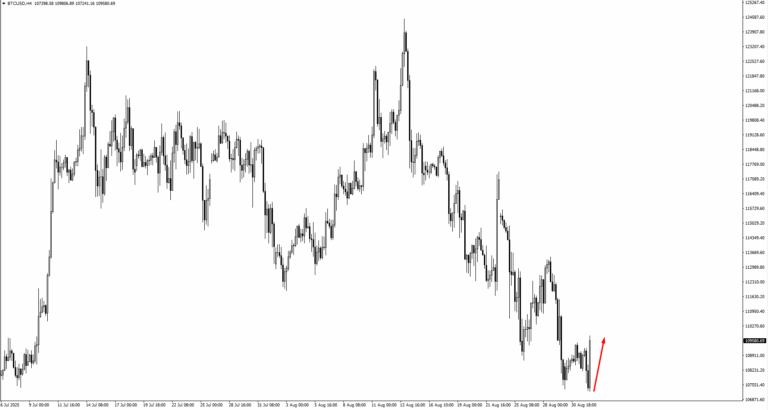

On 12 August, Bitcoin hit a record high of $124,492, only to fall back sharply to $107,340 by the end of the month.

Such dramatic reversals are nothing unusual for Bitcoin. The asset has always moved in cycles of euphoric surges followed by steep corrections, often flushing out excess leverage before testing just how firmly investors remain committed.

Liquidity Still Flowing

Liquidity conditions remain supportive. Between November 2024 and August 2025, over $67 billion in new stablecoins entered circulation across USDT, USDC, and EURC.

December 2024 alone added $10 billion, followed by $9.5 billion in January, while July and August combined delivered another $18 billion.

By late August, stablecoin supply had reached fresh records: USDT $167.3 billion, USDC $70.6 billion, DAI $5.4 billion, and FDUSD $1.45 billion – totalling close to $245 billion. Smaller issuers push the total above $275 billion.

This stockpile of liquidity is ‘dry powder’ that could be redeployed into Bitcoin when sentiment improves.

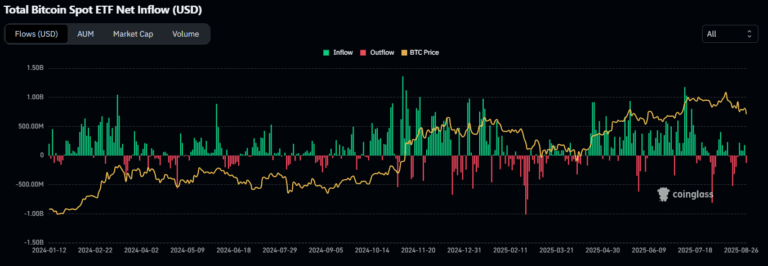

Institutions remain the other driving force. July was particularly strong, with US spot Bitcoin ETFs attracting $6 billion of inflows and crypto ETFs as a whole securing $12.8 billion – a record. This helped propel Bitcoin through the $120,000 barrier.

But August reversed the trend. Spot ETFs saw heavy outflows, including a single-day redemption of $2.6 billion from BlackRock’s IBIT, pulling Bitcoin down by $16,000.

The picture is one of timeframes. Daily ETF flows are erratic, monthly flows steer momentum, and cumulative flows define the long-term trajectory. Despite August’s setback, net institutional buying for 2025 remains intact.

The outlook is cautious: more withdrawals are possible if volatility stays high, yet the broader current still favours accumulation rather than abandonment.

Seasonal Trends Suggest Q4 Strength

Bitcoin’s seasonal pattern points to resilience in the final quarter. Historically, August and September have been weak, while October and November usually deliver strong gains.

On average, October has returned more than 20%, and November over 40%. With August already in the red, the pattern holds. If Bitcoin can ride out September without breaching support, conditions favour another rally into year-end.

Still, history only rhymes – it doesn’t guarantee repetition. Broader macroeconomic forces could always disrupt the seasonal narrative.

At present, Bitcoin is grappling with the $110,000 barrier, now acting as resistance after previously serving as support. Liquidity data shows strong selling pressure clustered between $109,000–110,000, as trapped longs seek to exit.

On the downside, liquidity pockets build up at $108,000 and $107,000. A move above $110,000 could restore momentum, while failure might send prices towards $105,000 or lower.

Traders Prepare For Volatility

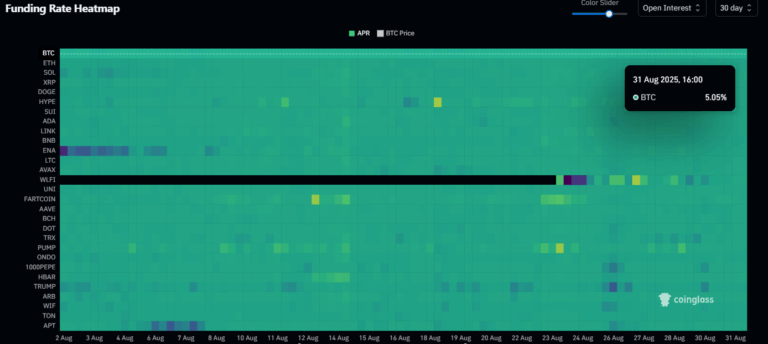

Market sentiment has cooled, but not collapsed. The Fear and Greed Index stands at 40, signalling caution rather than panic. Perpetual futures funding rates are only marginally positive, suggesting modest long positioning but no overheating.

This is the anatomy of a reset: excess optimism has been flushed, leverage cut back, but no full capitulation. It leaves room for stabilisation, though also signals hesitancy as traders wait for clearer signals.

August has tested conviction, but the cycle’s pillars remain: ample liquidity, positive net institutional flows, and favourable seasonal trends into year-end.

The key question now is whether Bitcoin can defend the $107,000 level and reclaim $110,000. Success could set the stage for another test of $124,000 before 2025 ends; failure risks a slide towards $105,000.

Market Movements Of The Week

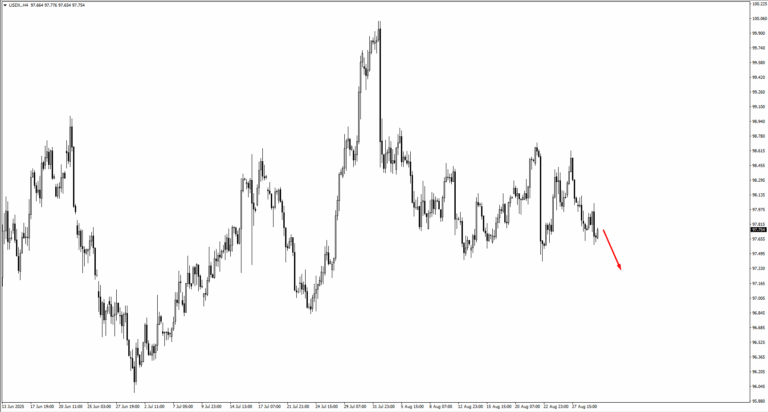

The new week opens with the US Dollar Index locked in a holding pattern. Prices have lingered around the same area since Friday, showing little appetite for a decisive move.

Traders are watching the 97.409 swing low, a level that, if broken, could pull the index lower toward 97.35.

For now, the lack of momentum signals indecision, but any sharp shift in data or sentiment may push the dollar out of its narrow corridor.

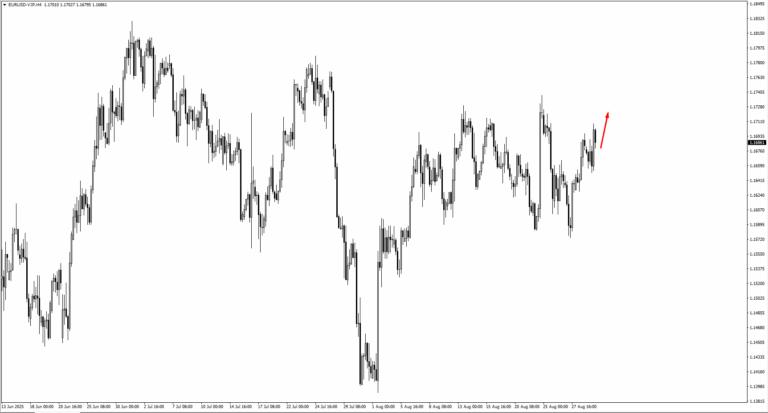

In Europe, the single currency mirrors the dollar’s pause. EURUSD trades close to Friday’s levels, though the charts suggest that a lift toward 1.1755 would be the next zone to monitor.

Sterling also sits in a pivotal position. GBPUSD dipped but failed to crack through 1.35435. If buyers step in and drive it higher, the 1.3555 mark becomes the line to watch for signs of strength.

Across the Pacific, USDJPY drifts lower, and eyes are set on whether 146.208 will give way. A break beneath that level could invite deeper downside.

USDCHF also trends down, with traders marking 0.7960 as the key checkpoint.

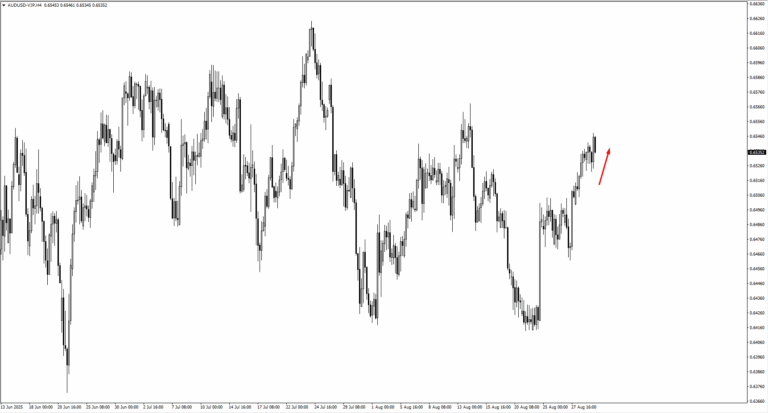

The Australian dollar is testing nerves at 0.6550. Sellers have held ground here, but if the price edges upward, 0.6570 offers the next area of interest. New Zealand’s dollar is climbing instead, with 0.5920 as its near-term target.

North America tells a mixed story, as USDCAD trades around 1.3735. Consolidation is evident, and should the pair slip lower, the 1.3700 handle could come into play.

Commodities, meanwhile, are showing more rhythm. Oil appears to be consolidating after recent swings. Traders have an eye on 66.45, where bearish price action could reassert itself should prices rise.

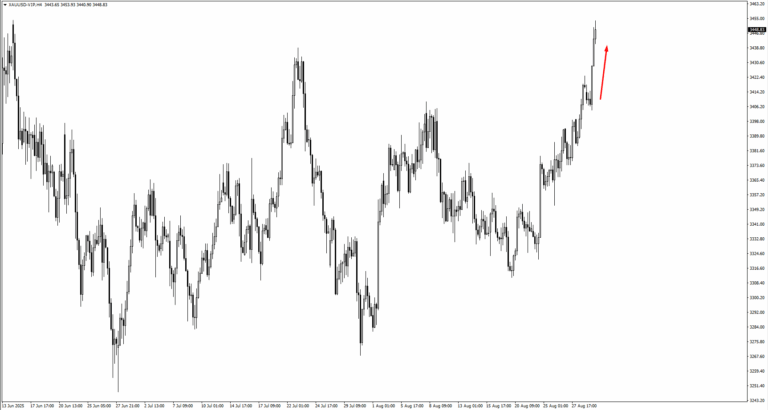

Gold, by contrast, has found traction. After pausing around 3,420 dollars, it pressed higher, with the next challenge set at 3,470 dollars.

Silver continues its own march upward, with momentum favouring the bulls. If a consolidation phase emerges, the 38.75 level will serve as the staging ground for the next push.

Natural gas is also climbing, having rebounded from 2.80. The market now leans toward testing 3.04. Energy traders will be alert to whether this move holds or fades under fresh supply pressures.

In equities, the S&P 500 retreated from the psychological 6,500 mark before settling. If it manages to rise again, traders are watching the 6,485 area for the quality of price action. A close above 6,497 could open the path to 6,630 or even 6,730.

Nasdaq tells a similar tale. It slipped from 23,780, but the focus now shifts to 23,600. Should it close above 23,700, momentum would likely swing back to the upside.

Bitcoin holds the spotlight among digital assets. It found footing at 107,245 but remains fragile. If the price makes a lower low, the market will eye 105,700 and even 101,400 as the next potential landing spots.

Ethereum has its own test ahead, with the 4,585 mark acting as the key pivot for traders seeking confirmation of renewed strength.

Among individual stocks, UnitedHealth shows potential consolidation. If support holds, bulls may look to 270 for a fresh entry, with intrinsic value estimates climbing as high as 410 on recent earnings.

Novo Nordisk, trading above 55.37, also signals the possibility of a fresh leg higher. Analysts now place its intrinsic value around 90, suggesting that investors still see more room in its climb.

The week is set against a backdrop of fragile confidence. Many assets hover around support or resistance, waiting for data or sentiment to tip the balance.

Key Events Of The Week

Activity starts to pick up on Tuesday, 2 Sep, when the US releases its ISM Manufacturing PMI. Forecasts point to a reading of 48.9, slightly higher than July’s 48.0.

Wednesday, 3 Sep, brings a pair of releases that could move different corners of the market. Australia’s GDP is expected to show growth of 0.5 percent quarter-on-quarter, an improvement over the previous 0.2 percent. In the US, JOLTS Job Openings are projected at 7.24 million, down from 7.44 million. The labour market remains a focal point for traders and policymakers alike.

Thursday, 4 Sep, shifts attention back to US services, with the ISM Services PMI forecast at 50.5 compared to the previous 50.1. This sits just above the expansion line and could reinforce the picture of an economy slowing but not yet stalling. Traders will be watching whether the reading provides relief for the dollar or continues to paint a cautious outlook.

Friday, 5 Sep, closes the week with the headline jobs report. Non-Farm Employment Change is expected at 74,000, just above the prior 73,000. The unemployment rate is forecast to tick up to 4.3 percent from 4.2 percent. Together these figures underline a gradual softening in the labour market.

Rising bond yields lead to declining stock markets in Europe, Japan, and the US

The pound falls as UK long-term yields rise, increasing pressure on political leaders to calm the markets.

Currency Performance

In currency performance, the pound is weak, with GBP/USD down 0.5% to 1.3483. Other major currencies are also slightly falling against the dollar, suggesting a cautious start to trading. The sharp rise in yields may negatively impact broader markets and risk sentiment. We need to keep an eye on how equity markets react as the day progresses. The pound is under significant pressure as UK long-term borrowing costs rise. The 30-year Gilt yield hitting 5.68% seems to follow a delay after the August ONS data showed headline CPI unexpectedly rising to 3.1%. Now, the market looks to leaders like Keir Starmer and Rachel Reeves for a plan to boost confidence. This situation brings back memories of the Gilt market crisis from autumn 2022, after the Truss government’s mini-budget. Traders are increasingly worried about the UK’s debt sustainability, especially with concerns over financing green energy subsidies. This history suggests that the pound is likely to keep declining.Risk Management Strategies

Given the negative outlook, we recommend buying GBP/USD put options to profit from or protect against further declines. The pair has already fallen to 1.3483, and momentum could push it towards the next key support level at around 1.3350 in the coming weeks. Implied volatility in sterling options has risen to a three-month high, indicating increasing uncertainty. This issue is not unique to the UK, as US 30-year yields are also nearing 5%, which strengthens the dollar overall. The Federal Reserve’s slightly hawkish tone last week is contributing to this trend, making long dollar positions appealing against various currencies. This is evident in USD/JPY, which has climbed above 148. The quick rise in “risk-free” rates will likely affect equity markets as well, increasing the discount rate for future earnings and lowering valuations. We should stay cautious and consider defensive strategies, such as buying put options on the FTSE 100 index. If global risk sentiment continues to worsen, UK stocks may be particularly vulnerable due to the pressures on currency and yields. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 02 ,2025

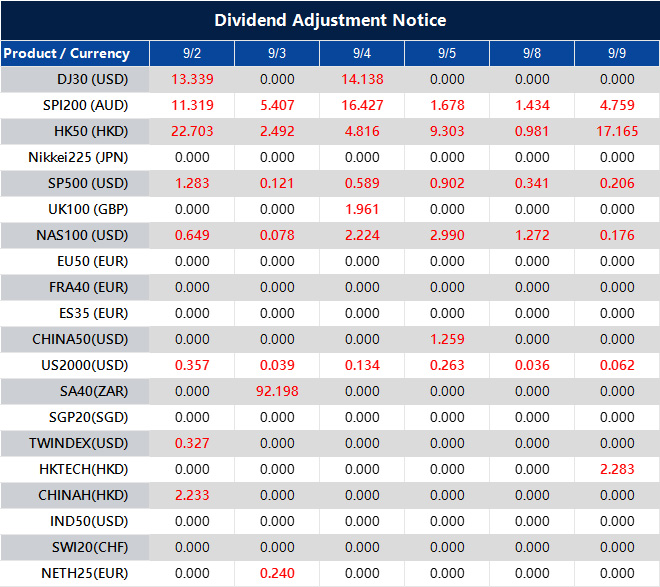

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].