Expectations for interest rates have changed slightly due to Australian CPI influences and anticipated data.

Consumer confidence in the Eurozone stayed the same, but economic sentiment dipped slightly in August.

Services Confidence Decline

Services confidence is at 3.6, lower than the expected 3.9, down from a previous figure of 4.1. Economic sentiment has decreased a bit this August, with a slight dip in the services sector. The Eurozone economy is still performing reasonably well in the third quarter. However, ongoing Trump tariffs pose challenges as the region heads into the final part of the year. Economic confidence has dropped to 95.2, missing expectations, suggesting that the Eurozone’s resilience may be fading. The fall in consumer confidence to -15.5 continues a troubling trend since the second quarter. This ongoing pessimism indicates that consumer spending, which is a crucial part of the economy, may stay weak as we move into autumn. The decrease in services confidence from 4.1 to 3.6 is especially worrying. The services sector has been propping up the economy while manufacturing struggles. For instance, German factory orders fell 2.1% month-over-month in July. If this stronghold weakens, we might have to lower our growth expectations for Q3.Potential US Tariffs Impact

Looking back to late 2022, we noticed that weakening sentiment came before a sharp decline in economic activity. The current industrial confidence figure of -10.3, although slightly improved from last month’s revised number, is still far from healthy. This indicates there’s no real recovery in the industrial sector to make up for the new weakness in services. The possibility of US tariffs brings more uncertainty for the fourth quarter. We remember the market instability in 2018 and 2019 when tariff threats severely impacted European industrial and auto stocks. This ongoing risk makes holding unhedged positions in European equities increasingly risky. Given this situation, we should consider buying downside protection on major European indices like the Euro Stoxx 50. Purchasing put options with October or November expiration dates can help safeguard against a continuing economic slowdown and any negative impacts from tariff developments. The prices for these options remain reasonable, but may rise if sentiment worsens. Holding volatility could also be beneficial. We can gain exposure by buying call options on the VSTOXX index, which tracks Euro Stoxx 50 volatility. If the tariff situation worsens or economic data continues to disappoint, increased market fear could make these positions profitable. This environment may also put pressure on the euro. If the European Central Bank acts cautiously in response to this data, the gap between its policies and those of the US Federal Reserve may grow wider. Therefore, we should explore strategies that profit from a drop in the EUR/USD exchange rate. Create your live VT Markets account and start trading now.The USD’s recovery and French politics affect the EUR/USD as traders await US labor data

Technical Analysis of EURUSD

Looking at the daily chart, the EURUSD rejected a trendline around 1.1740 but found support close to 1.16. On the 4-hour chart, we saw a bounce from 1.16, with resistance around 1.1664; buyers might aim for a breakout here. The 1-hour chart shows a swing low at 1.1627 acting as support, indicating potential price volatility ahead of US data releases. Key upcoming events include US Jobless Claims and inflation data from both the Eurozone and the US. As of today, August 28th, 2025, the dollar is recovering after comments made during the Jackson Hole Symposium. The focus is now on next week’s important US Non-Farm Payrolls report. Today’s jobless claims showed a resilient labor market at 230,000, while last month’s Core PCE inflation stayed steady at 2.9%. These numbers have created uncertainty around what the Federal Reserve will do next. The strong emphasis on jobs data has set up a binary scenario, perfect for volatility-based option strategies. With an 89% chance of a rate cut in September, a strong jobs report could dramatically shift these expectations and boost the dollar. Implied volatility for one-week EURUSD options has increased to over 8%, indicating that a long straddle strategy could be a smart way to trade the anticipated price movement.European Political Influence

In Europe, the euro is under pressure as we near the French confidence vote on September 8th. We experienced similar euro weakness during the French elections in 2022, showing how politics can impact the currency significantly. Buying short-dated, out-of-the-money EURUSD put options is a cost-effective way to protect against a potential negative outcome from Paris. There is a clear difference in policies between the central banks. Traders are expecting 55 basis points of cuts from the Fed this year but only 9 basis points of easing from the ECB. This fundamental divergence supports a stronger dollar, especially if US economic data remains solid. If the jobs report is strong, we might look to sell longer-dated EURUSD futures to take advantage of this growing policy gap. From a technical perspective, we are monitoring key support around the 1.1600 level. A clear break below this support, especially after the jobs report, could trigger us to increase our bearish positions or buy puts targeting the 1.14 level. Until that break occurs, price movements are likely to remain volatile within the current range. Create your live VT Markets account and start trading now.NASDAQ traders watch for bearish outlook below 23,650 and bullish potential above 23,711

TradeCompass Principles

NASDAQ futures are currently at 23,652, right at the tradeCompass bearish threshold. If this level breaks, we could see a drop with targets at 23,632, 23,615, 23,589, 23,562, and 23,520. There are also swing targets at 23,471 and 23,307. On the bullish side, if prices rise above 23,711, we have targets at 23,755, 23,775, 23,811, and a swing extension to 23,900. NVIDIA recently reported earnings, causing their shares to drop 5.5% after hours. Futures have bounced back slightly, making the U.S. market open very important. The tradeCompass approach looks beyond headlines to focus on clear thresholds. Profit targets align with historical Value Area Highs, Point of Control, and VWAP for partial profit-taking. The tradeCompass principles use clear thresholds to guide trading decisions and manage bias. Traders can secure profits by adjusting stop-loss orders to the entry point after reaching targets. The Value Area and VWAP are crucial reference points. Traders should also focus on risk assessment and their own trading strategies. This analysis is not financial advice. We are at a pivotal moment for the NASDAQ, with futures right at the bearish line of 23,650. The market is processing NVIDIA’s decline, which occurred despite strong earnings due to cautious guidance. The reactions of large institutions when the U.S. market opens will be significant for the coming days. If prices stay below 23,650, it indicates that sellers are in control, likely using the NVIDIA news to take profits. This aligns with the July 2025 inflation report, which was stubbornly high at 3.4% and has added concern about the Fed’s next steps. If we see a decline, then the first logical profit-taking points will be at 23,632 and 23,615. For traders taking short positions, risk management is crucial, especially since the CBOE Volatility Index (VIX) has risen to 17.5, indicating increased uncertainty. It’s wise to move stop-loss orders to entry after hitting the second target at 23,615. This strategy preserves capital in a volatile market where sharp reversals can occur unexpectedly.Market Reaction To NVIDIA News

Conversely, if the market starts climbing above 23,711, it indicates that buyers are stepping in and absorbing selling pressure. In this case, the NVIDIA dip may be viewed as a buying opportunity, similar to previous pullbacks by major tech companies throughout 2024. A rise above this level opens up bullish targets like 23,755 and 23,775. This uncertain price movement makes buying puts or calls more expensive due to increased implied volatility. Derivative traders should consider using credit or debit spreads to manage risk and lower entry costs in the coming weeks. A bearish trader might sell a call spread above the highs, while a bullish trader could sell a put spread below recent support. Create your live VT Markets account and start trading now.Rehn highlights Euro area resilience, noting inflation’s decline and close monitoring of economic conditions for possible action.

Dollar Dominance

Despite external pressures, a quick decline in the dollar’s dominance seems unlikely. As summer wraps up, more statements from ECB leaders are expected, continuing their focus on stable policies. The ECB’s steady approach signals that European interest rates may not change much in the near future. The latest flash estimate for Eurozone inflation in August 2025 is 1.9%, just under the target, meaning there is little incentive for surprise actions. This environment suggests that selling options on short-term interest rate futures, like the December Euribor contract, can be a smart strategy to earn premiums while the central bank remains inactive. In contrast, the situation across the Atlantic appears different. Potential political pressures on the Federal Reserve create uncertainty. The recent US inflation for July 2025 is higher at 3.2%, leading to a policy gap between the US and Europe, which might affect currency markets. For traders, it could be wise to buy volatility on the EUR/USD pair, as significant movements are likely to stem from news in the US.European Growth and Market Strategy

European growth remains strong, as shown by a slight increase in the German Ifo Business Climate index for August. This gives a positive outlook for equities. With steady borrowing costs, indices like the Euro Stoxx 50 may continue to rise slowly. Therefore, selling out-of-the-money puts on the index could provide a good way to gain bullish exposure while having some protection. We need to remember the intense market reactions to central bank changes in late 2023 and early 2024. Although the current market seems stable, this period won’t last. Hedging strategies, like buying longer-dated options for early 2026, can help protect against unexpected shifts in central bank policies as we enter the new year. Create your live VT Markets account and start trading now.In July, eurozone M3 money supply increased by 3.4%, just below the expected 3.5%

The European Central Bank’s Decision

With July’s M3 money supply being slightly lower, this supports the ECB’s choice to pause any changes. The data shows that while money growth is stable, it’s not speeding up, reducing any need for the ECB to consider raising rates soon. For traders in derivatives, this lowers expectations for any unexpected aggressive moves shortly. This steady money supply data fits into the larger economic picture we’ve been observing. The Eurozone’s GDP growth for Q2 2025 was only 0.1%, and although July’s inflation decreased to 2.7%, it still remains above the central bank’s target. This mix of a slowing economy and ongoing inflation puts the ECB in a tough spot, making it likely that interest rates will stay the same for a while. In this context, implied volatility for European assets might decrease in the upcoming weeks. Selling short-term call options on the Euro Stoxx 50 could be wise as the market adjusts to this steady information and the VSTOXX index could fall from its current level around 14. Without a clear trigger, big increases in stock prices seem unlikely for now.Interest Rate Traders Strategy

Interest rate traders should focus on the longer term. While short-term contracts are likely to stay stable, we can explore options that speculate on a possible policy shift in 2026. Reflecting on the market fluctuations in late 2024 after the last rate hike, it became clear that waiting was essential, and markets did not reward bets on immediate rate cuts. This situation is reminiscent of the “wait-and-see” phase we went through last year. Range-trading strategies on the EUR/USD, like selling strangles, could be effective since the currency may not have a strong directional trend. We should expect the euro to stay within its recent range until we get clearer signals about inflation or growth. Create your live VT Markets account and start trading now.Business confidence in Italy exceeded expectations, but consumer confidence fell short of predictions.

Market Impact

These small differences in confidence levels are not expected to affect the market significantly. They show only slight changes from what was anticipated, and larger shifts are needed to influence market conditions. Today’s confidence numbers from Italy do not change our short-term outlook. The small rise in business confidence is balanced by a decline in consumer confidence. Both indicators have decreased since July 2025, indicating a slow cooling trend. Traders will likely overlook these minor figures and wait for more substantial data releases. Our main concern is the upcoming Eurozone HICP inflation data. The preliminary figure for August 2025 remains steady at 2.5%. This persistence puts pressure on the European Central Bank, which has signaled it is ready to take action if necessary. Any surprises in the broader inflation data across Europe will have a more significant effect than today’s sentiment figures from one country.Italian Debt and European Policy

In the near term, this mild announcement from Italy may lead to selling front-week volatility in indices like the FTSE MIB. Options traders might consider selling short-dated strangles, betting that the index remains stable until more important European data emerges. The limited effect of this report supports the idea that there’s no immediate trigger for a breakout. We must keep the larger context in mind, especially the market turbulence during the 2023 rate hiking cycle. With Italy’s public debt close to 138% of GDP, the market’s attention is still on sovereign bond spreads and the ECB’s policy direction. Minor sentiment data does little to change this underlying sensitivity. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 28 ,2025

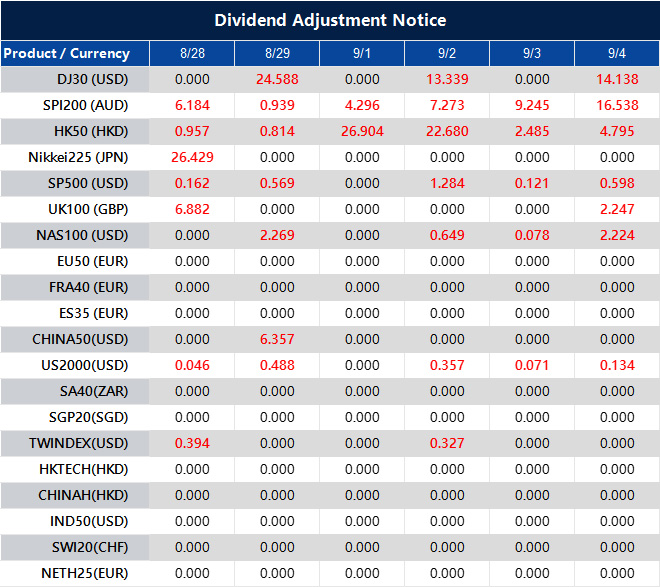

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].