Artificial intelligence remains the dominant theme in equity markets, but the narrative is evolving. Investor focus has shifted away from lofty expectations around productivity gains and towards the underlying economics of the AI build-out.

This stage of the cycle is increasingly about infrastructure: data centres, energy demand, and chip supply, rather than software breakthroughs or headline innovation.

Large US technology firms are set to spend more than $400 billion this year on AI-related hardware, facilities, and power capacity, even as the revenue generated directly from AI remains relatively modest.

That gap has left valuations more exposed to earnings guidance and capital expenditure discipline. Traders are growing more cautious, mindful that AI adoption could take longer to translate into profits than current share prices suggest.

This backdrop goes some way towards explaining why US equity indices have struggled to hold breakouts.

The S&P 500 recently notched a fresh record high before retreating, signalling rising hesitation rather than a clear shift into risk aversion. Momentum is still positive, but tolerance for disappointment is narrowing.

For traders, AI continues to underpin the broader equity trend, while also acting as a potential volatility catalyst when expectations are revised lower.

Dollar Weakness Builds Ahead Of Key US Data

The US dollar starts the week under pressure, with the Dollar Index finding a base around the 97.90 area. Recent price action reflects growing confidence that the Federal Reserve may need to deliver further easing as labour market conditions cool.

This week’s Non-Farm Employment Change is expected to come in at 50K, down sharply from the previous 119K, while the unemployment rate is forecast to edge up to 4.5% from 4.4%.

An outcome close to these projections would reinforce concerns about slowing US growth and could extend downside pressure on the dollar.

While a softer dollar continues to support selected risk assets, traders remain hesitant to chase moves ahead of firm data confirmation.

Central Banks Add Cross-Currents To FX Markets

Monetary policy decisions elsewhere are adding complexity to currency markets. The Bank of England is widely expected to cut its Official Bank Rate to 3.75% from 4.00%, placing the emphasis on forward guidance rather than the decision itself.

Sterling’s reaction is likely to hinge on whether policymakers open the door to further easing in early 2026.

In Japan, the Bank of Japan is forecast to lift its policy rate to 0.75% from 0.50%. Any signal that policy normalisation will continue could support the yen and limit upside in USDJPY, particularly if US economic data disappoints.

Market Movements Of The Week

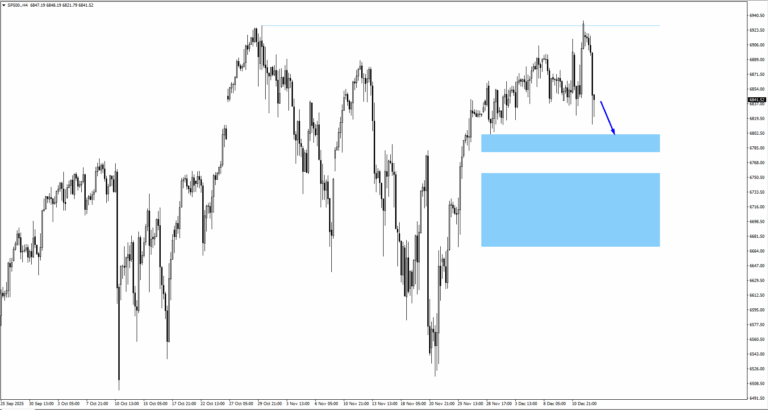

SP500

– The index made a fresh all-time high before pulling back sharply.

– AI-heavy stocks continue to drive direction, but valuations face tighter scrutiny.

– A sustained hold above 6,790 keeps upside open; failure may accelerate profit-taking.

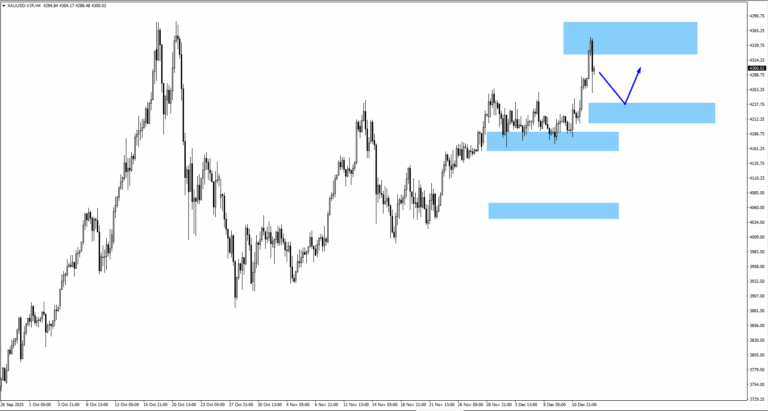

Gold (XAUUSD)

– Gold retreated from 4,360 and now consolidates near 4,220.

– Holding above this zone may open a move back toward 4,300.

– US data remains the primary short-term catalyst.

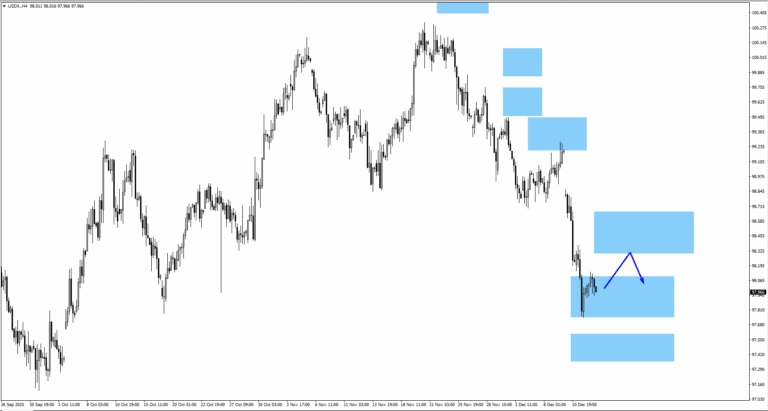

US Dollar Index (USDX)

– USDX found support near 97.90 after last week’s decline.

– Resistance sits near 98.30 and 98.55.

– Weak labour data could expose the 97.40 area.

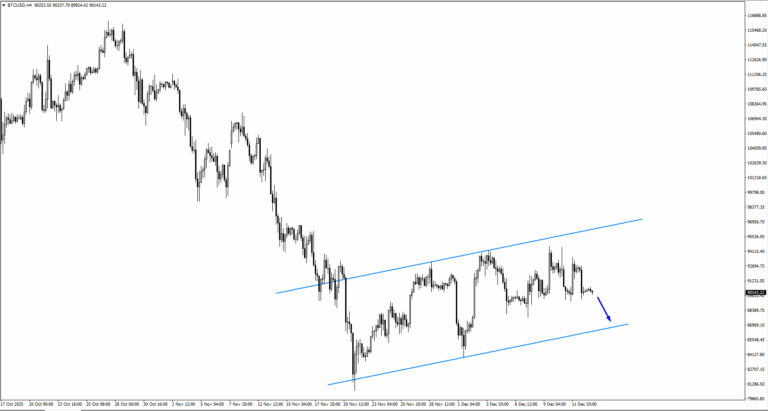

Bitcoin (BTCUSD)

– Bitcoin continues to consolidate within a descending channel.

– A close below 87,712 could expose lower levels near the 70K handle.

– Recovery attempts depend on stabilising risk sentiment.

Key Events Of The Week

16 December

1. US Non-Farm Employment Change, Forecast: 50K, Previous: 119K

Soft data may extend USD weakness.

2. US Unemployment Rate, Forecast: 4.50%, Previous: 4.40%

Rising unemployment supports easing expectations.

18 December

1. UK Official Bank Rate, Forecast: 3.75%, Previous: 4.00%

Focus on BoE guidance beyond the cut.

2. US CPI y/y, Forecast: 3.00%, Previous: 3.00%

Stable inflation keeps policy outlook unchanged.

19 December

1. JP BOJ Policy Rate, Forecast: 0.75%, Previous: 0.50%

Hawkish signals may strengthen JPY.

Bottom Line

AI continues to provide a structural tailwind for US equities, but investors are becoming more selective as infrastructure costs rise and earnings expectations come under closer scrutiny.

Upcoming US labour and inflation data, alongside key central bank decisions, will be critical in determining whether current easing expectations remain justified.

A run of softer data could keep the dollar on the back foot while supporting gold and risk assets, whereas any upside surprise may trigger sharper pullbacks as positioning adjusts.