The question isn’t if altcoin season will arrive. It’s when. Every major crypto cycle tends to follow the same rhythm: Bitcoin (BTC) rallies first, steadies, and then passes the torch to the broader market.

The last two rotations, in 2017 and 2021, both saw BTC’s dominance tumble from above 70% to roughly 40%, triggering explosive surges in Ethereum (ETH), Ripple (XRP), and a wide range of smaller tokens.

Now, that familiar pattern appears to be repeating. Bitcoin’s market share has fallen below 59%, its weakest level since early 2024, while the total market capitalisation of altcoins has swelled to around USD 1.69 trillion.

Market analysts are eyeing the USD 2.3 trillion mark as the key threshold that would confirm a full capital rotation out of BTC and into alternative assets.

Beneath the surface, activity across the decentralised finance (DeFi) sector is gathering pace again, transaction volumes are picking up, and large wallets have quietly resumed accumulating mid-cap tokens.

Institutional flows are also returning to the space. Inflows into altcoin-focused ETFs have begun to build momentum, signalling a comeback of patient, structured capital to a market long driven by emotion and retail speculation.

Liquidity Flows Back Into The Market

Macro conditions are beginning to align more favourably for risk assets. In September, the Federal Reserve trimmed rates by 25 basis points, its first cut in several months, with Chair Jerome Powell hinting that more reductions could follow before the year ends.

The US M2 money supply has ballooned to USD 22 trillion, marking its fastest pace of growth in a year and a half. Historically, periods of rapid liquidity expansion have coincided with a stronger appetite for risk, with cryptocurrencies often leading the charge.

If monetary policy remains on this easing path, that liquidity could propel the altcoin rally well into the early months of 2026.

Retail Interest Reawakens

Retail traders are starting to pay attention once more. Google search interest for ‘altcoins’ has jumped between 40% and 50% since late September, while social engagement around ETH, Solana (SOL), and Chainlink (LINK) has soared.

These early sparks of curiosity resemble the same build-up seen before previous altcoin seasons. The early movers are already showing strength: XRP, SUI, and LINK have all outperformed BTC recently, often a sign that capital is rotating toward higher-beta tokens.

Even so, caution remains warranted. The popular ‘Altcoin Season Index‘, which tracks how many of the top 100 cryptocurrencies are outperforming Bitcoin, has already crossed 80 this year but failed to trigger a sustained breakout. Many smaller tokens barely moved, suggesting the indicator tends to reflect what’s already happened rather than predict what’s next.

In truth, most of the profit opportunities emerge before the data confirms them. That’s why analysts tend to focus on BTC dominance, altcoin market-cap acceleration, and the growth of DeFi liquidity instead.

Has Altcoin Season Already Begun?

If current trends continue, the next altcoin season could unfold between October 2025 and February 2026. The timing, however, will likely depend on macro catalysts. Faster rate cuts, approvals for spot ETFs, or regulatory breakthroughs, such as the US Clarity Act, could all accelerate the rotation.

Conversely, delays in monetary easing or any abrupt risk-off sentiment could push the cycle back.

This time around, the rally may prove broader in scale but narrower in scope. Some projections suggest that the total market cap of altcoins could eventually hit USD 15 trillion, fuelled by institutional adoption and the tokenisation of real-world assets. Yet unlike the frenzied surge of 2017, the next rally may centre around fewer, more established names.

Institutional investors tend to favour liquidity and compliance, meaning capital could cluster around recognised ecosystems rather than scatter across thousands of speculative projects.

For traders, that shift alters the playbook. The coming cycle may reward precision and patience more than scattergun speculation. Watching how liquidity, regulation, and global monetary policy evolve will be crucial.

If history is any guide, what’s quietly forming beneath Bitcoin’s surface today could soon define the market’s next major rotation.

Market Movements Of The Week

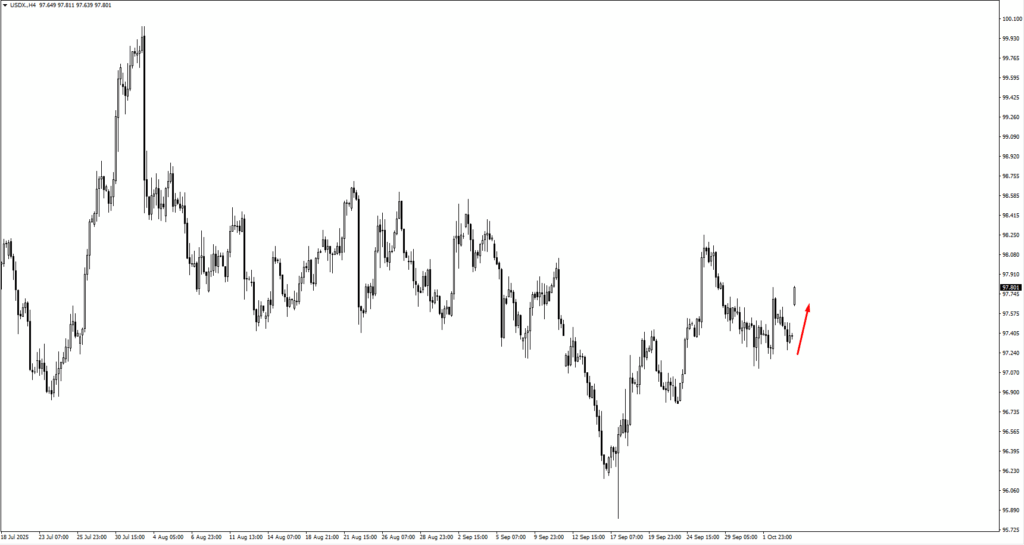

The US Dollar Index (USDX) extended its climb from the 97.00 zone, opening the week with a bullish gap. Traders are closely watching 98.05 as the next significant resistance level. While the broader uptrend remains intact, slowing momentum could trigger a period of consolidation. Should that happen, buying interest may re-emerge near 96.85 or 96.60, where previous rebounds have taken shape.

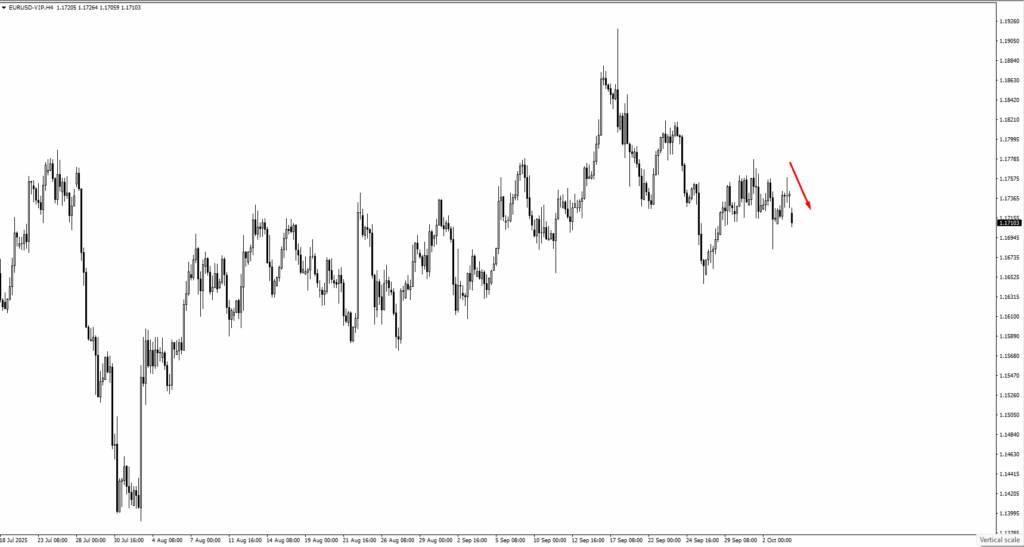

EURUSD mirrored the dollar’s strength in reverse, sliding lower after gapping down from the 1.1805 resistance zone. The pair’s current structure still points to downside pressure unless it can sustain a move above 1.1800, a level where sellers are expected to defend.

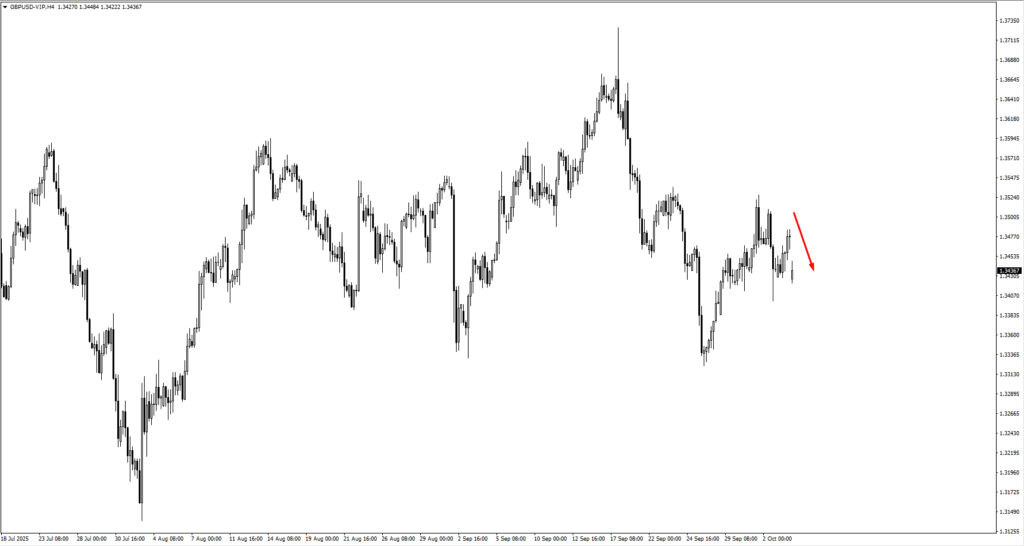

GBPUSD followed a similar pattern, extending its recent decline and finding temporary support around 1.3395. Any recovery toward 1.3540 is likely to meet renewed selling pressure as markets await fresh guidance from the Bank of England.

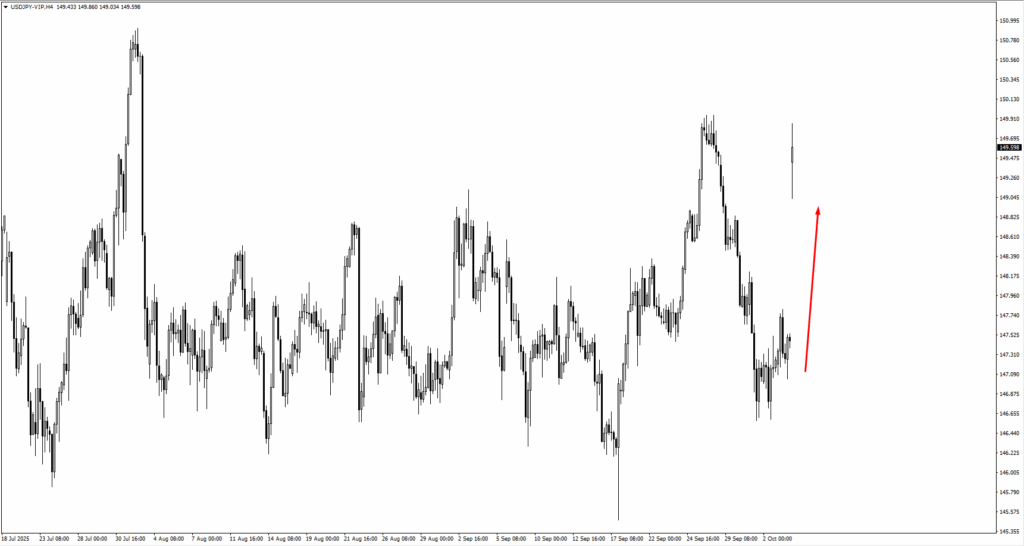

USDJPY gapped higher in line with last week’s bullish momentum, edging closer to the 149.95 high before potential consolidation. A confirmed breakout could see the pair extend toward 150.911, a move that would test the patience of Japan’s policymakers.

USDCHF, meanwhile, slipped from the 0.8000 zone and now trades within a consolidation band. Should price dip further, buyers are expected to defend the 0.7915 level to maintain upward structure.

Among the commodity-linked currencies, AUDUSD opened the week with a gap lower before stabilising near 0.6570. If recovery extends, traders will monitor 0.6650 for bearish price action.

The NZDUSD chart paints a similar picture: after dropping early in the week, price rebounded from the 0.5790 zone. Resistance remains between 0.5860 and 0.5890, with potential for sellers to re-enter if risk sentiment weakens.

Commodities extended their retracement.

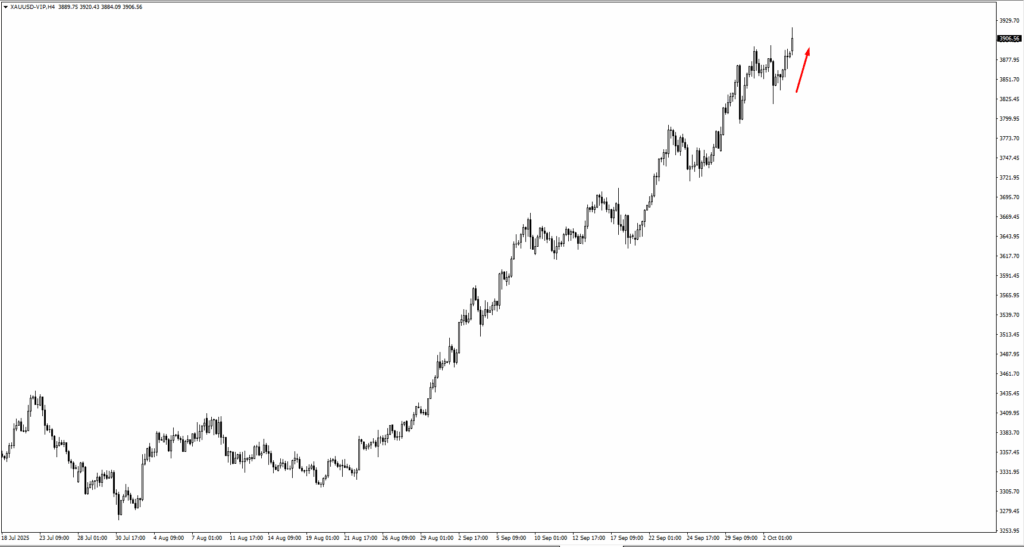

Gold surged to a fresh all-time high, testing resistance at around USD 3,915 as investors sought safety amid ongoing uncertainty over global interest rates. A decisive break above this level could open the path toward USD 4,075, though the move looks stretched following its strong rally. Traders are watching for signs of profit-taking before initiating new long positions.

Oil, meanwhile, is attempting to recover after weeks of losses. A sustained move above USD 62.665 would signal that buyers are regaining control, though fundamentals remain fragile amid uneven demand expectations. Any rejection at this zone could see prices retreat toward prior support levels near the low-60s.

Equities entered October on firmer ground but are showing fatigue.

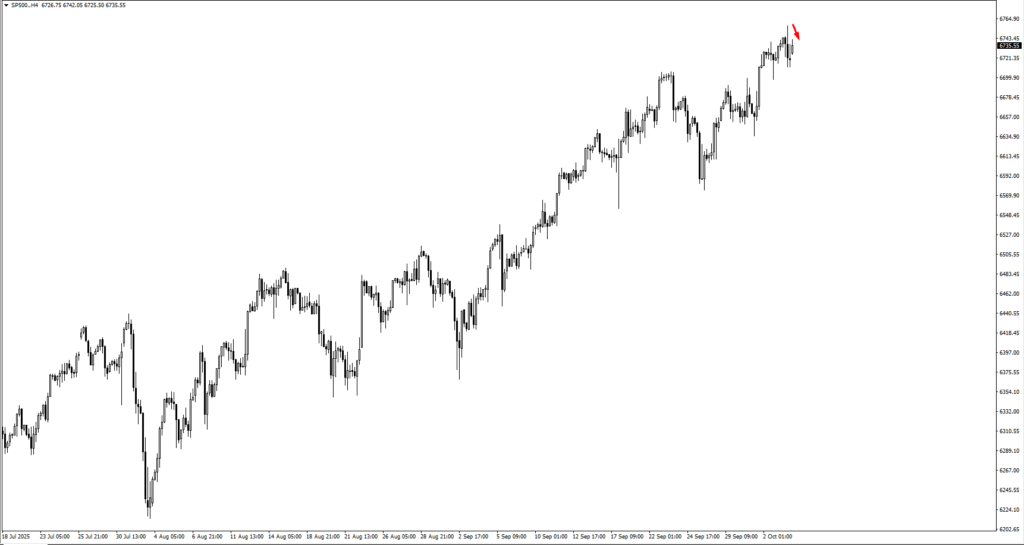

The S&P 500 continues to face stiff resistance near 6,750, where price action suggests sellers are beginning to reassert control. Should momentum hold, 6,840 marks the next area of interest. Sentiment remains cautious as investors await clarity on the Fed’s next policy moves and the upcoming Q4 earnings season.

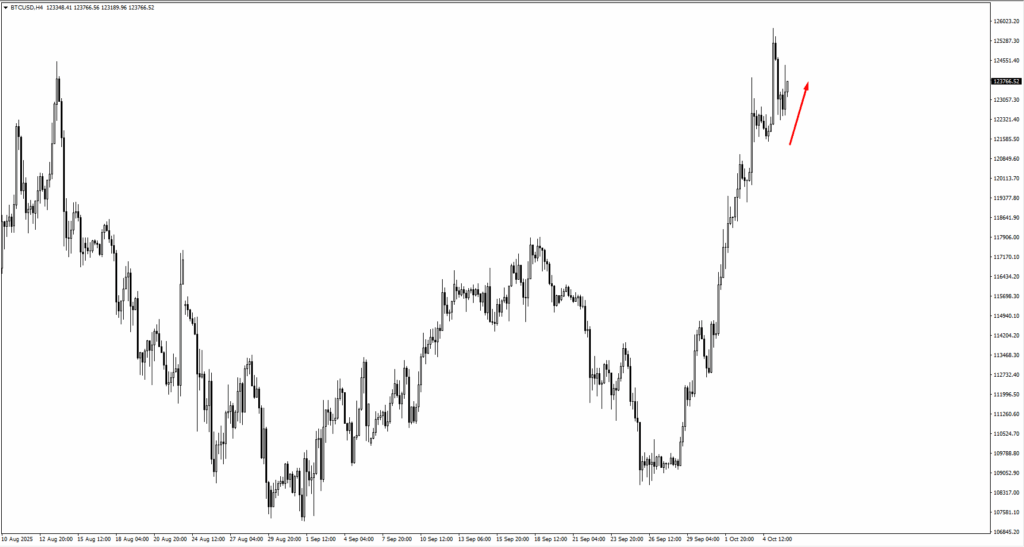

Bitcoin, by contrast, is once again stealing the spotlight. The world’s largest cryptocurrency surged to a new record above USD 125,700 on Sunday, breaking through resistance with strong volume.

If consolidation patterns hold, analysts see scope for another leg higher toward USD 135,000. The move underscores the broader divergence between traditional and digital assets, where equity traders are treading water, crypto investors appear to be gearing up for the next rally.

Key Events Of The Week

The week ahead offers a calmer start before major data hits midweek, setting the tone for currency and rate expectations heading into mid-October.

Tuesday brings two key central-bank speeches. ECB President Lagarde and BoE Governor Bailey are both scheduled to speak, and markets will be listening closely for clues on future interest-rate management. The euro and pound have traded in tight ranges in recent sessions, but any hawkish tone could revive volatility as traders recalibrate rate-cut expectations for year-end.

On Wednesday, the Reserve Bank of New Zealand will announce its Official Cash Rate, currently forecast at 2.75 % versus 3.00 % previously. A dovish reduction would confirm policymakers’ shift toward easing after months of slowing growth, potentially pressuring the New Zealand dollar. Traders are watching for selling opportunities on NZDUSD should price action make another attempt higher.

The focus then shifts to Friday, when the macro calendar accelerates. RBA Governor Bullock is set to speak, and markets expect remarks tied to Australia’s softer inflation outlook and the potential for further easing.

The same session will bring the all-important US Non-Farm Employment Report, with payrolls expected to rise by 51 K versus 22 K previously, while the unemployment rate is projected to hold at 4.3 %. Stronger-than-expected numbers could dampen speculation of additional Fed cuts, offering a temporary lift to the dollar; weaker data would reinforce the dovish bias that has underpinned recent market moves.

Later in the day, the University of Michigan Consumer Sentiment Index rounds out the week, with forecasts pointing to 54.6 versus 55.1 previously.

Any surprise rebound could suggest consumer resilience despite policy uncertainty, while further softening would fit the slowing-growth narrative that has shaped investor sentiment through early October.

Looking ahead, the following week will be heavier on data, featuring US CPI, PPI, and Retail Sales, alongside UK GDP, all due between 15–16 October 2025. These releases will provide the next key test of whether the global easing narrative can sustain its grip on markets or if inflation pressures return to complicate the picture.

Create your live VT Markets account and start trading now.