History delivers a clear message to markets. When a currency loses credibility, confidence is usually the first casualty, followed soon by institutions themselves.

Germany’s experience in 1923 is a classic example. Hyperinflation reduced the mark to near worthlessness, with citizens needing wheelbarrows of cash simply to purchase basic goods.

By November of that year, one US dollar was worth around 4.2 trillion marks. Personal savings were destroyed, and the government collapsed shortly afterwards.

A similar chain of events played out in Indonesia in 1998. During the Asian financial crisis, the rupiah lost roughly 80% of its value in just a few months.

Rising prices sparked widespread protests, and by May 1998, President Suharto stepped down after more than three decades in power.

For traders, these episodes matter because they illustrate how currency failure can rapidly alter political stability, redirect capital flows, and reshape demand for assets.

Iran’s Currency Crisis And Capital Flight

A comparable pattern is now emerging in Iran. Late last year, private lender Ayandeh Bank collapsed under the weight of nearly USD 5 billion in non-performing loans.

The government’s response was to print money to absorb the losses, a move that accelerated the currency’s decline rather than restoring confidence.

Already weakened by sanctions and policy errors, the Iranian rial entered a sharp downward spiral. After sustained losses through 2025, the currency sank to fresh record lows near 1.5 million per dollar on the black market.

By late December, rising living costs and eroding trust in institutions had triggered nationwide protests.

From a market perspective, currency collapse typically drives defensive behaviour. As the rial deteriorated, households and businesses moved swiftly to protect wealth through alternative channels, fuelling demand for assets outside the traditional banking system.

Why Crypto Gains Ground When Fiat Fails

History also shows that governments often respond to currency breakdown with redenomination. Venezuela offers a recent case. In 2018, authorities introduced a new sovereign bolivar, slashing five zeros from the old currency.

Inflation persisted. By 2021, another reform followed, with the launch of a digital bolivar that removed six additional zeros.

The outcome was largely unchanged. By late 2021, it still took millions of bolivars to buy a loaf of bread.

Those with access to US dollars via remittances or exports fared better, while workers paid solely in bolivars were trapped in an increasingly dysfunctional domestic economy.

To close that gap, many Venezuelans turned to cryptocurrencies. Digital assets became a means to receive remittances, preserve income, and transact beyond failing financial systems. For traders, this helps explain why crypto demand often rises during periods of crisis, even as prices remain volatile.

Iran’s Early Lead In Digital Adoption

Iran differs from Venezuela in one important respect: digital asset adoption is already high.

By 2023, around one in five Iranians owned cryptocurrency, and nearly one in three had used or invested in digital assets, among the highest adoption rates globally.

Years of sanctions and restricted access to international finance pushed many Iranians towards Bitcoin and stablecoins well before the current turmoil. As a result, if banking stress intensifies or political instability accelerates, capital can move into digital assets quickly, without the steep learning curve seen in other economies.

For global markets, this reinforces the view that crypto is increasingly functioning as financial infrastructure rather than purely a speculative vehicle in fragile states.

What Traders Are Watching Into 2026

Despite growing real-world usage, crypto markets remain sensitive to broader macro conditions. As of January 2026, expectations of persistently high interest rates and a relatively tight stance from the US Federal Reserve have weighed on Bitcoin.

Regulatory uncertainty has added to the pressure. In mid-January, delays to a US Senate crypto bill pushed Bitcoin back below the USD 95,000 level.

Early-year trading often remains choppy due to tax-related selling and shifts in liquidity. However, if inflation continues to ease and major central banks pivot towards looser policy later in 2026, liquidity conditions could improve.

In such an environment, assets like Bitcoin may attract renewed inflows, particularly as real-world use cases expand during episodes of currency stress.

Market Movements Of The Week

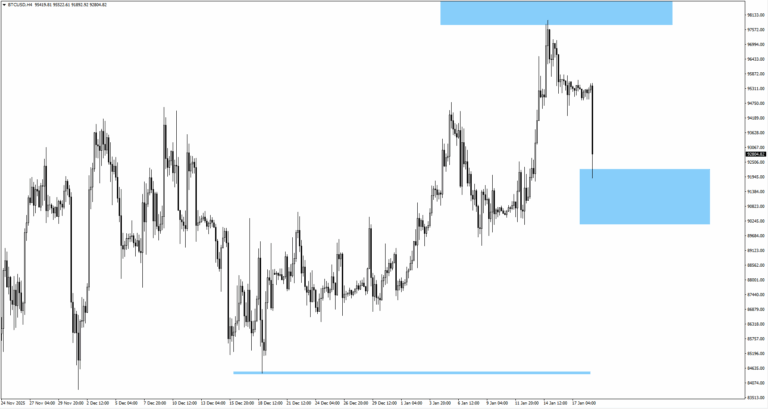

Bitcoin (BTCUSD)

– Bitcoin pulled back below 95,000 dollars following US regulatory delays.

– Elevated rates continue to cap short-term upside.

– Structural demand remains supported by emerging market adoption.

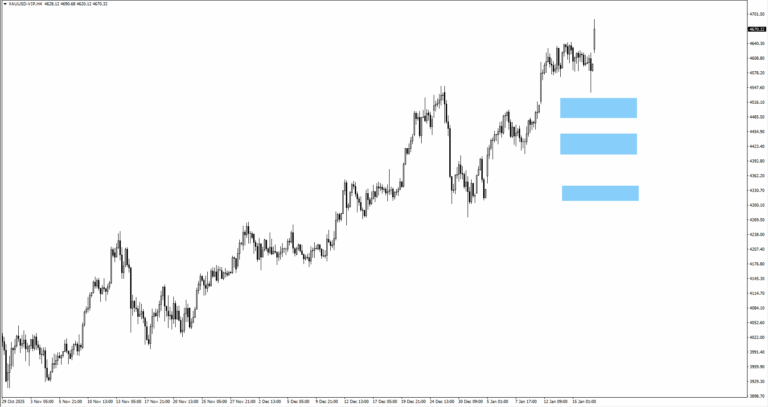

Gold (XAUUSD)

– Gold reached fresh all-time highs near 4,6904,505 before consolidating.

– Safe-haven demand remains firm amid currency stress headlines.

– Traders monitor US policy signals for directional clarity.

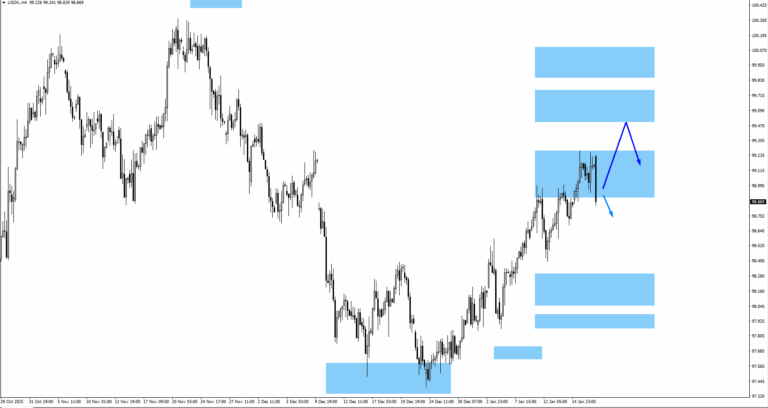

US Dollar Index (USDX)

– USDX trades near the 99.10 monitored area.

– Tariff rhetoric and rate expectations support near-term strength.

– Resistance sits near 99.70 and 100.00.

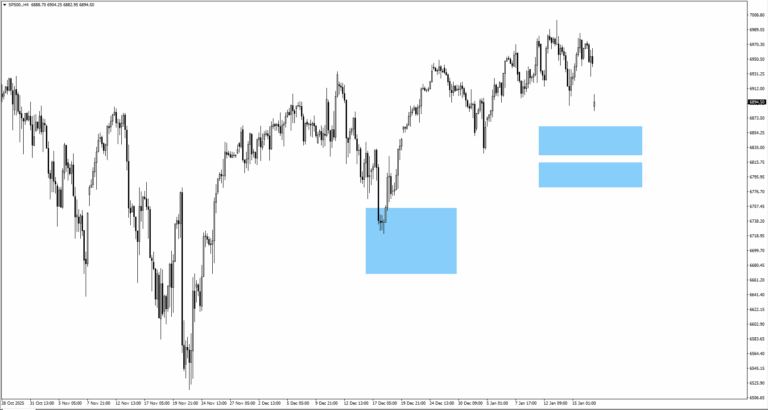

S&P 500 (SP500)

– The 7,000 level remains a key resistance area.

– Geopolitical risk could trigger pullbacks toward 6,840 or 6,795.

– Equity sentiment remains sensitive to macro stability signals.

Key Events This Week

19 January

1. US Bank Holiday

Thinner liquidity conditions may distort early-week price action.

20 January

1. UK BOE Governor Bailey Speaks

Refer to market structure for directional bias.

21 January

1. US President Trump Speaks

Monitor for further geopolitical and policy-related updates.

22 January

1. US Core PCE Price Index m/m, Forecast: NA, Previous: 0.20%

Inflation sensitivity remains elevated.

2. US Final GDP q/q, Forecast: 4.30%, Previous: 4.30%

Refer to market structure for confirmation.

23 January

1. JP BOJ Policy Rate, Forecast: 0.75%, Previous: 0.75%

Focus on Ueda’s guidance and yen reaction.

Bottom Line

Markets remain closely tied to the credibility of money itself. Ongoing currency strains across parts of the developing world continue to support demand for alternative stores of value, while tighter global financial conditions keep near-term volatility elevated across risk assets.

Crypto markets remain highly responsive to interest rate expectations and regulatory developments, yet adoption driven by necessity rather than speculation continues to build quietly in the background.

Traders are focused on upcoming policy signals and inflation data, which will shape liquidity conditions and determine whether defensive positioning gives way to a renewed appetite for risk later in 2026.