The late-2025 US government shutdown has created a significant gap in economic reporting, with several major indicators either postponed or unlikely to be published before the Federal Reserve’s 10–11 December meeting.

Thus far, only the September CPI figures have been released. The October non-farm payrolls report may slip into December, while the PCE inflation data may not meet the publication requirements in time.

This lack of visibility has left policymakers working with incomplete information. Multiple Fed officials have highlighted this constraint, with Atlanta Fed President Raphael Bostic cautioning that decisions may need to be taken without the usual depth of data.

As of 16 November, CME FedWatch Tool places the odds of a 25 bp cut at the December meeting around 44.4%, down from 63% earlier this month and from 85–90% pre–October FOMC. The drop in expectations reflects growing caution among policymakers.

Some policymakers, including Waller and Bowman, have pushed for a pre-emptive cut given signs of cooling in the labour market. Others, such as Jefferson and Schmid, have urged patience in light of still-elevated inflation.

The divergence within the committee raises the risk of an unexpected outcome.

Market Reaction Likely To Be Two-Sided

Investors now see the December decision landing in one of two clear scenarios. A rate cut would likely lift sentiment across risk assets; equities, gold, and cryptocurrencies among them, while placing downward pressure on the US dollar.

The scheduled end of quantitative tightening on 1 December would further support liquidity conditions. Conversely, if the Fed opts to keep rates unchanged, markets may tilt defensive.

A firmer dollar could drag on gold and Bitcoin, and equities may come under strain if easing expectations are pushed into 2026.

Elsewhere, Russia’s Novorossiysk port has restarted crude shipments after a two-day halt, calming supply concerns and pulling WTI prices back towards the $59 area. For traders, the rapid shift from disruption to normalisation serves as a reminder of how quickly supply-driven headlines can spark short-term volatility across oil and energy-related assets.

This week’s data releases, particularly Thursday’s US employment numbers, could become a major swing factor depending on whether they arrive softer or firmer than anticipated.

Market Movements Of The Week

Gold (XAUUSD)

– Price currently consolidates near $4,085 after a steep drop from recent highs around $4,260.

– If price retests and rejects near $4,160–4,170, downside continuation remains in play.

– Key support sits at $4,005–4,045; bullish setups may emerge from this zone if momentum holds.

– Break below $4,000 could expose deeper retracements; a reclaim of $4,170 reopens upside potential.

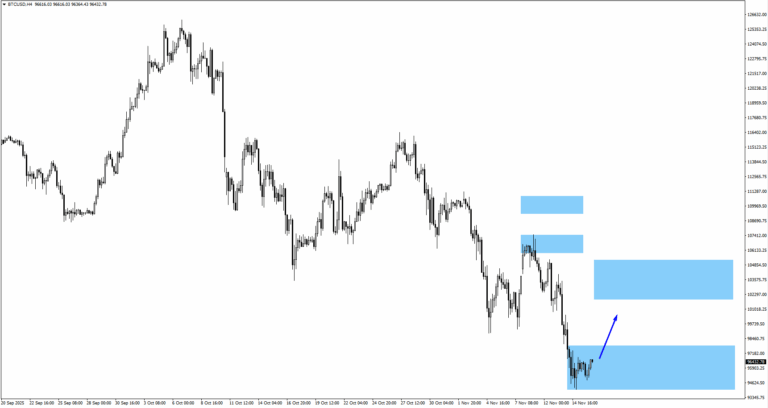

Bitcoin (BTCUSD)

– Bitcoin is trading around the $96,850 monitored zone; bulls lack momentum without liquidity tailwinds.- – A move toward $102,000 or $104,500 could follow if rate cut odds rebound.

– Downside risk grows if US macro surprises on the hawkish side.

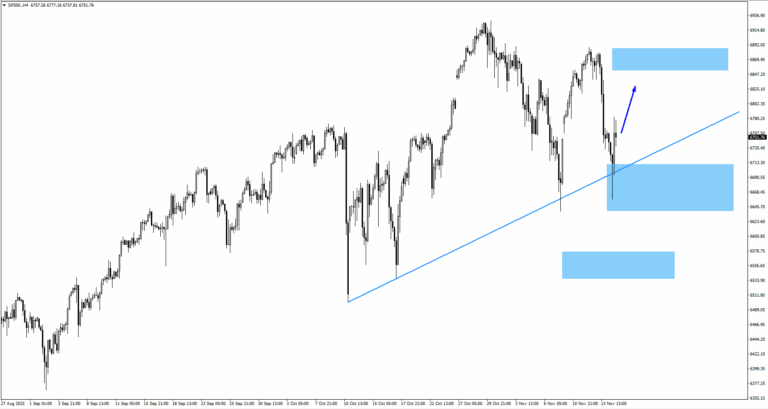

S&P 500 (SP500)

– SP500 is holding support around 6,665 but remains range-bound.

– If price consolidates, a retest of 6,865 may follow; a break lower would signal a deeper correction.

– Fed outlook and macro data will dictate broader equity sentiment this week.

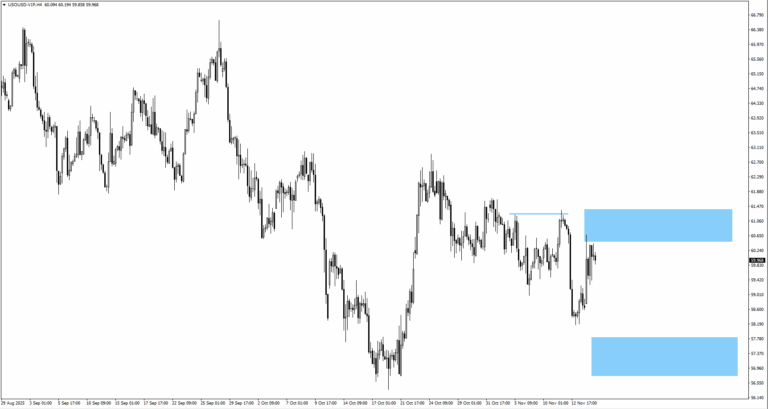

USOil

– USOil was trading around 60.45 last week, but quickly fell to around 59.5 per barrel on Monday, paring gains from the previous session after Russia’s Novorossiysk port resume oil loading operations.

– If momentum turns lower, the next key support to watch is around 57.80, where buyers previously stepped in.

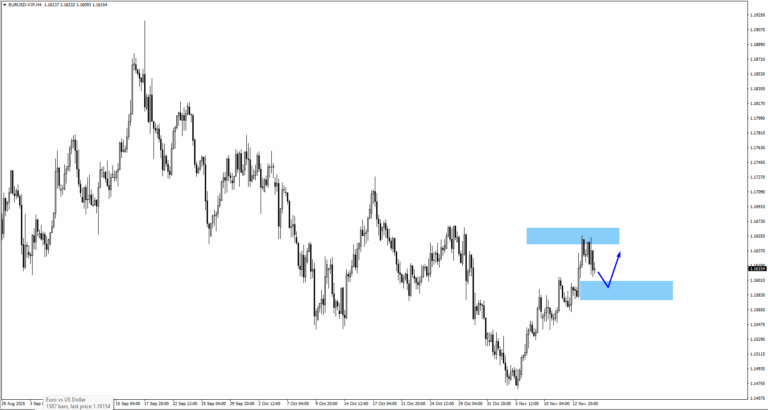

EURUSD

– EURUSD dipped from the 1.1650 area; bullish structure now monitored at 1.1590.

– A break below 1.1555 would invalidate the upside zone.

– Price action hinges on US inflation data and ECB tone.

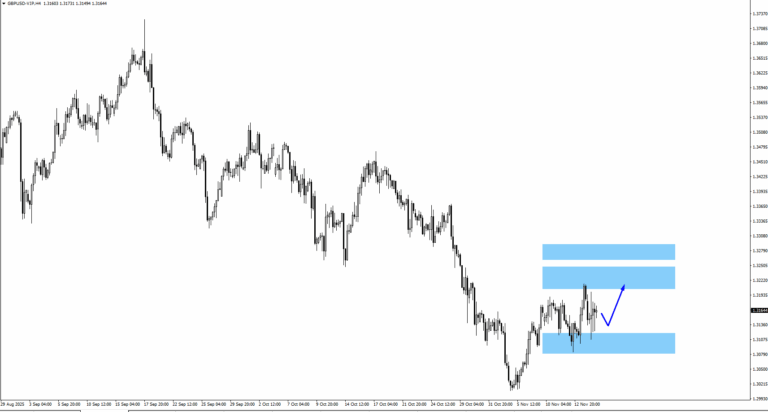

GBPUSD

– Cable pulled back from the 1.3225 zone and may revisit 1.3100 before the next leg higher.

– Traders eye price response near 1.3275 on a rally.

– CPI figures on Wednesday are key for the next directional leg.

Key Events This Week

17 November

1. CAD CPI m/m, Forecast: 0.20%, Previous: 0.10%

If USDCAD moves higher early in the week, this release could drag it lower.

19 November

1. UK CPI y/y, Forecast: 3.60%, Previous: 3.80%

A soft print reinforces cooling inflation narrative; watch for movement in GBPUSD.

20 November

1. US NFP, Forecast: 58K, Previous: 22K

Labour market update carries weight in absence of full data post-shutdown.

2. US Unemployment Rate, Forecast: 4.3%, Previous: 4.3%

Unclear if October figures will be released; any new data could sway Fed outlook.

Market Snapshot

The Federal Reserve approaches its December meeting with a divided stance and limited data visibility, making the policy outlook uncertain. Traders remain highly reactive to incoming macro headlines, particularly around employment and inflation. With CPI, NFP, and the Fed minutes all on deck, these events will play a key role in shaping market expectations as year-end approaches.