After a blistering start to the year, Wall Street has reached the part of the climb where the air feels thinner. Earnings remain on the rise, though the pace is easing. The S&P 500 booked gains of 13.6% in Q1 and 10.3% in Q2, but forecasts for the next two quarters suggest growth slowing to 7.6% and 7.0%. Still healthy, but no longer the double-digit bursts that make rallies easy.

One unusual twist this quarter: in July, analysts inched their Q3 expectations slightly higher — the first such move since Q2 2024. Optimism was strongest in Energy and Technology, though Healthcare lagged. With valuations around 22 times forward earnings, the market’s tolerance for disappointment is thin. A spike in tariffs or a softening in demand could quickly change the mood.

The Federal Reserve is stepping further into the spotlight. July’s jobs report disappointed, with only 73,000 new positions compared to the 110,000 expected, alongside downward revisions of 258,000 for previous months. Wage growth is cooling, temporary jobs are fading, and the labour market is loosening faster than many anticipated.

Traders now see a 90–95% probability of a September rate cut and expect around 62 basis points of easing by year-end. That implies two or three cuts, pushing rates towards 4% by early 2026. The market welcomes looser policy — but for the wrong reason. It’s not a clear win over inflation driving the shift, but mounting concerns over growth.

Trade tensions are simmering just below boiling point. On 12 August, the pause on U.S.–China tariffs is due to expire. If that happens, tariffs on many goods could snap back to around 80%. President Trump has already doubled tariffs on Indian imports to 50% and is considering targeted measures on Canadian and Mexican goods. Technology, automotive, and industrial sectors are particularly exposed.

The semiconductor industry is under the microscope, with Trump threatening 100% tariffs unless U.S. chip output ramps up. This has sparked a flood of record-breaking investment. Apple, TSMC, Nvidia, GlobalFoundries, and Texas Instruments are collectively committing hundreds of billions to build US capacity. While it’s a long-term push for supply chain resilience, in the short term it could squeeze free cash flow, pressure margins, and test investor patience.

Geopolitics In Play

Global affairs could deliver surprises in either direction. Trump is pressing for a resolution to the Russia–Ukraine conflict, and signals from Moscow suggest talks may be on the table. In the Middle East, the Gaza situation could be shifting, with key Arab nations and the EU urging Hamas to step aside. Any breakthrough here might drive oil prices lower, cool inflation, and give sectors such as airlines, transport, and consumer discretionary a boost.

Meanwhile, the Fed’s balance sheet has been trimmed from $9 trillion to $6.7 trillion, with quantitative tightening expected to conclude around $6.2 trillion in early 2026. Liquidity will remain tight until then, and a return to quantitative easing is unlikely unless the economy tips into a deep recession. The coming months will be a balancing act; weighing possible support from Fed cuts or peace deals against headwinds from slower earnings, trade shocks, and a weakening jobs market.

Market Movements Of The Week

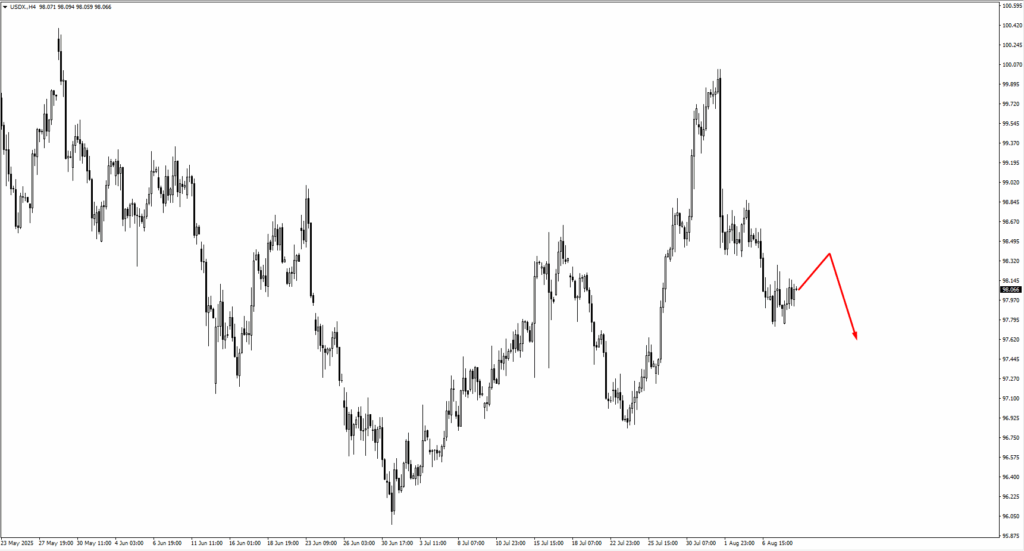

Currencies and commodities are setting up for an active spell as several assets approach key technical markers. The USD Index remains in consolidation, with traders eyeing 98.50 for potential selling pressure and 97.40 as the next downside checkpoint if momentum falters.

A softer dollar could lift EURUSD, where buyers may emerge at 1.1580 or 1.1545, with 1.1750 as the next upside target. Sterling shows a similar profile, with GBPUSD support at 1.3355 and 1.3300, while 1.3560 is the likely resistance.

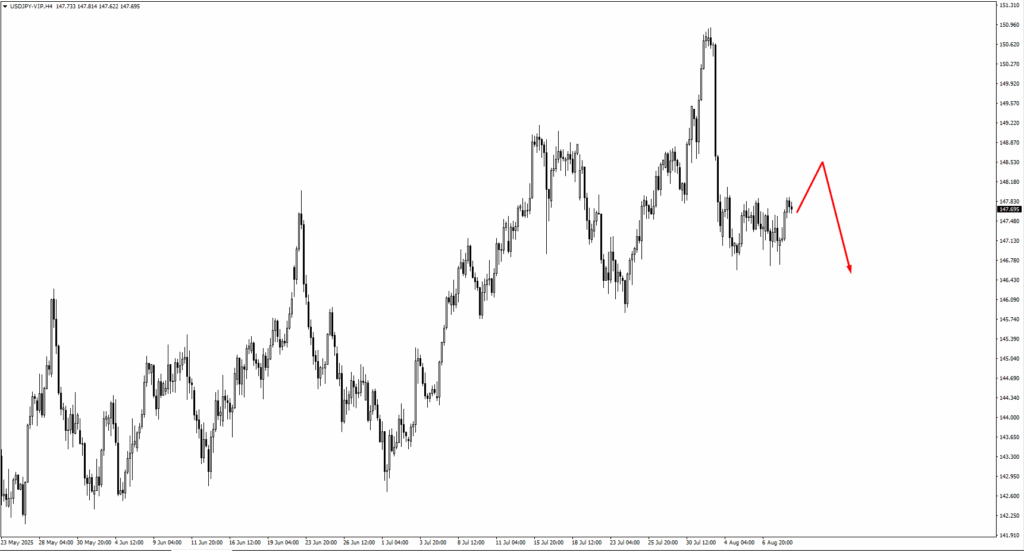

In yen trading, USDJPY’s upward drift has 148.75 and 149.30 under watch for signs of reversal. USDCHF could see sellers reappear if it rises beyond 0.8117 or 0.8150.

Among commodity-linked pairs, AUDUSD is nearing 0.6570, a level that may attract sellers, while NZDUSD’s next test lies at 0.6015. For USDCAD, buyers may step in near 1.3675 if the current decline continues.

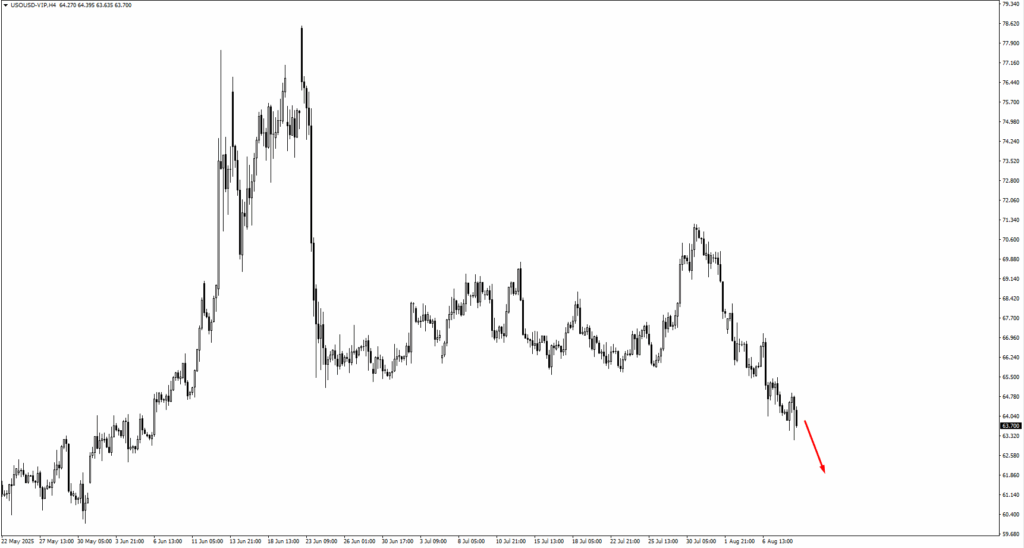

USOil remains under pressure, currently testing $63.35. A break lower opens the door to $61.15, particularly if consolidation patterns form here.

Gold’s rally has $3,430 in sight, a fresh zone to watch for profit-taking or reversal cues.

The S&P 500 has erased last week’s bearish tone and is pushing toward a potential new all-time high, with $6,630 marked as the next major reaction point.

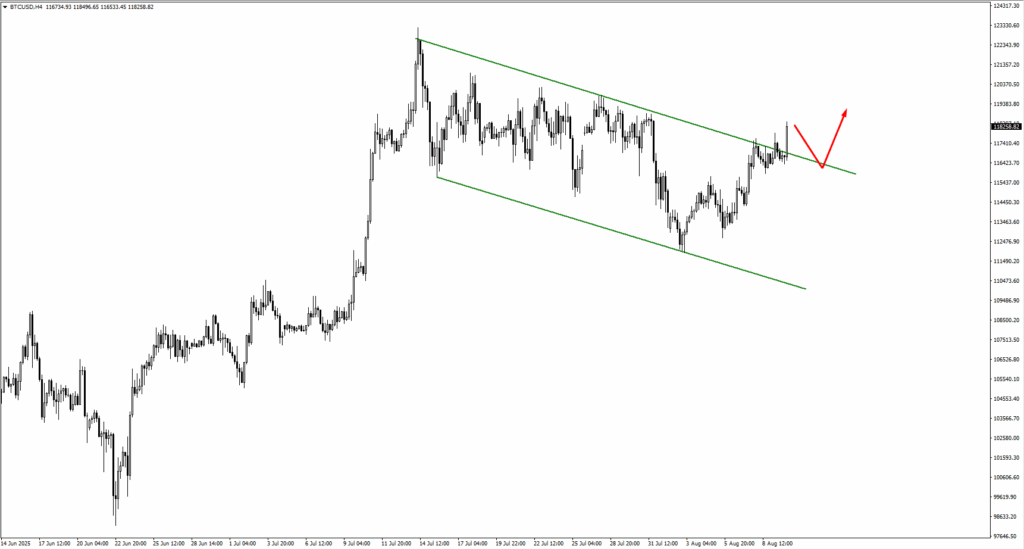

Bitcoin has broken out above its channel top and, after a period of consolidation, could advance toward $121,400. Natural Gas sits at $2.90; holding here could spark a rebound, while a drop to $2.55 may follow if momentum falters.

In each case, price behaviour around these levels will be critical. Sharp rejections could fuel reversals, while clean breaks on strong volume may set the stage for trend extensions. With macro risks from the Fed, tariffs, and geopolitical events still live, traders may want to blend technical signals with the broader market backdrop before committing to positions.

Key Events Of The Week

The macro calendar is light, but a few data releases could sway sentiment.

On Tuesday, 12 August, Australia’s cash rate decision is due, with forecasts pointing to a cut from 3.85% to 3.60%. If the Aussie dollar is testing 0.6570 while the USD Index presses support, AUDUSD could face fresh selling. The same day, U.S. CPI is expected at 2.8% year-on-year, up from 2.7%. This inflation reading will be closely watched, as it may influence the Fed’s pace of rate cuts after September.

Thursday, 14 August, brings the UK’s monthly GDP, forecast at 0.2% compared with -0.1% previously. While that’s an improvement, global headwinds continue to cloud the outlook. Also on Thursday, U.S. producer prices are expected to rise by 0.2% after a -0.5% drop, possibly hinting at building inflationary pressure at the wholesale level.

Friday, 15 August, rounds off with U.S. retail sales and preliminary University of Michigan consumer sentiment. Retail sales are forecast to grow 0.5%, slightly below June’s 0.6%, while sentiment is seen at 62.2 versus 61.7. Both will offer insight into the health of the U.S. consumer — still central to the growth outlook and, by extension, the Fed’s policy path.

Looking further ahead, traders will keep an eye on next week’s key events: Canada’s trimmed CPI on 19 August, New Zealand’s official cash rate decision on 20 August, and the Jackson Hole Symposium on 22 August, which could bring fresh central bank signals on rates and growth.

Create your live VT Markets account and start trading today.