What began as a carefully composed address in the mountains of Wyoming reverberated across the global financial system in seconds. Jerome Powell’s restrained tone, mixed with a hint that policy may soften, propelled Wall Street to fresh highs and reshaped capital flows in currencies and commodities almost immediately.

The Federal Reserve Chair’s speech at Jackson Hole was far more than a ceremonial appearance. His balanced caution, paired with a subtle nod to easing, set equity markets surging and forced traders to recalibrate their expectations.

Market participants are now betting with conviction on a September rate cut, and this sentiment has rippled through virtually every asset class.

Powell sketched a complicated backdrop: job creation has slowed dramatically, averaging just 35,000 a month versus 168,000 last year, while unemployment edged higher to 4.2% in July.

Inflation, however, remains sticky. Core PCE rose 2.9% year-on-year in July, partly underpinned by tariff effects. Powell suggested these tariffs would act as a one-off price shock rather than a structural driver of inflation, leaving the central bank space to ease if labour market strains intensify.

Euphoria In The Markets

Investors interpreted this as a green light. Futures markets quickly increased the odds of a September rate reduction to 80–85%, up from 70–75% earlier in the day, with two quarter-point cuts priced in before the end of the year.

The reaction was immediate and powerful. The S&P 500 climbed 1.3% by late morning and finished 1.47% higher, not far off record levels. The Dow Jones Industrial Average surged nearly 1.9% to a record close.

Small-cap stocks rallied almost 4%, reflecting widespread enthusiasm for a dovish shift. The rally also broadened beyond mega-cap tech, with cyclical sectors such as financials and industrials attracting fresh flows.

Should ISM manufacturing data strengthen under the promise of cheaper borrowing, these sectors may gather additional momentum. Still, the spectre of stagflation remains, a scenario where inflation lingers while growth slows, limiting the Fed’s room for manoeuvre.

Market Movements Of The Week

The trading week following Powell’s remarks was dominated by dramatic shifts in sentiment.

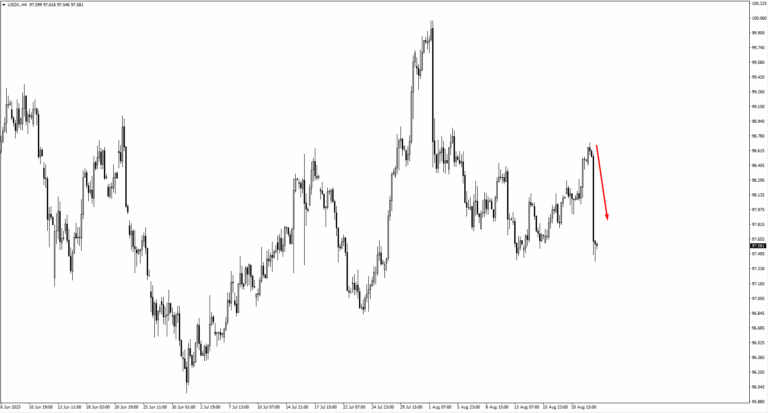

In currencies, the dollar index spiked to 98.70 before slipping toward 97.35, with 97.10 eyed as the next support.

The euro advanced toward 1.1755 and could test 1.17883 if consolidation holds. Sterling moved higher from the 1.3370 region, with 1.3605–1.3625 in view should it break above 1.35943.

The yen strengthened as USDJPY fell after breaching 148.513, with a test of 146.208 likely if downside pressure continues.

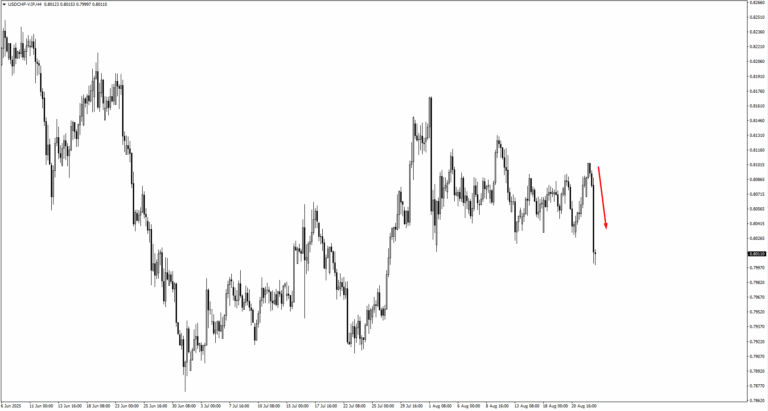

The Swiss franc also gained, pushing USDCHF down from 0.8110 towards 0.7960. Commodity currencies reacted strongly, with AUDUSD pushing higher toward 0.6515, NZDUSD eyeing 0.5890–0.5915, and USDCAD sliding to the 1.3810–1.3790 zone.

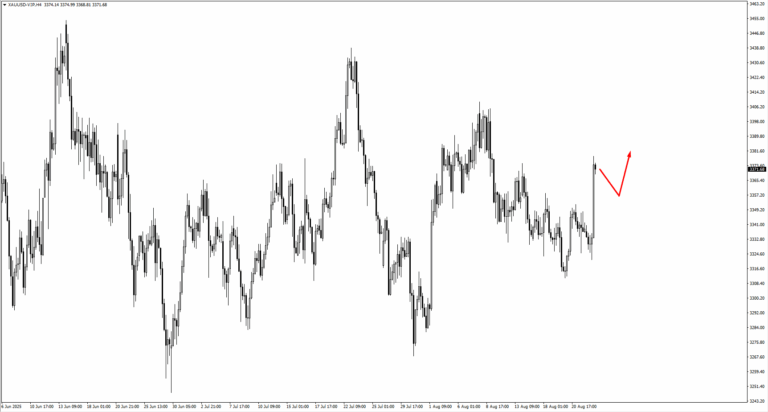

Commodities reflected Powell’s dovish lean, too. Gold extended gains with eyes on consolidation around the 3350 region. Oil looks set for sideways trade, with resistance near 66.45 and support around 61.15 if selling pressure resumes. Natural gas extended losses to 2.55, where buyers may re-emerge.

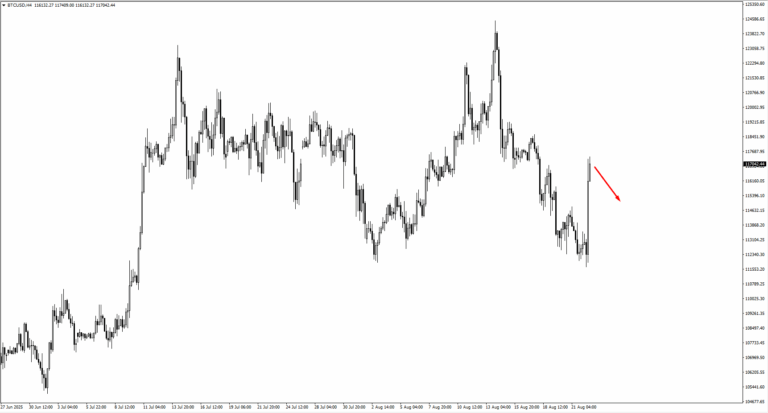

Bitcoin surged from 111,200 to the monitored 117,700 area after Powell’s speech. A period of consolidation here could see the cryptocurrency break higher, but failure to hold may drive it toward 108,900.

The SP500 already cleared 6445 and could now target 6630 or 6730, reflecting investor confidence in easier policy.

The broader picture is clear: Powell has tilted the Fed toward accommodation, and markets are pricing it in aggressively. Yet the balance remains fragile.

Employment risks loom and inflation has not subsided, making September’s data pivotal. The market may cheer lower rates, but sustainability will depend on whether growth holds steady under this policy shift.

Key Events Of The Week

The calendar is sparse at the start of the week, but builds into a string of pivotal data releases that could set the tone for markets following Powell’s Jackson Hole speech.

On Wednesday, 27 August attention shifts to Canada and Australia. The Bank of Canada’s Governor Macklem is due to speak as inflation concerns swirl. July’s consumer prices cooled, but uncertainty remains on whether the central bank will cut rates in September.

Meanwhile, Australian CPI is forecast at 2.30% year-on-year, compared with 1.90% previously. If the data continues to climb, AUDUSD could extend higher.

Thursday, 28 August brings the US preliminary GDP figures. Growth is expected at 3.10% quarter-on-quarter, up from 3.00% previously. The rebound follows a contraction in the first quarter, with consumer spending and government outlays expected to be the primary drivers.

A stronger reading would be positive for the dollar, though its impact will depend on how traders interpret the balance between firm growth and Powell’s dovish tone.

Friday, 29 August rounds out the week with inflation data from Japan and the United States. Tokyo core CPI is forecast at 2.60% year-on-year versus 2.90% previously, suggesting price pressures are easing.

A softer print may give the Bank of Japan reason to delay a rate hike. The US releases its Core PCE Price Index, the Fed’s preferred inflation gauge, with expectations of 0.30% month-on-month, identical to the previous reading.

Any deviation from this could test the credibility of Powell’s claim that tariff-driven inflation is temporary.

Looking ahead, the following week holds even weightier releases: ISM manufacturing PMI on 2 September, Australia’s GDP and US JOLTS job openings on 3 September, ISM services PMI on 4 September, and the nonfarm payrolls and unemployment rate on 5 September.

Create your live VT Markets account and start trading now.