Washington is gearing up for a pivotal showdown as the Supreme Court prepares to hear arguments this November on whether President Trump exceeded his authority by imposing emergency tariffs under the International Emergency Economic Powers Act.

The duties, set at rates of 10 to 50 per cent on imports from Canada, Mexico, China, and elsewhere, pushed the U.S. effective tariff rate to levels not seen since the 1930s.

Originally projected to raise between $2.3 trillion and $3.3 trillion over the course of a decade, the tariffs now face a serious legal challenge that could dismantle the framework entirely. If struck down, the ruling could trigger a historic refund, reshaping fiscal policy for years ahead.

Should cancellation be confirmed, equities would almost certainly celebrate in the immediate aftermath. Companies that have been squeezed by higher import costs would see relief, with sectors such as consumer electronics, car parts, and agriculture likely to benefit first.

Inflation, estimated by budget analysts to have risen 1.7 percentage points as a direct result of tariffs, could slip closer to 0.5 per cent. That would ease the Federal Reserve’s inflation headache, giving policymakers greater flexibility to cut rates, thereby adding fuel to equity market gains.

The first phase of adjustment, therefore, points towards a market rally rather than collapse, as investors pile into stocks that stand to gain most from lower trade barriers.

The second phase is less straightforward. While Trump’s tariffs have already raised more than $150 billion, potential refunds, including accrued interest, could total between $750 billion and $1 trillion. That repayment obligation would land on a Treasury already burdened with annual deficits exceeding $2 trillion.

Financing such liabilities would require further bond issuance in an already saturated market, where rising debt-servicing costs are a growing concern. Investors would almost certainly demand higher yields to absorb the influx, which in turn would ripple across the wider economy—pushing up borrowing costs for businesses and households.

Thus, while equities may rally on disinflationary relief in the near term, rising yields could eventually act as a ceiling on valuations.

Currency markets are poised for a similar two-stage adjustment.

Initially, U.S. Treasuries remain the world’s premier safe-haven asset. Even under fiscal strain, global capital often seeks shelter in American debt, which would underpin the dollar—particularly if equity gains are paired with expectations of rate cuts from the Federal Reserve.

Yet confidence could waver if deficits continue to balloon. In that case, the dollar could be forced into repricing—holding firm during risk-off episodes but facing longer-term structural weakness as investors demand greater returns to hold U.S. debt.

For traders, the message is clear: expect a two-step sequence. First comes a celebratory phase, with markets cheering reduced inflation and trade costs. Then comes the reckoning, with the reality of fiscal strain, swelling bond supply, and higher yields colliding with the initial optimism.

The cautious outlook: equities are likely to rise first, led by tariff-sensitive industries, but face headwinds if yields push borrowing costs higher. The dollar may hold steady in the short term, but risks gradual softening if deficits spiral further.

Market Movements This Week

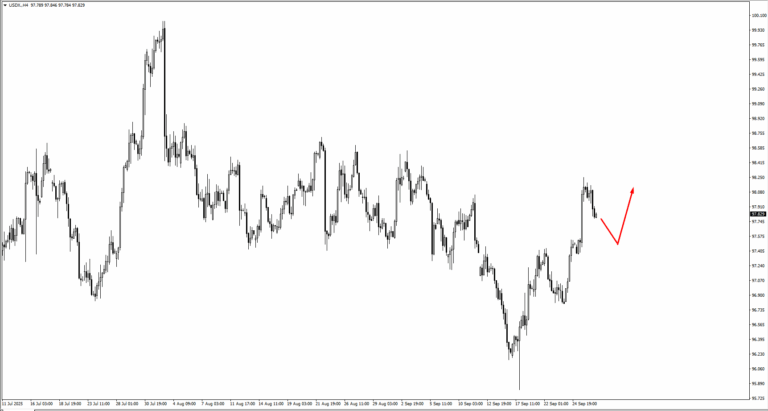

The dollar is still steering the wheel. USDX climbed from 96.60 and cleared 98.051 before pausing. The pullback is orderly so far, and the bias holds as long as 97.00 remains intact. Dips into the 97s are still the place to watch for buyers.

The euro and sterling are both struggling to keep traction. EURUSD fell through 1.16571 before rebounding, but rallies into 1.1745 or 1.1805 look stretched. GBPUSD carries the same weight, with sellers lining up near 1.3450 and 1.3505. For now, both pairs remain capped by fragile sentiment.

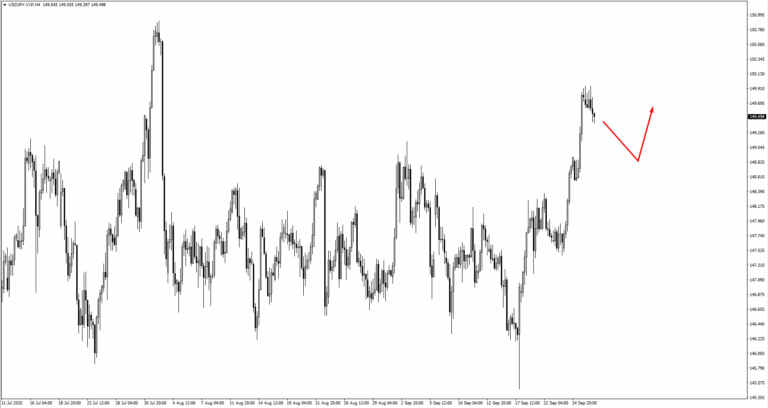

USDJPY keeps its bullish tilt. The push through 149.127 sets the tone, and any retreat into 148.75 or 147.75 is where momentum buyers are likely to re-engage. Dollar Swiss is also building higher ground, with 0.7950 and 0.7925 as natural springboards.

The commodity bloc is still under pressure. AUDUSD has been leaning lower from 0.6640, and NZDUSD mirrors the weakness, with sellers watching 0.5815 to 0.5860. The Canadian dollar, by contrast, is firming with the dollar, and 1.3900–1.3830 is the zone to watch for the next leg higher.

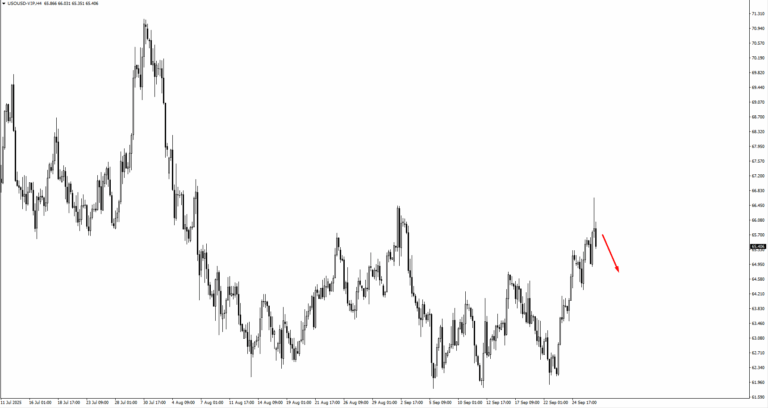

Oil’s breakout has hit resistance. Price cleared 66.442 but sellers stepped in quickly. The 64.60 handle is the line to defend if the uptrend is to hold. Gold is quieter, caught between 3835 overhead and 3690 below. Until one side gives, it remains a range-trader’s market.

Equities continue to climb. The S&P 500 bounced from 6576 and now eyes 6750 and 6840, though stretched valuations will test conviction if yields start pressing higher again.

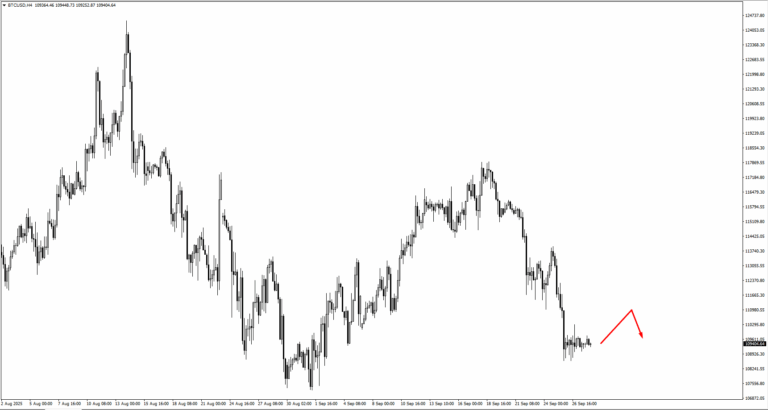

Bitcoin, too, is settling into a range between 109450 support and 114200 resistance. With two-way flows in play, the market is waiting for a clean break before leaning hard in either direction.

Natural gas sits on the back foot after losing 2.92, with 2.73 the next level for dip buyers to try their luck.

Key Events Of The Week

The calendar for the week sets a measured tone, with traders balancing central bank decisions against labour market data. Monday begins quietly, with no scheduled releases.

On Tuesday, 30 Sep, attention shifts to Australia and the United States. The Reserve Bank of Australia holds its cash rate steady at 3.60 percent, unchanged from the previous reading, while in the US, the JOLTS job openings survey is forecast at 7.15 million compared with 7.18 million previously.

These releases are expected to support consolidation in AUDUSD before fresh downside and could allow the dollar index to continue edging higher, though some stalling is possible.

Wednesday, 1 Oct, brings the ISM Manufacturing PMI, forecast at 49.1 versus 48.7 last month. A modest improvement would leave the index still below the 50 threshold, but if the dollar completes its consolidation phase by then, the release could provide the next impulse higher for the greenback.

Friday, 3 Oct, is the focal point. The Bank of Japan governor is due to speak, a reminder of yen policy sensitivity after recent weakness.

In the US, the September nonfarm payroll report is expected to show a sharp rebound with 51,000 new jobs compared to just 22,000 previously. The unemployment rate is seen steady at 4.3 percent. This combination may reinforce the dollar’s strength if the labour market shows resilience, though structure remains key as traders look for confirmation of the trend.

Looking beyond the immediate horizon, the following week brings the Reserve Bank of New Zealand’s official cash rate decision on 8 October and the University of Michigan’s preliminary consumer sentiment survey on 10 October, both of which could add another layer of volatility to dollar pairs.