After four months of uninterrupted optimism, could the markets be heading into an August comedown?

July wrapped up on a strong note, with the S&P 500 and Nasdaq marking a fourth straight month of gains. It’s been a powerful rally, with equities climbing around 28% since the spring season.

Now, as we step into August, the key question is whether the upward momentum can continue or whether the music is about to fade.

Historically, August is known for being one of the more subdued months for equities. It tends to coincide with a slowdown in market activity, as traders take a summer breather. In post-election years such as 2025, this seasonal weakness becomes more noticeable, with key indices typically retreating between 0.8% and 1.5%.

Given the recent surge, some cooling off wouldn’t come as a surprise. A period of consolidation, or even a modest correction, may be on the cards.

Strong But Not Spectacular Earnings

Corporate results for Q2 have remained generally positive, showing annual growth of approximately 6%. While this marks the eighth consecutive quarter of expansion, it’s a significant deceleration from the 17% surge seen towards the end of last year.

Roughly 80% of companies that have reported so far have outperformed analyst estimates. However, the scale of these beats has been modest. This points to firms achieving targets, but the kind of upside shocks that typically drive major rallies are becoming increasingly rare.

Tech stocks remain the main drivers of performance. Still, without broader support across sectors, earnings alone may not be enough to propel the market higher.

Limited Margin For Error

Valuations remain stretched by historical standards. The S&P 500’s forward P/E ratio currently stands at 22.4, significantly above the 5-year average of 19.9 and the 10-year norm of 18.4.

While elevated valuations don’t directly trigger corrections, they do leave the market more vulnerable. There’s little tolerance for disappointment.

If upcoming data or earnings fall short of the lofty expectations now priced in, any pullback could be more pronounced. In essence, the market is priced for perfection. It’s never a comfortable place to be.

Inflation In The Spotlight

The macro picture is mixed. Inflation has cooled to 2.7%, inching closer to the Fed’s 2% goal. Meanwhile, signs of softening in the labour market have emerged, with unemployment rising to 4.2%. These developments have fuelled speculation that the Federal Reserve could begin cutting rates as early as September.

However, traders are keeping a close eye on incoming data. Stronger-than-expected figures on employment or inflation may prompt the Fed to delay rate reductions, which could sour market sentiment.

In this scenario, what’s usually good news, as in strong data, could be interpreted negatively, especially if it means rates will stay higher for longer.

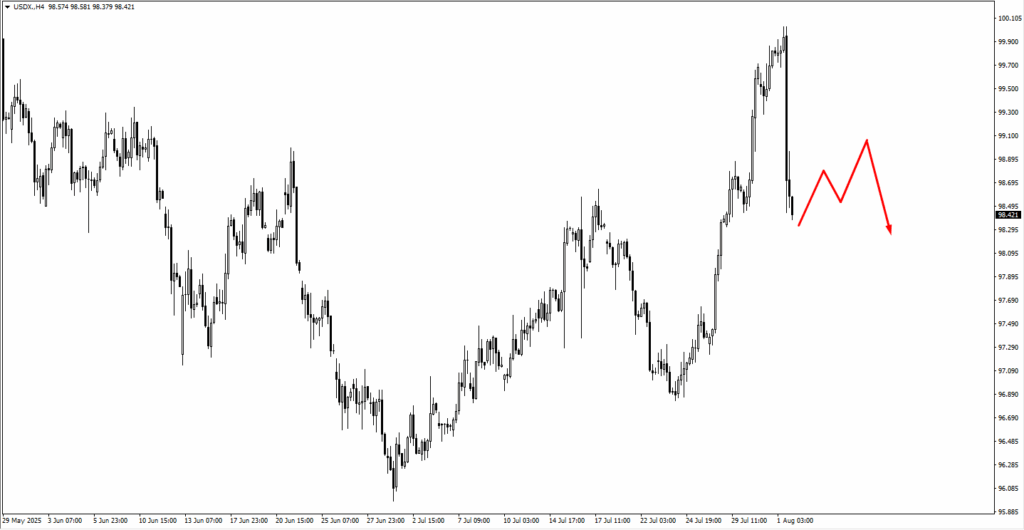

Market Movements Of The Week

The Dollar took a significant hit following the jobs report, breaking below the key 100.20 level. The path of least resistance appears to be lower as rate cut expectations make holding dollars less attractive.

Last week’s weaker-than-expected US jobs report was the main catalyst, reinforcing the view that the Fed will cut rates and sending ripples across asset classes.

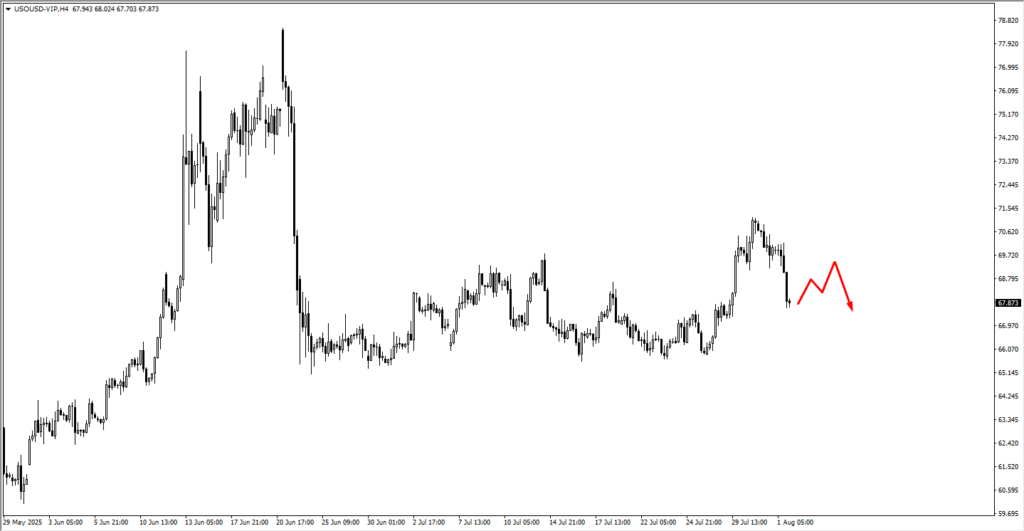

USOil is trading lower from its late-July highs of around $71.00. This decline appears to have been triggered by the recent non-farm employment news, which has introduced fresh uncertainty into the market. The price action shows a clear rejection from the upper end of its multi-week trading range, indicating that sellers have taken control in the short term.

A period of price consolidation would be a typical market response. As illustrated by the red arrow on the chart, the next key development would be a potential corrective bounce.

We suggest closely monitoring the price area around 69.30. Should the price rally to this level and show signs of weakness or bearish price action, such as failing to push higher and reversing, it could confirm that the downward momentum is likely to continue. This would establish a lower high, a classic technical signal that reinforces a bearish market structure.

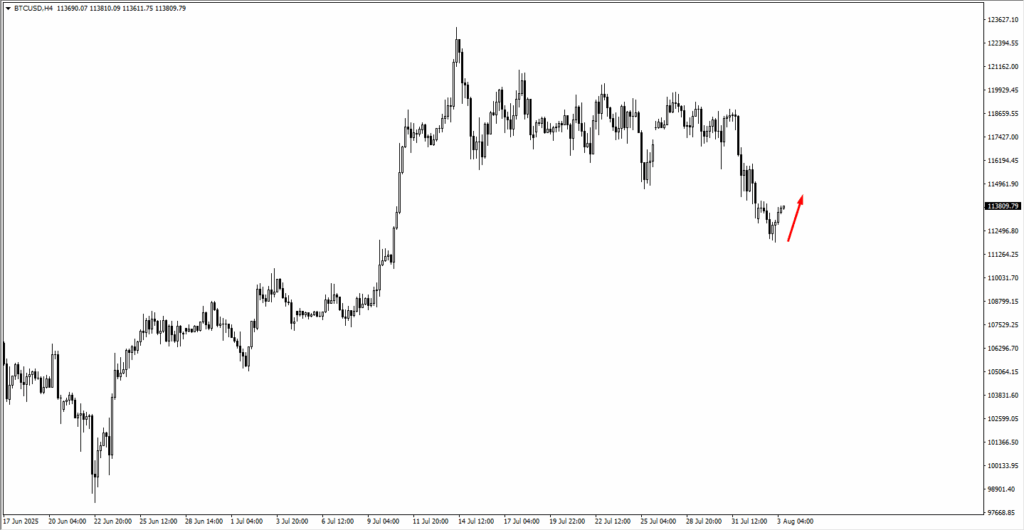

Bitcoin has recently experienced a notable decline after a period of consolidation. Following a strong rally in early July, the price entered a sideways range for several weeks, trading primarily between the $116,000 and $122,000 levels.

In late July, sellers took control, pushing the price below the support of this range, which led to an accelerated move downwards. This breakdown indicates a shift in momentum from neutral to bearish in the short term, with the market now testing lower price levels.

The price has since fallen into a monitored support zone, with the area around $111,000 being a significant psychological level for traders. After reaching a low near $112,500, the price has seen a minor bounce, as suggested by the red arrow on the chart.

More price action is needed to determine if this is the start of a sustainable recovery or merely a temporary pause in the downtrend.

Key Events Of The Week

On Tuesday, all eyes will be on Tuesday’s Services PMI report from the US. The market is currently expecting a print of 51.5, slightly above the prior month’s 50.8.

Following the sharp drop in the dollar after the jobs report, traders are anticipating a possible consolidation early in the week. The PMI data will be key in confirming or challenging the broader narrative of slowing growth.

A disappointing number would likely reinforce rate cut expectations and could reignite dollar weakness. On the flip side, a strong print could stabilise the greenback, especially if it challenges the idea of a slowing US economy.

Attention will shift to the Bank of England on Thursday. Markets broadly expect the BoE to trim interest rates from 4.25% to 4.00%. As this outcome is largely priced in, any immediate market reaction may be muted.

However, recent weak jobs data from the US adds an interesting twist. Normally, a BoE rate cut would weigh on the pound. But with the Fed also expected to ease, GBP/USD now finds itself in a tug-of-war between two softening central banks.

With no major data due Friday, markets are likely to wind down and prepare for next week’s critical US inflation data, including CPI and PPI.