The quiet appearance on the charts hides a growing risk. Should BOJ officials hint at even a slight change in tone, the yen carry trade, one of the major engines behind global market performance could unwind sharply.

With the Fed now in its blackout period, policymakers are unable to guide expectations, leaving markets to lean on a single assumption: easing is coming. Although a policy rate of 3.75% is largely priced in, the Summary of Economic Projections and Powell’s delivery will decide how confidently markets extend their easing outlook into 2026.

The dot plot will be the centrepiece. Traders are looking for clear confirmation that the Fed’s projected path is aligned with what markets have already priced. Any sign of reluctance could trigger a broad repricing across FX and risk-sensitive assets.

QT Ends And Liquidity Shifts

The end of quantitative tightening marks a return to more supportive liquidity dynamics. The Fed’s recent $13.5 billion repo injection, its second-largest since the pandemic, signals strain within the funding system. Historically, when QT concludes during such periods of stress, QE often follows not long after. Although consensus expects a formal move back to QE in 2026, much may hinge on upcoming leadership changes, with Powell’s term ending in May next year.

Prediction markets currently assign Kevin Hassett a 74% chance of becoming the next Fed Chair. Should an early nomination emerge, markets may begin responding more to the anticipated stance of the incoming Chair than to Powell’s current guidance. This shift could pull forward expectations for deeper and earlier easing.

Central Bank Highlights: BOJ, RBA, And BOC

While the US is moving toward a more accommodative stance, several overseas central banks introduce their own layers of uncertainty, with the BOJ representing the most significant swing factor, supported by key signals from Australia’s RBA and Canada’s BOC this week.

If the BOJ raises rates from 0.5% to 0.75% on 19 December, a narrowing yield spread between Japan and the US would make yen-funded carry trades far more expensive to maintain or unwind.

This could force investors to liquidate US assets to settle yen liabilities, potentially triggering a swift, disorderly correction.

Such a scenario would echo previous episodes where carry-trade squeezes produced heightened volatility.

A BOJ-induced shock, however, might also push the Fed towards even more accommodative measures or an earlier re-initiation of QE to stabilise liquidity. Any near-term turbulence could therefore contrast with a more supportive longer-term environment for risk assets.

Beyond Japan, traders should also pay attention to the RBA’s policy messaging and the BOC’s rate decision, as either could influence cross-asset sentiment, particularly if they affirm or challenge the broader global easing trend.

Market Movements Of The Week

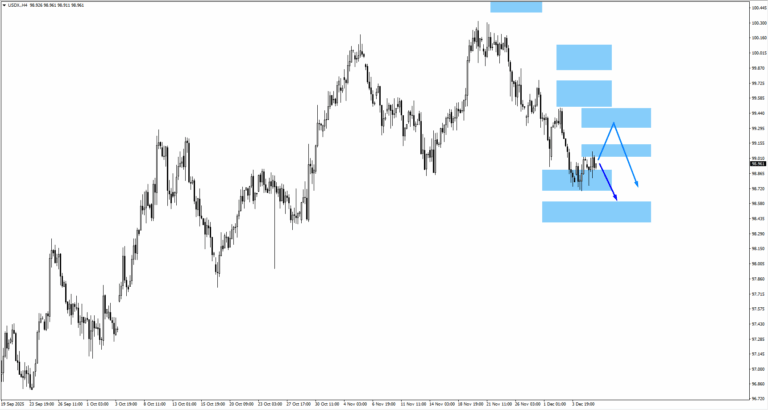

USDX

– USDX trades around the 99.10 monitored area where bearish price action is expected.

– If price moves higher, traders should watch 99.40 for renewed bearish structure.

– Downside continuation opens interest at 98.50.

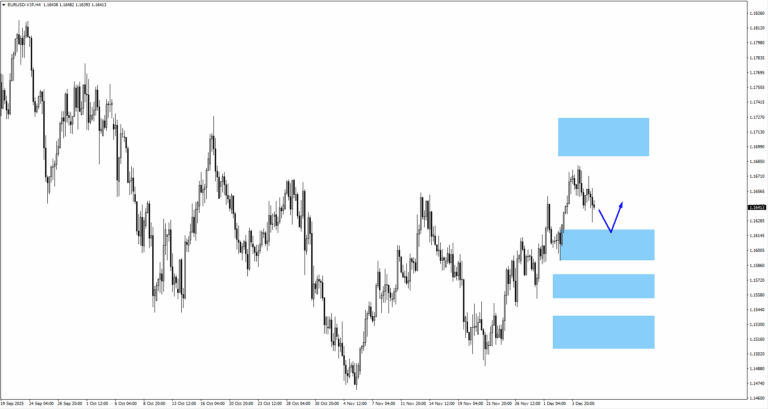

EURUSD

– A move lower into 1.1605 offers a zone to watch for bullish reactions.

– Upside structure may encounter resistance at 1.1710.

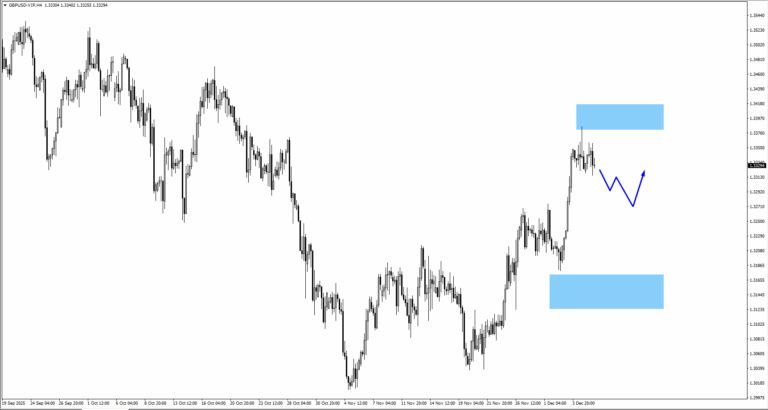

GBPUSD

– GBPUSD rejected the 1.3405 monitored area.

– Continued consolidation lower may target 1.3250 for bullish price action.

USDJPY

– USDJPY has traded above the descending trendline.

– If price moves higher, traders should monitor 156.00 for a potential bearish reaction.

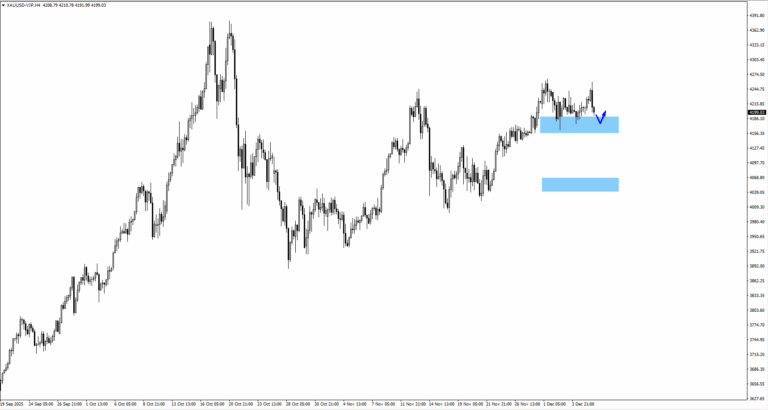

Gold (XAUUSD)

– Gold moved higher before reversing lower.

– Key level remains 4175 for near-term reactions.

– If consolidation deepens, the next bullish zone sits near 4070.

SP500

– SP500 broke above the 6888 swing high.

– Traders should monitor how the price behaves within the ascending channel.

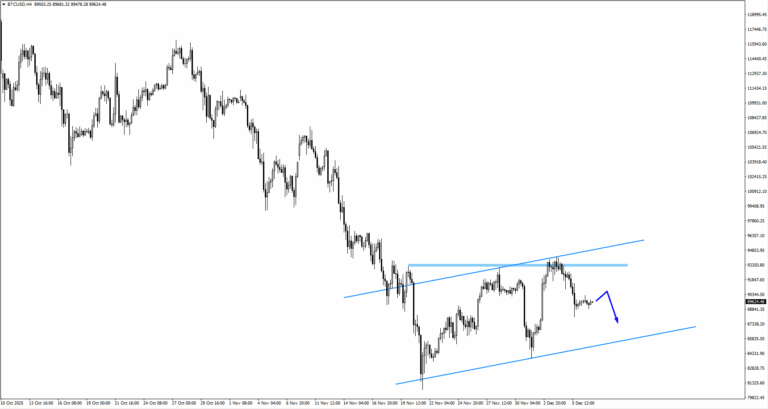

Bitcoin (BTCUSD)

– Bitcoin turned lower after breaching the 93156 swing high.

– If consolidation continues, upside structure is monitored once price retakes 90277.

Key Events Of The Week

9 December

1. JP BOJ Gov Ueda speaks

If BOJ signals continuous hiking or a rate increase beyond expectations, USDJPY could trade lower.

2. US JOLTS Job Openings

A weak reading could spur the Fed to act beyond December and weaken USD.

11 December

1. US Federal Funds Rate, Forecast: 3.75%, Previous: 4.00%

Market has priced in the cut. Powell’s statement will likely move markets.

12 December

1. UK GDP m/m, Forecast: 0.10%, Previous: -0.10%

A rebound from negative growth. Refer to the structure.

Bottom Line

The week ahead lies at the intersection of shifting US policy and a rising wave of overseas risk factors. The anticipated Fed rate cut, combined with the end of QT, places liquidity back at the centre of market dynamics, while the BOJ’s upcoming decision may unsettle positions that have relied for years on cheap yen funding.

As these forces interact, trading conditions could tighten abruptly or open up just as quickly.

With this backdrop, attention turns to the Fed’s communication, signals from deep within the financial system, and market reactions around the key levels mapped across USD pairs, equities, commodities, and cryptocurrencies.