President Trump’s latest economic manoeuvre is not just causing a stir. It’s fundamentally altering the landscape. In a notable break from classic free-market principles, the US government is now acting as an equity investor, taking stakes in companies it considers essential to national interests.

This shift is not occurring amid war or recession. It’s taking place during relative peacetime, which makes the move all the more impactful for markets.

A Seat At The Table

When Japan’s Nippon Steel made a bid to acquire US Steel, the deal only went ahead after the Trump administration secured a ‘golden share’.

This special share grants the US President the authority to block decisions such as factory closures or relocating operations abroad. The government didn’t provide direct funding but gained influence nonetheless.

In another case, the Pentagon injected $400 million into MP Materials, the only company in the US that mines and processes rare earths. That investment made the Department of Defence the firm’s largest shareholder. It guaranteed a minimum price for rare earth magnets, which are crucial components in everything from fighter jets to electric cars.

In short, the state is no longer merely observing. It’s now actively invested, with a clear stake in protecting key supply lines.

Strategic Stakes And Political Implications

Markets responded quickly. Shares of MP Materials jumped on the announcement, with traders factoring in lower risk and assured government demand. Attention has now turned to who might be next in line for such backing.

Likely candidates include defence firms, AI companies, quantum tech labs, and clean energy manufacturers. Essentially, those helping to build national resilience or support energy transition goals.

However, government involvement isn’t without its downsides. Political considerations often follow public money. Profit may be sacrificed for policy aims. And if things go south, it’s the taxpayer who shoulders the loss.

Furthermore, institutional investors may hesitate if they feel blindsided by sudden state involvement or fear being crowded out of decision-making.

Market Psychology Shifts

Perhaps the most notable change is psychological. Investors must now assess the likelihood of a firm being folded into a state-backed model. One golden share here, a sovereign-style investment there. Before long, what were once market-driven outcomes begin to look distinctly curated.

This dynamic may fuel sector-wide rallies in industries labelled ‘strategic’. At the same time, seemingly routine events, such as earnings reports, merger bids, and policy updates, might carry deeper implications.

Broadly speaking, the S&P 500 remains buoyant above the 6400 level, suggesting overall market confidence has yet to waver. But a growing number of equities now appear to be riding the tailwind of government involvement rather than fundamentals alone.

As the US shifts further toward industrial policy, allies may follow suit. This could usher in an era of state-aligned economic blocs rather than pure market competition.

This is particularly pertinent in sectors where China dominates supply chains. Rare earths are just the beginning.

If Washington succeeds in re-establishing domestic capabilities, especially with the Pentagon playing venture capitalist, it could serve as a blueprint for sectors like lithium, semiconductors, or digital infrastructure.

Timing And Monetary Policy Interplay

Timing is also significant. With the Federal Reserve keeping rates steady at 4.5%, and increasing speculation around a September cut, Trump’s investment strategy may coincide with a looser monetary stance.

Friday’s jobs figures are forecast to show a drop to 108,000 new roles (down from 147,000), with unemployment ticking up to 4.2%. Should these projections prove accurate, calls for a rate cut will likely intensify, which may soften the dollar in the near term, especially as the White House takes a more hands-on role in both economic and monetary strategy.

For the moment, investors should monitor firms in key sectors and pay attention to policy signals from Washington that could hint at further intervention.

Price action is likely to favour those companies with government backing or prospects of acquiring ‘golden share’ treatment. That said, expect fluctuations, like legal disputes, weak earnings, or political uncertainty, which could easily disrupt this new order.

Trump has brought a new player into the markets: the US government. And it’s no longer just regulating or backstopping. It’s buying, owning, and, at times, deciding.

Market Movements Of The Week

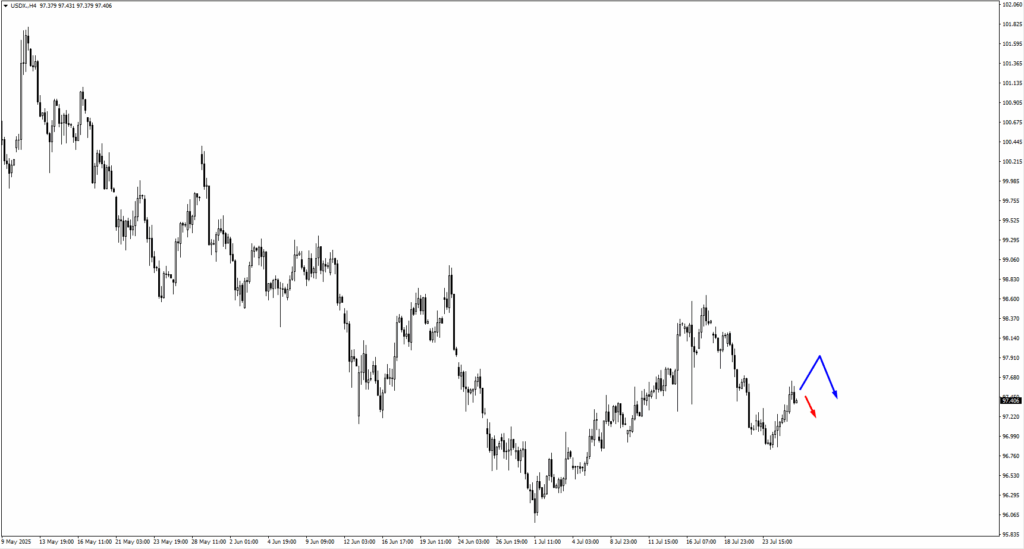

Following a slip from the 97.50 level, USDX has yet to show a clear consolidation. Without stabilisation, this dip might be a pause before another leg higher.

If an upward move materialises, watch for bearish pressure around 97.75 and 98.10. A rejection here could signal a downturn. But if the price breaks through, further dollar strength could follow.

EUR/USD has bounced from the 1.1700 region, as expected, but now sits in a holding pattern. A clear break below would place 1.1665 in focus. A bullish setup there might prompt re-entry. If not, momentum could fade, particularly if USD strength resurfaces.

GBP/USD dipped beneath 1.3470 last week. While there’s room for a rebound, this isn’t a clean reversal just yet. If declines continue, the 1.3310 area will be critical for buyers eyeing a potential bounce.

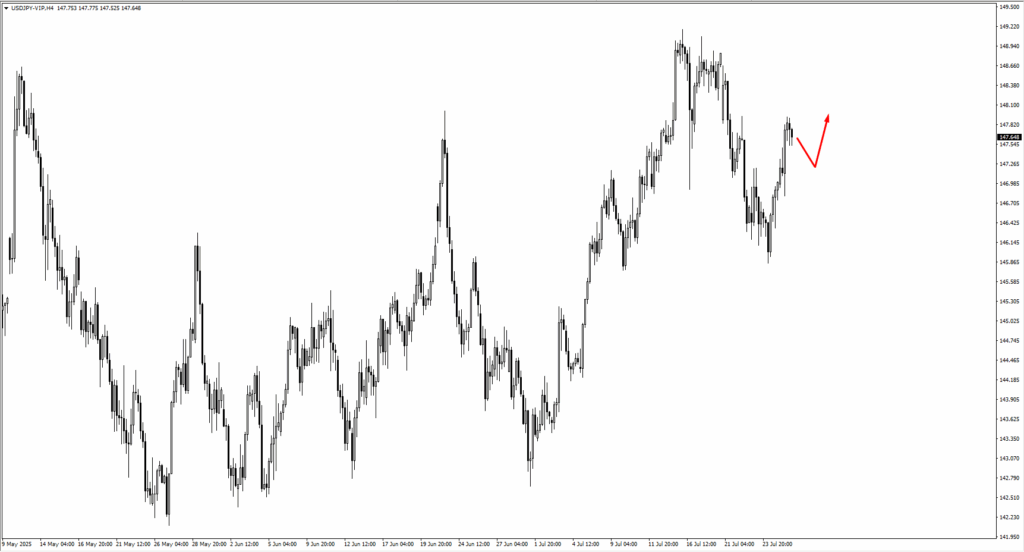

USD/JPY closed above 147.70, holding as a short-term pivot. Should price retreat, support may emerge around 147.15. On the upside, 148.40 becomes the next hurdle. Watch out for breakout or rejection cues as trade policy and inflation data approach.

USD/CHF reversed from the 0.7970 region. If it stabilises and rises, the 0.8000 area presents a potential setup for fresh bearish trades. Until then, short-term positioning may remain sidelined.

AUDUSD ended the week at the 0.6550 mark. This is an active decision point. Should the pair consolidate here, we’ll be eyeing 0.6580 to 0.6590 for fresh bearish patterns. If it drops, bulls could re-enter around 0.6515. That level has held well in recent months, and unless broken decisively, still offers a reliable bounce setup.

NZDUSD mirrored this structure, closing at 0.5995. If the pair consolidates, expect bearish signals to emerge near 0.6030. On the flip side, the 0.5955 level remains key for bulls. Should we test that lower boundary and see strength, it may offer a high-probability long opportunity in the days ahead.

USDCAD is the pair to watch if we see a classic consolidation. If price settles and coils, the 1.3670 and 1.3655 zones could invite fresh bullish pressure, especially with Canadian rate expectations already baked in. A push from these levels may be supported if oil prices soften further, as that tends to weigh on CAD.

US crude has drifted away from its trendline again, reflecting caution as supply-side stories evolve. If it moves lower, support may emerge at 63.35 and 61.00, the potential rebound zones pending geopolitical or OPEC updates.

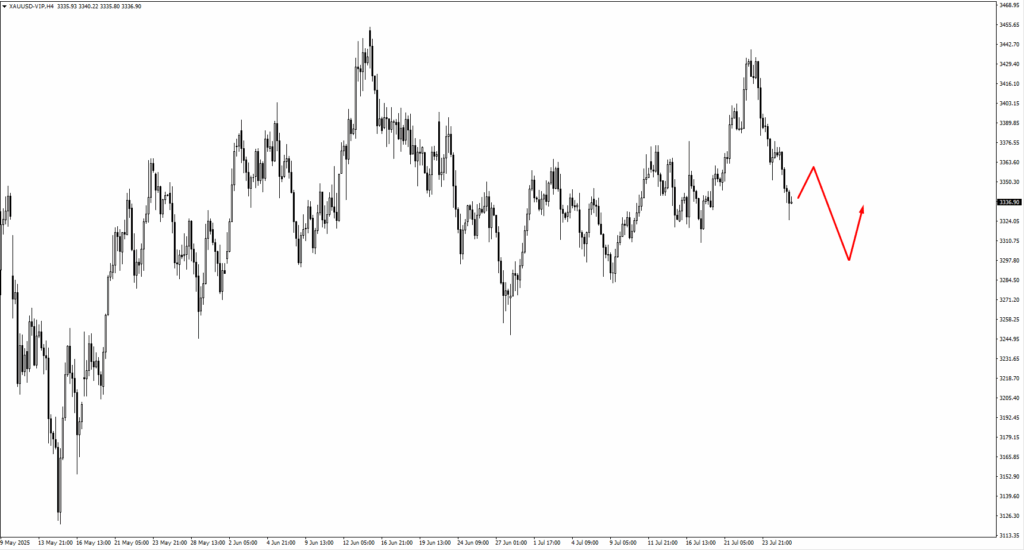

Gold has fallen from the 3390 level. If the slide continues, bulls will be watching 3295 closely. This level has acted as a launchpad in previous moves, but we’ll need to see a clear bullish structure before entering. Otherwise, gold may remain under pressure, especially if hopes for a rate cut weaken.

The S&P 500 hovers near 6400. A break higher puts 6630 in view, though traders remain cautious amid mixed earnings and uncertain Fed guidance.

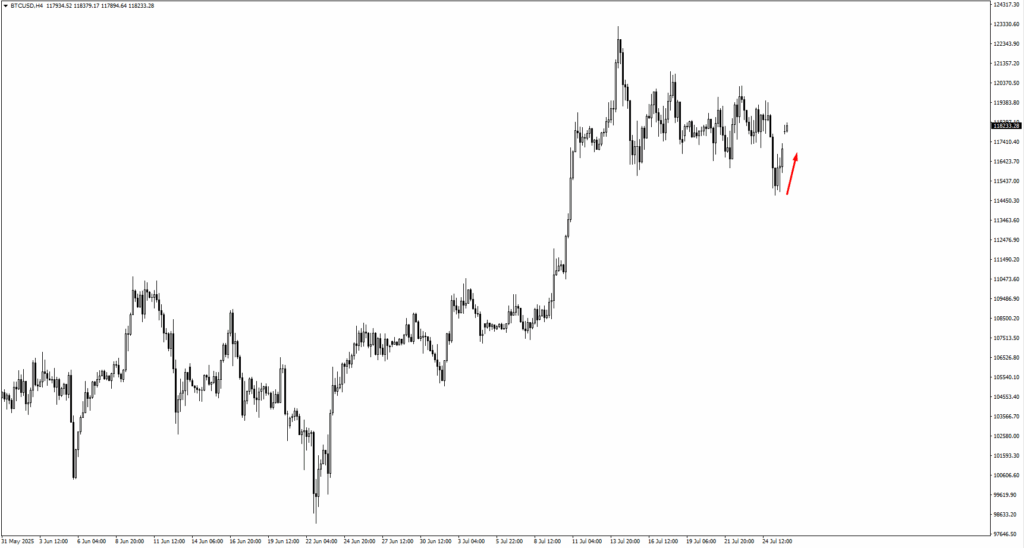

Bitcoin is staging a recovery after briefly taking out the 15714 low. The next critical step is whether price can close decisively above 120350. A clean breakout here might signal readiness to attack a new all-time high. If BTC falters or consolidates instead, watch for bullish setups at 113345 or 111000. These levels remain strong supports and could spark renewed rallies if tested again.

Natural Gas is playing a waiting game. If price consolidates soon, look for bearish patterns near 3.20 or 3.28. These areas remain sell zones unless we see a fundamental shift in demand or weather-linked supply headlines.

Key Events Of The Week

While no central bank surprises are expected, economic data from Tuesday to Friday could heavily influence the Fed’s September rate decision. Each release will add pressure and raise the stakes for policymakers.

Tuesday, 29 July brings the JOLTS job openings report, forecast at 7.49 million, down from 7.77 million. A weaker reading may nudge the dollar lower. Conversely, a strong result could reduce expectations for near-term easing.

Wednesday, 30 July features Advance US GDP, expected to rebound to 2.4% from last quarter’s -0.5%. This would signal ongoing resilience despite high rates. The Bank of Canada also announces its rate decision, expected to hold at 2.75%. Any dovish tone could push USD/CAD higher if the Fed stays cautious.

Thursday, 31 July is the most eventful day. The Fed is set to hold rates steady at 4.5 percent, but the market will be hanging on every word of the accompanying statement. Traders want clarity on whether a September cut is in play, especially after Trump hinted that his recent meeting with Fed officials leaned dovish. Meanwhile, the Bank of Japan is also expected to keep its rate at 0.5 percent. The newly struck trade deal with the US reduces some of the economic pressure on Japan, opening the door for a more hawkish lean. If the BOJ signals even mild intent to normalise further, USDJPY could pull back. Finally, the Core PCE Price Index is forecasted at 0.3 percent, slightly hotter than last month’s 0.2 percent. If inflation proves sticky, it may throw a wrench in rate cut expectations. If it cools, traders may find renewed confidence in a September shift.

Friday, 1 August wraps with the US Non-Farm Payrolls report, expected at 108,000 jobs versus last month’s 147,000, and a forecasted uptick in unemployment to 4.2 percent from 4.1 percent. These numbers will anchor the week’s macro narrative. If the jobs market is indeed slowing, it strengthens the case for rate cuts. But if the data holds firm or surprises to the upside, the path forward becomes murkier, especially if inflation remains above target.

While no single data point may be decisive, together they could reshape market sentiment. For now, FX pairs remain range-bound, equities test resistance, and gold flirts with support.