Financial markets are heading into the new week with more hesitation than conviction.

The Federal Reserve’s late-October update shifted the landscape. A December rate cut is no longer seen as a done deal.

Chair Jerome Powell reiterated that policy decisions will remain data-dependent, yet with a federal government shutdown halting much of the data flow, the Fed is effectively ‘driving through fog’. Traders, in turn, are rethinking how quickly monetary easing might resume.

The outcome so far? A mixed dollar, cautious equity markets, and investors taking refuge in safe-haven assets until clearer signals emerge.

The Fog Before The Cut

Before the Fed’s October meeting, futures markets were nearly unanimous in predicting a rate cut in December.

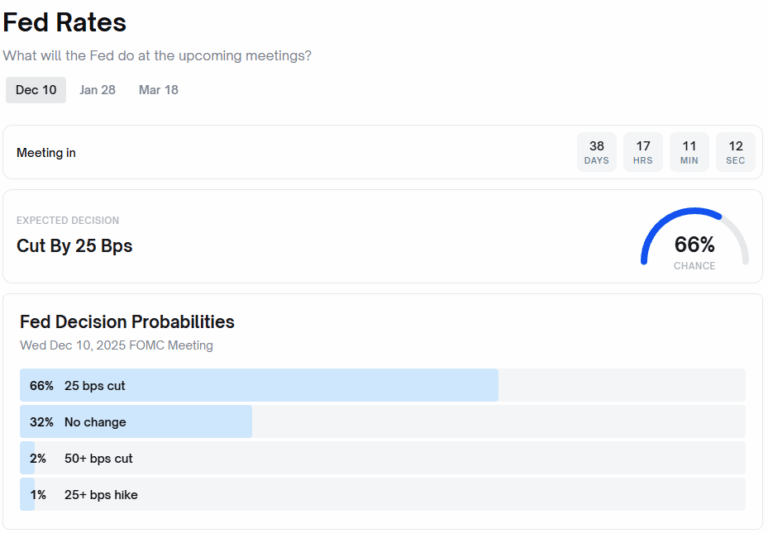

But Powell’s cautious tone has flipped the sentiment. According to the CME FedWatch Tool, the odds of a cut have tumbled from roughly 90% to around 63%, while Polymarket data suggests a 66% probability of a 25-basis-point reduction and a 32% chance of no change.

In short, the market still sees easing ahead. It just no longer trusts it will come smoothly.

The shift reflects Powell’s warning about divisions within the Fed and the impact of the data blackout due to the government shutdown.

Without updated figures, policymakers are essentially flying blind, and traders are hedging both sides of the trade to manage risk.

Options markets point to growing volatility pricing, suggesting investors expect a slower, bumpier approach to policy easing rather than a straightforward rate-cut trajectory.

A Case For Patience

If inflation continues its downward path, the Fed will have the justification to cut rates, but not necessarily the urgency.

September’s CPI rose 3.0% year-on-year, slightly up from 2.9%, largely due to higher energy costs. Yet beneath the surface, inflation pressures are easing:

– Core CPI stayed at 0.3% month-on-month, in line with a gradual cooling trend.

– The shelter component, the biggest driver of inflation, dropped to 0.16% m/m, its lowest level in more than a year.

– Over 51% of CPI categories are now in outright decline from their peaks, well above the long-term average of 32%.

Such broad-based disinflation indicates that the inflation battle is mostly won.

While Fed staff still forecast core PCE to end the year near 3%, the broader trend in price pressures looks decisively softer.

The key takeaway? Inflation is falling sharply. Yet the Fed remains cautious about cutting rates too soon and risking a policy reversal if prices reaccelerate.

From Euphoria To Hesitation

The market’s behaviour after Powell’s press conference told its own story.

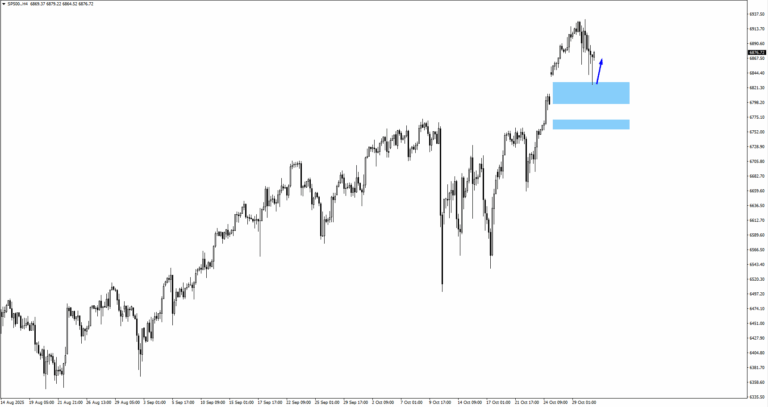

– US equities retreated from recent highs as traders priced in fewer cuts and slower growth prospects.

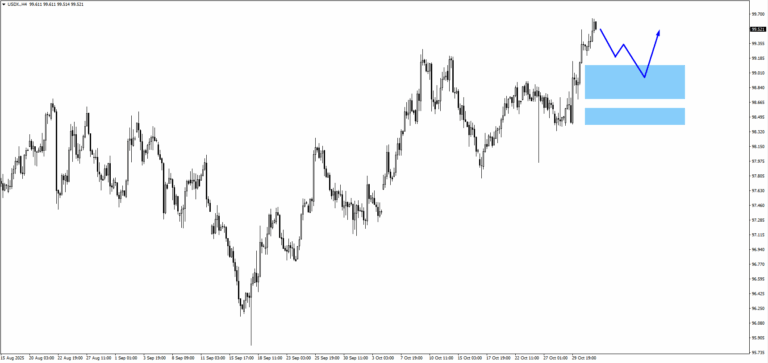

– The US Dollar Index (USDX) climbed back toward the 99.00–100.00 zone, signalling a defensive shift.

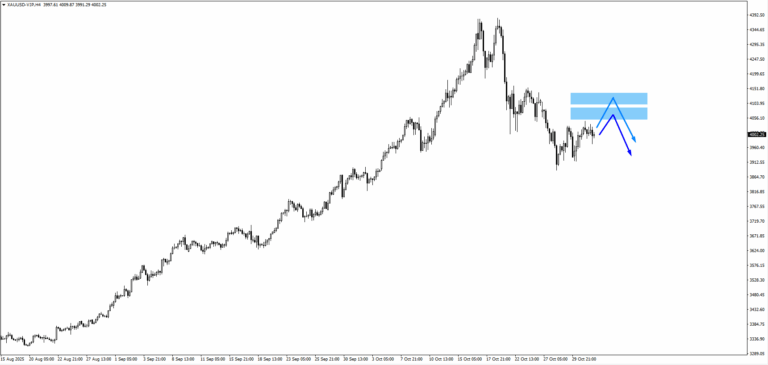

– Gold stalled around $2,070, caught between softer inflation data and a firmer dollar.

– Bond yields drifted lower, though not enough to reignite a sustained equity rally.

Prediction platforms such as Polymarket reflect this sentiment, showing a notable drop in confidence. It’s still leaning dovish, but with heavy hedging across asset classes.

Over $9 million has now been wagered on the Fed’s December decision, underscoring how pivotal it is to global positioning and risk sentiment.

Cautious Easing On The Horizon

The next move may depend less on a single economic print and more on how long the uncertainty lingers.

If the government shutdown stretches into mid-November, as betting markets imply, the Fed could enter December with limited data visibility.

That scenario favours a 25-basis-point cut as the most likely outcome, but with low conviction.

In essence, the market faces a split narrative:

– Macroeconomic indicators justify a cut.

– Policy caution urges delay.

– And risk assets remain directionless in the meantime.

Market Movements Of The Week

USDX (Dollar Index)

– Still supported by reduced rate-cut certainty, consolidation near 99.00.

– Watch 98.50 as short-term support, resistance at 100.20.

– Break above 100 could extend toward 100.75, reversal signals near 98.50.

Gold (XAUUSD)

– Stalled around $4,070 as traders balance cooling inflation with firmer yields.

– Resistance at $4,120, support near $3,930.

– Range-bound until a clearer Fed direction.

SP500

– Pulled back after testing 6,950 as caution dominates.

– 6,750 support remains critical. 7,000 psychological barrier caps upside.

– Sensitive to shifts in rate-cut probabilities and shutdown headlines.

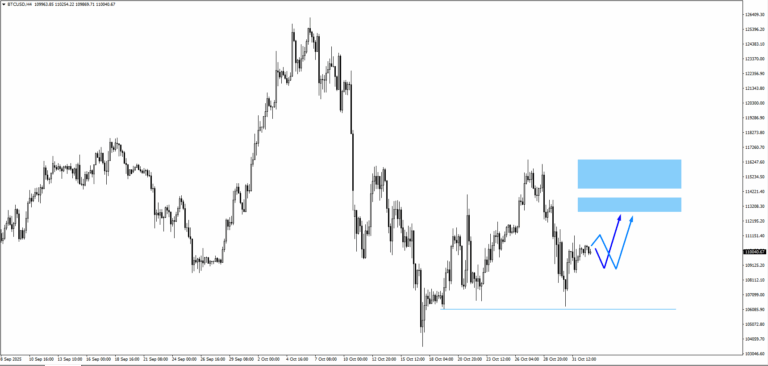

BTCUSD

– Consolidating above 106,000. Upside targets 112,800–114,650 if risk stabilises.

– Break below 106,000 exposes 103,500.

– Volatility may pick up as liquidity thins into mid-month.

Market Snapshot

Markets have shifted from confidence to caution following Powell’s recent remarks, which underscored the Federal Reserve’s data-dependent stance.

Although inflation continues to ease across key sectors, the path forward for policy remains uncertain. Traders are now positioning for a possible rate cut in December, but with no clear signal from the Fed, the U.S. dollar has held steady and broader risk sentiment remains subdued.