Just as markets were beginning to settle into the new year, an unexpected geopolitical jolt crossed the wires.

On 3 January, the United States carried out a military operation that led to the capture of Venezuelan President Nicolás Maduro. He has since been transferred to New York, as Washington considers its next move and regional governments assess the implications.

This single development has materially shifted expectations for oil markets, the Federal Reserve’s policy trajectory, and the broader global economic landscape for 2026.

Oil: A Long-Term Deflationary Story

Venezuela possesses the world’s largest proven oil reserves, yet output has fallen sharply from roughly 3.5 million barrels per day in the 1990s to around 1 million bpd today after years of sanctions and operational mismanagement. Restoring production capacity will require substantial capital expenditure and is likely to take 12 to 24 months, limiting any immediate increase in supply.

As a result, hopes of a rapid collapse in oil prices may prove premature. Over the medium term, prices could even remain firm as markets factor in reconstruction costs and lingering uncertainty.

The longer-term picture, however, is more bearish for energy prices. Venezuelan crude is heavy and sour, making it well-suited to US Gulf Coast refineries, in contrast to lighter domestic shale production. Once supply chains normalise, refineries can operate more efficiently using cheaper feedstock, ultimately pushing down petrol and diesel prices. In that scenario, Venezuelan oil becomes a meaningful deflationary force.

The Fed, Interest Rates, And A “Lame Duck” Powell

This evolving oil dynamic complicates the Federal Reserve’s policy outlook. In the near term, firmer oil prices could lift inflation expectations, encouraging Chair Jerome Powell to remain cautious about aggressive rate cuts as his term approaches its end in Q2.

Markets, however, tend to look beyond the immediate horizon. As expectations shift towards cheaper Venezuelan oil and stronger US capital investment, a successor appointed under a Trump administration would likely have greater scope to ease policy more decisively.

Should the “Lame Duck Powell” narrative gain momentum, markets may begin to price in cuts earlier. Historically, rate reductions outside of recessionary conditions and near market highs have been supportive for equities, with the S&P 500 finishing higher 12 months later in every such episode since 1980.

Tailwinds And Headwinds For The S&P 500 In 2026

Beyond developments in Venezuela, several factors continue to underpin a constructive outlook for equities. The Federal Reserve ended quantitative tightening in December 2025, removing a significant drag on liquidity.

Fiscal policy is also turning more supportive, with sizeable infrastructure spending plans, deregulation initiatives, and a combined USD 237 billion in corporate and household tax reductions. Earnings growth remains a central pillar, with S&P 500 profits forecast to rise by around 15% in 2026, driven by tangible AI adoption and productivity gains.

That said, risks have not disappeared. Unemployment has climbed to 4.6%, reflecting efficiency gains linked to AI rather than an outright recession, but it could increase pressure on the Fed to cut rates more quickly. A Supreme Court ruling expected in June on the legality of the 2025 tariffs may trigger refunds, higher bond yields, a weaker dollar, and renewed upside risk for gold.

Volatility is also likely to rise as the midterm elections approach. However, a scenario of political gridlock, such as Democrats controlling the House while Republicans retain the Senate, would likely be welcomed by markets, as it reduces the likelihood of sweeping legislative changes.

Market Movements Of The Week

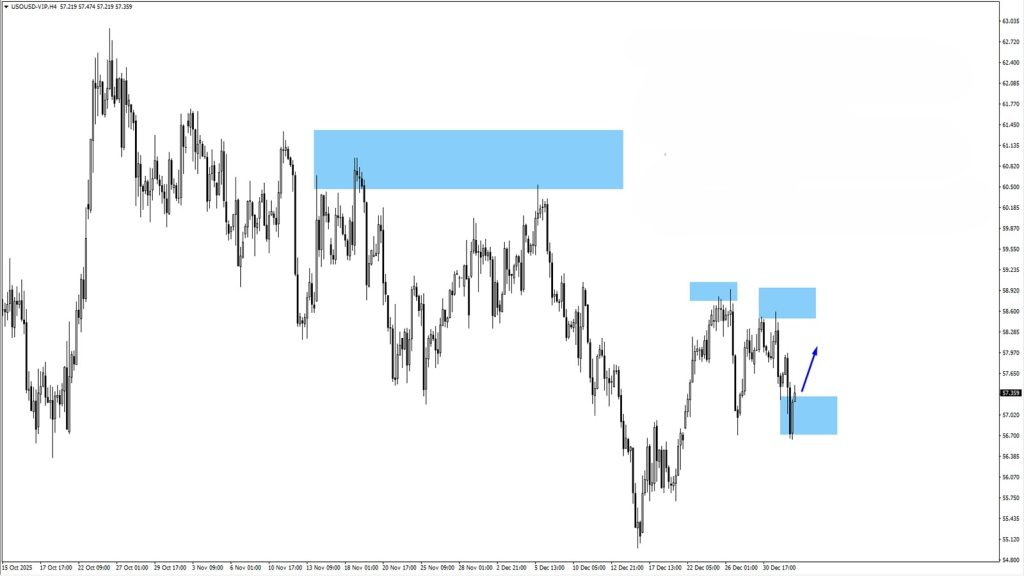

USOil

– After breaking down from the 58.50 monitored resistance zone, US Oil swept liquidity at 56.716 before rebounding higher.

– To assess whether upside momentum can sustain, watch price action closely on a retest of 57.75 or 58.18.

– Ongoing geopolitical developments surrounding Venezuela’s leadership may act as a short-term volatility catalyst.

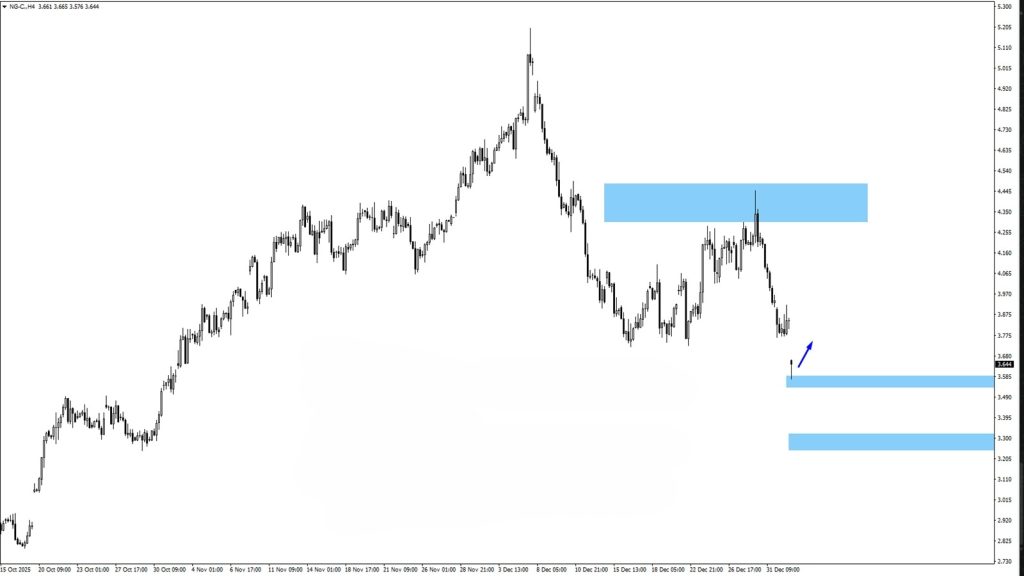

NG-C

– Natural Gas consolidated briefly before gapping lower on Monday, sliding into the 3.57 monitored demand zone.

– If price consolidates below recent structure, watch for bearish reactions near 3.86.

– Continued downside momentum would shift focus toward the next support at 3.22, where buyers may attempt to step in.

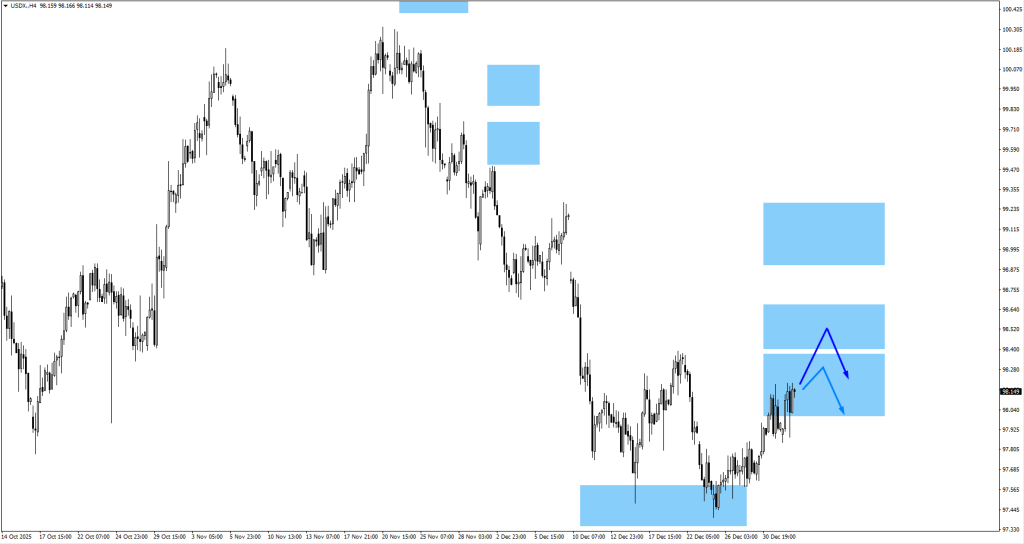

USDX

– USDX is currently trading around the 98.20 area, approaching a key reaction zone.

– If price fails to sustain above this level, watch for bearish price action and a potential move back toward 98.55, which now acts as a rejection zone.

– Ongoing geopolitical developments surrounding Venezuela’s leadership may introduce additional short-term volatility to the USDX.

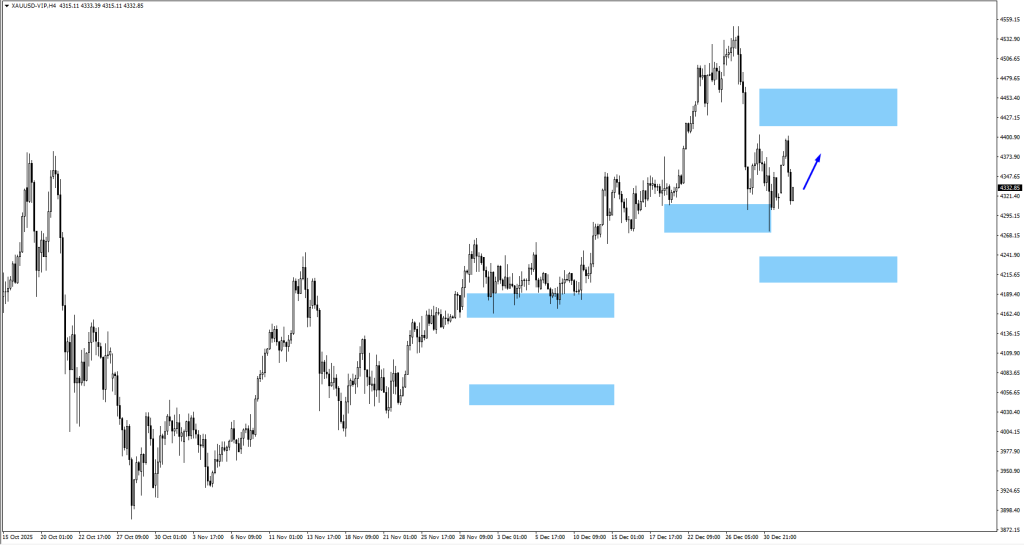

XAUUSD

– Gold is consolidating after rallying from the 4,290 monitored demand area, signaling a pause following strong upside momentum.

– If price resumes higher, watch price action around 4,445, where sellers may attempt to cap gains. Should price pull back, look for bullish reactions near 4,215, a key support zone that could attract dip buyers.

– As a traditional safe-haven asset, gold may see renewed demand during periods of heightened geopolitical volatility and market uncertainty.

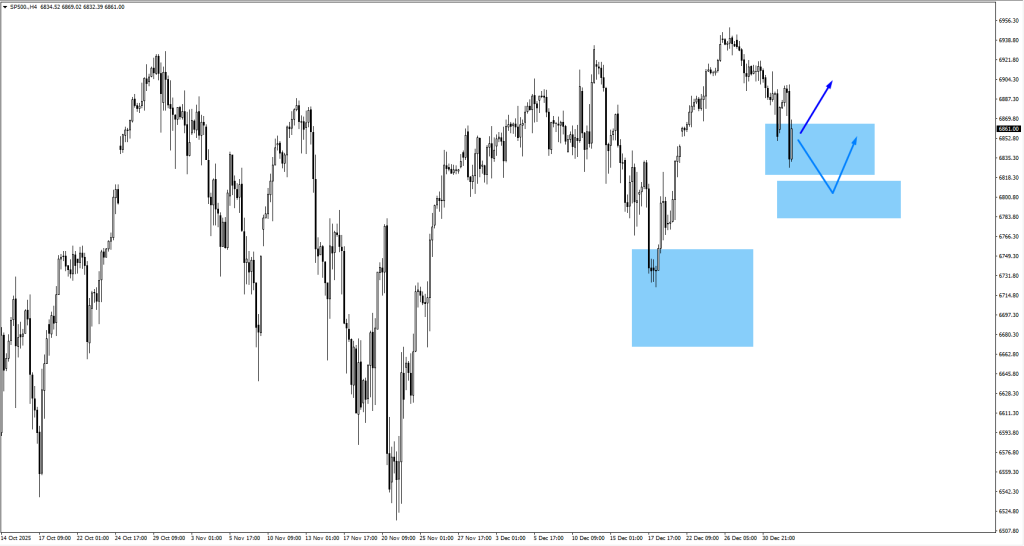

SP500

– The S&P 500 is currently trading around the 6,840 monitored area, making this a key zone to watch for near-term direction.

– If price pulls back, look for bullish price action near 6,795, where buyers may attempt to defend the move.

Key Events This Week

7 January

1. US JOLTS Job Openings, Forecast: 7.65M, 7.67M

Hiring demand is easing amid slower growth.

8 January

1. US Unemployment Claims, Forecast: 216K, Previous: 199K

Seasonal effects lift short-term claims.

9 January

1. US Non-Farm Employment Change, Forecast: 57K, Previous: 64K

Labour demand is cooling.

2. US Unemployment Rate, Forecast: 4.50%, Previous: 4.60%

Participation effects might offset job losses.

Bottom Line

Energy prices may remain elevated in the near term as rebuilding costs and uncertainty linger, but the longer-term effect is deflationary once Venezuelan heavy crude is fully reintegrated into US refinery systems.

For monetary policy, this sets up a two-phase dynamic. Near-term inflation expectations may remain sticky, constraining aggressive action from the current Fed leadership. Further out, as cheaper energy and stronger capital investment come into focus, conditions may favour deeper rate cuts later in 2026, a backdrop that has historically been supportive for equities.

Expect heightened volatility across oil, the dollar, gold, and equity indices, with price action around key technical levels likely to offer more reliable signals than headlines alone.