The new week begins with a noticeably different market tone. A trade that had appeared stable and well understood, built largely around yield differentials, fractured late last week, reminding participants how quickly currency dynamics can change once policy risk enters the picture.

A rate enquiry conducted by the New York Federal Reserve, acting on behalf of the US Treasury, sparked an abrupt market response.

The yen recorded its strongest single-day gain against the dollar since August, driving USDJPY sharply lower and reintroducing uncertainty into a market that had become heavily positioned in one direction.

US And Japan Hint At Intervention As Yen Swings Intensify

Signals around potential intervention did not emerge in a vacuum. Pressure on the yen has been building since October, fuelled by a sharp shift in Japan’s fiscal stance.

Prime Minister Sanae Takaichi’s promise to suspend sales tax on groceries for two years, part of an effort to shore up support ahead of the 8 February snap election, has heightened investor unease over government borrowing requirements.

That concern quickly filtered into bond markets. The benchmark 10-year Japanese government bond yield has risen to around 2.25%, up from roughly 1.6% when Takaichi assumed office.

With the Bank of Japan slow to respond through tighter monetary policy, the widening yield differential has weighed on the yen and encouraged sustained selling pressure.

From the US perspective, Treasury Secretary Scott Bessent has drawn a direct connection between volatility in American markets and developments in Japan.

Rising Japanese yields place upward pressure on US Treasuries, complicating efforts to keep financing costs under control. US 10-year yields have already climbed to around 4.31%, increasing sensitivity across equities and other risk assets.

Unlike previous administrations, the current leadership at the US Treasury has shown a greater willingness to engage directly in currency markets.

The recent rate check was widely interpreted as a warning rather than a one-off event. Markets are now assessing whether authorities move beyond signalling, or whether they attempt to steady sentiment through verbal guidance alone.

Market Movements Of The Week

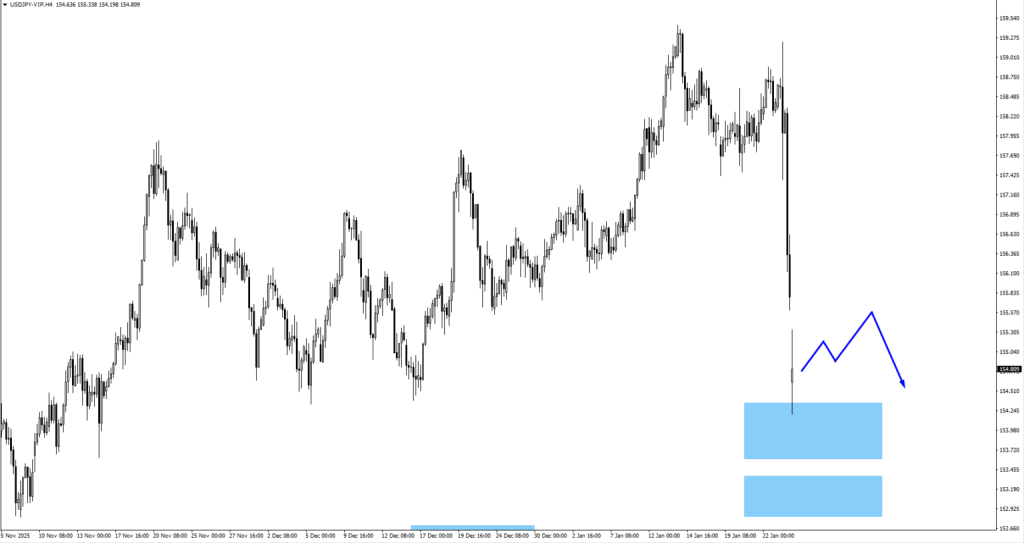

USDJPY

– USDJPY found support at 154.15 after the sharp selloff.

– If price consolidates, the pair could test 153.35 next.

– Further downside would keep policy risk firmly priced into the pair.

US Dollar Index (USDX)

– USDX continues to trade lower from the 98.70 area and has taken out 96.804.

– If consolidation forms, further downside toward 95.819 remains possible.

– Sustained weakness would support major currencies.

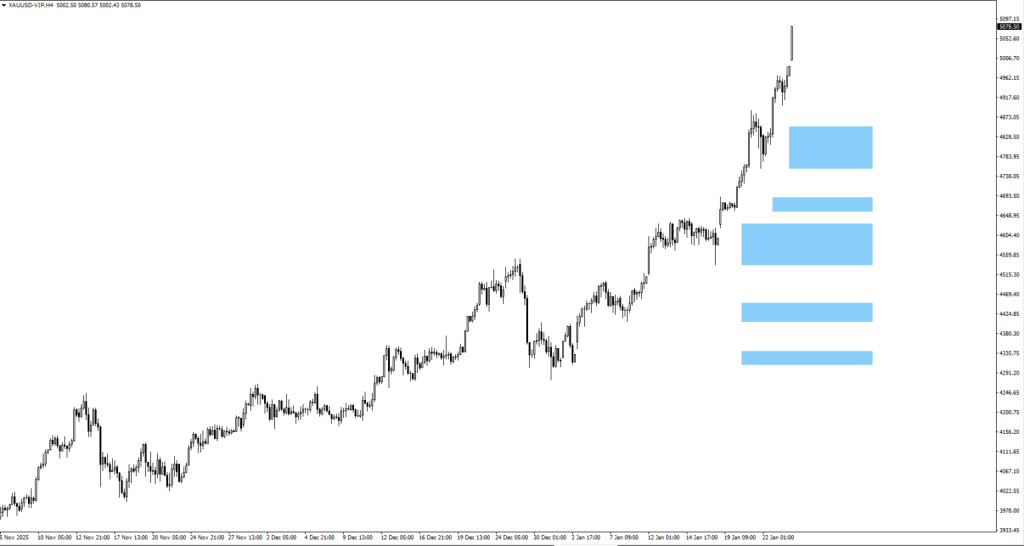

Gold (XAUUSD)

– Gold has broken above 5000 following last week’s move.

– No immediate trade setup until a new pattern forms.

– Elevated FX volatility continues to underpin longer-term demand.

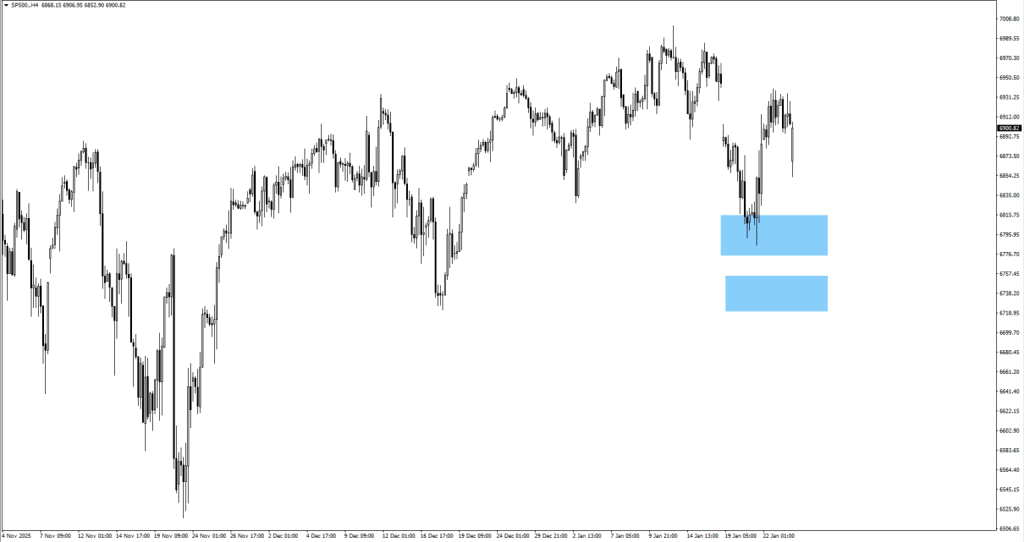

S&P 500 (SP500)

– The index met resistance at 6950 before gapping below 6890.

– Price has since stabilised and is trading higher again.

– A break above 6940 would be watched closely for follow-through.

Key Events This Week

29 January

1. US FOMC Statement, Forecast: 3.75%, Previous: 3.75%

Policy tone remains key amid yield volatility.

30 January

1. US PPI m/m, Forecast: 0.20%, Previous: 0.20%

Inflation pipeline in focus.

Bottom Line

The yen has transitioned from a straightforward yield-driven trade into an asset dominated by policy risk, with effects rippling through foreign exchange, bond markets and equities. Rising Japanese yields and their spillover into US Treasuries are keeping volatility elevated, while USDJPY remains the key gauge of whether policymakers are prepared to act on intervention signals.

With bond markets acting as the primary transmission channel, traders are likely to remain highly reactive in the coming week, placing greater emphasis on price action than on macroeconomic releases alone.