US stocks rallied sharply on Wednesday, witnessing fresh buying and extending the daily rally as Jerome Powell signalled a slowdown in the pace of tightening as early as December while indicating more hikes to fight inflation. The dovish comments from Federal Reserve (Fed) Chairman Jerome Powell provided strong support to the equity markets, as he was dovish while saying it makes sense to moderate the pace of interest rate increases and added that the monetary policy would need to remain restrictive for some time.

Additionally, Powell said that the time to slow the pace of rate hikes could come as soon as the next meeting in December and he does not want to over-tighten. Powell’s comments likely cement expectations for the Fed to hike by 50 basis points in December, following four straight 75 basis-point moves. However, rates are likely to reach a somewhat higher level than officials estimated in September. On the Eurozone front, European inflation fell for the first time in seventeen months, as the Euro Area annual Harmonized Consumer Price Index printed at 10% in October.

The benchmarks, S&P 500 and Dow Jones Industrial Average both advanced higher on Wednesday as the S&P 500 hit a two-month high and notched the longest monthly winning streak since August 2021 amid all the optimism. The S&P 500 was up 3.1% on a daily basis and the Dow Jones Industrial Average climbed higher with a 2.2% gain for the day. All of the eleven sectors in the S&P 500 stayed in positive territory as the Information Technology sector and the Communication Services sector are the best performing among all groups, losing 5.03% and 4.91%, respectively. The Nasdaq 100 meanwhile advanced the most with a 4.6% gain on Wednesday and the MSCI World index was up 2.5% for the day.

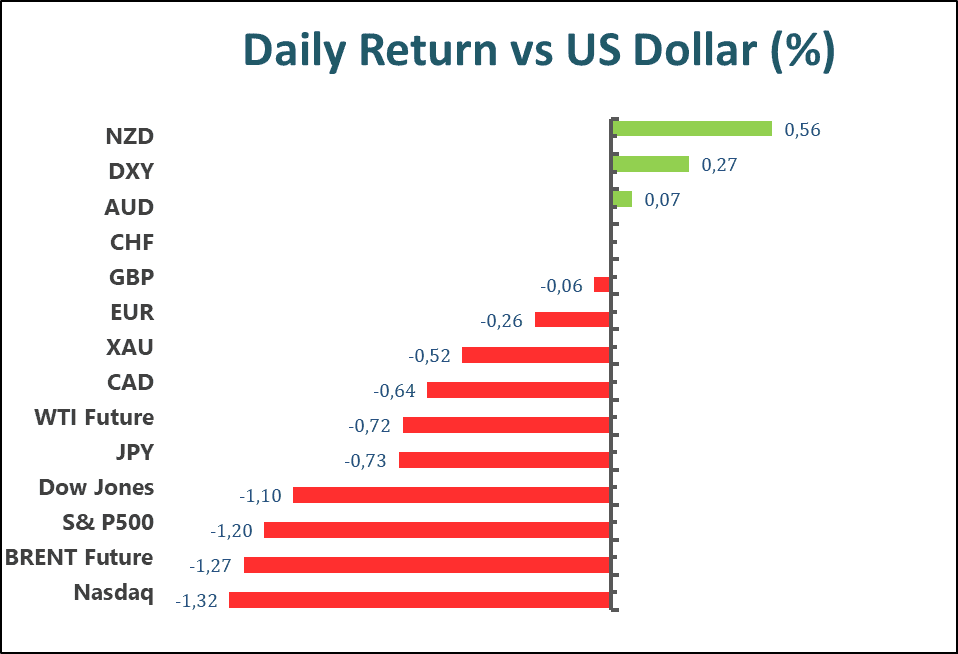

Main Pairs Movement

The US dollar slumped sharply on Wednesday, suffering from daily losses and dropped towards the 105.80 level amid US Federal Reserve Chair Jerome Powell’s dovish comments. The policymaker stated that it makes sense to moderate the pace of interest rate increases while also suggesting that the time to slow the pace of rate hikes could come as soon as the next meeting in December. Therefore, the chances of a 50 bps rate hike in December increased from 69.9% ahead of the speech to above 75%.

GBP/USD advanced higher on Wednesday with a 0.89% gain after jumping above the 1.2030s area as the Fed pivots to lower hikes. On the UK front, the Bank of England (BoE) Chief Economist Huw Pill said inflation is expected to fall quickly in the second half of 2023 while supply chain issues are being solved. Meanwhile, EUR/USD regained upside traction and jumped from weekly lows of 1.0290 amid a weaker US dollar across the board. The pair was up almost 0.74% for the day.

Gold rallied sharply with a 1.07% gain for the day after posting the biggest daily jump in three weeks around the $1,775 level during the US trading session, as the dovish comments from Fed Chairman Jerome Powell and optimism surrounding China both support the precious metal. Meanwhile, WTI Oil advanced sharply with a 3.01% gain for the day.

Technical Analysis

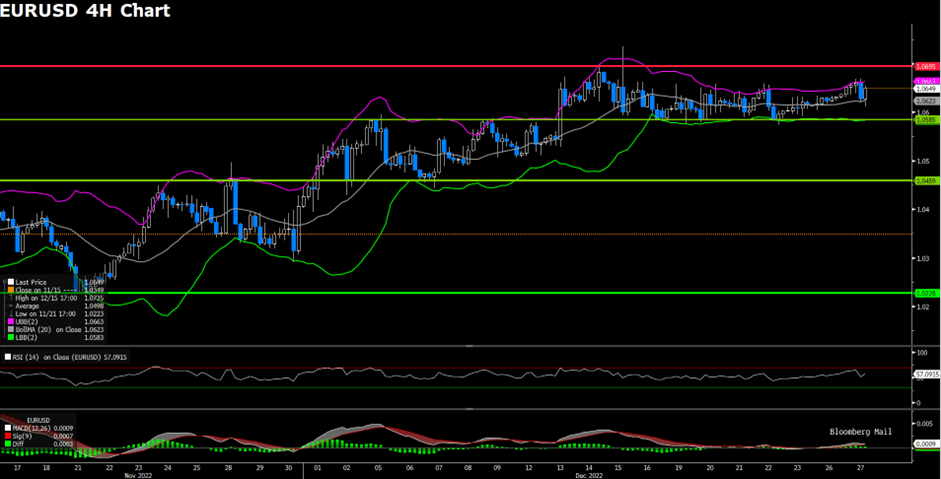

EURUSD (4-Hour Chart)

The EURUSD turned south and witnessed heavy selling pressure during the US trading session, as the US Dollar Index gathered strength following the mixed macroeconomic data releases while investors await FOMC Chairman Jerome Powell’s speech. The pair was trading at the 1.032 level at the moment of writing. Earlier, the National Association of Realtors (NAR) released the United States Pending Home Sales Report, which printed -4.6%, compared to market expected -5.0% and the previous -8.7%. Apart from this, the United States ADP Nonfarm Employment Change shows an increase of 127K in November, far from the forecast 200K and the previous 239K. Furthermore, the second estimate of the Q3 Gross Domestic Product (GDP) rallied to 2.9%, higher than the expectation of 2.7% and the previous 2.6%. The better market mood helps the EUR amid news suggesting China’s government has decided to ease coronavirus-related restrictions in Zhengzhou and Guangzhou. The country has continued to report record daily contagions, but massive protests across the country have forced the decision. Now, the US Dollar regained bullish strength ahead of FOMC Chairman Jerome Powell’s speech.

From the technical perspective, the four-hour scale RSI indicator surged to 54 figured following the dovish speech by Fed Chairman Jerome Powell, suggesting that the pair was amid an upbeat market mood. As for the Bollinger Bands, the euro was priced above the 20-period moving average, in a case that successfully breaks through the upper band, the bull has the chance to challenge the multi-month high 1.0497 level.

Resistance: 1.0497, 1.0604

Support: 1.0228, 1.0163, 0.9961

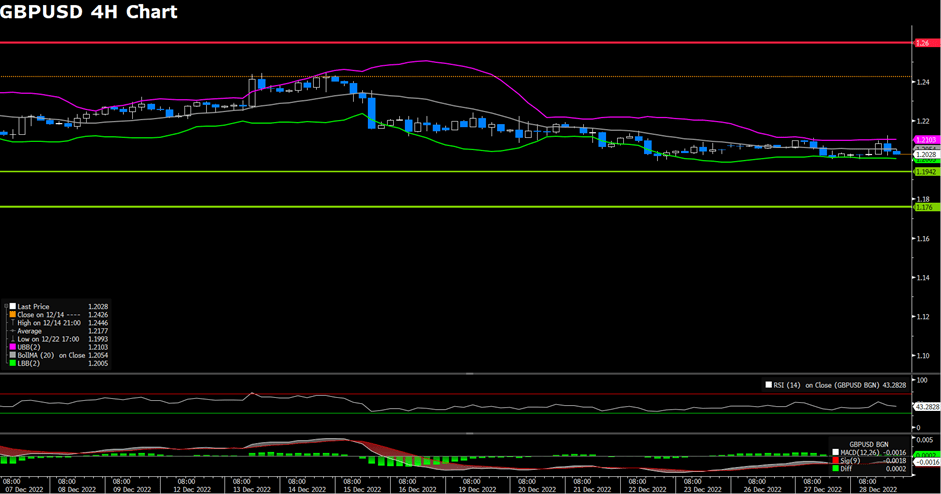

GBPUSD (4-Hour Chart)

The GBPUSD has reversed its direction and declined toward 1.1900 after having climbed above 1.2000 earlier in the day, as the safe-haven greenback benefits from the cautious mood ahead of Powell’s speech. The market sentiment remained fragile, as shown by US equities wavering. Latest Federal Reserve officials commented that the US central bank is ready to moderate the pace of rate hikes but also stated that rates would end higher than September projections. Therefore, any hawkish tilt remarks by Jerome Powell could rock the boat and bolster the US Dollar. On the data side, the ADP Employment Change report for November disappointed investors as the economy added just 127K jobs below expectation and trailed the 239K employees hired by private companies in October. Moreover, the US Gross Domestic Product (GDP) for the third quarter, on its second estimate, increased by 2.9% above forecasts of 2.7%, smashing Q3’s advanced reading of 2.6%. The higher-than-expected report sent recession speculations in the United States to the trash can. In the domestic, the BoE’s chief economist Huw Pill foresees rates to peak lower than the market projections and echoed the BoE’s Governor Andrew Bailey’s remark at the last monetary policy meeting. Therefore, further GBP weakness is expected.

From the technical perspective, the four-hour scale RSI indicator rallied to 54 figures after a less aggressive remark by Federal Reserve Chairman, Jerome Powell, suggesting that the pair were surrounded by positive market sentiment. As for the Bollinger Bands, the pair was priced above the 20-period moving average, meaning that the pair was more favoured to the upside path.

Resistance: 1.2124, 1.2253

Support: 1.1764, 1.1645, 1.1366

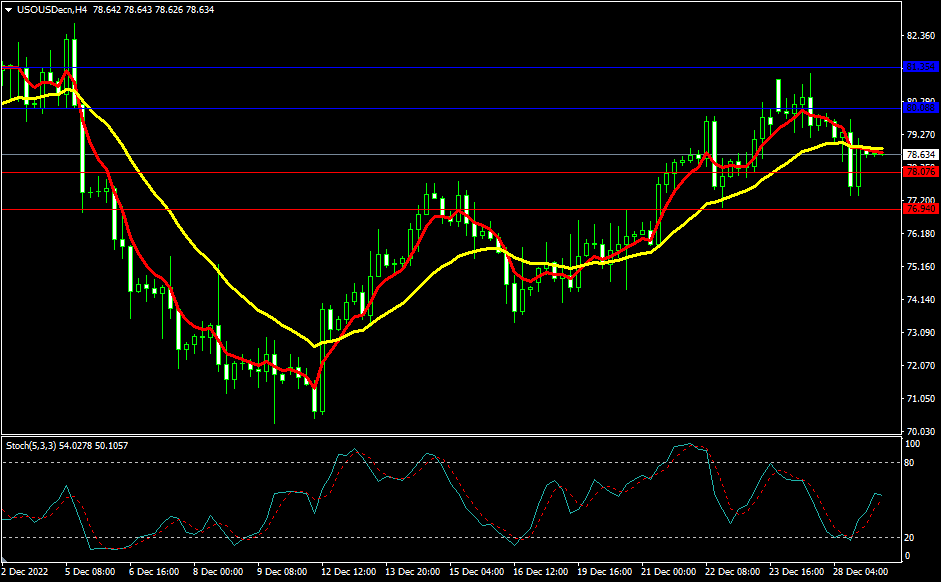

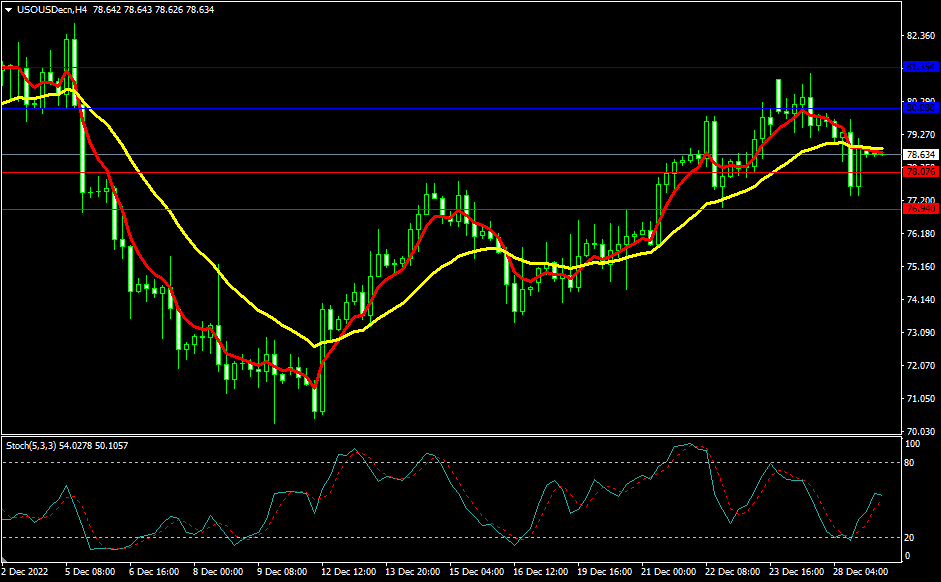

XAUUSD (4-Hour Chart)

The Gold was holding on to modest intraday gains after hitting a fresh weekly high, as investors await US Federal Reserve Chair Jerome Powell’s words to move more aggressively and mixed US data showed better-than-anticipated growth but tepid employment performance. The intraday US Dollar selling was witnessed following the disappointing release of the ADP report, showing that the US private-sector employers added 127K jobs in November. The headline print was well below the previous month’s reading of 239K and 200K anticipated. This tempered expectations for any positive surprise from the official jobs report (Nonfarm Payroll) on Friday. However, the upbeat GDP report capped the upside for the yellow metal ahead of Powell’s speech. The preliminary report released by the US Bureau of Economic Analysis showed that the economy expanded by 2.9% annualized pace during the third quarter against 2.6% reported previously. Traders will look for clues about future rate hikes upon Jerome’s speech and provide a fresh directional impetus to the non-yielding gold.

From the technical perspective, the four-hour scale RSI indicator rose to 59 figures after Powell’s dovish speech, suggesting that the yellow metal was attracting some flow from the greenback. As for the Bollinger Bands, the pair was challenging the upper band and two-week high $1767 mark at the moment of writing. As a result, we think the gold would move upward in the near future and target the $1784 mark if successfully stand firmly above $1767.

Resistance: 1785, 1800

Support: 1740, 1704, 1671

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| CNY | Caixin Manufacturing PMI (Nov) | 09:45 | 48.9 |

| EUR | German Manufacturing PMI (Nov) | 16:55 | 46.7 |

| GBP | Manufacturing PMI (Nov) | 17:30 | 46.2 |

| USD | Core PCE Price Index (MoM) (Oct) | 21:30 | 0.3% |

| USD | Initial Jobless Claims | 21:30 | 235K |

| USD | ISM Manufacturing PMI (Nov) | 23:00 | 49.8 |