Apa yang bermula sebagai ucapan yang tersusun rapi di pergunungan Wyoming bergema ke seluruh sistem kewangan global dalam beberapa saat. Nada berhemah Jerome Powell, dicampur dengan sedikit isyarat bahawa dasar mungkin dilonggarkan, melonjakkan Wall Street ke paras tertinggi baru dan segera mengubah aliran modal dalam mata wang dan komoditi.

Ucapan Pengerusi Federal Reserve di Jackson Hole itu jauh lebih daripada sekadar penampilan simbolik. Sikap berhati-hati beliau, digabungkan dengan sentuhan halus ke arah pelonggaran, telah melonjakkan pasaran ekuiti dan memaksa pedagang menilai semula jangkaan mereka.

Peserta pasaran kini yakin bertaruh pada pemotongan kadar pada September, dan sentimen ini dirasai di setiap kelas aset.

Powell melakar latar belakang yang rumit: penawaran pekerjaan telah merosot dengan ketara, purata hanya 35,000 sebulan berbanding 168,000 tahun lalu, manakala pengangguran meningkat kepada 4.2% pada Julai.

Namun inflasi kekal degil. Core PCE meningkat 2.9% tahun ke tahun pada Julai, sebahagiannya didorong oleh kesan tarif. Powell menyatakan tarif ini akan bertindak sebagai kejutan harga sekali sahaja dan bukannya pemacu struktur inflasi, meninggalkan ruang kepada bank pusat untuk melonggarkan jika tekanan pasaran buruh semakin mendalam.

Euforia Dalam Pasaran

Pelabur menafsirkan ini sebagai isyarat positif. Pasaran niaga hadapan segera menaikkan kebarangkalian pengurangan kadar pada September kepada 80–85%, meningkat daripada 70–75% awal hari, dengan dua pemotongan suku mata telah diambil kira sebelum akhir tahun.

Reaksi itu serta-merta dan kuat. S&P 500 naik 1.3% menjelang tengah hari dan ditutup 1.47% lebih tinggi, hampir ke paras rekod. Dow Jones Industrial Average melonjak hampir 1.9% ke penutupan rekod.

Saham syarikat kecil melonjak hampir 4%, mencerminkan keterujaan meluas terhadap perubahan dasar yang dovish. Ralli ini juga meluas melangkaui gergasi teknologi mega-cap, dengan sektor kitaran seperti kewangan dan industri menarik aliran masuk baharu.

Sekiranya data ISM manufacturing menguat di bawah janji kos pinjaman yang lebih murah, sektor-sektor ini mungkin mengumpul momentum tambahan. Namun, bayangan stagflasi kekal, iaitu senario di mana inflasi berlarutan ketika pertumbuhan perlahan, mengehadkan ruang pergerakan Fed.

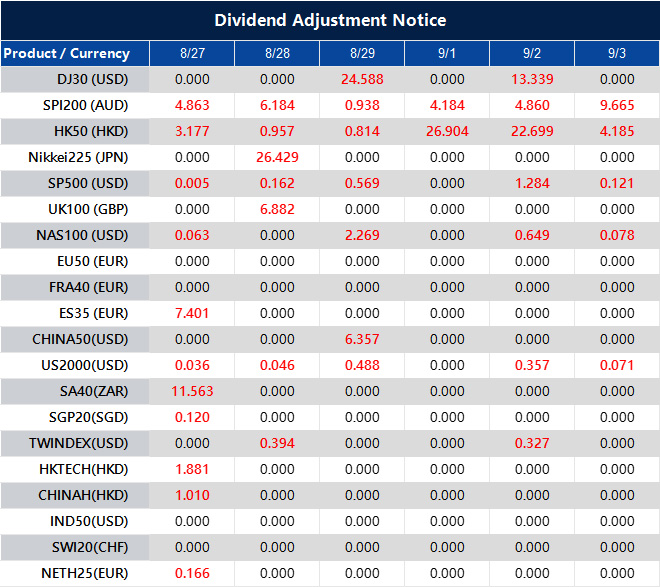

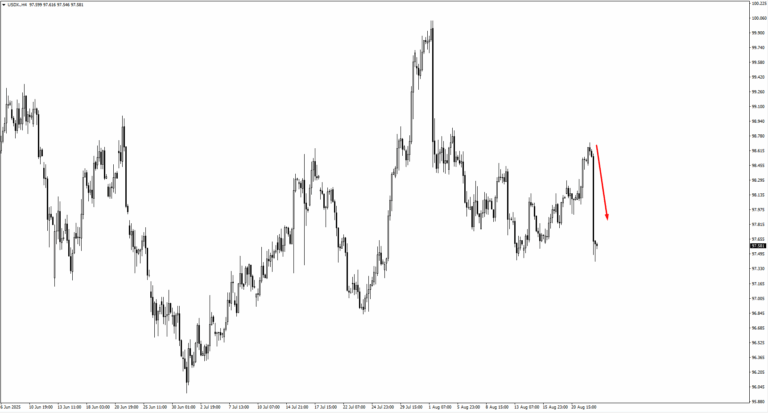

Pergerakan Pasaran Minggu Ini

Minggu perdagangan selepas kenyataan Powell didominasi oleh perubahan sentimen yang dramatik.

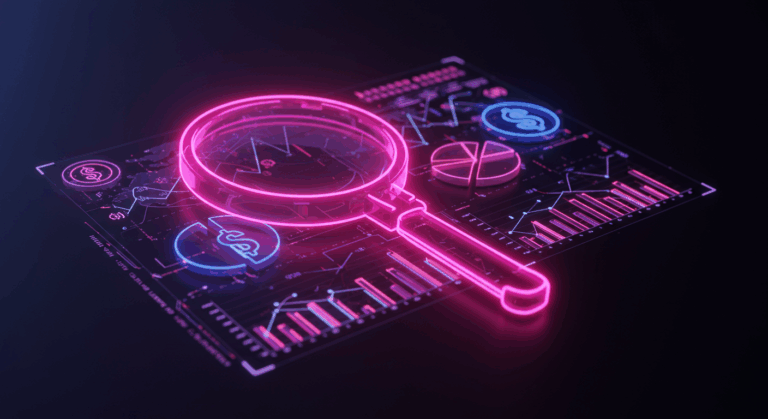

Dalam mata wang, indeks dolar melonjak ke 98.70 sebelum jatuh ke arah 97.35, dengan 97.10 dilihat sebagai sokongan seterusnya.

Euro meningkat ke arah 1.1755 dan boleh menguji 1.17883 jika penyatuan bertahan. Pound naik dari kawasan 1.3370, dengan 1.3605–1.3625 dalam jangkaan jika ia melepasi 1.35943.

Yen menguat apabila USDJPY jatuh selepas menembusi 148.513, dengan ujian 146.208 berkemungkinan jika tekanan penurunan berterusan.

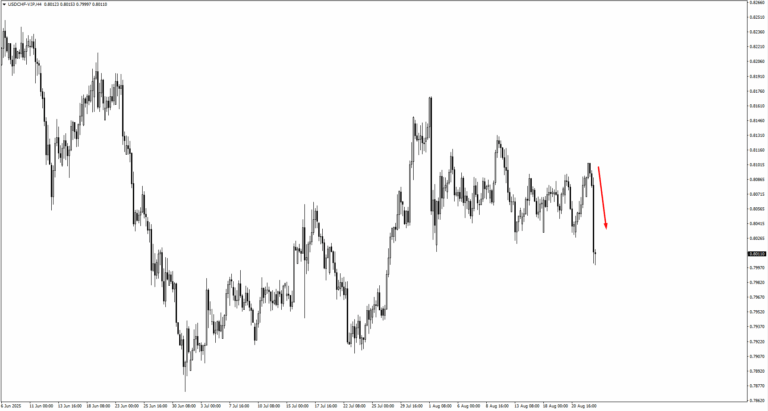

Franc Swiss juga mengukuh, menolak USDCHF turun dari 0.8110 ke arah 0.7960. Mata wang komoditi bertindak balas kuat, dengan AUDUSD melonjak ke arah 0.6515, NZDUSD mengintai 0.5890–0.5915, dan USDCAD jatuh ke zon 1.3810–1.3790.

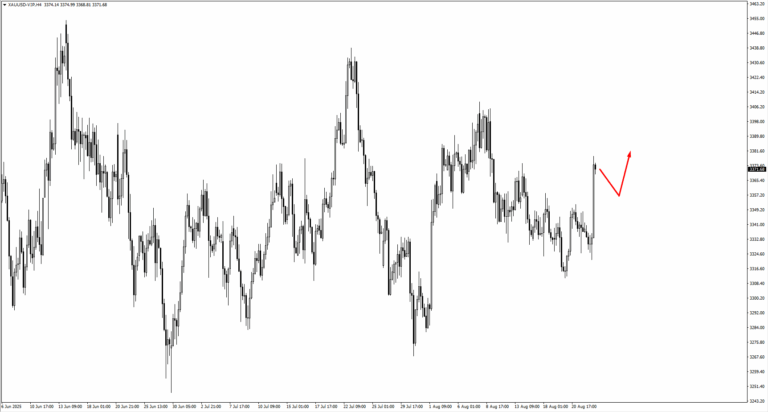

Komoditi turut mencerminkan nada dovish Powell. Emas melanjutkan kenaikan dengan fokus pada penyatuan sekitar kawasan 3350. Minyak nampaknya akan bergerak mendatar, dengan rintangan berhampiran 66.45 dan sokongan sekitar 61.15 jika tekanan jualan disambung. Gas asli melanjutkan kerugian ke 2.55, di mana pembeli mungkin muncul semula.

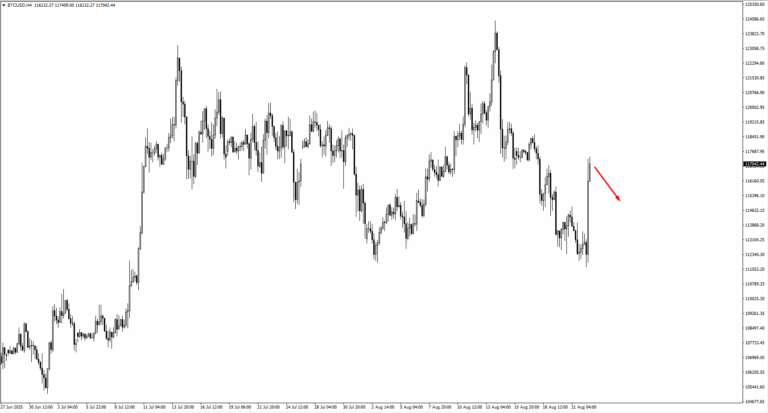

Bitcoin melonjak dari 111,200 ke kawasan 117,700 selepas ucapan Powell. Tempoh penyatuan di sini boleh mendorong mata wang kripto itu lebih tinggi, tetapi kegagalan bertahan mungkin menolaknya ke arah 108,900.

SP500 sudah melepasi 6445 dan kini boleh menyasar 6630 atau 6730, mencerminkan keyakinan pelabur terhadap dasar yang lebih longgar.

Gambaran lebih luas jelas: Powell telah memiringkan Fed ke arah akomodasi, dan pasaran sedang menilainya secara agresif. Namun, keseimbangan kekal rapuh.

Risiko pekerjaan membayangi dan inflasi belum reda, menjadikan data September sangat penting. Pasaran mungkin bersorak terhadap kadar lebih rendah, tetapi kelestarian bergantung pada sama ada pertumbuhan dapat kekal stabil di bawah perubahan dasar ini.

Acara Utama Minggu Ini

Kalendar agak lengang pada awal minggu, tetapi berkembang kepada rangkaian data penting yang boleh membentuk hala tuju pasaran selepas ucapan Jackson Hole Powell.

Pada Rabu, 27 Ogos tumpuan beralih ke Kanada dan Australia. Gabenor Bank of Canada, Macklem dijadualkan berucap ketika kebimbangan inflasi meningkat. Harga pengguna pada Julai menyejuk, tetapi ketidaktentuan kekal sama ada bank pusat akan memotong kadar pada September.

Sementara itu, CPI Australia dijangka 2.30% tahun ke tahun, berbanding 1.90% sebelumnya. Jika data terus meningkat, AUDUSD boleh meneruskan kenaikan.

Khamis, 28 Ogos membawa data KDNK awal AS. Pertumbuhan dijangka pada 3.10% suku ke suku, meningkat daripada 3.00% sebelumnya. Pemulihan ini menyusul selepas kontraksi pada suku pertama, dengan perbelanjaan pengguna dan perbelanjaan kerajaan dijangka menjadi pemacu utama.

Bacaan yang lebih kukuh akan positif untuk dolar, walaupun kesannya bergantung pada bagaimana pedagang menafsirkan imbangan antara pertumbuhan mantap dan nada dovish Powell.

Jumaat, 29 Ogos melengkapkan minggu dengan data inflasi dari Jepun dan Amerika Syarikat. Core CPI Tokyo dijangka pada 2.60% tahun ke tahun berbanding 2.90% sebelumnya, mencadangkan tekanan harga sedang reda.

Bacaan yang lebih lembut mungkin memberi alasan kepada Bank of Japan untuk menangguhkan kenaikan kadar. AS pula akan mengeluarkan Core PCE Price Index, ukuran inflasi pilihan Fed, dengan jangkaan 0.30% bulan ke bulan, sama seperti bacaan sebelumnya.

Sebarang penyimpangan daripada ini boleh menguji kredibiliti dakwaan Powell bahawa inflasi dipacu tarif hanya bersifat sementara.

Melihat ke hadapan, minggu berikutnya menampilkan data yang lebih berat: ISM manufacturing PMI pada 2 September, KDNK Australia dan data JOLTS job oepnings AS pada 3 September, ISM services PMI pada 4 September, serta data non-farm payroll dan kadar pengangguran pada 5 September.

Buka akaun live VT Markets anda dan mula berdagang sekarang.