Strive Asset Management merger excitement drives ASST stock rise amid strong speculation and ratings increase

Germany’s August ZEW survey shows worse-than-expected current conditions and outlook, disappointing financial experts

Analysts predict Nasdaq futures could rise if resistance is broken, while crucial support levels hold firm.

Pre-Market Dynamics

During pre-market hours, buyers initially defended prices but faced aggressive selling later. By mid-morning, buyers were firm at 23,630–23,643. However, late pre-market activity saw resistance at 23,664, limiting upward movement. Key levels for Nasdaq futures are support at 23,630–23,643 and resistance at 23,664. Upside targets range from 23,686 to 23,763. The price outlook is mildly bullish, rated at +3. A rise above 23,664 may lead to further increases, while a drop below 23,630 could indicate lower levels. Order flow is crucial as it reveals market transactions and the balance between buyers and sellers. InvestingLive utilizes this information to spot market shifts, giving traders an edge without providing direct financial advice. They also share more insights through a free Telegram channel. We believe the Nasdaq shows an upward structure but is currently facing a tough challenge. After a strong rally last week, momentum has slowed. Sellers have created a tough ceiling around 23,800. The key battleground is at 23,630 for buyer support and 23,664 for seller resistance.Economic Backdrop

This market tension exists amid positive economic data. The latest Consumer Price Index (CPI) report from July showed inflation cooling to 3.1%. This eases pressure on the Federal Reserve to make aggressive policy changes, generally benefiting tech stocks. The labor market also shows signs of balance, reinforcing positive sentiment. The non-farm payrolls report from July, released on August 1st, indicated a moderation in hiring to 190,000 jobs, alleviating fears of an overheating economy. This suggests a favorable “goldilocks” environment for traders in the near term. With the trading range tightening, traders might explore strategies that profit from low volatility, such as selling out-of-the-money call and put options. An iron condor strategy could work well if the Nasdaq remains steady between key support and resistance levels. This approach allows traders to earn premiums while awaiting the market’s next direction. Market volatility mirrors this calm. The CBOE Volatility Index (VIX) currently hovers around 14.5, a notable drop from above 18 levels during past market jitters in August 2024. With lower implied volatility, buying protective put options as a hedge against a drop below 23,630 is more cost-effective than it was a year ago. For those anticipating a breakout, a consistent move above 23,664 would signal an opportunity to act. Traders could then consider buying call options or implementing bull call spreads to target resistance levels around 23,735 and 23,763. On the other hand, if 23,630 support is broken, bearish strategies could target 23,600. Looking ahead to the following weeks, all attention will be on the Federal Reserve’s next meeting in September. Traders should be aware of options expiration dates and anticipate increased volatility as the meeting approaches. The current stability may just be a calm before a significant market shift. Create your live VT Markets account and start trading now.Forecasts for US CPI indicate consensus on core measures, with deviations likely to impact market reactions.

Consensus Figures

The year-on-year consensus for the Consumer Price Index (CPI) is 2.8% (59%), while other percentages include 2.9% (14%) and 2.6% (2%). For monthly CPI, there’s a strong agreement at 0.2% (65%), with small differences elsewhere. Core CPI year-on-year consensus is 3.0% (61%), and the monthly figure is centered at 0.3% (73%). If these consensus numbers deviate significantly, it could lead to major market movements. For example, a Core CPI year-on-year of 3.2% could cause the US dollar to rally, while a number of 2.9% might result in a weaker dollar. Recent dollar strength likely involved protection against possible CPI changes, and the Federal Reserve seems to be increasingly focused on labor market data. To lower the chances of a rate cut in September, a Core CPI of at least 3.2% might be needed, especially with the Federal Reserve discussions anticipated at the Jackson Hole Symposium. When considering the upcoming inflation report, it’s crucial to not only look at consensus figures but also how closely forecasts are grouped. There’s strong agreement for Core CPI at 0.3% month-over-month and 3.0% year-over-year. Significant deviations from these numbers could lead to the largest market shifts. This report is particularly important due to the recent change in Federal Reserve focus. The weak Non-Farm Payrolls report from July 2025, which added only 155,000 jobs, has made the Fed more attuned to the job market. Consequently, futures markets are currently pricing in a 70% chance of a rate cut in September.Market Implications

Given yesterday’s unexplained dollar strength, possibly a hedge against high inflation, the simplest trades are evident. A Core Y/Y reading of 3.2% would challenge the rate cut narrative and likely cause the dollar to rally. This would be a notable surprise, as only 2% of analysts predict this outcome. A similar situation happened in late 2023 when markets expected early and significant rate cuts. A series of stubbornly high core inflation numbers in early 2024 quickly caused a hawkish shift. A strong report now could trigger a similar reversal of current dovish sentiments. On the flip side, a Core Y/Y figure of 2.9% or lower would strengthen the disinflation trend and likely weaken the dollar. This result would confirm expectations for a September rate cut and could even prompt the markets to consider a third possible rate cut by the end of the year. Regardless of what happens, the market’s attention will quickly shift. We will be listening for comments from Fed officials about any changes in perspective. The upcoming Jackson Hole Symposium at the end of the month will be a significant event for shaping expectations. Create your live VT Markets account and start trading now.Traders assess potential Euro and Dollar movements ahead of expected US CPI data following recent market shifts.

Focus on US CPI

All eyes are on the US CPI report, which may impact decisions by the Federal Reserve. Some strength in the dollar was noted, likely because traders are positioning themselves ahead of this key event. Current statements from Fed officials indicate that a rate cut is likely unless the inflation data is unexpectedly high or the September NFP figure is strong. Regarding the euro, the US-EU trade deal has established tariffs at 15%, and European Central Bank (ECB) members are currently neutral regarding rate cuts. The market now anticipates only a modest easing of 11 bps by year-end, indicating that a rate cut is unlikely. On the daily chart, a significant resistance level of 1.1575 was surpassed but has since pulled back as the market awaits the CPI results. Buyers are hoping for a rally toward 1.1750, while sellers are looking for a decline to new lows. On the 4-hour chart, the 1.1590 support level is essential, with both buyers and sellers strategically positioned. The 1-hour chart offers little additional insight. Key upcoming data includes the US CPI report, followed by Producer Price Index (PPI), Jobless Claims, Retail Sales, and Consumer Sentiment. The comments from Fed officials will be especially important after the CPI data release.Current Market Sentiment

As of today, August 12, 2025, the EURUSD is near a critical support zone around 1.1590 ahead of the US inflation data. Traders’ heightened anticipation has pushed the implied volatility on one-week EURUSD options up by over 15% in recent days. This indicates that significant price movement is expected, making strategies like straddles or strangles beneficial for capitalizing on potential breakouts. The weak US jobs report for July 2025, which added only 155,000 jobs instead of the expected 190,000, has notably shifted market sentiment. This has reinforced expectations of more than 50 basis points in Fed cuts by year-end. If today’s US CPI reading is at or below the consensus of 0.2% month-over-month, it will likely confirm expectations for a September rate cut and could lead to a rally towards the 1.1750 resistance. Conversely, a surprising inflation increase would challenge the dovish sentiment that’s been growing since early August. The market would need a significant beat on expectations for traders to rethink a September cut; thus, managing risk is crucial. Buying protective put options with a strike price below the 1.1575 support level offers a way to hedge long positions against a sudden dollar rebound. Looking ahead, the Jackson Hole Symposium at the end of August will be a significant event. Here, we expect Fed Chair Powell to clearly outline his plans for the September meeting. This timeline suggests that options expiring in late September may capture ongoing volatility as the market reacts to this week’s data and prepares for the Fed’s formal announcement. The ECB’s neutral position, with members showing little inclination to cut rates after their June 2025 move, creates a clear divergence in policy compared to the Fed. This scenario resembles 2019, when a proactive Fed and a hesitant ECB resulted in prolonged dollar weakness. This historical context suggests that any temporary dip in EURUSD caused by dollar strength could present a buying opportunity for a longer-term trend. Create your live VT Markets account and start trading now.Analysts expect core inflation to be around +0.3%, but some warn of potential downside risks.

Jefferies’ View on Headline CPI

Jefferies suggests that without these adjustments, the headline CPI could drop to +0.1%. This contrasts with UBS’s view, which expects stronger inflation. The differing opinions of Jefferies and UBS show the variety of expectations before the data is released. More discussions will follow as the session unfolds. There is increasing speculation that the upcoming CPI report might come in lower than expected. While many anticipate a moderate reading, some analyses hint that core inflation could be around +0.2% for July. This belief stems from the idea that recent price increases in items like furniture and clothing may not happen again. Prices for used cars, which have driven inflation in the past, appear to have leveled off. Manheim’s July 2025 index data revealed almost no change, suggesting a potential decrease after adjustments. This view is backed by early travel data showing that premium airline cabin sales are hiding weaknesses in basic economy fares.Market Reactions and Opportunities

This chance for a lower-than-expected print comes at a crucial time, as the Federal Reserve has kept interest rates steady since December 2024. Market anxiety is evident, with the VIX rising to 17 over the past week. A lower inflation number would likely give the Fed more leeway to consider rate cuts earlier than expected. One way to respond could be to prepare for reduced interest rate expectations and a possible rally in equity markets. This means buying out-of-the-money call options on major indices like the S&P 500 or Nasdaq 100 for the coming weeks. These options provide an affordable way to capitalize on significant, unexpected market rises if inflation comes in low. Another strategy is to anticipate a decline in market nervousness after the report by purchasing VIX puts. We saw a strong market rally in late 2023 when lower inflation prints confirmed that price pressures had peaked. A similar situation now could reduce volatility, making VIX puts a smart investment. If the Fed surprises with a dovish stance, it may weaken the U.S. dollar. Traders could consider buying put options on dollar-linked ETFs or call options on currencies like the Euro. This offers another opportunity to benefit from the market’s reaction to easing inflation concerns. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 12 ,2025

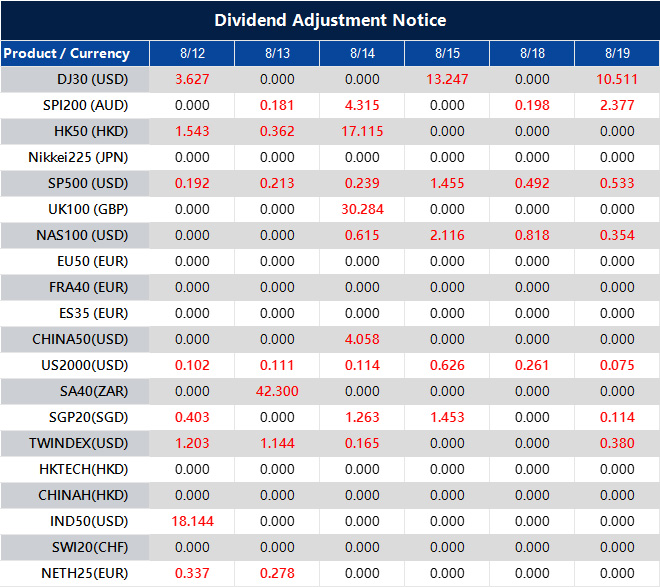

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].