The French manufacturing sector faces challenges with falling orders, low confidence, and longer delivery times due to uncertainties.

Italy’s July manufacturing PMI rises to 49.8, indicating possible sector stabilization and increased optimism

Italy’s Manufacturing Outlook

For the first time in nearly three years, Italy experienced a rise in input stocks while inflationary pressures returned. Italian manufacturers are boosting their inventories, likely due to supply chain issues, fewer orders, and increased business confidence. Optimism is growing above the long-term average, suggesting that some companies expect demand to increase. The EU–US trade agreement aids Italian exporters by replacing a potentially high 30% tariff with a 15% duty on certain goods. While this is an improvement, the 15% tariff still poses challenges for Italian competitiveness in the US. Uncertainty remains about how long this deal will last, as recent US trade policies could change the terms. We are starting to see signs of stability in Italy’s manufacturing sector, with the PMI nearing the critical 50.0 growth mark. This indication might lead to a decrease in negative views on Italian assets, such as covering shorts on FTSE MIB index futures. This improvement stands out compared to Germany’s PMI data from last week, which showed a deeper contraction at 47.5. It is important to monitor the increase in input stocks, a change not seen in nearly three years. Historically, such rebuilding of inventories often happens before broader economic recovery and a sustained stock market rally. This growing confidence may support cautious bullish strategies, such as selling out-of-the-money puts on the FTSE MIB to gain premiums.European Economic Strategies

The return of price pressures coincided with the European Central Bank’s recent decision to keep interest rates unchanged, due to ongoing core inflation. This situation might limit growth for the broader market but could strengthen the Euro. As a result, traders may want to consider taking long positions in the Euro, such as via EUR/USD call options. Despite the clarity provided by the new EU-US trade agreement, the continuing 15% tariff presents ongoing challenges for Italian exporters. Given the sharp market fluctuations seen during the 2024 trade policy disputes, it’s prudent to maintain some downside protection. Keeping long-dated, affordable put options on key industrial stocks could help hedge against any renewed trade volatility. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 01 ,2025

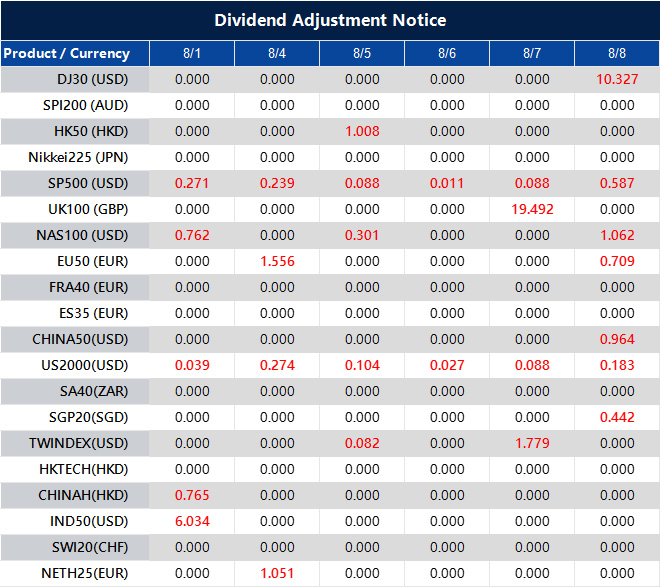

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].