Switzerland clarifies that US tariffs don’t affect pharmaceutical exports, making up 40% of total exports, while Malaysia states its 19% tariffs exempt both pharmaceuticals and semiconductors, with no US requests for rare earths.

July’s Eurozone final manufacturing PMI remains steady at 49.8, showing cautious recovery led by smaller economies.

Current Obstacles in France

France is currently hindering manufacturing growth in the Eurozone, with production dropping for the past two months, even as employment has seen a small rise. On the other hand, Germany is seeing production growth, but employment has decreased. France is dealing with a strict budget and rising political risks, while Germany enjoys stable fiscal policies. Additionally, the Eurozone’s supply chains are under strain, with longer delivery times not linked to increased demand. Issues with supply chains are worsened by changing U.S. tariff policies and geopolitical conflicts, affecting efforts to maintain sustainability in the Eurozone’s manufacturing sector. The Eurozone manufacturing sector shows some improvement but has not yet reached expansion, with a PMI of 49.8. This is the fourth month of improvement since it hit a low of 46.2 in March 2025. Traders should be cautious with European equities, as this recovery remains very fragile.Emerging Opportunities and Risks

The details suggest ongoing volatility, fueled by political uncertainty in France and ongoing supply chain issues. The VSTOXX index, which measures fear in Europe, is hovering around 20, notably higher than its historical average from the late 2010s. In this environment, option strategies that limit risk and take advantage of price movements are more favorable than direct bets on the market. Germany is becoming a strong area, with rising production and a more stable political situation. Recent data backs this up, as Germany’s IFO Business Climate Index for July reached a 12-month high of 92.5. There are opportunities to buy call options on the DAX index or top German industrial companies that benefit from this positive trend. Conversely, France’s manufacturing sector seems to be a major drag on the Eurozone. This is highlighted by France’s latest INSEE business confidence indicator, which unexpectedly dropped to 97, the lowest since the political unrest of early 2025. A pairs trade, where one goes long on German assets and shorts French ones through futures or CFDs, could effectively exploit this difference. We also need to keep an eye on the ongoing strain on supply chains, which is causing longer delivery times for goods. Current delays are similar to the disruptions seen after the pandemic in 2021 and 2022, now primarily driven by geopolitical tensions instead of health issues. This poses a risk for manufacturers that depend heavily on just-in-time inventory systems. This PMI reading is likely to keep the European Central Bank inactive for now. Being just below the key level of 50 does not support any tightening of monetary policy. The interest rate futures market supports this, with less than a 10% chance of an ECB rate hike before the end of the year. Create your live VT Markets account and start trading now.Germany’s final manufacturing PMI for July was 49.1, which is slightly below the preliminary figure.

Market Optimism Remains Cautious

Companies are still reducing inventory, reflecting a careful approach and uncertainty about a sustained recovery. This cautious mindset is leading to less optimism in the market. There is a positive sign from foreign markets, where demand is picking up, with export orders increasing for four straight months. The recent tariff agreement between the EU and U.S. might affect Germany’s exports to the U.S., but overall demand could steady. The production index indicates output has been growing for five months, though the pace of growth is slowing. While the capital goods sector is thriving, the consumer goods sector is lagging, suggesting that international demand is stronger than domestic consumption. As of August 1st, 2025, the latest figures from German manufacturing show a slow and uneven recovery. Although the PMI has risen, it remains below the crucial 50-point mark, indicating that a strong rally in German stocks is unlikely soon. The DAX index has been range-bound between 18,500 and 19,000 for six weeks, and this report doesn’t provide a reason to expect significant movement. Due to the cautious sentiment among companies and continued inventory cuts, there are opportunities to sell volatility. With companies reluctant to shift into a full recovery mode, the market is likely to remain unpredictable and stable through August. Traders may want to consider selling call options at the top of the current DAX range to take advantage of the lack of strong upward momentum.Foreign Demand Outpaces Domestic Consumption

One key takeaway is the contrast between strong foreign demand and weak domestic consumption. While capital goods production is thriving, the consumer goods sector is slowing. This situation suggests a pairs trading strategy could be effective: buying shares of major exporters like Siemens, which are performing better than the index, while shorting consumer-oriented companies. Weak domestic conditions are further highlighted by last week’s German retail sales figures, which fell short of expectations, potentially putting pressure on the Euro. The European Central Bank is likely monitoring this consumer weakness closely, especially since July’s flash inflation estimate dropped to 1.9%. This scenario may justify purchasing put options on the EUR/USD pair, betting on potential currency weakness ahead. The new tariff agreement with the U.S. presents a short-term risk, as it could dampen the recent spike in export orders to America. This may create challenges for the DAX in the near future and reinforce a cautious outlook. However, the agreement might reduce overall uncertainty, which helps explain why implied volatility on the DAX has decreased to around 12, its lowest this year. We can look back to late 2023 for a similar scenario. At that time, better industrial data didn’t immediately boost consumer confidence, resulting in a stagnant market for an entire quarter. History suggests that until there is a clear recovery in domestic demand, any rallies in the broader market should be approached with skepticism. Create your live VT Markets account and start trading now.EU trade commissioner highlights ongoing US negotiations as tariffs create competitive advantages

Potential Deterioration

There is a chance that the situation could worsen if the EU continues to see the agreement as unfair over time. However, the EU might choose to wait until the end of Trump’s term before making any decisions. As of August 1, 2025, the new US-EU trade framework with its 15% tariff cap is bringing a brief period of calm. For derivative traders, this means that implied volatility on trade-sensitive stocks, particularly in the European automotive and industrial sectors, is likely to decrease in the coming weeks. The VSTOXX index, Europe’s main volatility measure, has already fallen by 5% in the last week due to this news, showing the market’s short-term relief. With this expected stability, strategies that benefit from lower volatility, like selling covered calls or credit spreads on European ETFs like the FEZ, could be advantageous. The clear 15% tariff limit eases one significant source of uncertainty, making it easier to predict a trading range for these assets. This strategy allows us to collect premiums while the market adjusts to the current friendly relationship between the two economic regions.Lessons From Past Trade Disputes

Yet, we must remember the lessons learned from trade disputes between 2018 and 2020, when market sentiment could change rapidly. The current deal is temporary, meaning this stability is delicate and could fall apart later this year or in early 2026. Therefore, while we take advantage of the current calm, we also seek low-cost ways to protect ourselves against a potential breakdown in negotiations. Looking ahead, it may be smart to purchase longer-dated protection, such as out-of-the-money put options expiring in six to nine months. Recent data from German industrial output showed a slight 0.2% increase, highlighting the EU’s economic vulnerability to future trade disruptions. These longer-term options serve as insurance if the EU decides the deal is unfair or if political tensions arise again. The political aspect, suggesting that the EU might be waiting out the current US administration, adds another layer to consider. This means that while the next few months may be calm, volatility could surge around significant political events in the lead-up to the next election cycle. We’re paying close attention to political polling numbers to help time our long-term volatility trades. Create your live VT Markets account and start trading now.The French manufacturing sector faces challenges with falling orders, low confidence, and longer delivery times due to uncertainties.

Worsening Economic Outlook

The economic outlook for France’s manufacturing sector seems to have declined as the second half of the year begins. There were some signs of recovery in the first half, but recent data shows a slowdown. While the overall manufacturing index rose, it was overshadowed by fewer orders and poorer business expectations. While there is hope for economic improvement in 2025, the drop in orders and expectations is concerning. Recent easing of EU regulations and cuts in interest rates were anticipated to boost industry activity. However, political uncertainty and global trade tensions are hampering investments, leading to possible order cancellations. Delivery times are now much longer due to labor shortages, a lack of goods, and strikes. Supply chains may need to adjust due to new tariffs and changes within companies. Although the EU-US 15 percent tariff agreement could offer some stability, worries about its long-term viability persist due to the unpredictable nature of US trade policy. The finalized manufacturing numbers for July in France confirm a clear slowdown is occurring. Hopes for a recovery in the second half are now uncertain, especially as new orders are declining at the fastest rate since the year’s start. We should consider preparing for further weakness in French stocks by purchasing put options on the CAC 40 index.Economic and Political Challenges

This decline in manufacturing is occurring alongside persistently high inflation, creating a tough environment. The latest inflation data for the Eurozone in July 2025 showed a rate of 2.8%, still well above the central bank’s target, limiting its ability to respond effectively. This mix of slowing growth and high inflation highlights the need for caution and makes defensive strategies more appealing. The political climate in France, driven by the government’s new austerity plan, is impacting business confidence. This situation mirrors what happened during the 2011-2012 sovereign debt crisis when fiscal tightening led to a prolonged economic downturn and market volatility. Given this historical context, we see the current political environment as a significant obstacle for domestic investment and growth. This negative outlook for Europe contrasts with the stronger US economy, putting downward pressure on the euro. The EUR/USD exchange rate has already dropped by over 2% in the last month, recently hovering around the 1.07 level. We believe there’s potential for the euro to weaken further, and traders should look to sell on any strength. Overall uncertainty is increasing due to poor economic data, supply chain issues, and an unpredictable global trade environment. The VSTOXX, which tracks Eurozone equity market volatility, has been rising and is now above the 18 level, a significant increase from earlier lows this year. We see value in buying call options on the VSTOXX to protect against and potentially profit from expected market volatility in the coming weeks. Create your live VT Markets account and start trading now.Italy’s July manufacturing PMI rises to 49.8, indicating possible sector stabilization and increased optimism

Italy’s Manufacturing Outlook

For the first time in nearly three years, Italy experienced a rise in input stocks while inflationary pressures returned. Italian manufacturers are boosting their inventories, likely due to supply chain issues, fewer orders, and increased business confidence. Optimism is growing above the long-term average, suggesting that some companies expect demand to increase. The EU–US trade agreement aids Italian exporters by replacing a potentially high 30% tariff with a 15% duty on certain goods. While this is an improvement, the 15% tariff still poses challenges for Italian competitiveness in the US. Uncertainty remains about how long this deal will last, as recent US trade policies could change the terms. We are starting to see signs of stability in Italy’s manufacturing sector, with the PMI nearing the critical 50.0 growth mark. This indication might lead to a decrease in negative views on Italian assets, such as covering shorts on FTSE MIB index futures. This improvement stands out compared to Germany’s PMI data from last week, which showed a deeper contraction at 47.5. It is important to monitor the increase in input stocks, a change not seen in nearly three years. Historically, such rebuilding of inventories often happens before broader economic recovery and a sustained stock market rally. This growing confidence may support cautious bullish strategies, such as selling out-of-the-money puts on the FTSE MIB to gain premiums.European Economic Strategies

The return of price pressures coincided with the European Central Bank’s recent decision to keep interest rates unchanged, due to ongoing core inflation. This situation might limit growth for the broader market but could strengthen the Euro. As a result, traders may want to consider taking long positions in the Euro, such as via EUR/USD call options. Despite the clarity provided by the new EU-US trade agreement, the continuing 15% tariff presents ongoing challenges for Italian exporters. Given the sharp market fluctuations seen during the 2024 trade policy disputes, it’s prudent to maintain some downside protection. Keeping long-dated, affordable put options on key industrial stocks could help hedge against any renewed trade volatility. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 01 ,2025

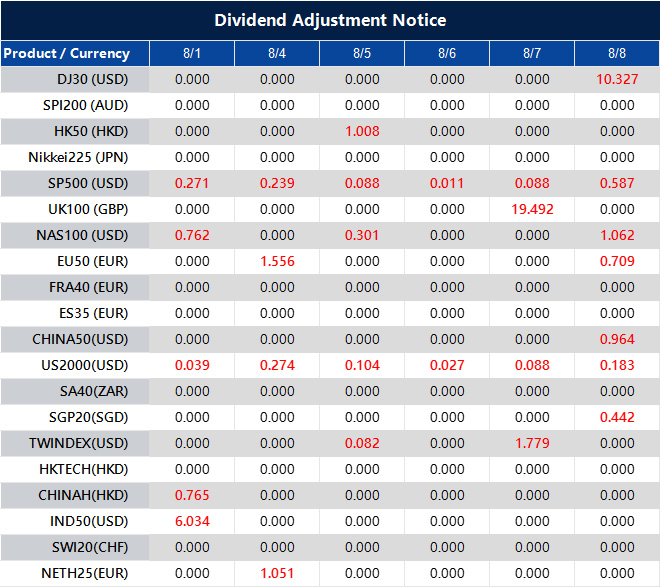

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].