US Lutnick expects economic data to improve after staff changes, impacting tariffs and NFP speculation

BLS reports technical difficulties with data retrieval, which may affect the upcoming NFP release

Market Reaction to Bureau Technical Issues

The market is in a state of uncertainty due to the BLS’s technical problems with the jobs report. This kind of uncertainty can increase volatility. We’ve already seen the VIX rise from a calm 14 to over 18 this morning. For the next few hours and days, trading options that benefit from large price movements seems to be the best strategy. The Federal Reserve’s upcoming rate decision depended on the NFP number, which is now unclear. When there is so much confusion, the market often reacts by selling off first and figuring things out later. We are looking into near-term put options on major indices as a smart way to protect portfolios from potential declines. This situation reminds us of past issues with data integrity from 2024 related to other economic reports. The immediate concern is the delay in the report, but a bigger issue is the growing distrust in the accuracy of the data. Even if a report comes out later today or on Monday, we must wonder if the market will truly trust it, which might lead to higher volatility lasting longer than usual.Impacts on Currency and Bond Markets

We should also monitor the currency and bond markets closely, as they respond quickly to these events. The US dollar might drop as confidence in a strong economic report falters, creating opportunities in currency pairs like EUR/USD. At the same time, we can expect a flight to safety, with more money flowing into US Treasuries, which will push their yields down. Create your live VT Markets account and start trading now.Attention on US NFP report as European data remains muted, with markets taking a dovish approach

The Market Outlook

Movements in the market reflected this cautious sentiment as traders waited for US and Canadian job data. The week ends with high expectations for these important economic indicators. Overall, the market seems to predict a weak Non-Farm Payroll report. We anticipate a number below the consensus forecast of 160,000, which could increase the unemployment rate to 4.1%. This outlook has strengthened throughout the week due to disappointing JOLTS and ADP numbers. If the weak report everyone expects comes through, traders might benefit from downside protection on the dollar, especially through put options on the USD/JPY pair. Moreover, Fed Fund futures are likely to rise, indicating a greater than 70% chance of a rate cut in November, compared to the 50/50 odds earlier in the week. This would confirm our belief that the Fed’s tightening phase has ended.Potential Market Reactions

However, there could be a larger opportunity if the report surprises on the upside, as many positions are currently dovish. A strong report, anything above 200,000, could lead to a significant market shift and increased dollar volatility. This situation is reminiscent of late 2023 when stronger labor data caught the market off guard and caused a sharp turnaround. Traders wanting to hedge or bet on a strong number might consider buying inexpensive, short-dated call options on the Dollar Index (DXY) for next week. The low premium on these options reflects the current dovish sentiment. If the NFP exceeds expectations, these options could rise significantly in value as the dollar strengthens. No matter the outcome today, the main focus will soon shift to the Federal Reserve meeting on September 17th. This jobs report is the last major data they’ll review before making their decision. Expect implied volatility to decrease sharply after the report, creating a potential opportunity to sell strangles on major currency pairs for those who believe the market will stabilize in a new range. Create your live VT Markets account and start trading now.Market reactions depend on forecast distributions: lower-bound results can surprise even with clustered upper estimates.

Non-Farm Payrolls Forecasts

For Non-Farm Payrolls, estimates fall between 0K and 144K. Most predictions are between 60K and 100K, with a consensus of 75K. The Unemployment Rate has a consensus of 4.3%, with 39% predicting 4.2% and 1% each expecting 4.4% and 4.1%. For Average Hourly Earnings Year-on-Year, the consensus is 3.7%, with 31% expecting 3.8% and 7% predicting 3.9%. The Month-on-Month earnings consensus is at 0.3%, anticipated by 91%. Average Weekly Hours are forecasted at a consensus of 34.3, expected by 83%, with 3% predicting 34.4 and 14% expecting 34.2. Current expectations are low, especially compared to August. Today’s market leans toward a soft jobs report, with a consensus for Non-Farm Payrolls at only 75K. This is a sharp change from August. Traders face risks not just from missing expectations, but also from where the numbers fall within that range. While estimates for payrolls can go up to 144K, most are clustered tightly between 60K and 100K. If the report shows 120K, even though that’s within the overall range, it would be a surprising hawkish figure that could challenge current market views. This presents a real trading opportunity since it diverges from crowd expectations.Market Reactions and Strategies

This cautious expectation isn’t random; August’s JOLTS report revealed job openings fell below 8.5 million for the first time since early 2021. The ADP private payrolls report this week also confirmed this trend, showing only 85K jobs added. These recent numbers reinforce the market’s belief that the labor market is cooling down. In the upcoming weeks, we should keep an eye on volatility in the markets. Implied volatility for short-term options on equity indices and currencies is high, indicating a significant move today. A simple straddle on the SPY or a currency pair like EUR/USD could effectively prepare for a sharp price change in either direction. For those with a specific view, any payroll number above 125K along with wage growth near 3.9% would signal an expectation of higher interest rates. This would dramatically contrast the narrative we’ve been building throughout 2025 and could lead to a bond market sell-off like what we saw in late 2023. Be prepared for a quick re-evaluation of Fed fund futures if hot data comes in. On the other hand, if the number drops below 50K, especially if the unemployment rate rises to 4.4%, it could shift the outlook from a manageable slowdown to fears of a recession. In that case, we would likely see a rally in government bonds as traders anticipate faster Fed rate cuts. This would prompt a shift towards defensive trades and long-term assets. Create your live VT Markets account and start trading now.Market positioning for the NFP report is sharply different from August’s, greatly impacting interest rate expectations.

Market Reactions and Trends

At that time, the US dollar rose, while stocks, bonds, and gold fell. When a muted NFP report came out, market attitudes shifted sharply. This led to increased expectations for rate cuts, and the Federal Reserve’s tone became more dovish, especially after Powell’s speech at Jackson Hole. Today, the market predicts 60 bps of easing and a 98% chance of a September rate cut. The dollar is weakening, while stocks, bonds, and gold are climbing. If strong data emerges today, a hawkish shift could happen further down the line, based on current market positions. Data that aligns with predictions would keep trends steady. Weaker data might make the market consider an extra rate cut by year-end or larger cuts in September, affecting overall market movements. The quick shift in market sentiment is striking. We began today, September 5th, 2025, with a 98% chance of a Fed rate cut this month and 60 bps in total cuts by year-end. This is a stark change from early August when the chance of a September cut was below 50%. August’s weak jobs report and the Fed’s comments prompted this dovish turn. However, today’s Non-Farm Payrolls data has changed everything. The report showed that the economy added 275,000 jobs in August, much higher than the expected 170,000, while the unemployment rate stayed low at 3.6%. This strong data challenges the idea of a rapidly slowing economy that many in the market had accepted.Investment Opportunities Amid Market Shifts

With the dovish outlook meeting a surprisingly strong economic report, a major market turnaround is likely. While the Fed may still feel pressure to go ahead with the September cut, expectations for further cuts in November and December are now likely to drop. This creates immediate opportunities for traders who were ready for this unexpected result. For interest rate markets, this suggests positions that benefit from a hawkish adjustment by year-end. Traders should consider put options on Treasury Note futures or short-term interest rate (STIR) options that bet against the deep cuts previously expected for the fourth quarter. The market was leaning towards one-way dovish trades, and this data challenges that belief. In equity markets, the reaction may be negative as expectations for higher rates weigh on valuations. With the VIX volatility index dipping to a low of 13 just yesterday, protective puts on the S&P 500 and Nasdaq 100 are now appealing. The market’s rally before this report was based on the expectation of imminent and continued rate cuts, a foundation that now seems unstable. The US dollar, which has seen significant selling over the past month, is set for a major bounce. Buying call options on the US dollar index (DXY) or puts on pairs like the EUR/USD offers a direct way to take advantage of this reversal. We witnessed a similar reaction after last month’s weak NFP, and we might see just as strong a snapback now. Create your live VT Markets account and start trading now.Market analysis shows bearish pressure on the S&P 500, highlighting key trading levels

Critical Levels And Trade Scenarios

S&P 500 E-mini futures reached a pre-market high but then plateaued. The fair value stands at about 6,521.95, aligning with important levels like VWAP and POC. Bearish scenarios appear below 6,527, while bullish scenarios unfold above 6,535, offering multiple targets. VWAP, Value Area, and POC guide trading decisions by marking fair value zones and activity points. Effective trade management includes taking partial profits and adjusting stop-loss orders after hitting targets. Price confirmation beyond critical thresholds is essential for validating trades. A negative NFP report could significantly change market bias and target levels. This analysis stresses the importance of risk awareness and the need for flexibility in changing market conditions. The market is paused at a crucial pivot, anticipating movement as today’s non-farm payrolls report was released. The report showed a significant miss, with only 110,000 jobs added in August, well below the expected 180,000. This confirms the slight bearish sentiment noted in the options flow. Weak labor data implies the uptrend is losing strength, prompting traders to brace for a potential shift in momentum. With the key bearish level of 6507.5 on the S&P 500 now breached, we can expect a retest of lower support levels in the coming weeks. Focus should shift to downside targets around 6485 and the significant liquidity pool at 6450. For derivative traders, adjusting or hedging strategies that were neutral or bullish may be necessary to account for further weakness.Market Volatility And Economic Conditions

Volatility is critical to monitor, as the low implied volatility of 11.8 is unlikely to last. The VIX, a measure of market fear, has already jumped from recent lows below 12 to over 15 after the jobs report. This rise makes buying protection with put options more costly, so considering bear put spreads could offer a more economical way to prepare for a move towards the 6450 level. The broader economic landscape supports this cautious view. Recent inflation data from August shows that Core CPI remains stubbornly above 3%. This creates a challenging scenario with slowing growth, highlighted by the weak jobs report, compounded by ongoing inflation. This environment, which mirrors trends seen in 2023, often results in volatile, downward-trending markets as investors adjust to increased economic uncertainty. Given this context, we should protect profits from the long-standing uptrend and consider taking bearish positions. Look for October expiration dates for put options with strike prices around 6450 and 6400 to allow enough time for this new trend to develop. Any rallies back towards the 6511 level should be seen as opportunities to increase short exposure rather than signs of strength. Create your live VT Markets account and start trading now.Eurozone’s Q2 GDP grew by 0.1% quarter-on-quarter and 1.5% year-on-year, unexpectedly.

Economic Indicators

Gross fixed capital formation dropped by 1.8% in the euro area and 1.7% in the EU, moving away from earlier gains. Exports fell by 0.5% in the euro area and 0.2% in the EU, reversing prior growth. Imports stayed the same in the euro area but grew by 0.3% in the EU after previous increases. Markets are now looking ahead at economic forecasts rather than focusing on past quarterly data. The Eurozone’s 0.1% growth in Q2 confirms the slowdown we expected after the +0.6% growth recorded in Q1. This stagnation is largely due to a big drop in business investment and falling exports. The data indicates the economy is struggling, relying mainly on government spending. Looking forward, weak performance is supported by recent indicators. The flash manufacturing PMI for August 2025 fell to 48.5, marking its third month in downturn territory. This suggests the weakness from Q2 has likely worsened in Q3.Central Bank Challenges

This situation poses challenges for the European Central Bank (ECB). After raising its key deposit rate to 3.0% in July 2025, the market may now expect no further rate hikes and even consider possible future cuts. We believe the ECB’s tough stance is no longer credible given the current economic climate. For equity index traders, a cautious approach with instruments like the EURO STOXX 50 is advised. Buying put options could be a good hedge against a downturn as corporate earnings forecasts are officially lowered. The significant 1.8% decline in capital formation is a strong warning sign of future weakness. This data suggests higher volatility in the coming weeks. A similar situation was seen in the 2011-2012 period when slowing growth data led to a spike in the V2X index. Traders should brace for wider trading ranges and more unpredictable markets. Overall, this environment is negative for the Euro, making short positions in EUR/USD futures or buying put options appealing. On the other hand, we expect German bund futures to perform well as investors seek safety and anticipate a softer ECB. The trend for yields seems to be downward from here. Create your live VT Markets account and start trading now.Retail sales in Italy held steady in July, defying expectations, with varying performance across categories.

Year-On-Year Sales Growth

Compared to last year, retail sales climbed 1.8%, up from a previous estimate of 1.1%. In comparison to July 2024, large-scale distribution saw a 2.8% increase, small-scale retail rose by 0.6%, and non-store sales went up by 0.9%. Online sales grew by 2.9% year-on-year. Among non-food items, cosmetics and toiletries increased by 3.7%, while electric household appliances and audio-video equipment dropped by 3.1%. The lack of growth in Italian retail sales is concerning. It indicates that European consumers are losing steam. This flat performance, below expectations, suggests our earlier hopes for a strong third quarter might not be realistic. This serves as a warning sign for European stocks focused on the domestic market. Consumer weakness stems from the European Central Bank’s policies, which have kept interest rates above 3.5% for over a year. This data could push the ECB to consider rate cuts sooner than expected, possibly before the end of 2025. This is different from the US Federal Reserve, which is taking a more cautious approach.Bearing In Mind Market Volatility

The Italian report isn’t alone; it follows last week’s news of a decline in Germany’s manufacturing PMI, which dropped to 48.5. Together, the slowing Italian consumer and weak German industry create a gloomy outlook for the Eurozone. We are entering a period of slowdown that seems to be quickening as autumn approaches. In light of this, buying put options on the FTSE MIB index may be wise, as it is highly influenced by domestic demand and the banking sector. The weak growth in retail suggests that the actual economic activity is weaker than reported. Historically, these kinds of discrepancies, similar to those seen in the slowdown of 2023, often foreshadow market corrections. This uncertainty can also lead to increased market volatility. The VSTOXX index, which measures volatility in Europe, has already risen to 15.6 this morning due to this news. Buying call options on the VSTOXX for October 2025 could be a smart way to benefit from the expected increase in market fluctuations. Moreover, the data is likely negative for the Euro. With a dovish ECB expected, we should consider short positions against the US dollar. Purchasing EUR/USD put options offers a way to limit risk while betting on the currency’s decline from its current level of around 1.09. The report also points to a cautious consumer who prefers cosmetics over pricey household appliances. This indicates a potential strategy: buying puts on consumer discretionary companies reliant on bigger sales while buying calls on consumer staples. This approach allows us to take advantage of the evident shift in spending habits. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 05 ,2025

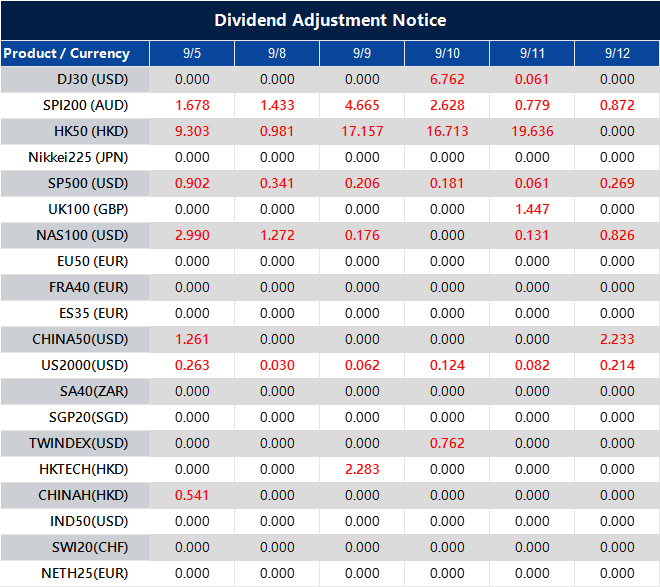

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].