Buyers are targeting the $4,000 level as Ethereum bounces back from a recent drop.

Oil Eases Ahead Of Fed Decision

Oil prices gave back some gains on Tuesday, pausing after Monday’s sharp advance, as markets absorbed the broader implications of a fresh US–EU trade agreement and turned their attention to an upcoming Federal Reserve policy meeting. West Texas Intermediate (WTI) edged down 0.2% to $66.60 per barrel, while Brent crude slipped 0.1% to $69.98.

The retreat followed a strong start to the week, which saw both major benchmarks climb more than 2%, with Brent reaching its highest level since 18 July. However, sentiment began to cool as traders examined the finer points of the trade deal. Though the agreement managed to avoid an all-out trade war, its terms introduced new uncertainties.

A key feature of the pact is the EU’s commitment to purchase $750 billion worth of US energy over President Trump’s second term.

Market watchers have expressed scepticism over the feasibility of this target. Similarly, a promised $600 billion in European investment into the US remains a lofty goal without a firm schedule.

In the near term, the outlook continues to lean bullish, but price action remains sensitive to central bank signals and any resurgence in trade tensions. The Federal Open Market Committee convenes on 29–30 July. While interest rates are expected to remain unchanged, a dovish shift in tone is possible should inflation indicators continue to soften.

Elsewhere, talks between US and Chinese negotiators in Stockholm remain in focus. Monday’s five-hour dialogue signalled interest in extending the current truce, though the path forward remains murky.

President Trump has also issued a 10–12 day ultimatum to Russia over rising tensions in Ukraine, adding another layer of geopolitical uncertainty.

Technical Analysis

Crude oil (WTI) surged to a session high of $67.123 on the 29th before retreating below the 5- and 10-period moving averages. The price action shows a clear uptrend from the low of $64.979, but the rally appears to be losing steam as the MACD crosses lower and the histogram shifts into negative territory.

The failure to hold above the $67 handle suggests a weakening of bullish momentum. This aligns with broader sentiment after recent API data hinted at a potential build in US crude inventories and ongoing concerns about Chinese demand weighed on energy markets. If the price holds above $66.40, a rebound remains possible. A break below may expose the $65.60 zone as the next downside target.

Outlook Remains Guarded

WTI continues to hold above $66.50 for now, but a lack of fresh drivers could see the upside capped near $67.20. Any hawkish surprises from the Fed or setbacks in trade negotiations could trigger a pullback toward the $66.00 mark. Traders should prepare for increased volatility around the Fed’s announcement.

European stocks rebound as indices rise, but worries about the recent trade deal remain

Market Mood

Today’s market mood, on July 29, 2025, shows a slight bounce in European stocks, signaling a fragile recovery. Although the DAX and CAC 40 are up, they are rebounding after several days of selling pressure linked to renewed trade issues with the US over digital services taxes. This temporary calm may be an opportunity to prepare for upcoming volatility. We are closely monitoring low volatility levels, with the VIX index around 14. Historically, such low levels before major earnings announcements from giants like Microsoft and Alphabet often lead to sharp market moves. The current low cost of options presents a chance to prepare for a potential spike in volatility. This situation suggests we should look into buying protection against a possible downturn. Purchasing out-of-the-money put options on major indices like the Euro Stoxx 50 or the Nasdaq 100 is a cost-effective strategy. These positions could gain if negative earnings surprises or bad trade news push the market lower in the coming weeks.Effective Strategies

For those who expect a big price swing but aren’t sure of the direction, a long straddle on key tech stocks could be a smart move. This strategy involves buying both a call and a put option, allowing you to profit from a significant move either up or down. We would focus on options that expire in late August to capture the immediate market reaction and any resulting trends. We also need to consider the broader economic data. Eurostat’s latest flash estimate shows Eurozone inflation steady at 2.8%. This ongoing inflation makes it less likely that the European Central Bank will intervene with supportive measures if markets begin to slide. This reinforces the case for having downside protection ready. Create your live VT Markets account and start trading now.Gold stays within a range as bearish sentiment lingers ahead of key economic data

Gold Daily Chart Analysis

On the daily chart, gold has dropped below a key trendline, with sellers increasing. The important level to monitor is 3,120, where buyers may try to push prices back up towards the resistance at 3,438. In shorter timeframes, a downward trendline remains, with sellers targeting 3,246, and there’s little bullish energy ahead of the FOMC meeting. Notable upcoming reports include US Job Openings, Consumer Confidence, US GDP, and Employment data, which will impact market movements. Gold is pulling back from its recent high above $2,400, making this a key moment for traders. The absence of immediate positive news has led to short-term weakness, but the overall upward trend stays strong. This situation creates opportunities for strategies that can benefit from both anticipated volatility and the underlying trend.Federal Open Market Committee Meeting Outlook

The upcoming FOMC meeting is highly anticipated, but we don’t expect any policy changes. According to the CME FedWatch Tool, there is over a 99% chance that rates will remain steady in June. The tone of Fed Chair Powell will be important; any suggestion of delaying rate cuts until late 2024 could lead to further declines in gold prices. We see the upcoming Non-Farm Payrolls report as the most significant event. The last report in early May showed a weaker labor market with only 175,000 jobs added, which was below expectations and initially supported gold. If this Friday’s report is unexpectedly strong, gold prices could drop towards the crucial support level around $2,280 per ounce. Inflation data is a key factor for the Federal Reserve’s decisions. The latest Personal Consumption Expenditures price index showed core inflation at 2.8% annually, still above the target. This ongoing inflation allows officials to remain cautious, limiting gold’s short-term upside and reinforcing bearish sentiment. For derivative traders, this situation suggests buying puts with a strike price near $2,280 to profit from a potential decline if strong economic data is reported. Alternatively, selling call spreads with an upper strike around the recent highs of $2,400 can generate income as long as momentum remains weak. This strategy allows traders to benefit from possible price drops or sideways movement in the upcoming weeks. Historically, gold tends to perform well during rate-cutting cycles, like in 2019 when it experienced a significant rally. We believe the long-term outlook for gold is still positive due to expected easing and declining real yields. Therefore, any notable dip could provide a chance to establish long-term positions, possibly using long-dated call options for leveraged exposure to a future rebound. In addition to U.S. monetary policy, strong demand from central banks also plays a role. The World Gold Council reported that central banks added a net 290 tonnes to their reserves in the first quarter of 2024, providing a strong foundation for the market. This structural buying should limit the extent of any corrections and provide confidence for buying during pullbacks. Create your live VT Markets account and start trading now.The Spanish economy sees modest growth as Q2 GDP rises by 0.7%, surpassing expectations.

Spanish Economic Resilience

This stronger-than-expected growth signals a positive outlook for Spanish investments in the short term. It highlights Spain’s economic strength compared to other European countries. We should take this opportunity to position ourselves for more gains. With the unemployment rate below 12%, we have more reason to invest in Spanish stocks. A good strategy might be to buy call options on the IBEX 35 index, aiming for expirations in the next quarter. This approach offers a way to benefit from a potential market rally while keeping our maximum risk in check. This strong data might also impact the European Central Bank’s next decisions, especially since President Christine Lagarde has stressed the importance of data. Increased domestic demand could raise Spanish bond yields compared to German bunds. We may want to consider interest rate swaps to take advantage of this trend.Inflation Concerns and Market Strategies

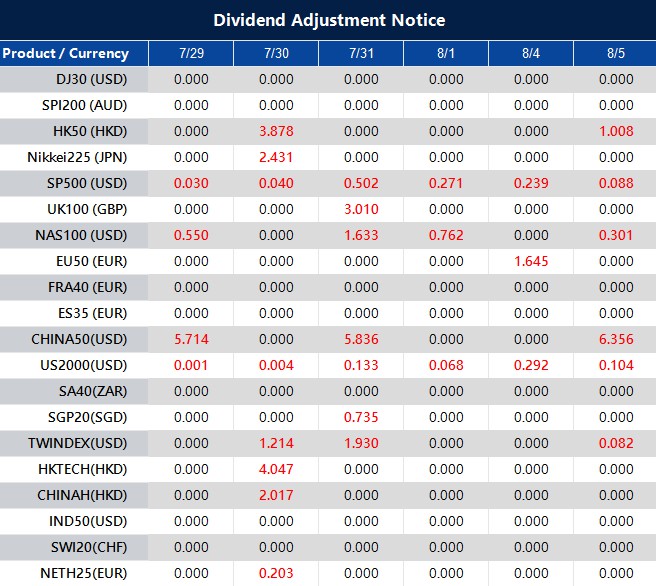

However, we need to stay alert about inflation, currently at a stubborn 3.4%. This ongoing price pressure might dampen market excitement and limit gains in the medium term. Selling out-of-the-money puts can be a good way to earn premiums while betting on stable to moderate growth. Historically, when Spain has performed well domestically—like from 2015 to 2017—it often led to big rallies in banking and tourism stocks. Past remarks from Lagarde remind us that central bank concerns can create volatility and impact such rallies. This history suggests we should focus our derivative strategies on these key sectors rather than simply on the overall index. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 29 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].