EUR/USD and USD/JPY option expiries indicate a bearish trend as dollar strength affects trading.

Earnings reports from major tech companies may impact trading in the coming week.

Tech and Automotive Report

On Wednesday, the attention will shift to tech and automotive sectors. Microsoft, Meta, Qualcomm, and Ford are set to announce their earnings. Investors are keen to see how these companies perform in technology and automotive trends. On Thursday, major players like Apple, Amazon, and Mastercard will take center stage. Their earnings releases will be pivotal for those monitoring advancements in tech and finance. On Friday, energy giants Exxon Mobil and Chevron are scheduled to report. Their results will be crucial for understanding the current energy market. We anticipate that this week’s reports will lead to significant market volatility. The CBOE Volatility Index (VIX) has been relatively low, recently around 17, suggesting that options pricing may not fully account for potential large swings. This could offer traders a chance to prepare for bigger-than-expected moves in either direction.Strategies and Market Indicators

For the major tech firms reporting on Wednesday and Thursday, we are paying close attention to comments about AI investments and cloud computing growth. Options markets are currently indicating significant post-earnings moves, with some suggesting a nearly 9% shift for the social media company. Since its stock rose over 20% after its February report, we are considering strategies like straddles, which profit from large price swings, regardless of direction. The results from payment processors and the e-commerce leader on Tuesday and Thursday will be crucial for gauging consumer health. We are closely monitoring their transaction volumes, especially as recent data shows a slowdown in US retail sales growth. This uncertainty could create opportunities in put options if spending forecasts are lowered. The aerospace company’s Tuesday report will be closely evaluated for updates on production and safety investigations, posing significant downside risks. On Friday, the two energy giants will report amid fluctuating crude oil prices, which have ranged between $80 and $90 per barrel due to geopolitical tensions. We see their derivative contracts as a way to trade based on these industry challenges and opportunities. Create your live VT Markets account and start trading now.The US Treasury will announce quarterly refunding details, expecting increased borrowing for Q3.

Financial Market Observations

Financial markets are closely watching if the US Treasury can keep issuing at consistent rates, even as the budget deficit grows. Due to recent legislative changes, the US fiscal deficit may reach $2.8 trillion over the next ten years. The Treasury will soon announce auction sizes and new issues of 3-year, 10-year notes, and 30-year bonds, with no changes expected to current plans. Continuing to issue short-term debt like T-bills shouldn’t disturb the bond market, as long as money markets can absorb the increase in T-bill offerings. However, this situation could change based on future economic and fiscal developments. With the Treasury planning to borrow over a trillion dollars in the third quarter, short-term interest rates might be under pressure. The influx of T-bills will quickly rebuild government cash accounts. Derivative strategies should focus on the expectation that short-term yields will rise as the market adjusts to this debt. It’s crucial to monitor the movement of cash out of the Federal Reserve’s reverse repo facility (RRP) and into these new securities. The RRP balance fell from over $2.1 trillion in May 2023 to under $450 billion by February 2024 during this adjustment. This reduction in liquidity means there’s less cash flowing in the financial system, which could tighten conditions.Expectations And Risks

We expect this will cause the yield curve to steepen, with heavy issuance in short-term debt and long-term bond auctions remaining stable. This creates opportunities for trades that benefit from a growing gap between 2-year and 10-year yields. The emphasis on T-bills is a strategy to avoid upsetting the market for longer-term debt for now. However, there is a risk that the market may not be able to absorb all this debt as expected, especially since this adds to long-term deficit projections. It’s wise to prepare for potential volatility spikes in funding markets. Options on short-term rate futures could be a smart way to hedge against sudden tightening in financial conditions. This situation mirrors past events, notably the repo market crisis in the fourth quarter of 2019. At that time, a combination of high Treasury issuance and a shrinking Fed balance sheet triggered a sudden cash shortage, driving up overnight lending rates. We should be ready for a similar, though likely less severe, liquidity event in the weeks ahead. In the end, this liquidity withdrawal poses challenges for riskier assets like equities. As yields on safe, short-term government debt become more appealing, capital may shift away from the stock market. Thus, adopting a more cautious approach is advisable until the market fully absorbs this surge in issuance. Create your live VT Markets account and start trading now.An ex-policymaker suggests the BOJ might raise rates to align the economy with inflation expectations.

Possible Interest Rate Hikes

Nakaso’s comments indicate that the Bank of Japan may be preparing for another interest rate hike. This move would aim to strengthen the yen and show that the BOJ is managing the economy effectively. For those trading derivatives, it’s a signal to consider put options on the USD/JPY pair, betting on a stronger yen. His concerns about rising inflation are backed by recent data. Japan’s core inflation rate, which excludes fresh food, reached 2.5% in May 2024, staying above the central bank’s 2% target for the 26th month in a row. This ongoing inflation pressure makes an interest rate increase at the July or September meetings highly likely, supporting a bearish outlook for USD/JPY. The idea that there are cracks in the dollar’s dominance aligns with a broader trend we are observing. Although the U.S. dollar index (DXY) has been strong, recently hitting a high of 106, central banks around the world have been slowly decreasing their dollar reserves in favor of other assets. This long-term diversification could cap the strength of the dollar, making a stronger yen more realistic.Market Volatility and Strategic Approaches

We also need to consider the “Trump tariff” scenario, which brings significant uncertainty. Proposed wide-ranging tariffs might push investors toward the dollar as a safe haven, temporarily increasing the USD/JPY pair and countering our strategy. This mixed outlook signals high volatility, so strategies like options straddles on the currency pair may be wise to capture large moves in either direction. Looking back at the last rate hike in March offers important insights. After that announcement, the yen weakened because the central bank’s guidance was seen as too lenient. For a stronger yen this time, traders will need to hear not just about a rate hike but also strong, hawkish statements from the bank. Create your live VT Markets account and start trading now.Credit Agricole indicates month-end activities show mild dollar selling, particularly against the euro and pound.

Positioning For A Weaker US Dollar

We are preparing for a weaker US dollar as July comes to a close, following the firm’s rebalancing model. This suggests considering derivative trades that benefit from a falling dollar, such as buying EUR/USD call options. The signal indicates mild selling, so we shouldn’t expect large movements. This view is supported by the strong performance of U.S. stocks this month. With the S&P 500 gaining over 3.5% in July, global fund managers will likely sell dollars to adjust their portfolios. We see this as a predictable trend that often puts pressure on the dollar in the last days of the trading month. The corporate flow model also points to a divergence, favoring the euro while suggesting sales of the British pound. This means options on the EUR/GBP exchange rate could be an interesting opportunity, especially buying calls to aim for upward movement. This aligns with the strategy of buying the euro against a weighted mix.Managing Positions With Tight Stops

Historically, these month-end flows aren’t guaranteed and can be affected by major data releases. This week also includes a significant inflation report and a central bank statement. Therefore, positions should be managed with tight stops, especially since no specific entry levels have been provided. Create your live VT Markets account and start trading now.Nvidia is waiting for U.S. approval on export licenses after ordering 300,000 H20 chipsets.

Key Catalyst For Nvidia Stock

The pending export license for the H20 chip is a major factor for Nvidia’s stock in the coming weeks. The uncertainty from the U.S. Commerce Department represents a binary event for traders. This situation is likely to keep implied volatility high, making options pricing sensitive to any news. The political landscape indicates that approval is not guaranteed. The U.S. has been tightening tech export restrictions to China. Announcements of new controls have historically led to sudden, sharp drops in stock prices. A denial could threaten a significant revenue stream, as China has accounted for up to 25% of Nvidia’s data center sales. Conversely, the order for 300,000 units highlights strong underlying demand. If approved, it would confirm Nvidia’s strategy to serve the Chinese market within U.S. regulations, likely resulting in a stock surge. The assurances the company received in July support this positive outlook.Trading Strategy And Timing

Considering these two possible outcomes, we suggest a smart approach is to purchase volatility. A strategy that includes both call and put options would allow a trader to benefit from a significant price movement, regardless of which way it goes. This approach means the trader doesn’t have to predict the government’s final decision. Timing is critical for these positions. We recommend focusing on options contracts that expire in the next one to two months to match the expected decision timeline. Holding positions longer than necessary could lead to losses due to time decay if there are further delays. Create your live VT Markets account and start trading now.The Asia-Pacific Forex session was quiet, with limited price ranges and a slight decline in USD/JPY.

Berkshire Hathaway sells about one-third of its VeriSign stake, lowering ownership to below 10%

Cash Reserves and Selling Trends

As of the end of March, Berkshire had a cash reserve of $347.7 billion and has sold more stocks than it bought for ten quarters in a row, according to Reuters. The sale of this long-term technology investment by Berkshire suggests a cautious view on certain growth sectors. Investors might want to reconsider holding similar tech stocks that have high valuations. This could mean that better investment opportunities are available elsewhere, or that risks of losses are growing. For VeriSign, the share price of $285 sets a strong resistance level. The possibility of more shares being sold could keep the stock price down. Strategies like buying put options or establishing bear call spreads may be worthwhile now. The significant selling pressure poses challenges for bullish investors. Berkshire has been a net seller of stocks for six consecutive quarters and has amassed a cash reserve of $189 billion as of March 31, 2024. This defensive stance usually indicates that the investor believes market valuations are too high, hinting that attractive investment options may be scarce at current prices.Market Indicators and Risk Assessment

Despite these cautionary signals from a major player, the CBOE Volatility Index (VIX) has remained low, ranging between 12 and 15 recently. This presents a chance to buy protective options on broad indices like the S&P 500 at a low cost. The market might be underestimating the risks highlighted by this selling strategy. By reducing its stake below the 10% threshold, Berkshire will not have to disclose future sales as transparently. This lack of disclosure raises the risk for the stock, which traders of derivatives should consider. We should watch for any unusual increases in implied volatility, as this may indicate further selling. Create your live VT Markets account and start trading now.Week Ahead: The Government Steps In

President Trump’s latest economic manoeuvre is not just causing a stir. It’s fundamentally altering the landscape. In a notable break from classic free-market principles, the US government is now acting as an equity investor, taking stakes in companies it considers essential to national interests.

This shift is not occurring amid war or recession. It’s taking place during relative peacetime, which makes the move all the more impactful for markets.

A Seat At The Table

When Japan’s Nippon Steel made a bid to acquire US Steel, the deal only went ahead after the Trump administration secured a ‘golden share’.

This special share grants the US President the authority to block decisions such as factory closures or relocating operations abroad. The government didn’t provide direct funding but gained influence nonetheless.

In another case, the Pentagon injected $400 million into MP Materials, the only company in the US that mines and processes rare earths. That investment made the Department of Defence the firm’s largest shareholder. It guaranteed a minimum price for rare earth magnets, which are crucial components in everything from fighter jets to electric cars.

In short, the state is no longer merely observing. It’s now actively invested, with a clear stake in protecting key supply lines.

Strategic Stakes And Political Implications

Markets responded quickly. Shares of MP Materials jumped on the announcement, with traders factoring in lower risk and assured government demand. Attention has now turned to who might be next in line for such backing.

Likely candidates include defence firms, AI companies, quantum tech labs, and clean energy manufacturers. Essentially, those helping to build national resilience or support energy transition goals.

However, government involvement isn’t without its downsides. Political considerations often follow public money. Profit may be sacrificed for policy aims. And if things go south, it’s the taxpayer who shoulders the loss.

Furthermore, institutional investors may hesitate if they feel blindsided by sudden state involvement or fear being crowded out of decision-making.

Market Psychology Shifts

Perhaps the most notable change is psychological. Investors must now assess the likelihood of a firm being folded into a state-backed model. One golden share here, a sovereign-style investment there. Before long, what were once market-driven outcomes begin to look distinctly curated.

This dynamic may fuel sector-wide rallies in industries labelled ‘strategic’. At the same time, seemingly routine events, such as earnings reports, merger bids, and policy updates, might carry deeper implications.

Broadly speaking, the S&P 500 remains buoyant above the 6400 level, suggesting overall market confidence has yet to waver. But a growing number of equities now appear to be riding the tailwind of government involvement rather than fundamentals alone.

As the US shifts further toward industrial policy, allies may follow suit. This could usher in an era of state-aligned economic blocs rather than pure market competition.

This is particularly pertinent in sectors where China dominates supply chains. Rare earths are just the beginning.

If Washington succeeds in re-establishing domestic capabilities, especially with the Pentagon playing venture capitalist, it could serve as a blueprint for sectors like lithium, semiconductors, or digital infrastructure.

Timing And Monetary Policy Interplay

Timing is also significant. With the Federal Reserve keeping rates steady at 4.5%, and increasing speculation around a September cut, Trump’s investment strategy may coincide with a looser monetary stance.

Friday’s jobs figures are forecast to show a drop to 108,000 new roles (down from 147,000), with unemployment ticking up to 4.2%. Should these projections prove accurate, calls for a rate cut will likely intensify, which may soften the dollar in the near term, especially as the White House takes a more hands-on role in both economic and monetary strategy.

For the moment, investors should monitor firms in key sectors and pay attention to policy signals from Washington that could hint at further intervention.

Price action is likely to favour those companies with government backing or prospects of acquiring ‘golden share’ treatment. That said, expect fluctuations, like legal disputes, weak earnings, or political uncertainty, which could easily disrupt this new order.

Trump has brought a new player into the markets: the US government. And it’s no longer just regulating or backstopping. It’s buying, owning, and, at times, deciding.

Market Movements Of The Week

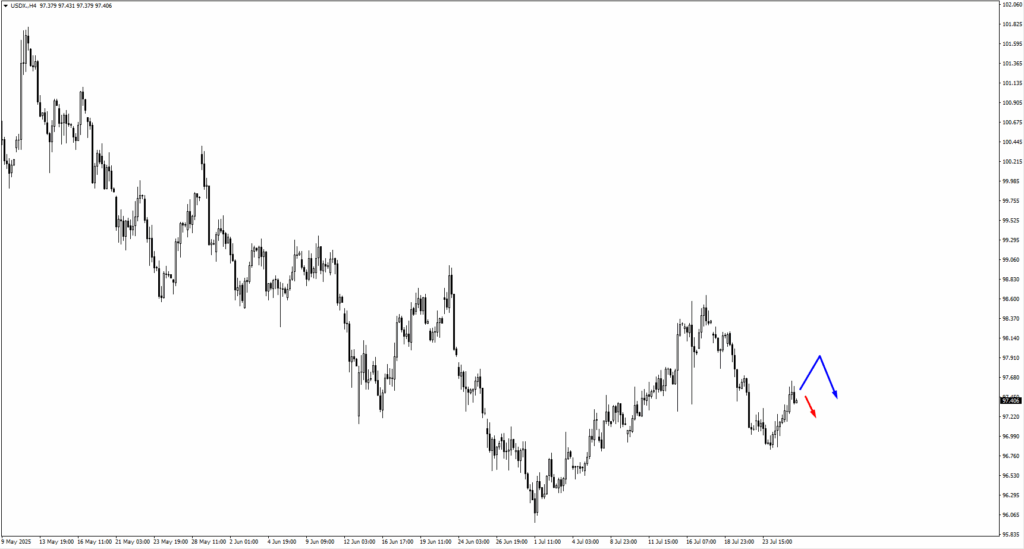

Following a slip from the 97.50 level, USDX has yet to show a clear consolidation. Without stabilisation, this dip might be a pause before another leg higher.

If an upward move materialises, watch for bearish pressure around 97.75 and 98.10. A rejection here could signal a downturn. But if the price breaks through, further dollar strength could follow.

EUR/USD has bounced from the 1.1700 region, as expected, but now sits in a holding pattern. A clear break below would place 1.1665 in focus. A bullish setup there might prompt re-entry. If not, momentum could fade, particularly if USD strength resurfaces.

GBP/USD dipped beneath 1.3470 last week. While there’s room for a rebound, this isn’t a clean reversal just yet. If declines continue, the 1.3310 area will be critical for buyers eyeing a potential bounce.

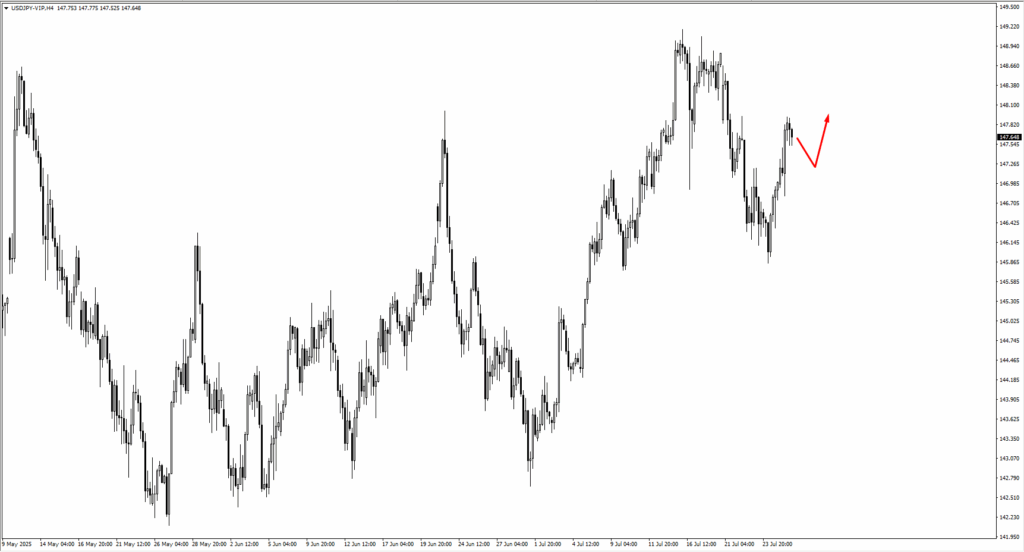

USD/JPY closed above 147.70, holding as a short-term pivot. Should price retreat, support may emerge around 147.15. On the upside, 148.40 becomes the next hurdle. Watch out for breakout or rejection cues as trade policy and inflation data approach.

USD/CHF reversed from the 0.7970 region. If it stabilises and rises, the 0.8000 area presents a potential setup for fresh bearish trades. Until then, short-term positioning may remain sidelined.

AUDUSD ended the week at the 0.6550 mark. This is an active decision point. Should the pair consolidate here, we’ll be eyeing 0.6580 to 0.6590 for fresh bearish patterns. If it drops, bulls could re-enter around 0.6515. That level has held well in recent months, and unless broken decisively, still offers a reliable bounce setup.

NZDUSD mirrored this structure, closing at 0.5995. If the pair consolidates, expect bearish signals to emerge near 0.6030. On the flip side, the 0.5955 level remains key for bulls. Should we test that lower boundary and see strength, it may offer a high-probability long opportunity in the days ahead.

USDCAD is the pair to watch if we see a classic consolidation. If price settles and coils, the 1.3670 and 1.3655 zones could invite fresh bullish pressure, especially with Canadian rate expectations already baked in. A push from these levels may be supported if oil prices soften further, as that tends to weigh on CAD.

US crude has drifted away from its trendline again, reflecting caution as supply-side stories evolve. If it moves lower, support may emerge at 63.35 and 61.00, the potential rebound zones pending geopolitical or OPEC updates.

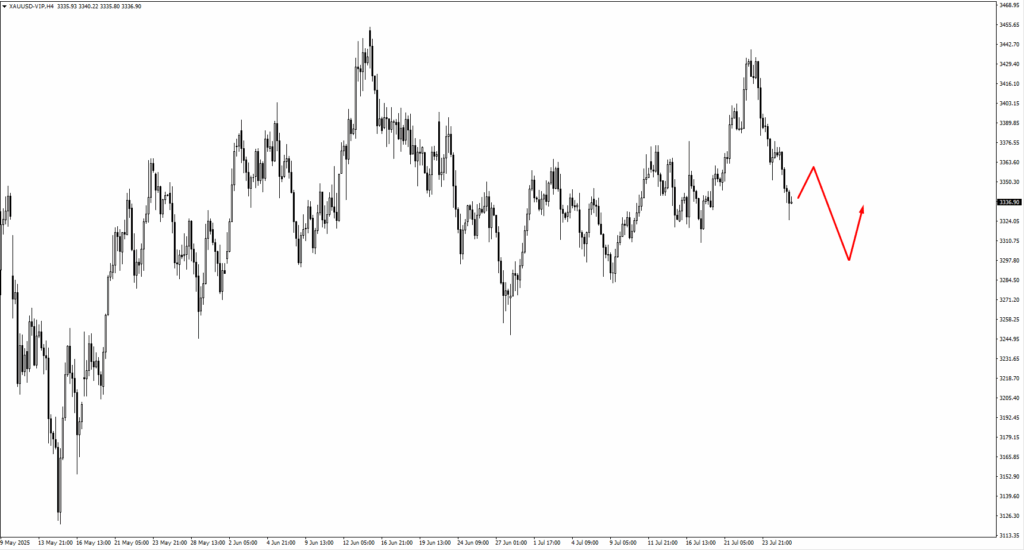

Gold has fallen from the 3390 level. If the slide continues, bulls will be watching 3295 closely. This level has acted as a launchpad in previous moves, but we’ll need to see a clear bullish structure before entering. Otherwise, gold may remain under pressure, especially if hopes for a rate cut weaken.

The S&P 500 hovers near 6400. A break higher puts 6630 in view, though traders remain cautious amid mixed earnings and uncertain Fed guidance.

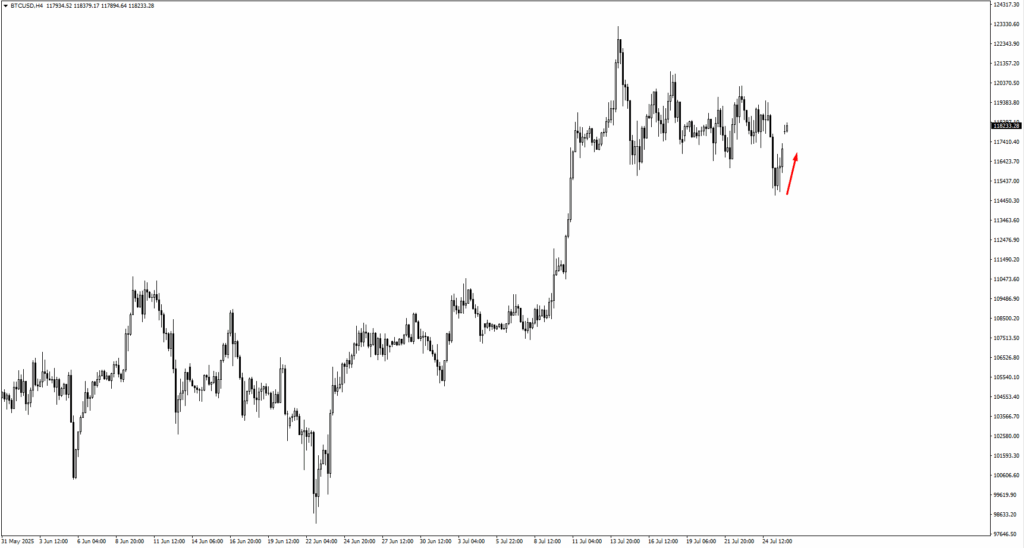

Bitcoin is staging a recovery after briefly taking out the 15714 low. The next critical step is whether price can close decisively above 120350. A clean breakout here might signal readiness to attack a new all-time high. If BTC falters or consolidates instead, watch for bullish setups at 113345 or 111000. These levels remain strong supports and could spark renewed rallies if tested again.

Natural Gas is playing a waiting game. If price consolidates soon, look for bearish patterns near 3.20 or 3.28. These areas remain sell zones unless we see a fundamental shift in demand or weather-linked supply headlines.

Key Events Of The Week

While no central bank surprises are expected, economic data from Tuesday to Friday could heavily influence the Fed’s September rate decision. Each release will add pressure and raise the stakes for policymakers.

Tuesday, 29 July brings the JOLTS job openings report, forecast at 7.49 million, down from 7.77 million. A weaker reading may nudge the dollar lower. Conversely, a strong result could reduce expectations for near-term easing.

Wednesday, 30 July features Advance US GDP, expected to rebound to 2.4% from last quarter’s -0.5%. This would signal ongoing resilience despite high rates. The Bank of Canada also announces its rate decision, expected to hold at 2.75%. Any dovish tone could push USD/CAD higher if the Fed stays cautious.

Thursday, 31 July is the most eventful day. The Fed is set to hold rates steady at 4.5 percent, but the market will be hanging on every word of the accompanying statement. Traders want clarity on whether a September cut is in play, especially after Trump hinted that his recent meeting with Fed officials leaned dovish. Meanwhile, the Bank of Japan is also expected to keep its rate at 0.5 percent. The newly struck trade deal with the US reduces some of the economic pressure on Japan, opening the door for a more hawkish lean. If the BOJ signals even mild intent to normalise further, USDJPY could pull back. Finally, the Core PCE Price Index is forecasted at 0.3 percent, slightly hotter than last month’s 0.2 percent. If inflation proves sticky, it may throw a wrench in rate cut expectations. If it cools, traders may find renewed confidence in a September shift.

Friday, 1 August wraps with the US Non-Farm Payrolls report, expected at 108,000 jobs versus last month’s 147,000, and a forecasted uptick in unemployment to 4.2 percent from 4.1 percent. These numbers will anchor the week’s macro narrative. If the jobs market is indeed slowing, it strengthens the case for rate cuts. But if the data holds firm or surprises to the upside, the path forward becomes murkier, especially if inflation remains above target.

While no single data point may be decisive, together they could reshape market sentiment. For now, FX pairs remain range-bound, equities test resistance, and gold flirts with support.