The Euro is expected to fluctuate between 1.1690 and 1.1760 against the US Dollar.

Hassett is emerging as a strong candidate for the next chair of the Fed.

Monetary Policy Direction

Hassett being seriously considered for the top job at the Federal Reserve changes our expectations for monetary policy. His talks with Trump indicate that his candidacy is more likely now, giving us a clearer view of future policymaking styles. Hassett is known for favoring easier monetary conditions, especially when economic growth slows. If he becomes the head of the Fed, we might see stronger resistance against further rate hikes, particularly if inflation data stabilizes. This would mark a shift from the current approach under Powell, who has been more focused on increasing rates to control inflation. This potential change allows for better scenario planning. Long-term bond yields might face downward pressure as the likelihood of stricter policy lessens. This isn’t just speculation; it’s how long-term rates usually respond when there’s a genuine chance of a softer monetary stance from the Fed. We’ve already noticed shifts in forward contracts on interest rates after earlier signals, similar to what happened with short-term SOFR futures last spring. The options market is leaning towards lower rate expectations, particularly for short-term rates. This doesn’t necessarily mean everyone believes Hassett will be appointed; it indicates that markets are adjusting their outlooks in subtle yet meaningful ways.Interest Rate Speculation

This development is significant. Traders focused on quick directional moves in interest rates or inflation-linked derivatives should be watchful for pricing changes as market outlooks evolve. Hassett’s policy history suggests he prefers growth-focused strategies. Should he provide forward guidance, any insights may clarify expectations quickly, reducing volatility but enhancing the value of curve shape trades. We’re now more interested in trades based on the idea that rate cuts might begin sooner. Some three-month basis spreads already suggest this perspective. Noticing unusual movements in 18- to 24-month tenors could provide early warnings—especially if they diverge from inflation swaps. Timing will be crucial. It’s important to remember that Fed leadership affects market sentiment beyond interest rates alone. If investors sense a steady, growth-oriented approach, risk assets in related sectors—like consumer lending credit derivatives—often show narrower spreads. However, we aren’t at that point yet. The White House hasn’t made anything official, but the situation has shifted enough to warrant adjustments in exposure and margin levels. Market participants should keep an eye on volumes in options for rate futures for the December and March contracts. Activity often spikes after speculation about Fed appointments, and this instance may follow suit. Small changes in implied volatility for these contracts frequently indicate stronger sentiment shifts than actual spot rate changes. Setting alerts could be beneficial. Create your live VT Markets account and start trading now.The PBOC sets the USD/CNY central rate at 7.1541, lower than the expected 7.1806

In a CNBC interview, Howard Lutnick mentioned expecting 15 to 20 upcoming letters about copper tariffs.

Trump’s Return and Trade Tensions

With Donald Trump running for president again, we expect increased tensions with China. Trump has vowed to implement a 60% tariff on Chinese goods during his 2024 campaign. This renewed trade war impacts global economies and supply chains, affecting spending and contributing to inflation. This information contains forward-looking statements and is not investment advice. It’s essential to do thorough research before making any financial choices. The authors express personal views and are not registered investment advisors, so they take no responsibility for reliance on this information. Lutnick’s statements hint at numerous official notifications likely aimed at specific trade partners. We see this as a first step before broader trade policy changes. Although these letters might initially carry only diplomatic significance, they signal a shift in Washington’s trade stance, particularly regarding copper—an essential material in industrial supply chains. The mention of potential tariffs on copper this summer suggests timing that may align with changes in commodity market liquidity and pricing for tech and energy companies. Additionally, the announcement of high-level discussions with Chinese officials this August indicates alignment within US fiscal and trade agencies. This sets the stage for a thoughtful policy adjustment rather than abrupt changes, but history shows that these talks seldom happen without administrative strategies in place. The 2018-2020 period serves as a reminder: the tariffs then triggered reactions that went beyond expectations, often catching experienced market players off guard. Many assets experienced volatility not directly tied to market fundamentals but rather to political timing and regulatory uncertainties.Metals Market Impact and Global Responses

We anticipate various pressure points will emerge once these letters are released. Traders focusing on the relationship between equity volatility and metals might see unforeseen changes. For trades involving copper and related assets—like aluminium or rare earth contracts—hedging costs could rise, especially if the letters contain detailed product information or suggest retroactive policies. Speculation about tariffs isn’t new, but Trump’s return to the presidency adds real risk. His plan to impose a 60% tariff on Chinese imports frames the market in terms of “when” rather than “if”—and more crucially, “how much.” Institutions will likely start factoring these expectations into their pricing sooner than some may think. This involves not just the direct effects of tariffs, but also anticipatory actions—like purchasing beforehand, stockpiling, or altering supply chains—that take place even before any laws are enacted. It’s important to view early summer as a time for expectations to solidify. In previous years, we’ve seen how miners, freight operators, and manufacturers react to even subtle regulatory hints. For derivatives markets, opportunities will arise from monitoring shifts in margins and implied volatility related to commodity-focused companies. For instance, the gap between futures and spot prices in metals ETFs could widen if tariff concerns start affecting overnight rates or dollar-based calculations. Another key issue is how other trading partners will react. In past instances, retaliatory measures have come faster than analysis predicted. For example, Canada and the EU quickly implemented retaliatory tariffs on selected US goods. This isn’t just past history; it sets a precedent. For anyone engaged in synthetic exposure to global trade patterns through FX options or cross-border indices, it’s crucial to keep a close watch. We don’t expect a repeat of the exact events of 2018. However, the familiar structure is there: public letters, economic signals, international meetings, and gradually increasing tariffs. Traders can no longer count on a stable trade backdrop for Q3. Adjustments to models may need to include the upcoming tariffs and shifts in implied risk—and especially for sectors like tech, mining, and industrials. As always, this information should not be taken as direct advice but as context to consider. Data can be volatile, sentiment often shifts quickly, and markets move rapidly once policy changes are anticipated. We have seen this cycle unfold before. Create your live VT Markets account and start trading now.The PBOC plans to set the USD/CNY reference rate at 7.1806, based on Reuters estimates.

Yuan Trading Range

The yuan can fluctuate within a +/- 2% range around the midpoint. This means it can rise or fall by a maximum of 2% in a single trading day. The PBOC may adjust this trading band based on economic conditions and policy goals. If the yuan gets close to the edge of its band or if there’s too much volatility, the PBOC might intervene. This could involve buying or selling yuan to stabilize its value, helping to keep the currency’s market position steady. This article explains how the PBOC manages the yuan’s exchange rate. Essentially, the central bank sets a daily guide price, known as the midpoint. This midpoint directs daily trading and keeps prices within a limited margin. The 2% band protects against sudden market shocks and avoids drastic price changes that could unsettle markets or create imbalance.Setting the Midpoint and Market Implications

Importantly, the midpoint isn’t set randomly. The central bank looks at the previous day’s currency movements, economic signals, and international capital flow changes. Although the system seems automatic, human decisions play a key role. Interventions aren’t common, but the PBOC may act when prices become too volatile. What does this mean for price action? We can expect the yuan’s volatility to stay relatively stable unless economic pressures change the midpoint significantly. When this shift occurs, it can impact nearby currency pairs, especially those sensitive to Asian currencies. As the midpoint changes gradually or suddenly, certain trading setups tied to implied volatility or delta-hedging might become more reactive. Recently, midpoints have been adjusted slightly downward over several sessions. This trend affects spot markets and increases forward pressure, which can be challenging for positions that anticipate changes too far in advance. Offshore one-month implied volatility has tightened, showing the PBOC’s effective communication even with limited transparency. Essentially, we’re working within known limits, and these price bands keep market movements predictable. Lately, investors are paying close attention to any signs of potential easing or tightening. Some experts suggest a greater tolerance for depreciation, while others emphasize the importance of stability. When Liu mentioned the PBOC’s commitment to keeping order in FX markets, it highlighted the connection between forward volatility curves and this positioning. In this situation, it’s wise to reassess gamma exposure, particularly in USD/CNH structures at the extremes of daily movement. Short-term options may start favoring higher protection costs if news begins to lean toward cautious easing, and risk reversal adjustments have already begun. As we enter the second half of the month, it’s essential to look for any patterns in consecutive midpoint fixings. Repetition beyond three sessions often signals positioning alerts. Cross-asset correlations support this: when dollar-onshore trading diverges from offshore futures pricing for a second consecutive day, spreads can tighten, with a quick reversion if liquidity decreases rapidly. It’s crucial to monitor hard data closely. Pay attention not only to published indicators but also to settlement flows, as discrepancies can signal changes before they’re reflected in the official fixing. Additionally, if swap points start steepening while we’re still trading near the edges, it might be a cue to reduce carry exposures, especially for durations affected by monetary actions. Now is not the time to chase yields indiscriminately. The controlled fluctuation band limits opportunities for drastic moves in implieds. Although some spreads may seem appealing, they are attractive because the likelihood of further intervention backs them up – a reminder not to make hasty guesses. Ultimately, directional strategies will continue to be guided by signals from the PBOC. How we interpret these signals and the value we assign to them will influence our positioning in the weeks to come. Create your live VT Markets account and start trading now.The greenback’s strong start faded as investors watched trade tensions from tariffs on Japan and South Korea.

Euro And Pound Movements

The EUR/USD stabilized above 1.1700, with upcoming speeches from ECB’s Lane and De Guindos. The GBP/USD fluctuated, hitting two-week lows before bouncing back around 1.3600, with the BoE’s Financial Stability Report being crucial. USD/JPY rose to multi-week highs near 147.00; Japan is closely watching Machine Tool Orders. The RBA’s hawkish stance helped AUD/USD surpass 0.6500, with important data releases and speeches from RBA officials expected. WTI crude prices climbed to monthly highs near $69.00, driven by strong demand and decreased US production. Gold continued to drop around $3,300 per ounce, affected by trade news, a strong dollar, and rising yields. Silver also fell, staying below $37.00 per ounce. After an initial surge, the US Dollar lost momentum, finishing the session nearly unchanged. The earlier strength—backed by higher yields—began to wane. New trade tensions emerged with fresh tariffs from the US aimed at Japan and South Korea. These events are part of a broader shift towards protectionism, which can affect global risk sentiment. Although the Dollar Index peaked close to 98.00, it struggled to go higher, showing that markets may be cautious ahead of upcoming policy updates. Now, attention turns to the Federal Reserve. The release of the minutes from their last meeting will shed light on their thoughts. Are more rate hikes likely, or has the outlook changed? In any case, short-term rate expectations are under scrutiny. Additionally, new mortgage data and domestic crude inventory figures will reveal how rising borrowing costs and energy trends are impacting the economy.Market Impacts On Commodities

The euro remained steady, holding just above 1.1700. Upcoming speeches by Lane and De Guindos will be significant; their tone may indicate whether Frankfurt will maintain its current policy or consider further tightening. Recent euro weakness seems more influenced by external events than by eurozone data. In contrast, the pound faced some pressure, briefly hitting two-week lows before recovering. The pound’s near-term direction may depend on the Bank of England’s latest risk assessment. Depending on how systemic threats are viewed, rate expectations could change. Bailey’s challenge remains managing high inflation while ensuring financial stability. The USD/JPY pair continues to rise, nearing 147.00. This strength is partly due to differing policy outlooks, but there’s also concern about domestic activity in Japan. Machine Tool Orders, often overlooked, can provide critical insights into industrial momentum that could influence policy decisions in Tokyo. The Australian dollar was boosted by a more assertive tone from policymakers. The RBA’s recent comments pointed towards tighter policy, pushing the AUD above 0.6500. Upcoming speeches and additional data will help traders gauge whether market expectations are overly optimistic or cautious. Oil prices continued to rise, hitting one-month highs, thanks to strong demand and limited supply. Improving summer travel trends and refinery activity have also supported prices. US domestic production has declined slightly, adding further support to crude prices. Gold prices fell further, approaching the $3,300 mark. It is under pressure from a strong dollar, rising yields, and renewed trade tensions that raise growth concerns without increasing demand for safe-haven assets. Silver also struggled, remaining below $37.00 amid competition from interest-bearing investments. For those trading derivatives, caution is advised. Monitor interest rate differences and stay alert for central bank policy hints. As implied volatility rises, it’s smart to reassess delta and gamma exposure. These moments reward precision. Understanding how macro factors relate to short-term contracts can provide insight into momentum shifts, especially when short-term carry costs rise. This week, price movements have become more reactive to data, rather than following set patterns. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 09 ,2025

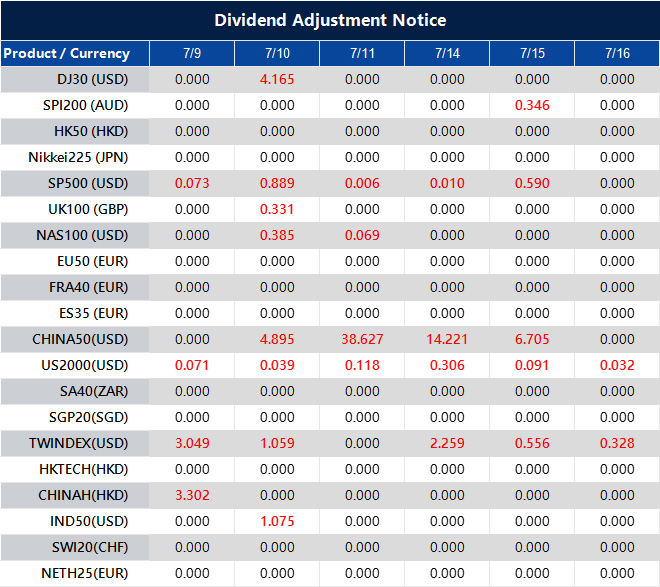

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].