Taiwan has not received any communication from the US regarding upcoming tariff implementation.

Trump’s tariffs create uncertainty, affecting USD and JPY and causing currency fluctuations

Geopolitical Developments

In geopolitical news, Trump announced plans to boost military aid to Ukraine. This shows ongoing political and economic tensions worldwide as countries manage trade talks and broader shifts. The situation remains dynamic and could have significant effects on global markets and economies. The initial sections highlight the high uncertainty in the markets, mainly driven by inconsistent tariff statements from the U.S. With the prior tariff deadline now uncertain, there’s room for continued negotiations. Unfortunately, this ambiguity creates more indecision rather than soothing the markets, impacting pricing mechanisms. Traders are reducing their dollar holdings, evident in its broad decline against major currencies—except for the yen. Japan, heavily dependent on exports, now faces a 25% tariff threat from the U.S. This poses serious risks to Japanese businesses that rely on favorable trade conditions. The yen’s unexpected weakness seems connected to these changing sentiments, indicating that the market is readjusting its expectations for future growth, which limits typical safe-haven investments in the currency. In Australia, business confidence figures exceeded expectations. For three months now, confidence readings have shown positive growth. This improvement is supported by real increases in essential operational areas: higher sales, greater profits, and job creation. Observers of the Reserve Bank of Australia expect a 25 basis point cut, with futures reflecting more than a 90% chance. However, strong domestic data could challenge the need for further cuts. The central bank’s stance may be less inclined toward additional cuts than before.Diplomatic Affairs

Regarding diplomatic matters, recent U.S. statements indicate plans to enhance military support for Ukraine. This isn’t only a military issue—it also affects markets as an additional geopolitical factor. The implications impact defense-related stocks, systemic risk assessments, and energy markets. For those monitoring closely, this adds another layer of sensitivity to short-term market movements. In light of this, we’ve adjusted strategies to favor options that could benefit from increased volatility. Directional investments remain risky, while straddle strategies and calendar spreads are looking more promising. Watching short-term implied volatility react sharply to daily news signals that the upcoming period may not be stable. It’s wise to keep duration short and adjust exposure as needed. Bid-ask spreads have narrowed in high-beta foreign exchange while widening in synthetic volatility, indicating that investment positions are changing rapidly. We see rising pressure across various asset classes in different ways. Bonds are sought as safe investments, while equities show selective buying, especially in technology and domestic cyclicals. Such dislocations don’t last and usually lead to convergence; often, this is where opportunities arise. Trade strategically, allocate resources carefully, and allow for flexibility in a market that reacts quickly to even minor signals. Create your live VT Markets account and start trading now.Economists warn that U.S. tariffs could harm Japan’s economy and exports, indicating a need for potential stimulus.

Gold stabilizes slightly as Trump proposes tariffs on South Korea and Japan amid rising trade war concerns

Economic Resilience and Gold’s Technical Outlook

Currently, gold’s price is just above $3,320, aligning with its 50-day moving average. This line often signals stability for prices. If it falls below, we could see increased selling, potentially lowering it to the next support level around $3,300. The Relative Strength Index shows that the market isn’t leaning strongly in either direction. It isn’t overbought or indicating excessive selling. This puts us in a waiting phase, as prices are stuck between different forces.Strategic Market Positioning in a Volatile Climate

For those trading in futures, options, or structured products, these patterns encourage a reevaluation of short-term strategies. With prices fluctuating around technical levels and macroeconomic stability outweighing geopolitical concerns, any plans to bet on a rebound need to be very careful. Although China and other major holders might continue to buy, this activity acts more like a background influence. The real market movement is happening with shifts in Treasury yields and changing expectations from the Federal Reserve. Create your live VT Markets account and start trading now.China’s central bank plans to expand offshore bond access for local investors to improve financial flow liberalization

Enhancing Global Role

These actions aim to relax capital controls and encourage two-way access to markets. This aligns with Beijing’s goal to boost the global significance of the yuan and diversify investment opportunities for domestic institutions. The update from the People’s Bank is a clear effort to open more channels for cross-border capital flow, especially in fixed income markets. By expanding Bond Connect to include more onshore participants, such as wealth managers and insurers, the central bank is encouraging domestic capital to invest abroad. This kind of move typically requires strong regulatory backing, highlighting the importance of this decision. At the same time, increasing the quota for the Southbound Bond Connect shows a strong intent to foster outbound portfolio diversification. Previous limits restricted offshore investment activity; raising this cap to approximately $139 billion removes a significant barrier, especially for institutions managing substantial fixed income assets. We can expect a noticeable increase in demand for foreign currency bonds, particularly those with a slight yield premium.Access to Swap Markets

On the derivatives side, the raised limits under the Swap Connect scheme are significant. This change allows Chinese financial institutions to engage more freely with international interest rate markets. For those tracking yield curve strategies, this access enables better duration management and new opportunities for risk-adjusted returns that weren’t possible before. For traders, this development is very important. We anticipate initial inflows into bond maturities that align with target duration ranges in key developed markets. If the exchange rate remains moderately managed and policy rates vary across regions, there will be further opportunities for convergence trades between currencies and rates. Hedging will also become more dynamic. With domestic funds showing greater interest in foreign exposure, this expansion will lead to more activity in interest rate swaps linked to foreign bonds. This amounts to a feedback loop affecting pricing on both sides. There may be temporary volatility around announcements and macro policy signals, but this reflects deeper market participation, not mispricing. Liu’s comments last week already provided momentum for this trend. Regulatory approvals will likely follow market demand, making it crucial to monitor the uptake of allocated quotas instead of waiting for new announcements from the central bank. Position your strategies accordingly. We also expect tighter Treasury-OIS spreads on days when Connect volumes increase, especially during periods of syndicated issuance. This type of friction can create tradeable opportunities, especially for those agile enough to adjust margin thresholds quickly and access overnight liquidity when possible. In the upcoming sessions, pay more attention to the yuan’s relative value compared to basket-weighted indices. This pricing will be more important than simple pairwise FX rates because hedging costs will depend on how new flows are affecting the market. Not all pairs will respond in the same way, and there will be points of saturation as domestic accounts concentrate on perceived safe jurisdictions. An adjustment is happening, and it’s measurable. Watch turnover figures for longer-term interest rate swaps; they have already started to rise along with these announcements. We should adjust our curve dynamics now that institutional participation is increasing. Create your live VT Markets account and start trading now.US dollar rises due to safe-haven demand as Trump announces 25% tariffs on Japan and South Korea

Trump Issues Tariff Warnings

President Trump has sent letters to Japan and South Korea warning about tariffs due to unfair trade practices that contribute to the US trade deficit. With the deadline coming, more countries may receive warnings, and the US is not offering any exemptions. Treasury Secretary Scott Bessent expects significant trade announcements before July 9, allowing some room for negotiations alongside the tariff notices. Global currencies are facing pressure from trade uncertainty and lower expectations for immediate Fed rate cuts. The US Dollar is gaining support during these tensions, with EUR/USD at 1.1725, GBP/USD at 1.3595, and AUD/USD at 0.6496. The US Dollar Index shows promise for further gains, bolstered by technical indicators like RSI and MACD, as it trades above key moving averages. With less than two weeks until July 9, the broader impact of the tariff announcements is becoming clearer. The US’s tough trade stance is stressing global currency markets significantly. The chance of high tariffs, some possibly reaching 70%, encourages defensive positioning, especially in FX-linked contracts. In this context, shifts in the US Dollar aren’t just affected by interest rate views; they stem from geopolitical factors and safer investments flowing in. Technically, the DXY is showing strength in a falling wedge pattern, indicating a temporary rise despite a longer-term downtrend. Near-term, the conditions favor strength due to increased demand for cash-based assets. This technical setup is likely to lead to short rallies with high implied volatility, allowing for effective delta-neutral or premium-collection strategies. As we approach the July 9 tariff notifications, implied volatility across major currency pairs should rise, particularly in Euro and Pound.Opportunities Arise in Market Volatility

Bessent’s comments about potential future trade announcements add more uncertainty. These statements might cause temporary price shifts, but markets are getting better at pricing in headline risk, which can lead to opportunities if we stay nimble and disciplined in short-term gamma plays. We may see wider bid-offer spreads during key announcements, but also notable pricing inefficiencies, particularly in shorter-duration contracts like 1-week and 2-week expiries. The strengthening of the USD, influenced by global trade worries rather than monetary policy, is pushing key FX pairs toward breakout points. GBP/USD at 1.3595 and AUD/USD at 0.6496 show where gamma scalpers could find advantages, especially if support levels begin to break. Eurodollar options are showing increased demand for downside puts, indicating a desire for more protection in leveraged portfolios. When these situations arise, the spot market often takes time to fully understand the impact. Additionally, indicators like RSI and MACD moving up on DXY charts mark potential consolidative breakouts. While we see momentum building, it’s important to note that the dollar’s rise isn’t just about growth differences or central bank policies; it’s also responding to widespread political instability. For those holding assets priced against the dollar, managing risk is crucial. Keep an eye on whether the US Dollar can sustain its rise above weekly highs; a move above 98.00 could lead to significant repricings. As trade deadlines approach and the demand for safe assets continues to influence market direction, caution is advised in directional strategies. We prefer to focus on strategies that take advantage of high implied volatility, especially where skew is extreme. Such noticeable shifts are rare and can lead to pricing anomalies, but these gaps typically don’t last long. That’s where valuable opportunities lie. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 08 ,2025

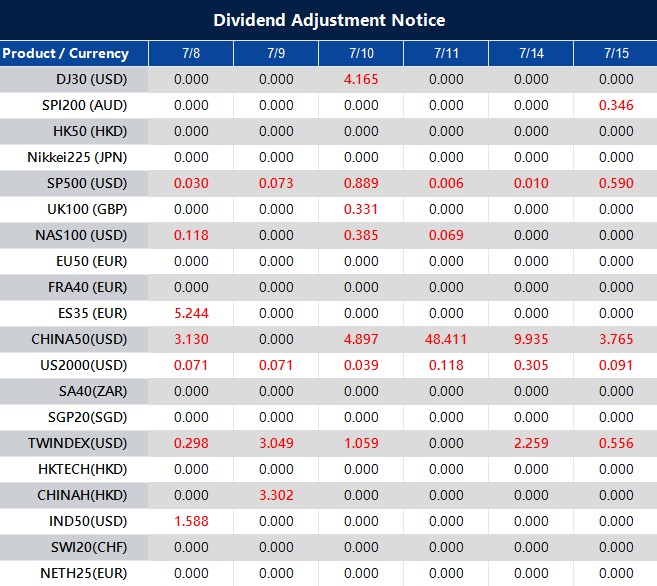

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].