European equity futures see slight declines as Germany, France, and UK markets lag behind

German retail sales fell 1.5%, missing forecasts, with food sales down 1.8% month-on-month.

Decline In Retail Sectors

Sales in the food retail sector fell by 1.8% from June. The non-food retail sector also saw a drop, with sales down by 0.7% during the same timeframe. However, when looking at year-over-year data, retail sales rose by 1.9% compared to July of the previous year. This significant decline in German retail sales signals trouble for Europe’s largest economy. The steep drop in July suggests that consumers are having a tough time. This news may negatively affect economic forecasts for the remainder of the third quarter. We have also observed other troubling signs. The German manufacturing PMI for August 2025 fell to 48.7, indicating a contraction in this sector. The retail data confirms that the manufacturing weakness is now affecting the retail space. A widespread slowdown seems increasingly likely.Impact On Currency And Stocks

For currency traders, this news may weaken the Euro. With the economy slowing, the European Central Bank will struggle to keep interest rates high, especially after their aggressive hikes in 2023 to combat inflation. It might be wise to consider buying put options on the EUR/USD pair, expecting a downturn. This situation also signals trouble for German stocks, especially in the consumer discretionary sector. The DAX index may encounter challenges as growth expectations are lowered. Now could be a good time to hedge long positions by purchasing put options on DAX futures. Considering the prolonged economic stagnation that Germany faced in 2024, this data feels like a setback to the ongoing fragile recovery. In this context, German government bonds, or Bunds, are likely to see increased demand as a safe-haven asset. We can expect Bund yields to drop, resulting in higher prices. The unexpected nature of this data will likely lead to short-term market volatility. This might cause option premiums to rise in the coming days. A strategy of buying a straddle on the Euro Stoxx 50 Volatility Index (VSTOXX) could be a way to take advantage of this anticipated increase in market nervousness. Create your live VT Markets account and start trading now.Germany’s import price index decreased by 0.4% in July, with declines in several categories.

Deflationary Signal

July 2025’s lower-than-expected import prices indicate a strong deflationary trend for the German economy. It confirms that both global and domestic demand are weaker than anticipated. This raises concerns about a potential recession as we approach the end of the year. This information suggests that the European Central Bank (ECB) may shift towards a softer approach in upcoming meetings. We believe the cycle of rate hikes that dominated late 2023 and 2024 is over. The market is likely to start pricing in rate cuts for early 2026. Traders should keep an eye on derivatives tied to EURIBOR futures, as they will be affected by changes in ECB policy expectations. We see this as a sign of weakness for German stocks, making long positions on the DAX index riskier. Given that Germany’s Q2 2025 GDP growth was just 0.1%, we expect further downward revisions in earnings for major industrial exporters. Using protective put options on the DAX or taking short positions through futures may be a smart strategy.Negative Euro Outlook

The Euro’s outlook is also negative, as interest rate differences are likely to work against it, especially compared to the US dollar. We have already seen the EUR/USD pair drop below 1.05 in August 2025 due to weak economic data from the Eurozone. We predict this trend will continue, making short EUR/USD futures an appealing position. This situation is reminiscent of 2011-2012, when falling prices preceded a broader economic slowdown and led to ECB intervention. At that time, early signs in German import data indicated increased market volatility. We are preparing for a similar rise in volatility, potentially using options on the VSTOXX index to benefit from expected market fluctuations. Create your live VT Markets account and start trading now.Currency traders stay cautious as month-end dynamics affect market movements and sentiment.

Dollar Drivers and Market Focus

As the week wraps up, there are few reasons affecting the dollar; month-end trading is taking the spotlight. We may get a clearer picture of market positions next week. Attention will soon shift to the US jobs report due on September 5. Barclays notes weak dollar selling signals this month-end, while Credit Agricole expects mild dollar selling toward the month-end fix. Right now, the US dollar is weak, but these unpredictable month-end trades make it tough to rely on current price movements. With an 84% probability of a rate cut in September, the market seems steady for now. Because of this, volatility is low, making it cheaper to buy options and prepare for surprises in next week’s important data.Implications for Stock Market and Strategy

Everyone is focused on the US jobs report coming out on Friday, September 5. Recent data points, like the Core PCE inflation for July at a cool 2.6%, suggest a slowdown. Predictions for the jobs number are around a modest 175,000. A much lower number could strengthen expectations for a rate cut and negatively impact the dollar, making bearish dollar options a smart choice. Despite the softer dollar, US stocks, especially in tech, are performing well because bad economic news is seen as positive for future interest rates. The VIX, which measures market fear, is around a low level of 14, indicating complacency. This situation is good for strategies that take advantage of premiums, like selling out-of-the-money puts on major indices, betting that the positive momentum will continue. We observed a similar trend back in summer 2019, when the market also anticipated Fed rate cuts amid slowing growth. The dollar fluctuated before weakening, while stocks rose on expectations of easier policies. With about 54 basis points of cuts expected by year-end, considering longer-dated call options on equity indices could be a way to prepare for a potential year-end rally. Create your live VT Markets account and start trading now.Today’s expected inflation data from German states shows a slight increase in headline figures.

Release Schedule for German CPI Data

The key focus is still the core inflation numbers. The CPI data from different German states, including North Rhine Westphalia, Hesse, Bavaria, Baden Wuerttemberg, and Saxony, will be released at 0800 GMT. Preliminary national figures will follow at 1200 GMT, with slightly varying release times. With the German CPI data for August 2025 coming out today, we should prepare for some market movement. The core inflation remains a significant issue, staying above the ECB’s 2% target even as overall figures have eased. This stickiness is why the ECB has kept its deposit facility rate at 3.50% for the last three quarters. The Eurozone economy has shown strong resilience, avoiding the recession many anticipated in early 2024 and achieving steady quarterly growth. For instance, Eurostat reported a 0.3% growth in the Euro area economy during the first quarter of 2025, allowing the central bank to concentrate on inflation. If core inflation comes in higher than expected today, it will reinforce the ECB’s “higher for longer” approach. For interest rate traders, a strong inflation report could signal that rate cuts will be delayed further, likely into the second quarter of 2026. This would suggest selling short-term interest rate futures that track EURIBOR, as market expectations are adjusted. Currently, futures markets indicate a 40% chance of a rate cut by December 2025, a likelihood that would drop with strong inflation data.Impact on Currency and Interest Rate Markets

In the currency markets, a surprisingly high German CPI number would likely boost the euro. The EUR/USD pair has stayed around the 1.0950 level this past month, and a hawkish hint from the ECB could push it above 1.1000. Traders might consider buying short-dated call options on the euro to take advantage of a potential spike. On the other hand, if core inflation drops significantly and unexpectedly, the opposite reaction would occur. This scenario would increase the chances of a rate cut before the end of 2025, making interest rate futures more appealing. In that case, the euro would likely weaken as yield differentials shift in favor of the US dollar. It’s important to remember the lessons from 2023 and 2024, when persistent services inflation delayed rate cuts. The ECB is very aware of this, making today’s German data crucial for their upcoming decisions. This situation suggests that buying volatility through options strategies like a straddle could be a smart way to trade this event, potentially profiting from significant price shifts in either direction. Create your live VT Markets account and start trading now.Inflation data will keep Europe’s markets engaged, with little expected effect on the ECB.

European Inflation Figures

The inflation numbers are expected to show that prices continue to rise in August. However, this is unlikely to change the European Central Bank’s current decision to pause rate adjustments for the summer. Market predictions indicate that policymakers probably won’t lower rates by the end of the year. Current money market trends suggest only about 9 basis points in rate cuts are expected before year-end. If nothing unexpected happens, it’s unlikely that this data will lead to big market movements. We are awaiting inflation data from Germany, France, and other important Eurozone countries to end August. The market expects the Eurozone’s headline CPI to be around 2.6%, a slight rise from July’s 2.5%, and still above the central bank’s target. This supports the belief that the European Central Bank will keep its deposit rate steady at 3.25% throughout the autumn. Since the ECB is likely to remain inactive, we don’t expect significant price fluctuations in the next few weeks unless there’s a major surprise in the data. This low volatility suggests that strategies like selling short-dated options on the Euro Stoxx 50 index to earn premium could be appealing. The market is calm, and the goal is to profit from this stability.Interest Rate Market Sentiment

Interest rate markets reflect this cautious outlook, with futures now showing less than a 40% chance of a quarter-point rate cut by the end of 2025. This is a sharp contrast to expectations at the beginning of the year, when more cuts were anticipated. For traders, this means using interest rate swaps or futures to bet on European rates staying high for a longer period. Looking back, we remember the high volatility during the rate-hiking phase of 2022-2023, and this current calm is a noteworthy change. While the main approach is to bet on stability, it might be smart to buy some inexpensive out-of-the-money puts on European stocks. This strategy could serve as a low-cost protection against an unexpected economic decline that could prompt the ECB to change its position. Create your live VT Markets account and start trading now.Asian FX shows mixed performance as Japan’s CPI exceeds Bank of Japan’s target for years.

China’s Financial Environment

China’s financial landscape also shifted, with the People’s Bank of China increasing the CNY fixing by 0.65% in August, marking the largest change since September 2024. The onshore CSI 300 index climbed about 10% this month, hinting at a possible record in trading volume. In the Asia-Pacific region, stock performances varied: Japan’s Nikkei 225 fell by 0.25%, Hong Kong’s Hang Seng rose by 0.66%, Shanghai Composite gained 0.16%, while Australia’s S&P/ASX 200 decreased slightly by 0.11%. With Federal Reserve officials advocating for lower interest rates, we are preparing for a cut in September. The futures market is now anticipating a near-certain 25-basis-point cut, a significant shift from just a few months ago when there were discussions about rate hikes. As a result, we’re focusing on interest rate futures and options on the SOFR to take advantage of this policy change.Divergence in Central Bank Policies

A notable divergence is emerging between the dovish Fed and a Bank of Japan that seems stuck. Inflation in Tokyo has been over 2% for more than three years, but the BoJ has been slow to respond. This situation may put downward pressure on the USD/JPY pair, making put options on this currency pair a smart move in the upcoming weeks. In China, the combination of government support for the yuan and positive institutional sentiment in the stock market indicates continued strength. Goldman Sachs has raised its CSI 300 target, prompting us to use call options to gain potential upside while managing risk as we approach the weekend’s PMI data. The recent surge in trading volume, with August turnover on the CSI 300 reaching its highest level since early 2024, reinforces this optimistic outlook. Overall, there is a notable rise in political influence over economic policy, especially in the US. The end of Fed independence and ongoing tariff threats from the Trump administration have created an unpredictable climate, similar to the trade disputes of 2018-2019. This uncertainty calls for some form of volatility protection, such as options on the VIX index, which remains historically low near the 14 level despite the increasing macroeconomic risks. Create your live VT Markets account and start trading now.Goldman Sachs raises 12-month target for the CSI 300 Index due to positive growth factors and valuations

Factors Supporting Equity Gains

Additionally, aspects like liquidity and valuation expansion are boosting global equity gains. These elements appear to be the primary drivers in today’s market, overshadowing traditional cyclical fundamentals. With the revised target of 4,900 for the CSI 300 Index, we see an opportunity for additional short-term gains. The index has risen about 10% this month, closing near 4,350 as of August 28, 2025. This momentum indicates strong bullish sentiment, paving the way for more upside potential. This positive outlook is supported by recent easing policies from Beijing, including a loan program for developers introduced two weeks ago. Recent data also revealed that China’s Caixin Manufacturing PMI unexpectedly climbed to 51.2 in August, marking a three-month high and signaling possible stabilization. These sentiment and liquidity factors are currently more significant than earlier reports of weaker GDP growth. In the upcoming weeks, we suggest considering out-of-the-money call options on broad China ETFs to take advantage of this upward trend while limiting risk. Look for options expiring in October or November with strike prices around the 4,600 mark. This strategy allows us to benefit from the rally’s momentum while setting a cap on potential losses.Risk Management Strategies

However, we need to be careful as these gains stem from valuations rather than a strong fundamental recovery. To mitigate the risk of a sudden drop from profit-taking, using bull call spreads is a wise option. This means selling a higher-strike call to fund the purchase of a lower-strike one. While this caps potential profits, it significantly lowers the initial cost. We recall the liquidity-driven rally of 2014-2015, which also experienced a large disconnect from actual economic health, leading to a sharp correction. With implied volatility on the VXFXI index decreasing but still above its yearly lows, some investors are clearly hedging. Therefore, a hedged bullish position seems to be the most suitable strategy in the current market. Create your live VT Markets account and start trading now.September Futures Rollover Announcement – Aug 29 ,2025

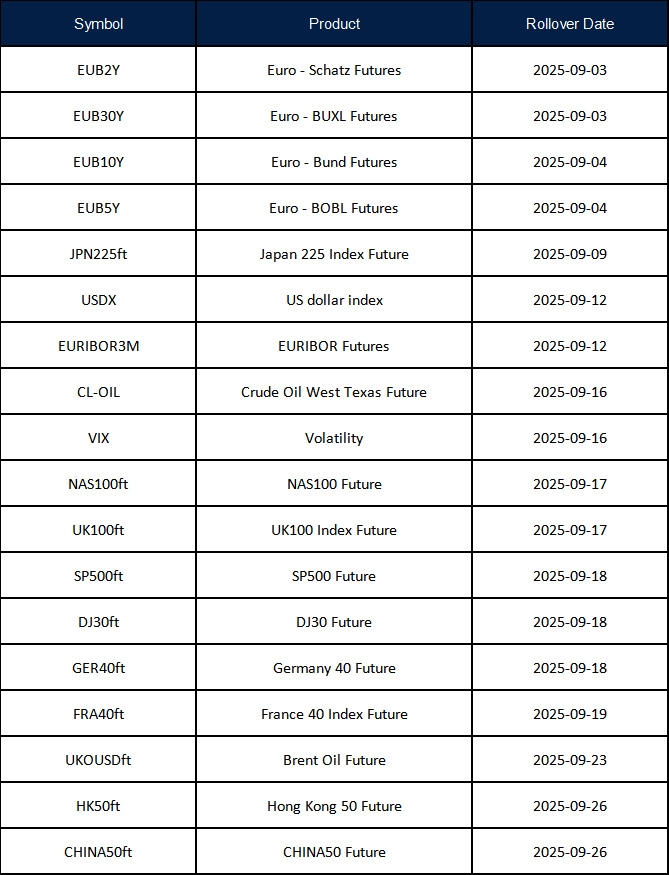

Dear Client,

New contracts will automatically be rolled over as follows:

Please note:

• The rollover will be automatic, and any existing open positions will remain open.

• Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.

• To avoid CFD rollovers, clients can choose to close any open CFD positions prior to the expiration date.

• Please ensure that all take-profit and stop-loss settings are adjusted before the rollover occurs.

• All internal transfers for accounts under the same name will be prohibited during the first and last 30 minutes of the trading hours on the rollover dates.

If you’d like more information, please don’t hesitate to contact [email protected].