QuantumScape’s share price has risen over 100% since June.

The EU and US are quickly negotiating a car trade agreement to prevent upcoming tariffs.

Trade Discussions And Their Ramifications

The EU’s push for trade talks shows their strong effort to counter the significant risk of high tariffs that threaten its auto exports. With tariffs at 25%, this isn’t just a typical trade disagreement—it’s a serious challenge for producers whose profit margins are already tight due to rising raw material costs and changing supply chains. The previous Merkel government set up the car sector’s reliance on U.S. access, and now Brussels is dealing with the fallout. The idea of export credits shows a strategic approach. If used properly, they could help manufacturers offset losses from import restrictions. If these suggestions evolve from discussions into actual policies, companies with factories in the U.S. could gain a competitive edge. Tavares, who has often warned about unfair trade conditions, might benefit from shifts that favor balanced trade between the two regions. What we are seeing is not just about reducing tariffs—it’s about rethinking how goods move between these two economies. The EU’s demand to protect vehicle exports is a crucial point, especially since nearly three-quarters of a million cars worth almost €39 billion were shipped to the U.S. last year. This is significant money, and the auto sector can’t quickly pivot away from the U.S. market. Washington’s reluctance to accept quotas suggests they want to focus on boosting domestic factory output rather than negotiating externally. This approach is understandable in an election year, but it complicates the pace of negotiations. Any belief that this will be resolved smoothly underestimates the political realities and economic priorities of both sides. U.S. leaders want to support local manufacturers—this includes reducing reliance on foreign competition and creating more high-value jobs, which makes it hard to agree to quotas.Potential Path Forward

Widespread reduction of tariffs is likely the most viable way forward, especially if combined with regulatory alignment on technical standards. This includes areas like emissions standards or safety classifications. Even minor harmonization can lower compliance costs across borders, quickly improving profit margins. There’s nothing groundbreaking about this—just enough to give medium-sized suppliers some relief while larger companies adjust. In the upcoming weeks, we might see progress, especially as mid-year forecasts start to influence budget planning in government agencies and economic ministries. If you’re involved with European auto stocks or are affected by currency fluctuations related to this deal, these negotiations demand your careful attention. Policy changes will start as discussions before becoming formal announcements, so keep an eye out for developments before they are widely reported. We have seen similar situations before. When officials emphasize non-negotiable industrial outcomes, it’s usually not just talk. It often leads to compromises in other areas—like agricultural access or agreements in related sectors. Watch for those smaller concessions; they could trigger the next significant changes in trade-linked markets. Create your live VT Markets account and start trading now.Chris Beauchamp, chief market analyst at IG, highlights Dax and Nvidia’s impressive milestones despite tariff concerns.

Currency Markets Amid Trade Concerns

The EUR/USD is trading just above 1.1700 and feels pressure due to market uncertainty tied to potential tariffs while investors wait for the FOMC Minutes. In contrast, GBP/USD sees daily gains around the 1.3600 level, though uncertainties in US trade policies challenge the US Dollar’s strength. Gold prices have climbed over $3,300 per troy ounce, supported by falling US yields and calls for lower interest rates. The upcoming minutes from the US Fed’s June meeting will shed light on expected rate cuts amidst ongoing trade tensions. New tariffs impacting Asian economies have higher-than-expected rates, although some nations might benefit from tariff discounts. Countries like Singapore, India, and the Philippines could see positive outcomes if negotiations work out well. Despite the concerns around tariffs, equity markets—especially in Europe—are pushing indices like the DAX to record highs. This reflects a strange gap between political noise and the market’s risk sentiment. Currently, investors seem to believe that trade disputes—especially those over tariffs—will linger into late summer without causing immediate disruptions. This is a directional sign but isn’t foolproof. For traders tracking short-term volatility or making strategies sensitive to news risks, caution is critical. A sudden imposition of tariffs—especially in sectors closely tied to Asian exports—could upset the current calm. Even with discussions of delays, the unpredictability in politics suggests that exposure going into August may need tighter controls or less risk, particularly in cross-border issues that could react unexpectedly.Tech Stocks and Market Outlook

After an exhilarating surge, especially with Nvidia joining the rare $4 trillion valuation club, positions around tech-heavy benchmarks are becoming more speculative. This stock has become a symbol of optimism fueled by artificial intelligence. However, the upcoming earnings report could trigger volatility. Traders who are already invested in tech-heavy index derivatives or single-stock options should prepare for increased market fluctuations around that time. If the market meets expectations, momentum could continue, but the risk rises if sentiment turns negative for anything less than perfect results. In the currency market, the euro holding above 1.1700 shows its strength, but it still faces pressure from an unpredictable economic environment. The dollar isn’t seeing significant rush either; its shaky behavior reflects trade speculation and what the Fed minutes might reveal. Until there is more clarity on interest rate direction, EUR/USD and GBP/USD are likely to stay within similar ranges, with occasional sharp movements based on comments from Fed Chair Powell or unexpected remarks from other board members. The modest gains in sterlings may reflect dollar weakness rather than its inherent strength, so we shouldn’t mix the two. For trading in FX volatility, dollar crosses continue to show attractive setups—especially if expectations surrounding the Fed’s interest rate shift clearly after discussions about the balance sheet and rate normalisation. For commodities, gold staying above $3,300 aligns with the current expectations of easier monetary policy and low yields. Recent price movements in precious metals strongly connect with the reduction in real interest rates and serve as protection against inflation—which remains inconsistent—as well as rising trade tensions. Those invested in precious metal futures should closely monitor both inflation expectations and commentary from central banks. Gold often reacts to rate policy instead of leading it. The spread of tariffs affecting more of Asia, especially at higher rates than expected, adds complexity to the current economic environment. Markets might not accurately reflect the uneven trade impacts—especially where regions like India or Singapore could see protective measures implemented sooner. How negotiations play out will significantly affect those invested in emerging market instruments or capital flow-sensitive pairs. Overall, derivatives may show interesting price variations in the short term, particularly within the intersection of news headlines, domestic economic trends, and the current earnings cycle. Create your live VT Markets account and start trading now.Brazil’s coffee and orange juice supply to the US faces rising prices and challenges

The Euro falls against the Swiss Franc, hitting a multi-week low amid ECB worries

Global Risks Impact

ECB Chief Economist Philip Lane has pointed out rising global risks, including trade barriers and restrictions on capital flows. Deputy Director-General Livio Stracca warns that climate-related issues could lower eurozone GDP by up to 5% over the next five years, similar to the effects of the COVID-19 crisis. These concerns make the ECB cautious, which may keep the Euro under pressure. Currently, the EUR/CHF pair is moving within a range between 0.9300 and 0.9430, a pattern that has persisted since April. If the pair breaks below the 0.9300 support level, it could signal a bearish trend. The pair is trading below the 20-day Simple Moving Average of 0.9365, making it a strong resistance level. Momentum indicators show weakness, with the Relative Strength Index (RSI) around 40, signaling declining buying interest. A drop below 0.9300 could increase downward pressure, while a recovery would need to push above 0.9365 to change the current trend. The Euro’s ongoing decline against the Swiss Franc reflects overall market sentiment shaped by the ECB’s cautious stance. Lane’s warnings about increasing trade barriers and limited capital mobility point to potential risks for the eurozone’s competitiveness and productivity, not just in the future but impacting current market dynamics. Stracca adds another concern, suggesting that climate-related issues could have significant medium-term economic effects, similar to those seen during the pandemic. He connects climate instability to real risks to both output and price stability. This makes it unlikely that the ECB will consider aggressive interest rate changes or balance sheet adjustments.Trading Standpoint

From a trading perspective, the signals of caution are impacting price movements. The EUR/CHF’s long-standing range shows that traders are hesitant to move beyond established support and resistance levels. This month, the inability to maintain gains above 0.9365 highlights the challenges short-term buyers face. The recent rejection from the 20-day simple moving average just above 0.9360 was noticeable and coincided with declining momentum, evident from the RSI around 40. There have been limited attempts to stabilize near 0.9330, and with ongoing downward pressure, testing the support level near 0.9300 seems more likely now. If the pair breaks below 0.9300, there isn’t much support nearby, making further declines more probable. In such a case, sellers may not hesitate. Any upward corrections are likely to be minor unless market volatility increases or short-position traders become overcrowded. Conversely, if the pair manages to rise past 0.9365, it would prompt a reevaluation of market intentions, possibly hinting at a short-term reversal, but that’s not the current scenario. For those involved in trades or cross-market strategies, our focus remains on the lower range. This cautious approach, supported by the ECB’s stance and ongoing economic risks, suits range-trading strategies while the floor holds. It is crucial to maintain tight risk thresholds near 0.9300, as a breach could lead to broader price adjustments. Leverage should reflect the prevailing trend. In summary, resistance is strong, and support is weakening. Both technical indicators and policy perspectives suggest limited opportunities for Euro buyers unless a new macro narrative emerges. Currently, the trend leans downward, not upward. Create your live VT Markets account and start trading now.Japan’s wholesale inflation likely decreased in June, sparking rate hike speculation

Slower Pace Suggests Easing Pressure

The slower rise in wholesale prices indicates that the upward pressure on production prices is relaxing. This means that input costs for businesses are likely not increasing as quickly, which could delay how fast these costs affect retail prices for consumers. Since the central bank emphasizes its inflation target is still not met, we can conclude that tighter monetary policy is coming but not immediately. This allows for a careful assessment of any rate path changes. Ueda, who has previously expressed concerns about tightening too soon, might see the slowdown in producer prices as a reason for the Bank to remain patient. Although food and rice prices—often volatile due to seasonal and geopolitical influences—have fluctuated, the bank seems willing to view these changes as temporary rather than indicating a new trend. This means that overall consumer inflation might remain distorted for a while. The key focus is on underlying inflation and its relationship to wages and corporate profits. The economic news set for the Asian session on July 10 aligned with market expectations, suggesting that short-term pricing models and consensus forecasts were fairly accurate. There weren’t significant differences between what was expected and the actual figures. This minimizes the chances of any sudden movements in the yen for now, keeping implied volatility for currency derivatives relatively calm. For those tracking curve dynamics and short-term rate pricing, the PPI results from June are significant mainly for how expectations might shift quietly rather than through any major changes. We should not anticipate dramatic shifts, but rather a gradual adjustment of probabilities as more data comes in.Efforts for More Transparency

Kuroda’s successor has worked to provide clearer communication, making it easier to forecast policy, even amid external shocks. This stability allows us to adjust rate differentials and volatility premiums in a measured way. Over the next two weeks, consumer-focused indicators like retail spending and wage data will give us better insights into how much pricing power companies can exercise. It’s important to note the lack of upward momentum in wholesale prices as we adjust gamma exposures in rates and FX. Inflation in Thailand, credit data from China, and export figures from Korea are all interlinked pressure points for Asian markets. However, Japan seems to be somewhat out of sync with these trends. This suggests that its policymakers are responding cautiously and aren’t overly influenced by regional events. Given this context, we prefer to observe how forwards are stabilized through reduced volatility rather than expect any surprising statements soon. The current price action in yen-related gamma appears steady enough for risk adjustments without urgent changes. The key metric to watch is where funding stress aligns with signals of steepening yield curves, as this divergence often indicates upcoming changes in policy tone before formal guidance is provided. Create your live VT Markets account and start trading now.The Euro weakens against a stronger Pound due to improved risk appetite and positive performance in the US market.

Concerns About The Pound

Concerns about the Pound persist due to recent changes in UK welfare policies that may lead to higher borrowing or taxes. The Bank of England’s financial stability report highlights risks associated with US tariffs. While EU-US trade talks show some progress, the EU might face higher tariffs than the UK. The EUR/GBP is expected to stabilize around 0.8600, although a decline is still possible. Sellers need to push below 0.8600, with the next target at 0.8567. The RSI indicates some bullish momentum but suggests that buyer strength is weakening. If the pair maintains above 0.8600, it could rise towards 0.8650/75 and eventually 0.8700.The Euro’s Role

The Euro, used by 19 countries in the EU, is significantly influenced by ECB policies. Important economic indicators play a key role in determining the Euro’s strength. Investors should carefully research market risks before making any decisions. The recent drop in EUR/GBP during North American trading, alongside gains in US equities, points to broader market dynamics that may affect pricing and sentiment. With the pair settling around 0.8622, there is both short-term technical pressure and ongoing macroeconomic concerns. From a broader perspective, the currency movements reflect the market’s digestion of US trade policy discussions. The US is contemplating tariff adjustments, while the Pound has the advantage of an early trade agreement. However, fiscal challenges in the UK are emerging. Increasing worries about changes in UK domestic welfare policies could influence positioning in the coming weeks. The reforms may pressure the government to borrow more or raise taxes. Once these shifts are absorbed into the market, they could lead to fluctuations around the 0.8600 level, serving as both a target and a resistance point. As the Bank of England’s report indicates, the global economic landscape is uncertain, with external threats lingering. The situation with US tariffs remains crucial. While the EU seems to be making progress in negotiations, the UK might still face favorable treatment that enhances investor sentiment towards the Pound in the short term. The current trading level, just above 0.8600, is crucial to monitor, especially since RSI data shows a decline in buyer strength. While momentum is positive, it isn’t very strong. If the rate falls below 0.8600, the next support level is likely at 0.8567. If there is a rally, resistance could be tested around 0.8650 to 0.8675, potentially reaching 0.8700 if buying activity increases. We consider the Euro’s role in this pair not just in terms of trade weight, but also in structural factors driven by decisions from Frankfurt. Central bank decisions, especially those relating to monetary guidance and inflation, can quickly alter market positioning. In this regard, derivatives are influenced not only by technical factors but also by expected changes connected to economic data. Currently, the risk lies not just in market volatility, but in the assumed relationships between policy changes and market movements. For those with leveraged positions or options strategies, it’s essential to keep in mind that execution opportunities may shrink, especially if there are unexpected UK fiscal announcements or EU responses to tariffs. This environment rewards strategic awareness and planning over fixed biases. However, if US equity markets remain strong and the monetary outlook remains gentle, demand for the Pound could stay robust, albeit in a relative sense. As we keep track of spreads and implied rates, minor shifts in sentiment may present tactical opportunities for short-term strategies, particularly if volumes confirm a breakout or rejection at the noted technical levels. Create your live VT Markets account and start trading now.Modification on Leverage for All Shares – Jul 10 ,2025

Dear Client,

To provide a more stable trading environment for our clients and in light of the recent increase in stock market volatility, VT Markets will be adjusting the leverage settings for all Shares products.

Please refer to the details below for further information.

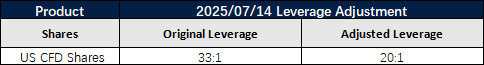

1. All US Shares products leverage will be adjusted to 20:1.

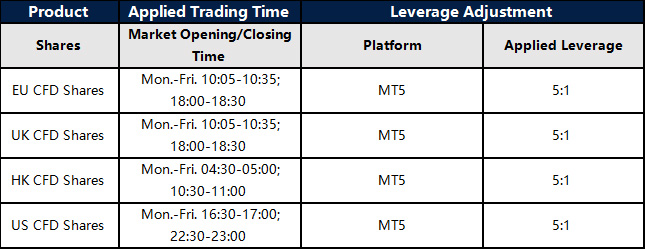

2. MT5 All Shares products: New positions opened within 30 minutes before market closing and after market opening will start with leverage of 5:1. After the mentioned period, the leverage will be resumed to original leverage and will not be adjusted back to 5:1.

MT4 will not be affected.

The above data is for reference only, please refer to the MT4 and MT5 software for specific data.

Friendly reminders:

1. All specifications for Shares CFD stay the same except leverage during the mentioned period.

2. The margin requirement of the trade may be affected by this adjustment. Please make sure the funds in your account are sufficient to hold the position before this adjustment.

If you’d like more information, please don’t hesitate to contact [email protected].