Goldman Sachs predicts lower US Treasury yields in 2025 due to expected early interest rate cuts from the Fed

Traders await clarity on Trump’s tariff plans as NZD/USD remains around 0.6050

US Tariff Concerns

The NZD/USD exchange rate is facing challenges due to worries about weak oil demand and lower expectations for Federal Reserve rate cuts. In June, the US added 147,000 jobs according to the Nonfarm Payrolls (NFP) report, and the Unemployment Rate fell to 4.1%. Currently, the pair trades around 0.6070, affected by surprisingly strong job growth in the US. Ongoing political and fiscal uncertainties are contributing to a cautious mood, with speculation about potential US trade tariffs. President Trump is planning to send letters to several countries outlining tariffs between 20% and 30%. Additionally, weekly Jobless Claims have decreased to 233,000 from 237,000, indicating strength in the labor market. The tax bill passed by Trump’s administration includes cuts aimed at stimulating economic growth. Meanwhile, the Reserve Bank of New Zealand (RBNZ) is likely to keep its cash rate steady at 3.25% due to ongoing tariff concerns. The New Zealand Dollar is influenced by the country’s economic performance and external factors like dairy prices and may benefit from stronger growth. However, negative news from China or increased global uncertainty could weaken the NZD. The RBNZ’s focus on controlling inflation through interest rates can impact NZD/USD movements. Economic data from New Zealand is essential for assessing the NZD’s value.Economic Indicators And Sentiment

The NZD/USD pair is under pressure, largely due to strong US labor reports and uncertainties around global trade and US domestic policies. The latest Nonfarm Payrolls data showed that 147,000 jobs were added in June, and the Unemployment Rate dropped slightly to 4.1%. This data boosts confidence in the US job market, even with high interest rates from the Federal Reserve, making anticipated rate cuts seem less likely. This matters because ongoing job creation and low unemployment weaken the argument for relaxing monetary policy. A robust job market lessens the need for the Fed to provide stimulus, which supports the US dollar. A stronger dollar tends to pull down the NZD/USD pair, especially if New Zealand’s economic data don’t excite. Additionally, new US tariffs are part of the conversation. The White House is considering implementing tariffs between 20% and 30% on some goods. Such actions are linked to ongoing trade tensions that affect global risk sentiment. When risk levels rise, traders often pull back from assets like the NZD and instead favor safer investments like the US dollar. Last week, US Jobless Claims fell from 237,000 to 233,000, a sign of resilience in the labor market. While this drop might not seem large, it underscores a trend that supports consumer spending and income growth, crucial for the US economy. In New Zealand, the RBNZ has taken a cautious stance. They are expected to leave the official cash rate unchanged at 3.25% during their next meeting, aiming to balance inflation control and support for the domestic economy. This steady approach may limit upward movement for the NZD without a change in outlook. Trade dynamics, particularly dairy exports to China—New Zealand’s largest trading partner—also impact currency performance. Weaker demand from China can negatively affect the NZD. If Chinese economic data continues to disappoint, investments in export-focused currencies may decline. We are closely monitoring economic performance and price stability. The RBNZ’s focus on inflation means any unexpected changes in domestic prices or employment could lead to significant shifts in the NZD’s value. Upcoming data releases from New Zealand, including employment figures, inflation rates, and trade balances, will be vital for direction. If these reports show weakness or fall short of expectations, the NZD may struggle, especially against a solid backdrop of US job growth. In the coming weeks, we should expect more volatility driven by headlines. Traders dealing in derivatives, whether for short-term contracts or long-term investments, must consider potential rate changes from both central banks, especially as inflation data is released. Price adjustments may occur depending on whether geopolitical developments pressure the Kiwi or support the US dollar. Currently, the price level around 0.6070 serves as a psychological benchmark. Future momentum will likely depend on upcoming economic indicators from both the US and New Zealand. With a defensive sentiment prevailing, any gains will be tested, especially if US discussions around trade and taxes become more aggressive. Create your live VT Markets account and start trading now.Concerns about falling oil demand lead to WTI dropping near $66.00 per barrel

Impact Of Tariffs And Inventory Reports

People are closely watching US President Donald Trump’s plans for tariffs on other countries. Oil inventory reports from the American Petroleum Institute and the Energy Information Administration impact WTI prices by showing changes in supply and demand. WTI oil is a type of crude oil known for its high quality because of its low gravity and sulfur content. Its price is influenced by political and economic factors, as well as OPEC’s decisions. The value of the US dollar also impacts WTI prices, as oil is usually traded in dollars, affecting global affordability. The recent decline in WTI prices to just over $66 reflects concerns about demand and shifts in market sentiment due to broader economic signals. The recent job data shows that while jobs are still being added, the labor market is stabilizing. A slight drop in the unemployment rate to 4.1% suggests some job strength, complicating the case for rate cuts by the Federal Reserve. This situation keeps inflationary pressures in place and may lead to longer periods of higher borrowing costs than predicted earlier in the year. For those tracking market volatility and interest rate differences, these policy signals are crucial as they directly influence hedging costs and future price movements. A steadier job market suggests the Federal Reserve will be careful, especially if energy-related inflation rises again. Pricing in the derivatives market may need to anticipate a slower decrease in interest rates, particularly for oil-linked futures.Sanctions And OPEC’s Production Strategy

New sanctions are putting pressure on oil supply, especially with the US targeting networks involved in Iranian oil smuggling. Past disruptions have caused short-term pricing volatility, but this time, any reduction in Iranian exports could be balanced out by OPEC’s decision to gradually increase production. The planned August rise of over 400,000 barrels per day may add downward pressure on oil prices if demand does not significantly improve in major markets such as China and Europe. As we observe tensions in the Middle East and shipping route stability, we should consider this production increase alongside delivery risks. Physical traders might already be adjusting prices accordingly. OPEC’s projected production rise until 2025, aiming for over 1.7 million barrels per day, shows that producers are confident the market can absorb more oil eventually. However, mismatches in timing could cause lags in pricing unless supported by significant inventory reductions or increases in consumption. Inventory reports from both the API and EIA are crucial to watch in the coming days. Any unexpected increase in inventory could worsen market sentiment, especially if it aligns with weak industrial demand from Asia. Conversely, a significant drawdown in inventory could temporarily help prices, especially if refineries ramp up production during the busy summer driving season in the US. These reports often change outlooks quickly. On the political front, discussions about tariffs are important as well. Confirmation of new US import duties, particularly on energy-exporting countries, could change global trade patterns. Price channels that depend on steady oil supplies are particularly vulnerable to such regulatory changes. Traders should be ready to adjust their positions quickly. The strength of the US dollar also plays a key role. Since WTI is priced in dollars, recent stability in the dollar index puts additional pressure on commodity prices for buyers using weaker currencies. A stronger dollar makes oil more expensive overseas, which can hinder demand growth among import-dependent regions. Developing effective currency hedging strategies is essential for managing risks, especially with rising geopolitical tensions limiting exchange rate flexibility in emerging markets. In the coming weeks, price movements will depend on supply management, economic indicators, and market confidence in central bank actions. The heightened uncertainty around policy decisions, trade, and restocking intentions could lead to higher premiums on short-term options, especially around inventory and payroll data release days. Staying flexible with positions—both in direction and duration—will help adapt to new information as it becomes available. Create your live VT Markets account and start trading now.The USD/CAD pair stays around 1.3575 as downward pressure continues and bears remain active.

Trading Volumes and Channel Formation

Ongoing uncertainties around trade have made traders cautious, leading to lower trading volumes, especially during the US Independence Day holiday. The forming descending channel, along with negative oscillator signals, suggests a short-term downtrend for the USD/CAD pair. The Canadian Dollar is affected by various factors, including the Bank of Canada’s interest rates, Oil prices, and overall economic health. Generally, higher interest rates support the CAD, while changes in Oil prices have a direct effect, given Canada’s reliance on exports. Economic indicators like GDP and employment figures also influence the CAD value and may lead the Bank of Canada to adjust interest rates. The current USD/CAD movement near 1.3575 indicates a loss of momentum. Despite a stronger-than-expected Nonfarm Payrolls figure, concerns about US fiscal policy seem to take priority, especially regarding the potential $3.4 trillion debt increase. This has heightened worries about long-term borrowing, putting pressure on the Dollar. Market sentiment is reassessing risk, which leaves the USD struggling. Conversely, Canada is benefitting somewhat from Oil. Despite talk of increased production potentially upsetting the balance, Crude Oil prices have held on to most of their weekly gains. This resilience in Oil prices is supporting the Canadian Dollar, providing a modest boost. Canada relies heavily on commodity exports, and stable energy prices tend to stabilize the currency, particularly during quieter trading periods.Market Activity and Outlook

Market activity has been low. With US markets on holiday, trading volumes are thin. Traders are being cautious, and this hesitation is visible in the charts. Price movements are currently confined within a descending channel, suggesting sellers are in control. Oscillators, like the RSI, continue to stay below neutral, indicating a short-term downward trend. Unless there’s a change in policy or surprises from upcoming economic data, the outlook remains heavy. For those eager to see progress in the CAD, the situation closely ties to broader economic trends and energy prices. Key decisions from the Bank of Canada are crucial. When rates rise, it typically attracts more capital, boosting the local currency. However, if inflation data or GDP growth falters, policymakers might need to be cautious, which could create pressure against the USD. In the coming weeks, we need to pay close attention to Canadian employment reports and early signs of inflation. We will also look out for comments from central bank officials, as language is more important than ever when discussing potential rate changes. On the US side, concerns about the debt ceiling are likely to linger, keeping market sentiment jittery as bond yields fluctuate. Timing trades during periods of lower liquidity requires extra precision. We are carefully mapping out key levels. Minor price retracements may present opportunities, but any significant recovery in the pair will need a clear break out of the descending pattern. Until that happens, shorting from the upper range of the channel could provide better risk-reward options. Monitoring WTI prices will also give us insights into the strength of the CAD. A drop in Oil prices would weaken the support for the Canadian Dollar, but so far, the market hasn’t shown urgency in that regard. Create your live VT Markets account and start trading now.India’s regulator bans Jane Street from the securities market over suspected manipulation activities

Trump announces plans to send letters about trade tariffs tomorrow

Market Reaction

The US Dollar Index (DXY) fell slightly, dropping 0.05% to around 97.10. This reflects market concerns about US financial conditions, which worsened after Trump’s tax and spending plans. Tariffs are fees on certain imported goods meant to help local businesses compete. Unlike regular taxes, tariffs are paid when goods arrive and are charged specifically to importers. The impact of tariffs can vary. Some see them as protective, while others worry about potential trade conflicts. Trump intends to use tariffs to strengthen the US economy and support American producers, focusing on key trading partners like Mexico, China, and Canada. The revenue from these tariffs is expected to help reduce personal income taxes. According to the US Census Bureau, Mexico will be the largest exporter to the US in 2024, with exports worth $466.6 billion. Washington is clearly trying to establish its trade stance through these letters. This administrative move is straightforward in its goals. The controlled batches of letters aim to inform specific countries of upcoming tariffs, ranging from 20% to 30%. Sending them in groups of ten indicates a gradual approach to implementation, allowing for measured reactions in both diplomacy and markets. Tariffs impose costs on imports and differ from domestic taxes. They specifically target importers when goods enter the country. While the intention is to boost local competitiveness, they also serve a fiscal purpose. The aim is not only to protect domestic industries but also to raise money that could offset income tax reductions—making it a dual economic strategy.Importance of Timing

The timing is especially noteworthy. The August 1 start date creates a clear deadline, allowing businesses to plan accordingly. For those sensitive to rate changes—especially those linked to North American or East Asian trade—effects could start impacting profit margins as soon as the next quarter. The sectors likely to feel the brunt include automotive parts, electronics, and agricultural products, which often rely heavily on cross-border trade. The small dip in the DXY—0.05% to around 97.10—might seem minor, but it signals caution among currency traders. This change coincides with tariff announcements and overall concerns about fiscal policies, particularly after the recent national budget adjustments made by Trump’s administration. These changes led to increased discretionary spending and tax adjustments, which many believe will widen the budget deficit. Short-term market fluctuations could rise, characterized by smaller, more frequent changes rather than major shifts. Tariff policies can unexpectedly affect cost structures. Companies that rely on imports may delay large purchases until the total price impact is understood. For those monitoring trends and options, this uncertainty might reveal opportunities for strategic trading or to identify inefficiencies in pricing. From a market structure perspective, we also need to focus on Mexico’s position. With $466.6 billion in goods sent to the US this year, according to Census Bureau data, Mexico is the largest supplier of imports. New tariffs on Mexican goods could reshape risk assessments for peso-related financial products. China is known for reacting quickly to tariff news. If the majority of new tariff increases hit Chinese goods, we might see shifts in commodities and currency markets. Canada may have smaller trade volumes but still has enough activity to affect forward swap markets related to North American trade agreements. This strategy is deliberate, not random. Traders should approach this time as a measurable transition. Early indicators like skew charts and implied volatility curves will provide valuable insight on market responses to these changes, beyond just media reports or government statements. Consistency in data is crucial. Watch for changes in customs records, import volumes, and cross-border payments. Signs of stress or adaptation often show up in paperwork before they affect prices. Create your live VT Markets account and start trading now.Reuters anticipates the USD/CNY reference rate will be set at 7.1688.

PBOC Intervention Strategy

If the yuan gets close to the limits of this band or becomes too volatile, the PBOC may step in by buying or selling the currency to keep its value steady. This strategy helps the currency adjust in a controlled way, reflecting economic conditions and policy goals. The PBOC is expected to set the USD/CNY reference rate at 7.1688, with the announcement likely around 0115 GMT, according to a Reuters estimate. This explanation outlines how China’s central bank determines the official rate for the yuan. The daily reference is not just a fixed number; it’s based on economic data, comparisons with other currencies, and market activity from the previous day. While traders can freely buy and sell the yuan within the narrow band, this midpoint acts as both a limit and a signal for the market. When the market moves quickly in one direction, especially near the daily limit of ±2%, authorities may intervene by buying or selling to prevent big swings. These actions are not random; they show the market the central bank’s intentions and guide trading sessions. This can influence regional currencies and the broader positioning in derivatives.Impact on Trading Dynamics

For this week, the expected midpoint against the dollar is 7.1688. This number reflects overnight trading and how the central bank wants the market to behave. It sets the early tone and subtly influences trading enthusiasm. For traders pricing options or watching volatility curves, this starting point shapes implied ranges and sentiment. Recent daily changes have been small, keeping short-term implied volatility contained. However, if the fixing consistently approaches the upper limit of the band, or if the central bank repeatedly intervenes to prevent the yuan from weakening, traders may need to reassess their strategies. A noticeable divergence between the fixing and market pricing would increase risks and sensitivity to market movements. Derivative desks monitor the fixing closely for tactical moves and because it indicates potential reversals or breakouts. Strong interventions often reduce volatility afterward but increase it just before, leading to observable skew in options—especially in short-term expirations where short bursts of policy surprises can be absorbed more easily. From our perspective, the fixing and band mechanics also influence back-end hedging demand, as directional trends affect cross-currency pairs and interest rate differences. The week starts with the fixing close to levels where prior interventions have occurred. While this doesn’t guarantee action, it suggests that the risk of being unhedged might increase. It’s important to monitor not just the midpoint but its proximity to stress points and surrounding prices. This highlights the importance of range strategies and limited-risk positions, especially when price action creates tension near policy levels. The location of fixes and whether the spot price challenges the band is key information for risk structuring. Though the daily midpoints may seem mechanical, they reveal the interaction between policy and markets when viewed alongside positioning and skew adjustments. Recognizing consistent patterns in this dynamic can improve future exposure models. Create your live VT Markets account and start trading now.The People’s Bank of China set the USD/CNY central rate at 7.1535, which is a slight increase.

Monetary Policy Tools in China

The PBOC uses several unique monetary policy tools, such as the seven-day Reverse Repo Rate, Medium-term Lending Facility, and Reserve Requirement Ratio. The Loan Prime Rate functions as China’s main interest rate, affecting loans and mortgages and influencing the value of the Chinese Renminbi. China has 19 private banks, with WeBank and MYbank being two prominent digital lenders backed by tech companies Tencent and Ant Group. In 2014, China allowed private banks to operate in its state-led financial system. By setting Friday’s midpoint rate at 7.1535, slightly higher than Thursday’s 7.1523 but below expectations, the PBOC indicates a desire for a stable foreign exchange environment. This rate is lower than the Reuters estimate of 7.1688, highlighting the central bank’s readiness to counteract speculative pressures on the yuan while avoiding excessive volatility. This rate setting shows the central bank’s careful balancing act between maintaining stability and supporting domestic growth. The midpoints serve as more than just daily figures; they communicate the official stance against sudden currency changes, especially during a fragile recovery and unpredictable global rates.Monetary Decisions and Political Influence

Given this context, it’s important to pay attention to short-tenor swap spreads and longer-term hedging. They reflect expectations for stability and could signal a need for adjustments if spreads widen again, particularly in monthly FX swaps or synthetic forwards in CNH. Pan’s dual leadership integrates political oversight with monetary policy. The party’s strong influence means decisions often reflect political intentions, not just data trends. Traders should closely monitor any changes to repo operations or shifts in the Medium-term Lending Facility around policy meetings or economic updates. Recent liquidity operations show a reluctance to inject large amounts of money into the system, although there are efforts to maintain short-term rates through seven-day reverse repos. These tools are not focused on the larger economic cycle but aim to manage short-term rate fluctuations. Increased or larger use of these tools may hint at future shifts in central guidance. While adjustments to China’s Reserve Requirement Ratio (RRR) have been lighter this year, they can still surprise the market. Usually timed with external economic pressures or weak domestic data, these changes often result in shifts in short-term interest rate futures. Unscheduled RRR cuts could signal upcoming liquidity boosts more than official rate changes. The Loan Prime Rate (LPR), which serves as a benchmark for loans, hasn’t changed much recently, indicating a limited desire for broad monetary easing. However, changes in the LPR can have a significant impact on USD/CNH forwards. Long-term positions should align with the slower pass-through effects seen now compared to early 2022. On the structural side, private banks like WeBank and MYbank are still too small to shift overall market flows but are growing in importance for credit distribution and customer engagement through digital services and micro-lending. Their growth, supported by Ant and Tencent, hasn’t changed core monetary transmission significantly but adds competition in retail financing. These developments should be tracked in credit impulse indicators to understand their effect on base money demand. If tech financing trends continue, short-dated interest rate curves may begin to reflect liquidity changes more closely tied to fintech activity rather than traditional industrial spending. Considering all of this, our current perspective suggests that short-term strategies should reflect a stronger connection to official rate ranges. A surprising strength in the USD, along with limited policy initiatives, may lead to some risk widening. However, it is not expected to move beyond the informal limits set by fix guidance just yet. The key opportunity lies in strengthening hedging strategies rather than making directional trades. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jul 04 ,2025

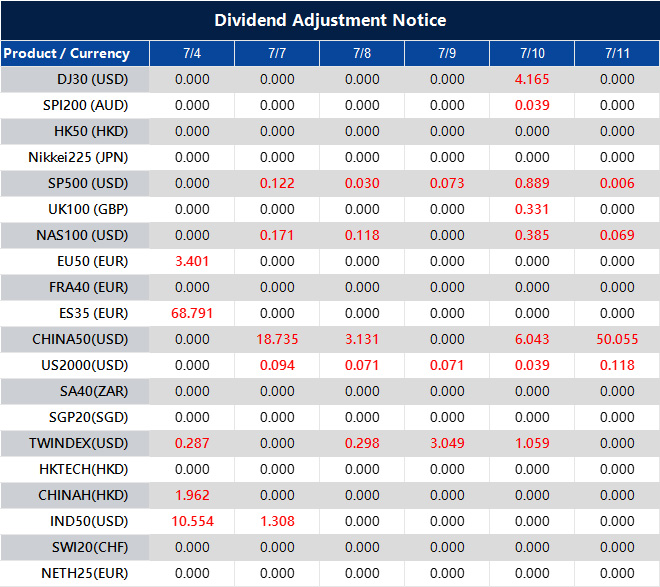

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].