The USD strengthened slightly as risk assets faced pressure amid talks of a US attack.

The pound remains weak against the dollar near 1.3400 due to rising dollar strength.

Impact of Geopolitical Tensions on GBP/USD

US officials are reportedly preparing for a potential strike on Iran, according to Bloomberg and the Wall Street Journal. President Trump approved plans for a strike, depending on changes in Iran’s nuclear program. The market is expecting around 48 basis points of interest rate cuts in the UK by the end of the year. Currently, GBP/USD is trading close to 1.3410. This shows that the pair is struggling to gain momentum due to increasing global uncertainties and strong demand for the US Dollar. The 1.3400 level has become a key resistance, as investors seek safety amid rising unrest. Tensions in the Middle East are pushing money towards safer currencies, and this trend is likely to continue as long as the geopolitical situation remains unclear. In the UK, price pressures have slightly decreased, but the annual Consumer Price Index (CPI) is at 3.4%, far above the Bank of England’s target. While the drop since April suggests easing inflation, it’s not enough to prompt significant changes in policy. The market generally expects the Bank to maintain its benchmark rate at 4.25% for now. Expectations for rate cuts in the near future are evident in the market. About 48 basis points of easing are anticipated before the end of 2024. However, this outlook is dependent on an unstable macroeconomic landscape. Fed Chair Powell’s recent comments about inflation possibly rising again—partly due to previous tariffs—indicate that the Fed isn’t rushing to implement cuts. In contrast, the emerging softening economic pressures in the UK suggest a widening gap in expected paths between the two countries.Implications of Inflation and Monetary Policy

However, this gap isn’t always straightforward. The market’s pricing might not match reality if geopolitical events add new risks or volatility. Recent reports highlight that US plans regarding Iran are shifting from a strategic phase to operational readiness. Potential military actions could lead to defensive positioning, further supporting the Dollar and adding pressure on the Pound. In the short term, we should observe how options markets are reacting. Implied volatility for one-week and one-month periods is increasing, indicating higher expected short-term movements, especially around central bank meetings or significant geopolitical events. Those with leveraged positions should consider tighter risk limits while volatility is high. The risk of GBP/USD going up is limited unless UK data turns unexpectedly positive or the Fed takes a softer approach due to new domestic pressures. From a market flow perspective, it’s essential to monitor changing yield differentials. Treasury yields have remained strong, driven by safe haven demand for US assets, which supports the Dollar. On the other hand, Gilts have not seen consistent demand as some investors weigh the long-term consequences of an early shift in Bank of England policy. While a near-term retest of 1.3400 seems likely, breaking below that level could become more realistic if geopolitical risks continue or if UK data suggests a more dovish outlook. Pay attention to short gamma positioning as expiry dates near; reactions in spot could be more pronounced if hedging needs increase. Directional strategies should be paired with careful execution and active hedge management, especially leading up to the next Bank of England announcement. Create your live VT Markets account and start trading now.PBOC sets USD/CNY reference rate at 7.1729, lower than the expected 7.1916.

Open Market Operations

The PBOC is actively managing the market using open market operations. They are employing 7-day reverse repos, a short-term liquidity tool, to add funds to the banking system. This aims to manage short-term interest rates and ensure financial stability. The injection of 203.5 billion yuan, with only 119.3 billion maturing, leads to a net addition of 84.2 billion yuan, showing a clear intent to ease market conditions. The midpoint fix for the yuan plays a crucial role in China’s currency system, setting the benchmark for spot market trading. By keeping the yuan within a 2% range around this midpoint, authorities maintain control while allowing some market flexibility. The previous closing rate of 7.1900, likely at the high end of this band, indicates efforts to stabilize the currency after recent declines. For those involved in derivatives, especially with exposure to changing rates or short-term liquidity, the central bank’s actions are significant. This injection signals that authorities are addressing potential funding tightness. Cheaper or more accessible short-term funding can lead to changes in implied funding rates and forward curves.Exchange Rate and Market Impact

More broadly, if the central bank’s actions respond to capital outflow pressures or are a subtle defense of the exchange rate, this could increase volatility in longer-dated currency options. While the managed float limits sudden changes in the spot rate, it doesn’t prevent shifts along the curve when liquidity changes. In practical terms, lower onshore rates might spark more carry trades, affecting premiums in longer-term contracts and widening bid-ask spreads as market participants reassess funding assumptions. It’s important to watch future repo operations compared to maturing amounts; additional net injections may indicate a longer-term plan to support market sentiment. Given the 7-day tenor of these operations and the calm in the spot market, it might be easy to see this as routine. However, the key takeaway is the shift towards looser liquidity—not aggressively, but intentionally. This creates a trading environment where short-dated implieds might not provide the complete picture. Monitoring the trend towards easing, especially close to key roll dates, should influence how risk is hedged and priced in delta-neutral strategies. This situation reminds us that central bank operations, even without a direct currency target, affect the pricing of vol curves and shape expectations through lower rates. Create your live VT Markets account and start trading now.Silver price stays stable around $36.75, showing bullish potential despite recent fluctuations.

Technical Patterns Suggest Upward Movement

Silver is steady, holding its position near a recent peak and avoiding a decline. The outlook is positive; upward movement seems likely unless it drops below $36.00, which would signal a different trend. The metal is trading in a narrow range around $36.75 during Thursday’s Asian session. Technical indicators show a potential upward trend, with a flag pattern suggesting it could move above $37.00. If Silver breaks through the $37.30-$37.35 range from Wednesday’s high, it could head towards $38.00, possibly even reaching $38.50-$38.55. Support around $36.55, including the 50-period Simple Moving Average, might prevent sharp declines. Silver’s price often follows gold and reacts to changes in industrial demand, especially from electronics and solar energy sectors. Typically, lower interest rates and a weaker US Dollar boost Silver prices. A high gold-silver ratio may suggest Silver is undervalued or Gold is overvalued. Factors like geopolitical instability and changes in mining supply can greatly influence Silver prices.Broader Economic Factors Influence Silver

Silver shows indecision, sitting near $36.75 without making strong moves. Although it hasn’t surged past Wednesday’s highs yet, underlying conditions suggest it might gain upward momentum. This setup is familiar; when technical patterns are sideways but fundamentals remain supportive, a small catalyst can push Silver past the $37.00 level. The developing flag pattern isn’t just for show; it usually indicates a pause before a continuation. Observing this near the top of a recent uptrend boosts expectations for a rise, as long as it stays above $36.00. This level is critical—staying above it maintains an upward bias, while dropping below changes the outlook entirely. As we look for potential gains, pay attention to the $37.30 to $37.35 range. This area was last week’s ceiling, and breaking through it could lead to testing $38.00, with a chance to reach the upper band between $38.50 and $38.55 if momentum continues. Remember, price often accelerates or stalls around round numbers, and these levels attract trader interest. Support around $36.55, especially coinciding with the 50-period moving average, suggests that it’s more than just a number. It has held firm recently, and if market conditions shift, we can expect buyers to regroup there. This isn’t just statistical; it indicates collective attention at these levels. Beyond the charts, Silver is influenced by broader economic factors. Unlike other stable assets, Silver reacts quickly to monetary and real-world economic changes. Demand from electronics and solar panel manufacturing remains strong, distinguishing its behavior from Gold. While Gold can rise merely due to monetary factors, Silver benefits from both monetary influences and physical usage. A weaker Dollar generally supports Silver. If the Federal Reserve favors lower interest rates soon, it gives metals priced in USD more room to rise. A weak Dollar means it takes more of that currency to purchase an ounce of Silver. So, monitoring real yields and currency movements can help predict Silver’s next steps. Keep an eye on the gold-silver ratio—it’s a valuable tool for assessing relative pricing. A rise in this ratio often indicates Silver is lagging or Gold is overvalued. Being aware of this can improve decisions about rebalance across the two metals. Changes in mining output, especially from key producing countries, directly affect supply. Recent talks of reduced output or production issues subtly tighten the market, boosting bullish confidence. Geopolitical events, while not primary movers, can intensify trading. They often bring safe-haven investment into play, giving precious metals unexpected boosts or drops. Currently, with persistent global tensions and no fresh shocks, this backdrop supports underlying demand. In this situation, maintaining a balanced viewpoint is essential. Stay alert to the $36.00 support level on the downside, and if prices break above recent highs, reassess growth targets based on upcoming payroll data, Dollar performance, or energy prices. When the market tightens within a narrow range, risks become less forgiving but also clearer. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 19 ,2025

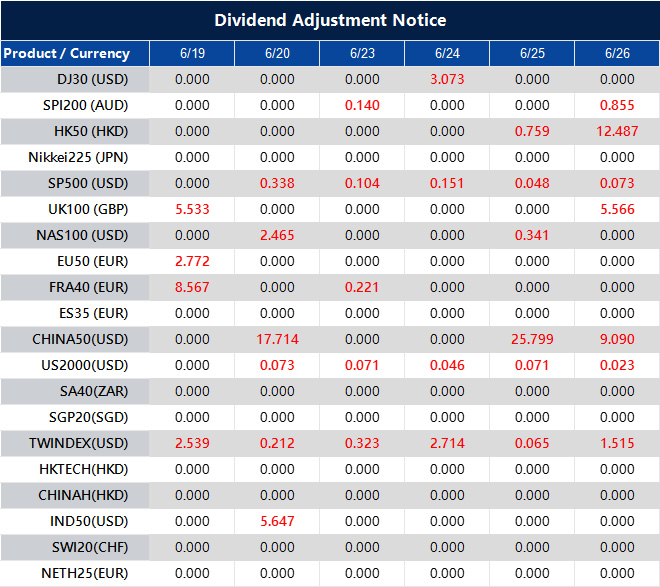

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Japan is cutting super-long bond sales by about 10% this fiscal year to ease market concerns.

Bank Of Japan’s Role

The Bank of Japan is essential in managing the currency, sometimes intervening in the markets to stabilize the Yen’s value. From 2013 to 2024, the bank’s very loose monetary policy weakened the Yen due to differing approaches from other central banks. Recently, as other central banks are lowering interest rates, the Bank of Japan has begun to shift away from its super-loose policies, which has helped support the Yen. The Yen is often viewed as a safe-haven currency, gaining value during times of global economic uncertainty. The information in this document is not without risks and uncertainties and is for informational purposes only. It’s crucial to do thorough research before making any investment decisions, as there is no guarantee that the information is error-free or timely. This recent cut in super-long bond sales by Tokyo gives bond traders a clearer picture of Japan’s debt market. Reducing the issuance by about 10% indicates concern that there may not be enough steady demand to meet earlier targets. Poor auction results in recent weeks have prompted a more cautious approach, which is reasonable. If issuance had stayed the same, it might have further strained weak demand, possibly raising yields and increasing volatility. For those observing exchange rate changes, especially involving the Yen, this reduction aligns with gradual shifts in Japan’s financial policies. The Bank of Japan has kept rates near zero for over a decade, while many central banks have tightened policies aggressively. This difference in approach—the gap between Japanese and US Treasury yields—has largely drove the Yen’s weakness for the past ten years.Shift In Financial Policies

However, the Bank’s gradual move away from ultra-loose policies seems to be offering the Yen some support. With Western central banks appearing to reach the end of their tightening cycles, this gap could close, not just from slowdowns abroad but also from possible adjustments in Japan. Narrowed yield gaps can impact foreign exchange derivatives, especially options and carry trades. Kuroda’s successor has not deviated significantly from previous strategies, though there is a slight shift in focus. This subtle rebalancing, along with a reduced bond issuance schedule, may help stabilize both rate and currency volatility, at least in the short term. Despite a small decline today, with USD/JPY at 145.05 down 0.07%, traders should recognize that the pricing reflects changing risk premiums rather than a single data point. Even small changes in the structure of Japanese Government Bond (JGB) auctions or soft shifts in the central bank’s tone can affect implied volatility levels. This is important to consider for short-dated option structures. Contracts tied to yield differential expectations might show lower premiums if the market views these developments as stabilizing. However, those relying heavily on past assumptions of yield differences may need to reassess. Additionally, the JPY is often seen as a barometer during times of global uncertainty due to its safe-haven status. This could quickly become relevant again if macro risks emerge from abroad. As policy changes take place, even cautiously, there can be mismatches between expectations and actual results. Keep an eye on instruments linked to longer-term rates. Cutting back on super-long bond sales changes the risk/reward ratio for spread trades between Japanese bonds and similar foreign government bonds. Reduced supply might flatten domestic yield curves and trigger a short squeeze in low-liquidity areas. This won’t happen in isolation; effects will be felt across currency volatility and yield curve strategies. Those monitoring the spot JPY may underestimate the impact of structural decisions like this one. This situation goes beyond just policy—it involves market mechanics, relative expectations, and how small adjustments can compound their effects. Staying flexible in positioning is wise, especially since another poorly received auction result could spark speculation about further changes to issuance. Create your live VT Markets account and start trading now.US Dollar Index strengthens to around 99.10 amid Middle Eastern tensions and Fed’s rate hold

Demand as a Safe Haven Currency

The Dollar is gaining value as a safe-haven currency amid growing tensions in the Middle East. Reports indicate the US may prepare for strikes on Iran, while President Trump has criticized Iran’s position. The US Dollar is widely traded, responsible for over 88% of global foreign exchange transactions. The Federal Reserve’s policies, including changes in interest rates, significantly impact its value. Measures like quantitative easing and tightening also affect its strength or weakness. The DXY’s rise to around 99.10 during the Asian session clearly responds to the Federal Reserve’s stance and international tensions. By maintaining rates between 4.25% and 4.50%, the Fed has indicated it is ready to act if inflation changes or if labor market conditions shift. Powell also noted that inflation could rise again, referencing the ongoing effects of previous trade policies and tariffs. This cautious approach, along with the readiness to adjust rates based on data, has added volatility that markets didn’t fully anticipate. The slight increase in the DXY shows not only the Fed’s policy but also rising demand for the US Dollar due to geopolitical tensions. With the US preparing for possible actions against Iran—and Trump’s public discontent with Tehran—investors are seeking safer assets. When investors are drawn to safer options, they tend to invest more in Dollar-denominated assets, which supports the currency. Traders considering options or futures linked to major currency pairs should pay close attention to this shift. Implied volatility for several FX pairs may rise, especially where the USD is involved, potentially amplifying market movements compared to actual data releases.Implications for Traders

The anticipated rate cuts of 50 basis points by the end of 2025 provide a long-term anchor but may not stop short-term increases. This gap between short-term and long-term outlooks can lead to distortions in pricing, favoring short-term positions if managed carefully. Furthermore, since the Dollar makes up a large portion of global FX turnover, these policy signals have a significant impact beyond the US market. With the Fed being cautious yet not overly soft, any deviation from predictions—like changes in inflation rates or nonfarm payroll data—could quickly affect market positioning. Traders dealing with interest rates and forex should adjust their strategies with more frequent monitoring. The Dollar tends to outperform in times of crisis, requiring regular assessments of exposure and margin needs. Spreads may widen unexpectedly as liquidity shifts to safer investments, and this should be factored into risk management. For those using short-dated options, implied volatility could exceed actual volatility, leading to potential mispricings. With futures, tightening variability bands and closely monitoring basis movements will provide better control. Flexibility will be crucial, as we navigate a situation where geopolitical risks and a cautious Fed are influencing prices rapidly. Upcoming economic data from Washington—especially concerning wage inflation or strong core CPI—could further increase demand for the USD. Traders with leveraged positions should prepare for possible significant overnight gaps, especially when liquidity in Asian or European sessions may lag behind North American market trends. Overall, with Powell focused on inflation and international tensions rising, it’s time to adapt strategies actively. Utilize policy guidance, but avoid making assumptions. Events are changing quickly, and prices are reflecting those changes just as fast. Create your live VT Markets account and start trading now.Victory Awaits in the VT Trading Arena

VT Markets Launches Global Trading Competition with a USD1,000,000 Prize Pool, Focusing on Strategy, Precision, and Performance

19 June 2025 – Sydney, Australia – VT Markets, a leading multi-asset brokerage, is raising the stakes for traders worldwide with the launch of the VT Trading Arena – a high-intensity, 10-week global competition with up to USD1,000,000* in cash prizes up for grabs.

Running from 23 June to 31 August 2025, the VT Trading Arena is set to be one of the standout trading events of the year and a centrepiece of VT Markets’ 10th anniversary celebration. Open to traders of all levels, the VT Arena offers a world-class competitive stage where participants can test their skills, sharpen their strategies, and compete for global recognition, exclusive rewards, and their share of one of the largest prize pools in the industry.

With a total prize pool of USD1,000,000, the competition is divided into two tiers to cater to all experience levels. The Beginner Tier prize pool stands at a total of USD300,000, whereas the Advanced Tier is allocated USD700,000. This tiered structure allows traders to compete within their skill range while still aiming for the respective top prizes.

In addition to the main prize pool, participants can win extra cash prizes, including a grand prize of USD10,000 for the top trader every 5 weeks. The second-place finisher will receive USD7,000, and third place will earn USD3,000 – providing multiple opportunities to win beyond the main prizes.

To participate, traders simply need to open a VT Markets account, deposit a minimum of USD1,000 and meet the competition’s minimum trade requirements to qualify. Each eligible deposit earns one spin on the prize wheel, offering even more chances to win attractive prizes such as USD1,000 in cash, trading vouchers, hospitality tickets to exclusive match and race days, and more.

The global trading competition is designed not only to offer a thrilling experience, but also to foster a sense of community among traders worldwide. With a decade of innovation behind it, VT Markets is using this milestone moment to transform the trading experience — turning it into a global avenue of ambition, excellence, and opportunity.

For full details on how to participate, eligibility requirements, how to win, and the full list of prizes, please visit: https://vttradingarena.com/

*Terms and Conditions apply.

About VT Markets

VT Markets is a regulated multi-asset broker with a presence in over 160 countries as of today. It has earned numerous international accolades including Best Online Trading and Fastest Growing Broker. In line with its mission to make trading accessible to all, VT Markets offers comprehensive access to over 1,000 financial instruments and clients benefit from a seamless trading experience via its award-winning mobile application.

For more information, please visit the official VT Markets website or email us at [email protected]. Alternatively, follow VT Markets on Facebook, Instagram, or LinkedIn.

For media enquiries and sponsorship opportunities, please email [email protected], or contact:

Dandelyn Koh

Global Brand & PR Lead

Brenda Wong

Assistant Manager, Global PR & Communications