Schmid believes the FOMC can assess the inflation impact of tariffs before making rate decisions.

NZD/USD pair climbs to 0.6035 as new buyers enter around 0.6000 level

New Zealand Trade Data

New Zealand’s trade data exceeded expectations, supporting the NZD/USD pair. The monthly trade surplus was NZ$1.235 billion, while the annual deficit was NZ$3.79 billion in May. Expectations for further rate cuts by the Reserve Bank of New Zealand could limit significant gains for the NZD. The repeated difficulties near the 0.6065-0.6070 resistance levels make traders cautious, as they wait for a clear breakout above this barrier. The Kiwi’s value is influenced by the state of New Zealand’s economy, central bank policies, and China’s economic performance. Changes in dairy prices, New Zealand’s main export, also impact the currency’s value. The Reserve Bank aims for medium-term inflation between 1% and 3%, which affects the NZD/USD relationship. Looking at the recent price movement of the NZD/USD pair, the current rise around 0.6035 is mainly due to a softer US Dollar rather than strong Kiwi performance. This shift reflects changing expectations about the Federal Reserve’s future borrowing costs. Even though Powell kept a hawkish tone, markets are sensing some potential for rate relief in the medium term. This difference has led the USD Index to drop to a one-week low. Safe-haven demand is also waning as geopolitical concerns, especially in the Middle East, ease. A temporary ceasefire reduces the Greenback’s appeal, shifting interest toward risk-sensitive currencies like the NZD.Technical Dynamics and Market Sentiment

Domestically, New Zealand’s trade balance data exceeded forecasts with a monthly surplus of NZ$1.235 billion. While the annual trade gap is more cautious, this immediate boost in exports is significant for those monitoring the Kiwi. A positive trade performance helps strengthen the NZD, particularly when China—an important trading partner—maintains stable demand. However, challenges remain. The Reserve Bank of New Zealand is navigating ongoing price pressures and declining domestic demand. Market discussions are trending toward more dovish policies in the upcoming months, which could limit substantial upward momentum for the NZD. Technically, the 0.6065 to 0.6070 zone has proven to be a strong resistance level. The price has struggled here multiple times, indicating uncertainty that keeps short-term excitement in check. Until we see a clear break above downward trends or former resistance levels, optimism will be cautious at best. The currency is influenced by several factors. Commodity prices, especially dairy (New Zealand’s main export), are critical drivers. Changes in global milk powder auctions affect exchange rates, so monitoring upcoming GDT releases is essential. Additionally, domestic inflation targeting within the 1% to 3% range guides RBNZ policy, and any fluctuations will impact interest rate futures and the NZD. Traders need to stay flexible. Support for the pair is near the 0.6000 mark, and falling below this level could lead to a broader drop towards early-June levels. Volatility will likely stem from various sources: US economic data, market sentiment shifts, and changes in expectations regarding China’s growth. Ultimately, patience is key, and traders should balance short-term price signals with broader, slower-moving macro factors. Create your live VT Markets account and start trading now.US and Israeli strikes reportedly delay Iran’s nuclear program by two years amid concerns of rebuilding

GBP/USD remains on an upward trend above 1.3600, recently hitting 1.3648, its highest level since February 2022.

Ceasefire’s Impact on Forex Markets

US President Trump announced a ceasefire between Iran and Israel, creating hope for an end to their 12-day conflict. However, uncertainties about the ceasefire’s durability remain, especially regarding potential nuclear talks and the status of Iran’s enriched uranium. In his testimony, Fed Chair Powell suggested that rate cuts should be delayed until later this year. Kansas City Fed President Schmid advocates for waiting to see the economic effects of tariffs. The dovish comments from BoE officials could affect the GBP, as BoE Governor Bailey has expressed concerns over the reliability of labor data. The Pound Sterling is the UK’s official currency and plays a vital role in global foreign exchange trading. The BoE’s monetary policy, especially through interest rate changes, significantly influences its value, particularly in managing inflation. Economic indicators like GDP, PMI, and trade balances also affect the strength of Sterling. The GBP/USD pair has sustained its upward movement and is nearing levels not seen since early 2022. This rally coincides with improved global risk appetite, shifting flows away from safe-haven currencies like the US dollar. The fragile ceasefire in the Middle East serves as temporary relief for global markets, giving the Sterling more space to rise.Monetary Policies and Market Reactions

While US officials claim that military tensions have eased, there is still low confidence in the ceasefire’s stability. As we watch for the potential restart of nuclear negotiations and their implications, any setback could reverse the current favorable mood and bring demand back to the dollar. Until then, lighter trading volumes are likely to favor risk-oriented currency pairs. On the monetary policy front, Powell’s comments emphasized patience. He noted that inflation remains stubborn and the US job market has been stronger for longer than expected. His remarks suggest that interest rate cuts are unlikely in the near term, pushing expectations for the first cut potentially toward late 2024. Schmid supported this view by noting that new tariffs could change growth and inflation dynamics in ways that will take time to reflect in the data. This indicates a reluctance to make premature cuts to monetary policy. In contrast, the Bank of England has a different outlook. Bailey’s concerns about the inconsistencies in labor market data raise worries about ongoing wage pressures. Without clear employment trends, policymakers may feel limited. If revisions show weaker job growth, it could point toward earlier rate cuts in the UK. Recent communications from BoE officials have leaned toward caution, reflecting discomfort with maintaining tight policies amid uncertainties about economic slack. In the coming weeks, we will closely monitor the UK’s GDP figures and upcoming PMI surveys. Any signs of weakness may reinforce dovish expectations and limit the Pound’s gains, even if the dollar remains weak. In the US, inflation data and employment reports will be scrutinized for signs of slowing, which could lead markets to adjust their timelines for Fed easing. Markets are currently testing assumptions around central bank reactions daily. We expect increased sensitivity to speeches and unexpected data. The widening gap between Fed and BoE rate trajectories could lead to more volatility, especially if geopolitical risks resurface. For instance, Victoria at the BoE earlier stressed the importance of looking past one-off price shocks, showing their tendency to under-react. This stance contrasts with US officials, who are currently less flexible. From a trading perspective, market positioning appears skewed toward expectations of slower US rate cuts, but this could change rapidly. For now, the Pound remains strong, but this depends on ongoing optimism that attracts capital to risk trades. With market pricing potentially shifting quickly due to unexpected data, we should be prepared for changes. Create your live VT Markets account and start trading now.Members voice concerns about tariffs, wages, inflation, and economic stagnation at recent meeting

Global Economic Policies

Global economic policies and their effects on Japan were discussed, highlighting potential inflationary pressures. Several members emphasized the need to keep current interest rates and financial conditions stable due to ongoing uncertainties from global geopolitical issues. They noted the risk of unintended market effects from international events and rising bond market volatility. Even with inflation higher than expected, some members supported maintaining current policies due to these uncertainties. Meanwhile, the USD/JPY exchange rate remains stable. Recent discussions have clearly shown opposing forces at play domestically. On one side, businesses display a moderate resilience, particularly those focused on investment and keeping labor amid structural shortages, despite external shocks. This ongoing commitment indicates a long-term confidence in internal growth. However, these positive actions must also deal with external risks that are not temporary or minor. The stability of the dollar-to-yen exchange rate may seem reassuring, but it should not lead to complacency. It reflects investor expectations that policy changes are unlikely to happen abruptly without significant data shifts. If bond markets become more sensitive—experiencing increased volatility from abroad—the assumption of stable rates could be challenged. Any sharp reactions in rates could impact leveraged positions, especially those linked to long-term instruments, as yield predictions influence margin behaviors. Interestingly, rice prices, less discussed in Western markets, are rising enough to shape public inflation expectations, affecting future pricing behaviors. If not addressed through policy discussions or economic developments, these effects could build up, prompting yield changes in instruments that track household consumption. The latest Consumer Price Index figures support this notion, slightly ahead of consensus predictions, suggesting even well-prepared portfolios may need adjustments.Corporate Sentiment and Tariff Policies

Pressure from foreign tariff policies, particularly those from Washington, is affecting corporate sentiment. While the direct impact might take time, senior management teams are adopting a cautious approach, which could influence hiring and domestic capital expenditures. Any decline in forward business confidence indicators—especially in export-sensitive sectors—should be taken into account regarding implied volatility. Wage growth remains a glimmer of hope. Sustained upward pressure could indicate wage-driven inflation instead of cost-driven inflation, changing how official releases are interpreted in the next three quarters. This could also influence implied rate volatility, especially if policymakers do not take counteractive tightening measures. Some policymakers might prefer to pause rather than act preemptively, waiting for more data before making changes. This caution is understandable given the current uncertainties, but it means there will be a heightened focus on upcoming domestic inflation and global trade data, which may broaden implied curve trades. From our perspective, a near-term shift seems unlikely unless prompted by significant external events. In the meantime, paying attention to subtle changes in yield curvature and slope steepening may prove beneficial as the market adjusts its expectations for forward guidance. Monitoring open interest in bond-related futures and options shows no sudden shifts yet, but increased activity in contracts further out may indicate greater confidence in hedging against rate surprises down the line. Therefore, closely watching how sentiment shifts regarding commodity-linked inflation, currency alignment with rate policies, and relative differences between Japan and its main trading partners could provide clearer entry and exit points. With market pricing very finely balanced, minor disturbances—whether from geopolitical changes or short-term data fluctuations—could lead to temporary but significant disruptions. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 25 ,2025

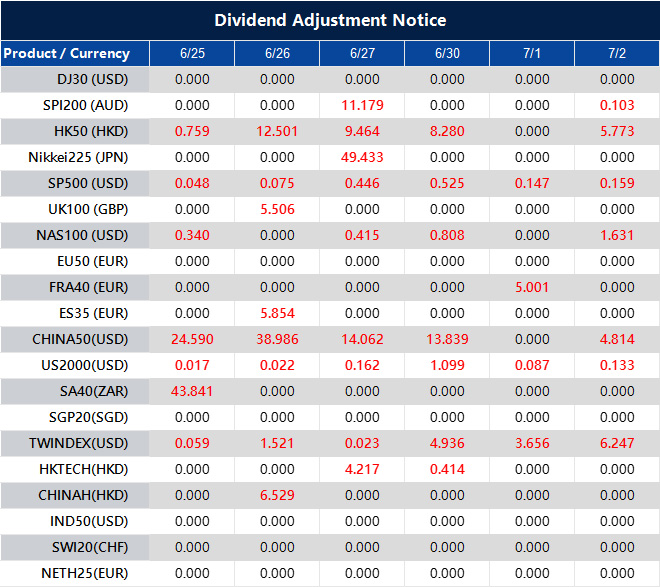

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].