TradeCompass advises Nasdaq traders to be patient and suggests strategic entry points above $21,860 and below $21,800.

EUR/USD and USD/JPY expiries may restrict price movements before US inflation data and trade discussions.

The dollar stays steady before European trading as US futures show cautious sentiment.

Market Movement

The dollar changed little ahead of European trading. The EUR/USD was slightly above 1.1400, and the USD/JPY was near 145.00. The AUD/USD struggled to go above 0.6500. Overall, caution ruled the market, and US futures appeared hesitant. The S&P 500 futures fell by 0.3%, reversing previous small gains. These trends show ongoing uncertainty amid US-China discussions. The main takeaway is that while the talks sound calmer than in the past, expectations for immediate results are low. Recent history, especially past commitments like agricultural accords, shows that many agreements do not lead to reliable follow-through. Traders have learned that hope isn’t enough. In the current market, the recent price action in FX and equity futures isn’t driven by strong convictions but rather by a lack of strong catalysts. The dollar’s muted behavior reflects this. The EUR/USD staying above 1.1400 shows mild euro strength, but there is no strong motivation behind it. The USD/JPY’s position near 145.00 reflects safe-haven behavior more than new optimism. The Australian dollar’s struggle to hold above 0.6500 emphasizes trader caution in the region. Equity futures are simply treading water. The 0.3% drop in S&P 500 futures does not indicate fear but rather a hesitance to commit. There’s less appetite for risk, and a cautious wait-and-see mindset prevails, especially since recent diplomatic moves appear more focused on appearances than on factors that would significantly change market flows in the short term.Trading Environment

Given the narrow trading ranges and lack of follow-through from overnight comments, we can expect short-term moves to remain unpredictable. Market direction won’t come from political headlines unless they clearly outline enforceable policy changes, especially affecting sectors like semiconductors, clean energy, and heavy manufacturing. It’s also clear that implied volatility across various time frames remains low, suggesting options markets are not anticipating significant directional risk. This is valuable information. Current derivatives show premiums that do not reflect the expectation of quick changes. If there were real concerns about potential risks, we would notice broader skews and increased protection costs, which isn’t happening. So where do we stand now? For near-term setups, we should keep our strategies focused. No wide-ranging plays without stronger macro signals. Instead, this situation calls for tactical entries with clear timing and limited exposure. Overall sentiment is soft, not negative—people are more disengaged than alarmed. Short-term derivatives could benefit from this pause by using strategies that perform well in tight ranges, especially for index-linked instruments. However, longer-term risks are limited due to a lack of conviction. Without a catalyst to shift expectations, traders shouldn’t expect major changes in positioning. In the bond market, yields have barely moved, highlighting the limited urgency inferred from recent diplomatic events. Derivatives tied to cross-asset volatility are also quiet. Until we see significant shifts in base rates or clear changes in supply chains, larger movements are unlikely. Patience may be more beneficial than aggression during this period. This isn’t fatigue—it’s a purposeful calm, and at times like this, that speaks volumes. Create your live VT Markets account and start trading now.Survey shows BOJ plans to keep interest rates steady through year-end, despite expectations for future hikes.

Morgan Stanley notes growing interest among international investors in Japan’s long-term bonds due to rising yields.

Increased Interest In Japanese Bonds

Japan’s long-maturity government bonds, especially those with 30- and 40-year terms, are now offering better returns. This has drawn the attention of investors worldwide, especially from Canada, Europe, and Asia. The main reason is that these bonds are providing yields that compete with those in other markets, contrasting Japan’s past trend of low returns on government debt. This change is largely due to the Bank of Japan’s recent actions. They have reduced their regular purchases of government debt, which previously kept yields low. With their support diminishing, yields have risen naturally. In bond markets, lower prices lead to higher yields, so with less central bank buying, bond prices have fallen, resulting in higher returns for current buyers. Morgan Stanley’s insights are significant. They indicate that the Ministry of Finance in Japan might need to cut back on bond issuance, but only if market conditions require it. This is not a set plan but depends on the situation. If investors are reluctant to buy more bonds at current rates or if borrowing costs become too high, fewer long-duration bonds may be issued in the future. However, there’s no specific timeline for this change. While Japan once played a major role in shaping global debt dynamics, its influence has diminished. It used to sit alongside the US and EU as a key player in determining interest rate expectations, but that is no longer the case. However, actions by central banks like the Federal Reserve and the European Central Bank will likely put downward pressure on global rates over time, assuming inflation stabilizes and policymakers feel that sufficient measures have been taken.Reacting To Shifts In The Market

For those managing derivatives linked to long-term yields, the key response involves adjusting exposure based on changes in the yield curve. If long-term JGBs continue offering higher yields, there will likely be a shift in pricing assumptions not only for options and swaps tied to Japan but also for global risk models. It’s important to consider how changes in Japan’s yield curve may impact cross-currency swap spreads, especially in yen or depending on rate hedging. Additionally, the volatility of these long-dated instruments may increase—not just from short-term news but due to broader shifts in supply expectations and central bank activities. It’s also a good idea to review short-term funding strategies. If longer bonds gain popularity or face liquidity issues, this could impact repo markets and influence cost of carry assumptions. Traders who base their strategies on the relative values of domestic and international sovereign bonds might discover new opportunities or encounter increased challenges. In simpler terms, we can expect more market fluctuations. Finally, being adaptable is better than waiting for certainty. Keeping an eye on supply announcements, central bank minutes, and cross-border positioning data remains crucial. There are enough developments to warrant our attention. Create your live VT Markets account and start trading now.Risk FX weakened after disappointing US-China trade talks, while Chinese equities gained.

Nathanael Benjamin from the Bank of England speaks at the Global Investment Management Summit on financial stability today.

Role of Risk Management Frameworks

Benjamin stressed the importance of strong risk management frameworks and the need to adapt to the fast-changing financial environment. He noted that these frameworks are crucial for the investment management sector to thrive. As market dynamics shift, Benjamin outlined effective strategies for long-term economic advantages. He emphasized taking proactive steps to protect against financial disruptions. His remarks remind us that we cannot leave market stability to chance. It requires continuous management through forward-thinking risk assessments and collaboration among institutions. He called on decision-makers to rely on frameworks that can withstand shocks and adapt under pressure. This isn’t just about creating new systems; it’s about strengthening the ones we already have and identifying any shortcomings. Although his speech targeted all asset managers, it delivered a clear message: we must address risks before they spiral out of control, requiring active engagement rather than passive observation. We must not depend on reactive strategies to navigate volatility. Instead, Benjamin urges us to refresh existing risk protocols immediately. This means examining not just the familiar hedges but also the ones we’ve neglected, assuming calm conditions would continue.Adjustments in Market Dynamics

Looking ahead, we cannot ignore the changes in interest rate expectations, geopolitical uncertainties, and liquidity pressures that are beginning to affect short-term exposures. Traders who speculate on interest rates or asset performance will need to adjust their positions carefully. Price spreads will fluctuate, and market reactions will be more sensitive to policy comments from authorities and financial institutions. At the core of Benjamin’s message is the need for discipline—not just in risk planning but also in its implementation during stressful times. Simple drawdowns won’t react the same way they have in the past. We must focus on layered controls, including stress testing, margin adjustments, and re-evaluating capital efficiency. This will impact how we assess certain trades. Carry positions might seem viable until they aren’t, and duration trades that once appeared reliable may need to be reduced before any major changes happen. We should consider simulating extreme outlier events more rigorously than we have in recent months. To assume that current volatility is the worst we’ll face invites risks of deeper systemic issues. These factors should be incorporated into every derivative position taken over the next quarter. The necessary tools already exist, many developed during previous downturns, but we must stop treating them as mere backups. Benjamin’s guidance is practical and meant for application across all active risk desks, margin call frameworks, and pricing models based on short-term assumptions. We need to reset our expectations. The message is clear: success in this field isn’t about predicting the next move; it’s about being prepared for unexpected changes. Create your live VT Markets account and start trading now.Modification on Leverage Notification – Jun 11 ,2025

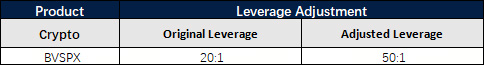

Dear Client,

To provide a favorable trading environment to our clients, VT Markets will modify the trading setting of Index products. Please refer to the following details:

1. Index BVSPX products leverage will be adjusted to 50:1.

The above data is for reference only; please refer to the MT4 and MT5 software for specific data.

Friendly reminders:

1. Except for leverage, all other transaction details remain unchanged.

2. The margin requirement of the trade may be affected by this adjustment. Please make sure the funds in your account are sufficient to hold the position before this adjustment.

If you’d like more information, please don’t hesitate to contact [email protected].

Asian markets react tepidly as US dollar rises amid stable currencies and tariff talks

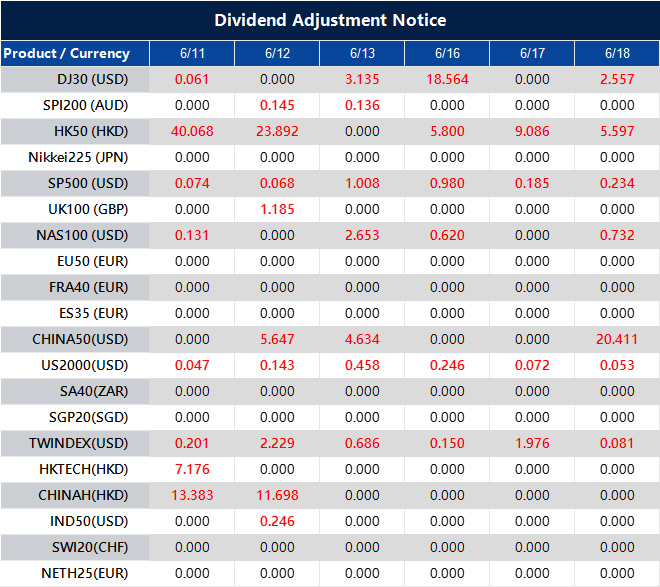

Dividend Adjustment Notice – Jun 11 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].