Today’s agenda has no data releases and instead focuses on anticipated positive US-China trade talks in London.

Week Ahead: Trade Tensions Take Centre Stage

Markets opened the week with cautious optimism following a strong finish the previous Friday. Investors were still digesting an encouraging US employment report, which revealed 139,000 jobs were added in May, comfortably exceeding the forecast of 125,000.

That headline figure helped lift equities to fresh highs, with the S&P 500 closing above the 6,000 mark. However, deeper inspection revealed a softer backdrop: revisions to past data resulted in a net decrease of 95,000 jobs over the previous two months, suggesting that while job creation continues, the pace may be moderating.

Wage data added complexity to the picture. Average hourly earnings rose by 0.4% on the month and 3.9% year-on-year, indicating that workers’ purchasing power remains ahead of inflation for the time being. This supports consumer spending and points to ongoing resilience in retail sectors as summer approaches. Still, questions remain over whether this can be sustained if uncertainty over trade policy begins to dent business sentiment.

Inflation, for now, remains contained. Headline CPI holds steady at 2.3% year-on-year, the lowest reading since early 2021, while core inflation has eased to 2.8%. These figures are within touching distance of the Federal Reserve’s 2% target, suggesting that pricing pressures are manageable for now. Crucially, neither wage gains nor tariffs have yet fuelled a fresh inflationary spike, though that balance may yet be tested.

Fed Remains Cautious

One reason inflation may appear subdued is the way businesses have front-loaded imports ahead of anticipated tariff increases. This strategy has bolstered inventories and helped cushion price pressures, but it could simply be postponing the real inflationary impact. Markets are alert to this possibility.

The Federal Reserve has so far resisted political pressure to act. Despite President Trump’s calls for a sharp 100 basis point cut, the Fed is standing pat. With unemployment low and inflation moderate, there is little case for immediate policy easing.

CME FedWatch data shows no chance of a rate cut at the upcoming June 17 – 18 FOMC meeting. Markets instead anticipate the first cut in September, potentially followed by a second before year-end, but only if the data warrants it.

This deliberate stance reflects the balancing act facing the Fed. Move too early and credibility is at risk; act too late and economic headwinds, such as tariffs, may bite harder. For now, the Fed remains guided by macroeconomic fundamentals rather than political demands.

Trade Tensions Take the Spotlight

Trade policy continues to loom large as the most significant potential catalyst for volatility. President Trump’s announcement that US – China trade discussions will resume in London brought brief relief to markets. Equities rallied on hopes for diplomatic progress, though companies remain hesitant. Many major firms have delayed investment and hiring decisions as they await clarity on tariff measures, a caution that may soon appear in earnings outlooks and capital expenditure data.

Markets find themselves in a delicate balance. Positive employment figures and subdued inflation offer support, but any misstep in trade negotiations could quickly undermine that stability. On 6 June, both the Dow and Nasdaq gained more than 1%, fuelled by the strong jobs print. Yet the rally could quickly reverse if talks stall or if inflation surprises to the upside once stockpiled goods give way to tariff-inflated costs.

Bond markets reflect this tension. Yields have ticked higher following the employment surprise, but softer data could see them retrace. The interplay between expectations for Fed policy and trade risks will continue to shape fixed income flows.

Prudence is prevailing. Traders are approaching mid-2025 with a mix of restraint and readiness. Should trade talks yield progress and inflation stay controlled, the argument for a rate cut later this year remains valid. However, if discussions falter and inventories shrink, consumers may begin to feel the pressure, forcing a repricing of risk across the board.

Market Movements This Week

In light of recent data and the Fed’s current stance, price action is being approached with a balanced perspective. While sentiment retains a cautiously positive tilt, several major markets are approaching key inflexion points.

The U.S. Dollar Index (USDX) climbed just above the 98.00 zone we’ve been monitoring. At this juncture, price appears poised to either consolidate near-term before pulling back, or continue higher into the 99.80–100.50 region. That next range becomes critical. Price action there will determine whether we’re shaping a broader bullish continuation pattern or setting up for a medium-term reversal. With the Fed holding steady and inflation in check, the dollar is trading more on positioning and global demand for safety than on yield dynamics alone.

EURUSD has slipped just below the 1.1520 zone, with 1.13564 now the key support. A break below may trigger broader downside, while a bounce could signal consolidation. We’re watching closely for structure confirmation at this level, maintaining a neutral stance until direction resolves.

GBPUSD sits just below 1.3600, with attention on 1.3460 and 1.3440 as key support levels. A break lower could trigger a broader correction, while a bounce may signal consolidation. With the dollar firm and risk sentiment cautious, we remain neutral-to-bearish until a clearer structure emerges at these thresholds.

USDJPY has been grinding higher, forming what could be a larger consolidation on the weekly scale. We are eyeing the 145.75 and 146.60 levels next. A rejection at either zone, with clear bearish structure, could offer a cleaner short-side play. However, the yen remains the weakest major currency structurally, and unless yields fall sharply, further upside is not off the table.

USDCHF also continues to lean into a consolidation phase. Our eyes are on the 0.8275 zone for signs of bearish exhaustion. If momentum stalls there and structure turns, we may see short setups develop, though the Swiss franc remains fundamentally driven by safe-haven flows, especially during tariff flare-ups.

AUDUSD and NZDUSD both printed new swing highs recently but have pulled back. For AUDUSD, 0.6460 becomes the pivot for any bullish setups. For NZDUSD, we’ll look to 0.5960. Both pairs are still largely tracking broader risk appetite and commodity sentiment. Watch copper and oil as secondary indicators.

USDCAD remains in a broader up-channel structure. If price consolidates into the 1.3750–1.3780 zone and fails to break higher, we will consider bearish opportunities. Crude oil stability could also cap further CAD weakness.

Speaking of oil, USOIL has finally begun to lift, but we remain cautious. The current move may be part of a larger consolidation. The 66.10 level is key. If price rejects there, we may see another corrective leg lower before more stable directional movement resumes. The market remains highly sensitive to geopolitical supply disruptions and trade-related demand forecasts.

Gold has been less convincing. Price failed to hold higher levels and has now revisited 3310. We anticipate a consolidation phase, with potential bearish setups at 3340. On a downward move, we are watching 3295 and 3265 for bullish price action support. Gold’s behaviour continues to reflect a lack of fear. There is no flight to safety just yet.

The S&P 500, on the other hand, continues its upward momentum. As we move higher, the 6100 level becomes the next key area. Reaction there will determine if the breakout holds or stalls. We approach this zone with caution given stretched sentiment and headline-driven volatility.

Bitcoin tested the 99,600 area and may now consolidate before attempting a move toward 107,550. Crypto markets remain highly reactive to risk appetite, regulatory headlines, and liquidity conditions. For now, structure remains bullish, but stretched.

Natural gas (Nat Gas) is showing upward momentum, but we expect resistance at 3.60. A clean bearish pattern at that level would mark a possible swing short opportunity.

As always, we monitor price zones for confirmation. Structure must align before entry. With macro sentiment holding firm but risks rising, it’s the reaction, not the forecast, that defines the trade.

Key Events This Week

Attention turns sharply to the US CPI report on Wednesday, June 11. Forecasts point to a year-on-year headline inflation rate of 2.5%, up from the prior 2.3%. A hotter-than-expected print could reignite concerns that the recent cooling in inflation may be stalling. That would likely push back expectations for a September rate cut and may firm the US dollar while weighing on risk assets. Conversely, a softer number would reinforce the recent disinflation narrative, potentially boosting equities and high-beta currencies.

On Thursday, June 12, the macro spotlight shifts to the UK and the US simultaneously. The UK GDP month-on-month figure is projected at -0.1%, down from the previous 0.2%. A downside print may weigh further on sterling, particularly if paired with risk aversion or dollar strength. Meanwhile, the US PPI is forecast at 0.2%, rebounding from last month’s -0.5%. This release will be closely watched for early signs of producer-level cost pressures feeding into consumer prices, especially in light of tariff implications.

Friday, June 13, rounds out the week with the University of Michigan Consumer Sentiment reading, forecast at 52.5 versus 52.2 previously. Though a secondary-tier release, sentiment data will offer insight into whether higher wage growth is translating into consumer confidence, or if political and trade concerns are beginning to weigh on expectations.

Create your live VT Markets account and start trading now.

In early European trading, Eurostoxx and German DAX futures fell, while UK FTSE futures gained slightly.

In May, Japan’s economy watchers index increased to 44.4, boosted by better household retail activity.

Consumer Sentiment And Business Confidence

The data indicates a slight boost in consumer mood on the high street and some growth in household spending, yet businesses, especially in manufacturing, feel uncertain. The diffusion index, which shows the percentage of respondents seeing better conditions, rose as consumers became more active, likely due to warmer weather and promotions attracting more shoppers. Nonetheless, production sectors face challenges tied to supply chain issues and shifts in global demand. Factory orders and export sentiment are weaker than expected, possibly leading to lower capital spending and hesitance in hiring in the coming months. The increase in the outlook index suggests people feel more secure in their jobs or see a slight improvement in job opportunities. This is often a lagging indicator; it doesn’t always lead to increased consumer spending, but it could indicate less hesitation in household spending if the trend continues. For traders focusing on volatility, this information could influence expectations around domestic demand and impact the yen’s value as more data becomes available.Market Dynamics And Strategic Adjustments

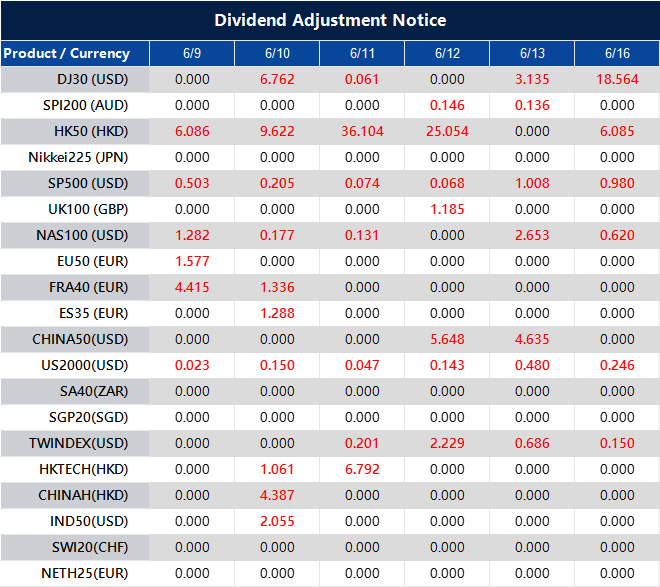

We see opportunities for relative value plays since short-term consumer resilience might not align with medium-term business caution. If retail data continues to strengthen without a similar rise in industrial output, the gap between consumption-focused investments and industrial ones could grow. This divergence is particularly important during the low-summer months when minor news can cause significant market movements. As market participants, we should view these indices not as definitive signals but as pieces of a broader picture that includes monetary policy, inflation trends, and local dynamics. With the Bank of Japan maintaining a unique position compared to other central banks, a sustained gap between employment expectations and manufacturing caution could open opportunities for adjusted hedging in interest-sensitive structures. Instead of making strong positions based solely on current sentiment, the data suggest better results by shifting focus to consumption-heavy sectors using short-term instruments while staying cautious on industrials until clearer signs of recovery appear. Balancing this with volatility metrics, which continue to lag behind actual moves, might allow for lower-cost entries into convexity trades within regional equity options. Throughout this period, household-led improvements are likely to fade faster than corporate recoveries solidify. We could analyze this gap by comparing small-cap performance to exporters or looking at upcoming inflation forecasts. The key lies not in the headline figures, but in how consistently consumer spending outpaces business sentiment through early summer. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Jun 09 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].