Gold prices rise in Pakistan today, according to the latest data.

New Zealand announces NZ$4 billion increase in bond program over four years, says Willis

Currency Reaction

The New Zealand Dollar has barely reacted to the budget news, trading 0.25% lower at around 0.5925. The government does not expect to see an operating balance surplus in the next five fiscal years, and trade tariffs remain influential on how quickly the economy can recover. Although the deficit figures may seem alarming—especially with a deeper deficit forecast for 2025/26—the government is prioritizing fiscal support over spending cuts. The projected 0.8% GDP contraction next year reflects this broader borrowing strategy which favors economic stimulus. Despite these challenges, core inflation remains steady. The forecast keeps inflation within the 1% to 3% band, indicating that price stability is not currently at risk. This allows monetary policy to stay stable without needing an immediate response. As the government increases bond issuance, funding costs may rise, but the Reserve Bank doesn’t need to react aggressively right away. The currency’s slight dip suggests that the market was prepared for these projections. The Kiwi dropped only 0.25%, indicating that investors are becoming more accustomed to deficit announcements when inflation and growth seem stable. This indicates a calm response regarding interest rates and currency fluctuations.Trade and Interest Rates

The balance of risks largely depends on timing. While the multi-year recovery looks promising from 2025 onward, the current economic downturn will impact interest rates. Expect the yield curve to remain relatively flat over the next two quarters, especially if international factors remain subdued. It’s essential to analyze future expectations. Export tariffs continue to impede predicted trade growth, which adds uncertainty to the recovery but is less affected by domestic policies. Positions that consider a slow or uneven improvement in trade balances may perform better than fixed growth expectations. Short-term interest rate trades may stay stable unless the Reserve Bank changes its approach sooner than anticipated. However, for longer-term rates, any increase in bond issuance could widen spreads, especially during periods of weaker GDP. We are focusing on how interest rates in New Zealand compare to global benchmarks, noting how the budget plan aligns with monetary policy. For those trading volatility, a stable inflation outlook suggests limited upward movement in break-evens and inflation swaps in the short to medium term. However, with growing deficits and borrowing needs, concerns about sovereign credit can arise intermittently. Option pricing might remain low, but could rise if debt issuance outpaces market absorption. Robertson’s budget figures did not significantly impact the Kiwi, but the ongoing debt dynamics and changing long-term growth rates create opportunities—especially as policy differences emerge. Be cautious with long Kiwi positions during global rate changes or demand shocks. The real challenge will be watching whether the anticipated bounce in 2025/26 overcomes initial hurdles or if downward revisions threaten the projected 3% growth targets. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – May 22 ,2025

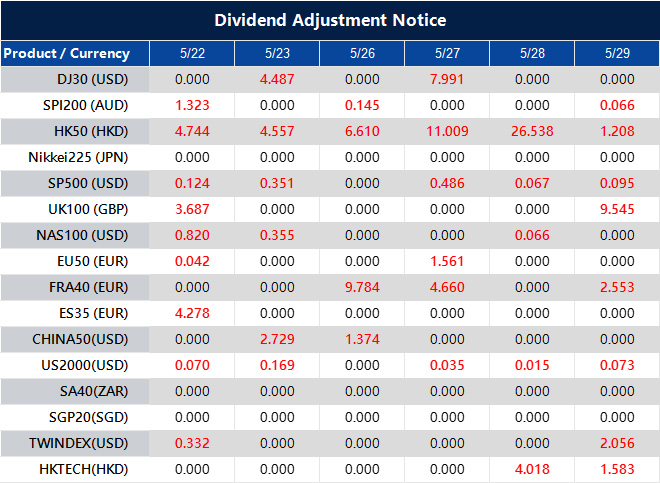

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].