Swiss unemployment rate hits 2.9%, surpassing expectations and reaching its highest level since August 2021

Japan to propose cooperation package with the US on rare earth elements and tariffs

The Nasdaq shows tight trading around VWAP, suggesting indecision and offering cautious bullish and bearish strategies.

VWAP Prediction

VWAP helps predict Nasdaq prices and guides entry, exit, and stop-loss strategies using standard deviation bands. A bullish level is set above $21,750, with partial profit targets at $21,763.5, $21,771, and $21,789.5. Additional targets are $21,840, $21,855, and an ambitious $22,000. A bearish strategy activates below $21,740, just under yesterday’s VWAP. Quick profit-taking is advisable, with targets at $21,734, $21,726, and $21,713, among others. Traders should focus on taking profits at these levels to manage risk and adjust stops accordingly. This analysis comes from tradeCompass, which will soon be integrated with investingLive.com. Building on these observations, it’s important to understand what these technical signals mean as they influence our trading decisions. When the market forms a doji candle pattern at a price level where it has spent a lot of time, it often suggests a pause in direction—there’s no clear buying or selling pressure. So, when futures linger around the VWAP with minimal movement, it often indicates a tired trend or hesitation before a bigger decision. Currently, this is happening just above 21,700. There’s congestion in this price range as buyers and sellers both attempt to gain the upper hand without success. The VWAP acts like an anchor point around which recent trades fluctuate. When prices edge above 21,750, there’s usually more interest in testing previous highs or pushing above known resistance levels. This creates an opportunity for quick trades and small profits. Looking ahead, the goal is not to expect a huge price swing but to watch for smaller movements that align with earlier price points. The upper targets—once prices rise above the neutral line—are based on recent price ranges, making them less reliant on speculative breakouts.Downside Strategy

On the downside, the same principles apply. Falling below 21,740 is significant because it’s below both an average and recent trading activity levels. This breach can eliminate support, leading to faster downward movements and lower support targets. It’s about reducing risk early rather than assuming those levels will hold. During quieter trading weeks, when volatility is low and prices coil around the VWAP, we focus on areas where prices have spent time instead of where large price movements happened. This allows for smaller trades with tighter stops and quicker exits—not because we predict a sudden price snap-back, but to protect our positions and avoid midday drift that can reduce profit opportunities. Thompson’s structured exit zones are based on these value areas, allowing partial profits to be taken before entering less liquid price zones. It’s also notable that upper targets don’t skip multiple levels; instead, they follow measured steps, inviting shorter holding times unless there’s a significant increase in volatility. Ultimately, a market session like this doesn’t require aggressive overnight positions or hasty short trades without clear breakdown signals. Instead, we watch for signs of impatience or stability in the market and use the standard deviation lines around the VWAP to define safe trading spaces. Create your live VT Markets account and start trading now.The Asian market stays quiet, awaiting ECB decisions, even as China’s Services PMI shows growth

Kugler and Harker will speak about economic matters and policies at upcoming events.

Federal Reserve Speeches Impact

The speeches from Kugler, Schmid, and Harker will shed light on the Federal Reserve’s views on monetary policy, regulation, and banking conditions. Kugler’s comments are important as they will be delivered at a luncheon with many market participants. She is likely to discuss interest rates, inflation trends, the strength of the job market, and the impacts of previous tightening measures. These topics can significantly affect short-term trading, especially on interest rate expectations. Therefore, any changes in tone or references to timing for policy adjustments must be closely monitored. Schmid will focus more on banking issues than on interest rates. His thoughts on regional banks’ strength and the regulatory environment may influence views on financial stability. If he highlights concerns about funding stress or risks from deposit withdrawals amid rising rates, it will likely attract attention to the Fed’s focus on the broader effects of tighter policy. Any mention of contingency plans or changes in supervision could trigger volatility in bank-related financial products. Harker’s comments may echo Kugler’s themes but usually feature more anecdotal evidence. Markets are attentive to his insights on regional economies, including spending habits, service sectors, and employment patterns. If Harker emphasizes a “higher-for-longer” approach—especially with mentions of wage persistence or inflation in housing—it could lead to fewer expected rate cuts than futures currently predict. Recent market responses to Fed officials with voting power indicate that SOFR and Treasury option markets have reacted swiftly following similar speeches. Although volatility has decreased, it can quickly change based on the tone and wording of policymakers.Market Reaction Strategy

With all three speeches timed closely together, it makes sense to stay flexible with interest rate positioning this afternoon. While one comment may not change the market significantly, the combined messages over a short time can influence expectations for rate cuts, especially in light of Tuesday’s CPI data and recent jobless claims. Our strategy suggests maintaining a neutral stance and being cautious ahead of these speeches. Be ready to quickly adapt if the remarks lean more hawkish or dovish; even slight changes in language can impact the market when all three officials speak nearly at once. Create your live VT Markets account and start trading now.PBOC may cut RRR to support liquidity in 2025, according to a state media report.

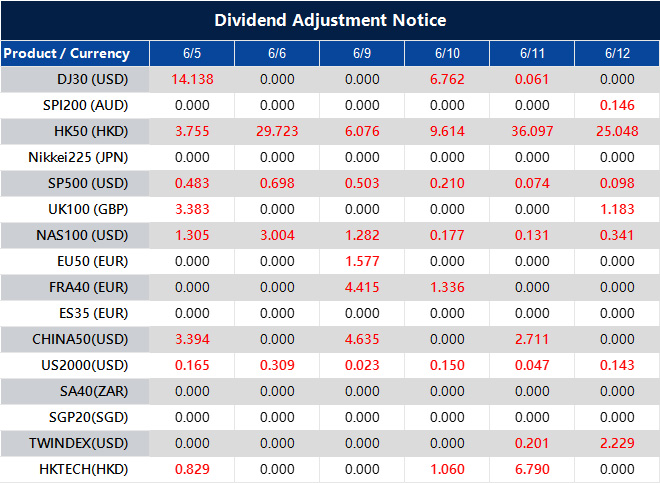

Dividend Adjustment Notice – Jun 05 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].