In August, the small business optimism index increased to 100.8, exceeding its historical average.

Economic slowdown and Fed rate cuts raise concerns, causing USDCHF to decline at a key level

The US Dollar Stays Within a Range

The US dollar is stuck in a range, pressured by expectations about the Fed’s plans. If the expected rate cuts boost the economy, it could cancel future rate cuts, helping to stabilize the dollar. However, the dollar’s overall trend is downward, and we need strong data to change this. The Swiss National Bank (SNB) is currently on hold because Swiss inflation is not reaching the 2% target. The central bank is reluctant to lower rates to negative levels, which makes the CHF responsive to the strengths of other currencies. On the 4-hour chart, the USDCHF is near 0.7910, a critical point for buyers looking to push prices to 0.7985, while sellers are watching for a drop to 0.7870. Economic reports expected this week, including US PPI, CPI, and jobless claims, could influence these predictions. The US dollar is under pressure after the August NFP report showed only 110,000 new jobs, raising the unemployment rate to 4.1%. Markets are now fully anticipating 70 basis points of Fed rate cuts by the end of the year. The CPI report on Thursday is key; if it shows lower growth than the expected 0.2% monthly rise, it could lead to a larger rate cut in September and push the dollar lower. We should be cautious, as speculative short positions on the dollar are at levels not seen since early 2021, indicating a crowded bearish sentiment. If these rate cuts stimulate the economy in the coming months, expectations for further easing in 2026 could evaporate quickly. This would set a strong base for a dollar recovery, even if the immediate trend remains negative.Swiss National Bank Remains Neutral

On the other side, the Swiss National Bank is staying neutral, as recent inflation data showed only a 1.4% annual rate, far from their 2% target. They are unlikely to cut rates into negative territory, meaning the franc’s value relies mainly on the US dollar’s movements. Thus, upcoming US data is critical for this currency pair. For traders anticipating a bounce off the 0.7910 support level, buying short-dated call options on USDCHF with a strike around 0.7925 could be a good strategy. This provides a way to profit with defined risk from a move back towards the 0.7985 resistance. This strategy would be effective if the US PPI or CPI report later this week surprises positively. Conversely, if we expect the dollar’s downward trend to gain speed, a break below 0.7910 would be a good signal. A simple approach is to buy put options with a strike near 0.7900, targeting the 0.7870 level. This trade would be especially appealing if Thursday’s CPI data comes in much lower than expected, supporting the market’s dovish Fed outlook. Create your live VT Markets account and start trading now.Market sentiment in Asia improves as stocks and gold hit record highs, despite worrying economic indicators

Japanese Market Update

The PBOC set the USD/CNY rate at 7.1008, the strongest since November 2024. The USD weakened as Japanese stocks rose. Japan announced an LDP leadership election set for October 4, sparking local interest. In the U.S., a job survey revealed that the chance of finding a job has decreased to 44.9%. In Australia, consumer sentiment fell by 3.1% in September, while UK retail sales showed a 3.1% yearly increase in August. Lumber futures plummeted nearly 24% from their highs in August. In politics, Athens felt a 5.2 magnitude earthquake, and China and Canada are discussing economic cooperation. Overall, the market atmosphere was risk-positive, with gold, Bitcoin, and oil prices rising despite some weak economic signals.Market Signals Analysis

Currently, the market is sending mixed signals. Gold is rising above $3,650, indicating either high inflation or a shift towards safer investments. However, the U.S. job market looks weak, with the job-finding probability reaching a record low, and non-farm payroll growth for August slowing to just 95,000. This puts the Federal Reserve in a tricky situation, making future interest rate decisions uncertain. Some believe the Fed won’t cut rates, but we see potential in currency markets, as the Fed might need to ease while the European Central Bank stays steady. This situation supports the expectation for the EUR/USD to rise above 1.2000 by year-end, making long positions in euro derivatives attractive. Strong momentum in hard assets suggests they could be a key hedge amid economic uncertainty. Gold testing $3,700 and oil near $63 per barrel indicates traders are betting on ongoing inflation. Last month’s CPI data showing core inflation stubbornly above 4% backs this outlook. We also need to pay attention to warning signs in certain sectors. The significant drop in lumber futures raises concerns for the housing market, supported by the recent 10% dip in housing starts in August. This situation suggests that put options on homebuilder ETFs might provide valuable protection against downturns or even speculative profits. While the Nikkei reaches new heights, we remain cautious about U.S. tech stocks, as major players like NVIDIA show signs of stalling. We saw a similar trend in 2022, where rising commodity prices and inflation fears led to sharp corrections in growth-focused tech stocks. With these mixed signals, positioning for higher market volatility using VIX options seems wise. Create your live VT Markets account and start trading now.The USD/JPY pair is trending down as discussions about BOJ rate adjustments continue.

This week focuses on US inflation, but job revisions are expected to show downward adjustments.

Job Revision Impact

Last year, a similar adjustment showed that there were 818,000 fewer jobs than reported up to March 2024, highlighting issues in the labor market. The current revision might affect how people view interest rate cuts, especially since nearly three cuts have already been anticipated, raising questions about what actions might be taken before new inflation data comes out this week. This jobs revision is likely to reveal that the U.S. labor market is weaker than previously believed. The preliminary estimates could show a loss of up to 800,000 jobs by March 2025, significantly altering the previous narrative. It implies that the average job growth for last year was about 100,000, rather than the reported 165,000. This slowdown doesn’t happen in isolation; it adds to existing data. The unemployment rate rose to 4.1% in August 2025, and job openings reported in the JOLTS survey have fallen below 8 million. A significant downward revision today would confirm that the strength of the labor market was overestimated. We saw similar patterns when last year’s data was revised. The adjustment through March 2024 revealed 818,000 fewer jobs, serving as an early indicator of emerging weaknesses. If confirmed, this year’s revision suggests that such weaknesses are becoming a trend rather than an isolated instance.Implications for Traders and the Fed

For traders in derivatives, this scenario makes a case for a more cautious Federal Reserve stance. Since the market is already anticipating nearly three rate cuts, using options on SOFR futures could be a direct way to prepare for lower interest rates. This allows traders to benefit if the Fed ends up cutting rates more than expected. The immediate focus will be on the chance of a larger rate cut sooner rather than later. This revision, before the crucial CPI inflation data on Thursday, could lead the market to favor a 50 basis point cut at the next Fed meeting. Thus, keeping an eye on shifts in fed funds futures pricing will be crucial throughout the day. Given the potential for a significant market reaction, volatility could rise. Purchasing call options on the VIX index may provide a cost-effective hedge against sudden movements following today’s data or Thursday’s inflation report. This strategy can help protect a portfolio from uncertainties regarding the Fed’s future actions. Create your live VT Markets account and start trading now.The BoJ sees potential for a rate hike this year despite political influences and conditions

Market Sentiment and Investor Expectations

Demand for the yen went up after this news, but overall market feelings haven’t changed much. Investors still expect no hike in September. There’s growing belief that the BoJ will raise rates again before the year ends, probably in October or December. While the September 19 meeting is expected to be uneventful, this strengthens the idea of a more aggressive stance in the fourth quarter. The yen’s recent strength shows this shift in expectations. This optimism is backed by good data: Japan’s core inflation for August 2025 rose to 2.3%, above the bank’s 2% goal. A US trade deal finalized last month, which lowered tariffs on cars, has also eased pressure on the economy. This could give the BoJ the confidence to act. For derivative traders, this indicates a clear strategy to invest in yen volatility. The time between the September and October meetings is now active, making it a good opportunity to buy short-dated USD/JPY straddles to take advantage of any movements before the announcements. The implied volatility on the yen is low, similar to levels not seen since before the pandemic, indicating options are relatively inexpensive.Trading Strategies and Market Reactions

The strategy is to bet on a stronger yen, as the USD/JPY rate has stayed near the 155 mark for weeks. We are considering puts and put spreads on USD/JPY that expire in the fourth quarter, aiming for a drop back to around 150. Selling calls to fund these positions seems appealing, given the BoJ’s clear direction. Recalling the market’s reaction to the last rate hike in March 2024, the first in 17 years, can inform our strategy. That hike caused a quick but temporary price change in the yen and Japanese government bonds. This next hike would indicate a true path toward normalization, suggesting that long-term derivative strategies betting on a stronger yen could be worthwhile. Create your live VT Markets account and start trading now.USDCAD faces resistance at 1.3860 as both currencies deal with recent job report challenges

Technically For USDCAD

Technically, the USDCAD pair shows patterns across different timeframes. On the daily chart, rejections around the 1.3860 level hint at a head and shoulders pattern, needing a break below 1.3720 for confirmation. The 4-hour and 1-hour charts exhibit range-bound behavior, indicating defined risks and possible moves toward the 1.40 level or lower to around 1.3550. Key upcoming events include the US PPI, CPI reports, Jobless Claims figures, and the University of Michigan Consumer Sentiment report. Currently, USDCAD is tightly coiled between critical levels. The weak US job numbers from last Friday indicated that Non-Farm Payrolls added only 155,000 jobs in August 2025, heightening expectations for Federal Reserve cuts. This has removed some pressure from Canada’s weak employment report, leaving the pair lacking direction for now. The market has factored in roughly 70 basis points of Fed cuts by the end of 2025, a significant shift that has developed over the last quarter. This dovish sentiment is heavily impacting the US dollar, especially after the August 2025 CPI report revealed core inflation slowed to a 2.8% annual rate. However, with so much easing expected, we might be reaching peak pessimism for the dollar.Canadian Economic Outlook

In Canada, the outlook is challenging after Statistics Canada reported a net loss of 20,000 jobs and a rise in the unemployment rate to 6.3% for August 2025. This cements expectations for a Bank of Canada rate cut in October, limiting any potential strength in the Canadian dollar. The central bank is now balancing between a weakening labor market and persistent inflation. For derivative traders, the setup ahead of this week’s US inflation data indicates a volatility opportunity. The clear range between 1.3720 and 1.3860 makes an options strangle an appealing strategy. By purchasing both a call option above 1.3860 and a put option below 1.3720, traders can profit from a sharp move in either direction after the data is released. If the upcoming US CPI report on Thursday is weaker than expected, we anticipate a decisive break below the 1.3720 support level, potentially confirming a bearish head and shoulders pattern that has been developing since July 2025. This would likely shift our focus to the 1.3550 area as the next target. On the other hand, if the inflation number surprises on the high side, markets may quickly reduce their Fed cut expectations, leading to a strong USD rally. In this case, a break above the critical 1.3860 resistance would signal a sustained upward move. The next major target for buyers would then shift to the significant 1.4000 level. Create your live VT Markets account and start trading now.European stock indices show mixed performance, with gains in French and Italian shares

Market Sentiment: Calm Before the Key Event

Currently, the market feels steady, with European indices showing a mixed but calm start. This calm might signify a quiet period before the important US CPI report. Traders often see this as a chance to prepare for possible volatility. The CBOE Volatility Index (VIX) is near 14, indicating relatively cheap options before the major data release. It might be wise to buy protection, like puts on the S&P 500 or Eurostoxx 50, to shield against any negative surprises. This is a cost-effective way to protect long positions before potential market moves. Expectations are leaning towards a US CPI figure of 3.3%, a slight decrease from 3.4% in the last August 2025 reading. We remember the intense market reactions to inflation data in 2022 and 2023, where even a 0.1% miss could cause major fluctuations. A higher-than-expected number could negatively impact equities and pressure central banks to remain hawkish.Trading Strategies in Uncertainty

In Europe, the political situation in France adds specific risks, especially as markets react to the recent prime minister change. This might lead to underperformance in French equities if overall market sentiment declines. Traders might consider buying puts on the CAC 40 index to target this regional uncertainty. For those uncertain about market direction but confident there will be significant movement, volatility strategies can be appealing. There’s growing interest in straddles or strangles on major indices, which would benefit from a large price shift in either direction after the CPI report. This approach allows traders to focus on the extent of the reaction rather than predicting if the news will be favorable or unfavorable. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 09 ,2025

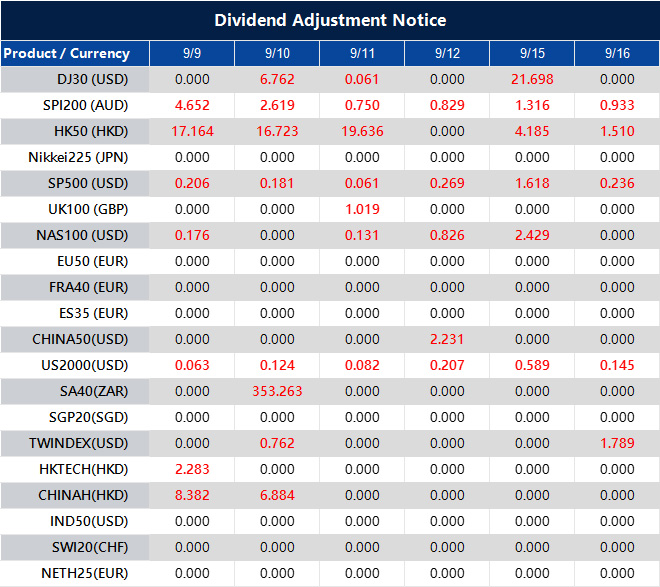

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].