The yen weakened after Ishiba’s resignation, but markets are cautiously optimistic about Japan’s stability.

European equities opened positively, showing a mild recovery in US futures after recent job report uncertainties.

Slight Rebound

We’re seeing a slight bounce as the market reacts to last Friday’s news. The jobs report indicated that non-farm payrolls were only 110,000, far less than the expected 180,000. This has led traders to expect a more relaxed approach from the Federal Reserve, shifting attention from inflation worries to possible economic slowing. This uncertainty is evident in the VIX, which has climbed to about 19, even as stocks rise. This means traders are seeking protection against a possible drop while also wanting to join in on a rally. One approach to navigate this uncertain market is through options strategies like collars, which involve buying a protective put and selling a call option. Now, everyone is focused on the inflation data set to be released on September 17th. If the Consumer Price Index shows lower inflation, it may strengthen the belief that the Fed will keep rates steady at its next meeting. We are also seeing more activity in options that expire right after that date, anticipating possible price movements.Looking Back To 2023

This situation reminds us of late 2023 when weaker economic data fueled a strong rally in equities as the year ended. Traders who bought call options on the S&P 500 during that time saw great gains. Many are now positioning for a similar outcome, though they’re wary of unexpected changes. A significant shift is occurring in interest rate futures too. The likelihood of a Fed rate cut by early 2026, according to the futures market, has risen from 40% to over 65% since last week’s report. This indicates that betting on lower rates lasting longer could be a smart move. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Sep 08 ,2025

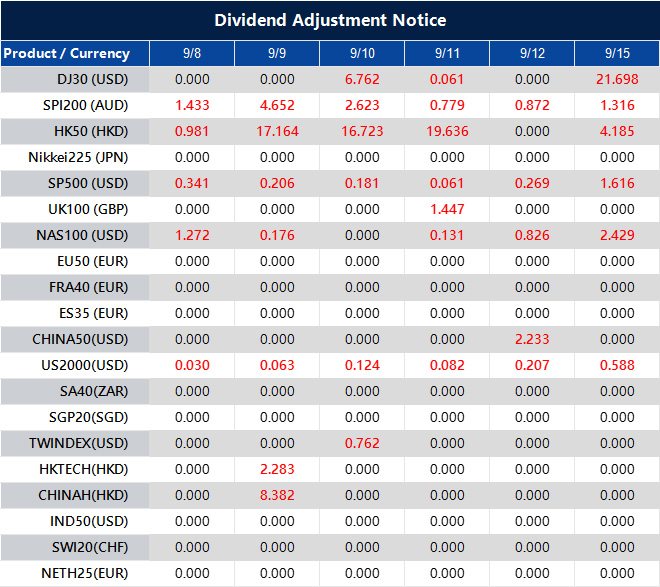

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].