Crude oil prices rise following cautious OPEC+ guidance and possible sanctions on Russia

Week Ahead: The Fed’s Bumpy Road

The American labour market has stumbled, and investors are already bracing for the Federal Reserve to hit the brakes.

August’s non-farm payrolls showed just 22,000 jobs added, a steep slowdown from July’s 79,000. Unemployment edged up to 4.3 per cent, its highest in years. Hardly a surprise, given the earlier warnings.

On 3 September, the JOLTS report revealed job openings had slipped to 7.18 million, the lowest since late 2024. The signs were there; the NFP merely confirmed them.

With manufacturing and trade shedding jobs and overall demand softening, the Fed is finding itself in a tight spot. Markets have reacted swiftly.

According to the CME FedWatch Tool, traders now price in a full 100 per cent chance of a rate cut at the 17 September meeting. That’s taken as a given. What has shifted is the outlook beyond: a 79.5 per cent probability of another move in October, with December’s odds climbing to 73.3 per cent.

Only weeks ago, investors were still debating whether the Fed would cut again at all this year. That conversation is over. The question now is how many times.

Much of this change stems from Powell’s comments at Jackson Hole. The Fed Chair didn’t just reference jobs. He made them the centrepiece. After two years of focusing squarely on inflation, he acknowledged that the balance of risk has tilted toward employment.

Governor Waller reinforced that urgency, insisting cuts should begin straightaway. It is now clear that the Fed views a weakening labour market as the more pressing danger, even while inflation holds above three per cent.

That makes the September FOMC meeting pivotal not only for the rate call but also for the dot plot. In June, projections pointed to two cuts in 2025. That stance already looks dated.

Following this NFP, policymakers may shift their dots lower, signalling three cuts rather than two. They will tread carefully, though. Inflation hasn’t convincingly broken lower, but softening the dot plot allows flexibility without over-committing.

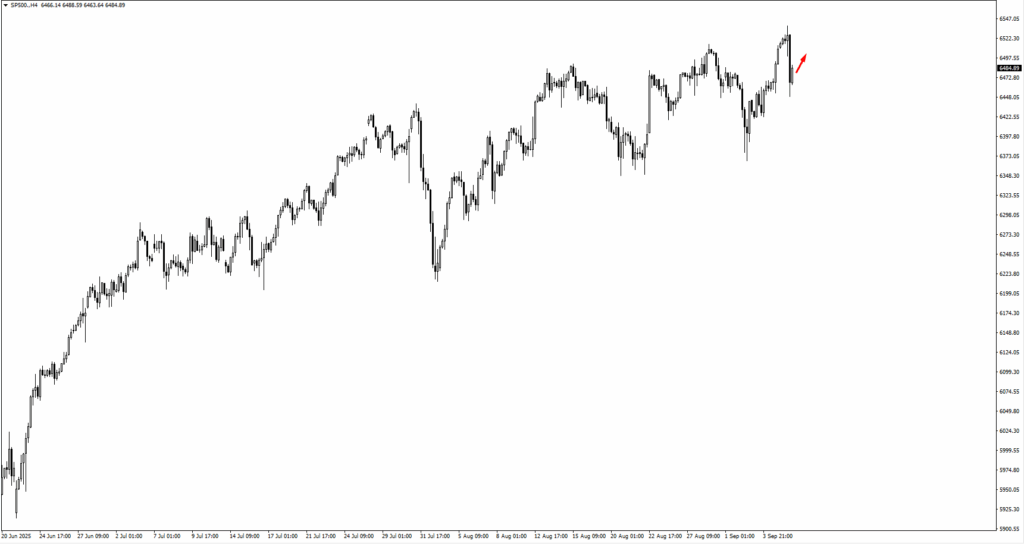

Market reactions have been uneven. The S&P 500 initially jumped on hopes of easier policy, but the rally quickly fizzled and the index closed near 6,480.

The failed breakout suggests investors are wary: they like rate cuts aimed at supporting growth, but cuts triggered by economic weakness tell a different story.

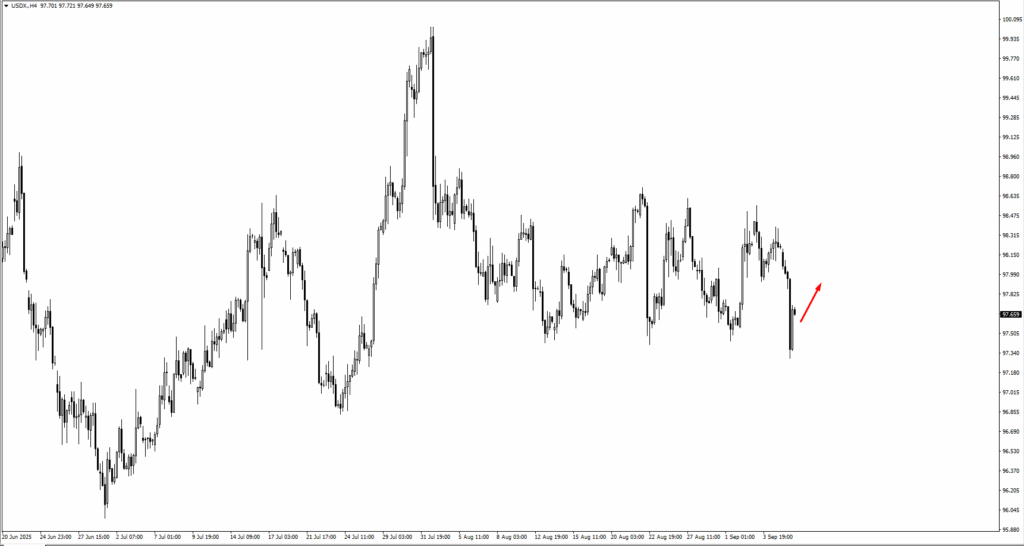

The dollar slipped too. The US Dollar Index fell beneath 97.40 before rebounding slightly to around 97.65. The move reflects collapsing yield expectations but stops short of a breakdown. A sustained move below 97.30 would tilt momentum more decisively lower.

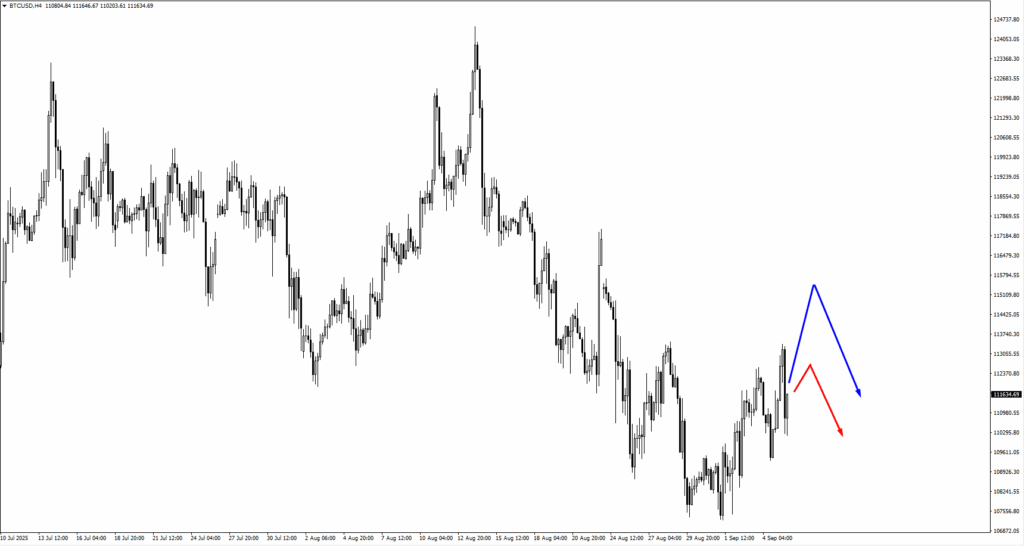

Bitcoin has acted like a classic risk proxy. It spiked to 113,000 USDT after the NFP before giving back gains, consolidating around 110,900.

With equities unsteady, BTC looks set to trade in a narrow band between 109,500 and 111,500. Sentiment is cautious, and without a lead from stocks, crypto may remain choppy.

Looking forward, the 11 September CPI report and the 17 September FOMC meeting are the real catalysts. A sub-3 per cent inflation print would harden expectations for October and December cuts.

If inflation proves sticky, especially in the core measures, the Fed may be forced to hold fire into year-end, keeping scope for easing in early 2026 instead.

Until then, markets sit between two narratives: confidence in a soft landing versus anxiety that the runway is running out.

Market Movements Of The Week

The US Dollar Index moved as expected post-NFP, slipping lower after breaking 97.409, then bouncing near 97.35 as it attempted to reclaim higher ground. Price action is now hovering just below 97.90, a key area where bulls will want to see a decisive close.

EURUSD pushed higher in response to the softer dollar backdrop. After forming a new swing high, the pair found resistance near 1.1755. The rejection at that level halted further upside for now.

GBPUSD also followed the directional bias, making a new swing high before rolling over. As the pair trades lower into the week, the 1.3475 level becomes the next important price zone to monitor for signs of renewed interest from buyers.

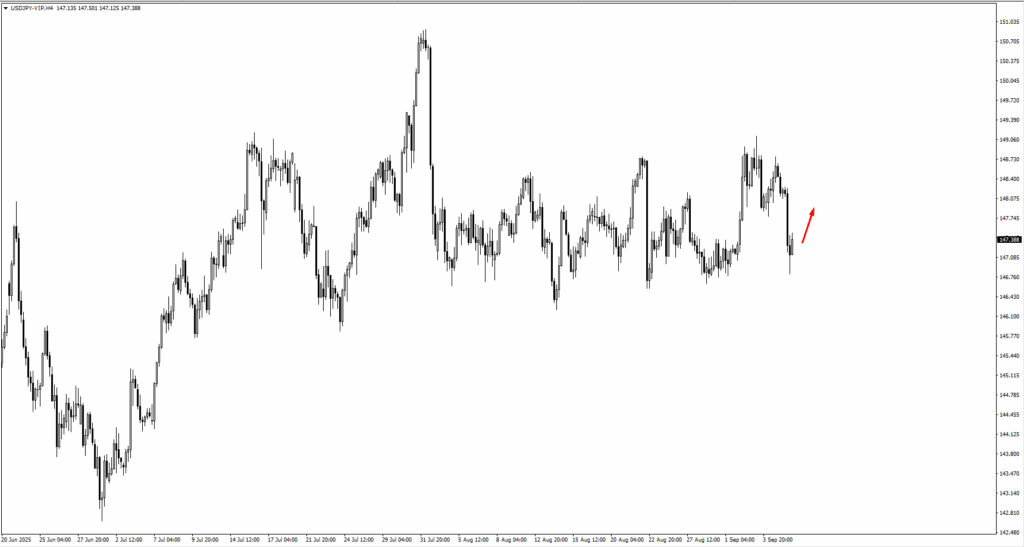

USDJPY remains in its consolidation phase, with price flirting above the recent 148.939 high before pulling back. With the pair still range-bound, eyes are now on the 148.00 handle as a possible re-entry point for buyers.

USDCHF followed the playbook almost perfectly. After hitting a weekly high from the monitored 0.8090 zone, price retraced and found support at 0.7960. The rebound from there has set up a new area of interest near 0.8015.

AUDUSD and NZDUSD both caught downside momentum. Aussie dropped from the 0.6590 resistance area and now eyes 0.6515 for potential support. Kiwi followed suit, falling from the 0.5930 zone and tracking toward 0.5850.

USDCAD bucked the dollar weakness trend and moved higher after the NFP release, breaking cleanly through local resistance. Traders are watching for follow-through above 1.3880.

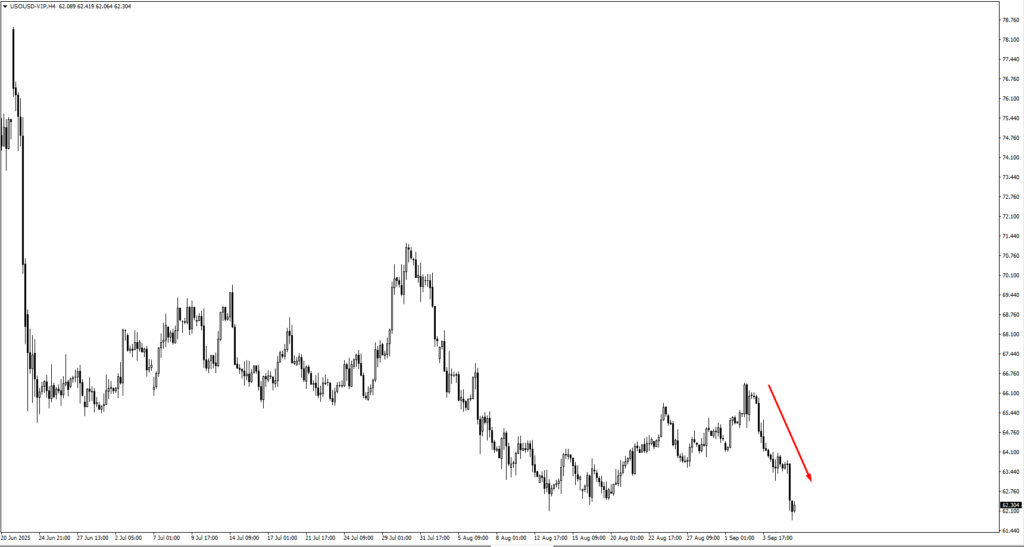

Oil struggled last week, pulling back from the 66.45 zone and now tracking toward 61.15. With demand expectations softening alongside global growth concerns, traders are starting to question whether crude can hold its recent uptrend.

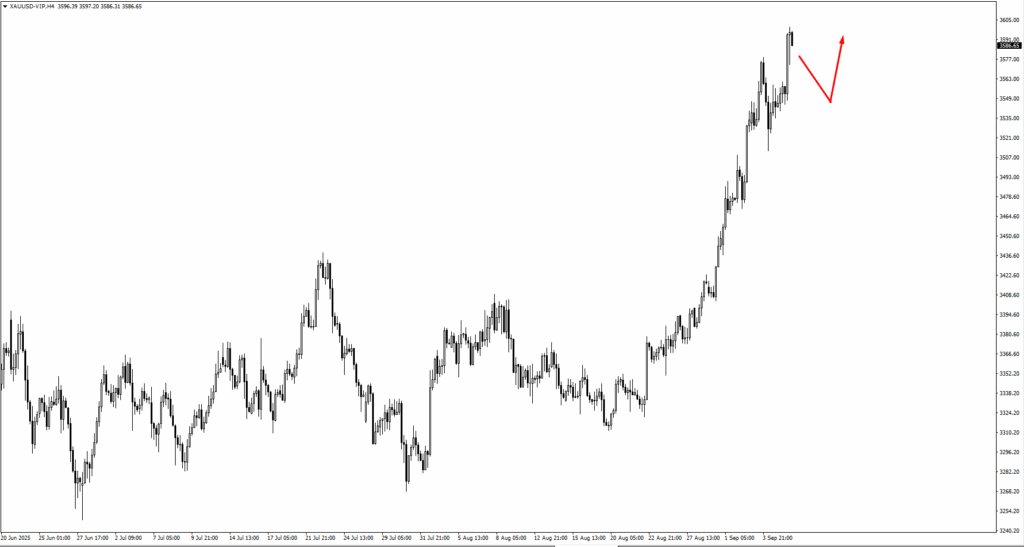

Gold is waiting. After reacting to the post-NFP drop in yields, the metal is now consolidating. Price action at 3530 will be critical. A strong bullish setup there could open a path toward 3650, especially if CPI prints softer and the dollar stalls.

The S&P 500 mirrored the broader risk tone. The index made a new swing high but failed to extend, pulling back and closing below 6,500. A retest of that level now becomes the line in the sand for bulls.

Bitcoin continues to behave more like a sentiment barometer than a safe haven. It dropped toward the lower edge of the 114,400 zone and has yet to show decisive direction. Price is hovering near 112,350, where bulls may attempt to defend again.

Natural gas has slipped lower once more after failing to break out above the 3.04 zone. Price is now eyeing 2.91 and potentially 2.87 next. With cooling demand and no clear catalyst, nat gas remains in a technical downtrend for now.

Across the board, markets are recalibrating. The weak jobs print changed the tone, but this week’s CPI and the FOMC next week will decide whether traders double down on the dovish pivot or rein in expectations.

Key Events Of The Week

On Wednesday, 10 Sep, US Producer Price Index (PPI) month-over-month is forecast to rise 0.3 percent, cooling from July’s 0.9 percent. The drop would support the case for weakening inflation momentum, especially if it aligns with soft labour conditions.

If the US Dollar Index has indeed finished its upward consolidation, this number could nudge it lower again. That said, any upside surprise may revive short-term dollar bids.

Thursday, 11 Sep, brings two big prints. The Eurozone’s Main Refinancing Rate is expected to remain flat at 2.15 percent. That’s no change from the prior reading, but with inflation still sticky and growth slowing, the tone of the accompanying press conference will matter more than the number itself.

Traders will likely treat the policy language as a signal of whether the European Central Bank will hold the line or join the global dovish pivot.

Meanwhile, US CPI year-over-year is forecast to accelerate to 2.9 percent from 2.7 percent. If the data comes in below expectations or stays flat, markets may take it as a green light for the Fed to proceed with a full rate-cut cycle.

On Friday, 12 Sep, the UK takes the spotlight with GDP month-over-month expected to stall at 0.0 percent, down from 0.4 percent. That’s a weak signal, and if confirmed, it could increase pressure on the Bank of England ahead of its upcoming policy decision.

Weak GDP might reduce the odds of further hikes or even accelerate discussion around rate stability. Sterling could come under pressure if paired with soft CPI the week after.

Rounding out Friday’s session is the University of Michigan Prelim Consumer Sentiment Index, forecast at 58.0 versus 58.2 previously.

While not a market mover on its own, a surprise drop could reinforce recession worries. With consumers driving the bulk of US GDP, any sharp swing here may contribute to risk-off trading heading into the weekend.

French Prime Minister Bayrou faces a confidence vote, raising concerns about potential market impacts on EUR/USD.

GBP/USD recovers after losses from a weaker NFP report as market expectations shift significantly

Technical Analysis Of GBP/USD

For GBP/USD, traders watch key resistance and support levels closely, reacting to potential breaks or rebounds. The daily, 4-hour, and 1-hour charts suggest that buyers may aim for higher levels if current momentum continues or if they break through key resistance. Upcoming economic reports, like US PPI and CPI, UK GDP, and consumer sentiment, will influence the market. The US dollar weakened last Friday after the Non-Farm Payrolls report revealed only 110,000 job gains, missing expectations. This weak data has led to predictions of three Federal Reserve rate cuts by the year’s end. As a result, the derivative markets now show over a 90% chance of a cut at the September 17th FOMC meeting. All eyes are now on the US CPI report scheduled for this Thursday, with economists expecting a 0.2% month-over-month increase in the core reading. A lower figure could prompt more dollar weakness and signal options traders to buy GBP/USD calls. Conversely, a stronger-than-expected result could quickly shift the market’s view on the pace of Fed cuts. For the pound, the situation is quite different. The Bank of England is worried about persistent inflation, as last month’s UK CPI printed at 3.1%. This keeps pressure on the central bank to hold off on further cuts. This difference in policy approaches is a key reason for the continued strength in the GBP/USD pair.Market Positioning Strategies

Currently, the pair is testing the important 1.3590 resistance level after bouncing back from the 1.3368 support area. Traders may consider buying short-dated call options with a strike price above 1.3600 in anticipation of a breakout from a weak US CPI report. Alternatively, put options below the current upward trendline could offer protection if US data turns out strong. This situation reminds us of market behavior in spring 2024, when weak US data led to a significant dollar decline. While we acknowledge that bearish dollar positions may be getting crowded, it seems that the easiest path for the dollar is down. A strong upside surprise in the data would be needed to change this outlook. Create your live VT Markets account and start trading now.Bitcoin activity stays strong, but treasury companies are spending cautiously, indicating a shift in approach.