USD weakens after Powell’s comments; upcoming US data could impact rate expectations and fluctuations

Nasdaq futures indicate bearish trends below $23,463, necessitating price movements to surpass certain thresholds for changes.

Bearish and Bullish Targets

If prices stay below the Decision Range, the market is likely to decline. Initial bearish targets are $23,417, $23,400, and $23,374. Further targets to watch are $23,312, $23,276, $23,226, and $23,123. It’s wise for short positions to not extend beyond $23,482; failing to stay below $23,513 could signal a shift to bullish trading. If prices hold above $23,513, potential bullish targets include $23,531, $23,543, $23,575, $23,665, and $23,695. A drop below $23,445 would cancel the bullish trend. Traders should manage risk carefully and take partial profits at key levels. TradeCompass can support decision-making but traders must act independently. Since hitting an all-time high of over 24,000 on August 13, 2025, the Nasdaq has pulled back, and we now focus on the key pivot zone around $23,450. The current trend feels bearish as long as we stay below this mark, indicating the market is searching for its next major driver. The upcoming Federal Reserve’s Jackson Hole symposium later this week should provide guidance on interest rates, which will be crucial as recent economic data has created uncertainty. The Fed’s messages will shape market direction in the weeks ahead, explaining the range-bound trading since the pullback.Economic Indicators and Market Strategies

The July 2025 Consumer Price Index (CPI) was 3.4%, offering a slight relief but still showing inflation is stubbornly above the Fed’s 2% target. When combined with a slowing Q2 2025 GDP growth of 1.8%, the information gives the Federal Reserve reasons to consider various actions. For derivative traders, it’s essential to prepare for substantial movements as the market chooses its path. If the news pushes the market down and we break below $23,400 decisively, traders might position for a deeper correction, targeting a retest of the recent lows around $23,000. Buying put options with September expirations or starting short futures positions would be direct strategies in this case. On the other hand, if encouraging remarks help the market reclaim the $23,513 level strongly, the uptrend might restart. A sustained move above this point would make call options or long futures positions more appealing, aiming first for the $23,700 resistance before attempting the 24,000 all-time high. As we approach September, we can expect increased volatility regardless of whether the market rises or falls. Historically, September has been a weak month for stocks, with the S&P 500 averaging declines since 1950. Strategies that profit from price swings, like straddles, may work well. Currently, with the VIX at a relatively low 15.2, buying options is not very costly, making it a favorable time to define risk through derivatives. Consider purchasing puts to protect long stock portfolios or using debit spreads to speculate on upcoming moves with limited downside risk. Create your live VT Markets account and start trading now.Credit Agricole expects the Fed to make two rate cuts because of ongoing inflation pressures

Market Expectations

Credit Agricole expects the Federal Reserve to lower interest rates twice before the year ends—once in September and again in December. They predict the target rate will drop to 4.00% after a period of steady policy. This forecast comes from ongoing inflation, which limits the Fed’s ability to make big changes to monetary policy. The US economy is slowing down but not heading into a recession. Credit Agricole finds the job market to be fairly stable. This stability allows the Fed to avoid major reductions in rates. While inflation might temporarily rise due to tariffs, any impact is likely to be brief. As the US awaits the next jobs report, which will help guide the Fed’s decisions, the outlook aligns with expectations for rate cuts beginning in September. We anticipate two rate cuts of 25 basis points each by the year’s end. However, because inflation remained stubborn at 3.4% in July 2025, the Fed won’t be able to make dramatic cuts. This situation indicates a slow, careful approach to reducing rates.Investment Strategies

We are closely monitoring interest rate futures linked to SOFR, which show a strong chance of the first cut happening next month. The upcoming jobs report, due in early September, could change these expectations. If the report is unexpectedly strong, it might challenge the idea of a rate cut in September and increase short-term market volatility. In this context, we expect a modest rise in stock prices, unlike the sharper market movements we observed in late 2023 when rate cuts were first anticipated. Given the unpredictability, options strategies that thrive on increased volatility, like purchasing straddles on the S&P 500 before major data releases, could be beneficial. The CBOE Volatility Index (VIX) is currently around 15, which is low historically and offers a cost-effective opportunity for volatility trades. The job market remains robust, evidenced by the last Non-Farm Payrolls report, which added 190,000 jobs. This gives policymakers a reason to be patient. Consequently, we see trading strategies heavily reliant on fast rate cuts as risky. Data indicating continued economic strength may pose short-term challenges for both bonds and stocks. Additionally, we must note that tariffs could lead to a temporary increase in inflation later in the year. This complicates straightforward predictions that interest rates will only fall. It may be wise to protect long-term positions against possible short-term spikes in inflation expectations. Create your live VT Markets account and start trading now.Barclays’ model indicates dollar weakness, mainly driven by US equities and bonds, excluding the euro and yen.

Neutral Outlook for the Euro and Yen

The euro and yen are stable due to the strong performance of European and Japanese bond markets. This helps offset the selling pressure on the dollar. In the upcoming month, we expect selling pressure on the U.S. dollar against most currencies. The S&P 500 has gained 1.5% this August, causing large funds to sell dollar-denominated stocks to balance their portfolios. This selling is likely to influence dollar prices as the month ends. For traders, this indicates a strategy of betting on a weaker dollar, especially against commodity currencies like the Australian and Canadian dollars. Buying short-term call options on AUD/USD or NZD/USD could be a smart way to take advantage of this expected dollar decline. These rebalancing flows are usually predictable and can overshadow other market trends.Euro and Yen as Exceptions

However, the euro and yen are expected to behave differently, likely staying stable against the dollar. The strong performance of European and Japanese government bonds this month is countering the weaker dollar trend. For example, German 10-year bund yields fell 20 basis points in August, balancing out pressures from US equity markets. This suggests selling short-term volatility in EUR/USD could be a good strategy. Last week’s comments from the Jackson Hole symposium should be seen as a minor factor for now. While the Fed hinted at a possible pause, the market is mainly focused on large month-end liquidity events. The lack of strong policy commitments means that these technical flows will dominate. This pattern is similar to what we observed in parts of 2023, where market flows often influenced currency movements when there were no major economic surprises. We predict this trend will continue over the next week or two. Therefore, opting for strategies that benefit from a gradual decline in the dollar or stable trading ranges is the wisest approach. Create your live VT Markets account and start trading now.European markets open lower as French stocks see the biggest decline, reflecting cautious sentiment

Traders await US employment data that could affect gold prices amid changing interest rate expectations.

Impact of NFP Data

If the NFP data is positive, it might reduce the chances of a September rate cut, which could negatively affect gold prices. On the other hand, weak data could raise expectations for more rate cuts, helping gold prices rise. Although we expect real yields to fall due to Fed easing, any adjustments to short-term interest rates may cause fluctuations in gold’s current upward trend. In the daily gold chart, prices are moving between 3,438 resistance and 3,245 support. The market remains in a range until a clear breakout happens. In the 4-hour chart, gold saw a rise but then fell back to 3,350. Buyers are likely targeting the resistance level. If prices drop further, sellers might look to reach the 3,245 support. Today’s key focus is on the US Consumer Confidence report, followed by US Jobless Claims on Thursday and the US PCE price index on Friday.FED’S Impact On Gold

The Federal Reserve’s recent dovish shift has changed the outlook, leading us to believe rate cuts are on the way this year. The market is currently forecasting a high chance of a September cut, especially after July’s Core PCE data showed a manageable 2.7%. Attention will be on the upcoming labor market data for direction. Next week, the US Non-Farm Payrolls (NFP) report will be crucial for derivative traders. It could determine the Fed’s next move and influence gold’s short-term direction. Traders should be ready for two different outcomes. If the jobs data is strong, say over 200,000, expectations for a September rate cut will likely fall, putting pressure on gold prices. In this case, traders might consider buying puts on gold futures or ETFs to hedge against or profit from a potential drop to the 3,245 support level. A solid report would challenge the current dovish stance. Conversely, if the jobs report shows less than 150,000 jobs, it would boost expectations for more rate cuts, possibly three by year’s end. This could drive gold prices higher, making call options appealing to capture the upward momentum toward the 3,438 resistance. Such low job numbers would indicate that the economy is slowing sufficiently for the Fed to take action. We saw a similar situation during the aggressive rate hikes of 2022-2023, where consistently strong labor data kept real yields high, putting pressure on gold prices. Now, with the Fed easing, lower real yields should support gold over the long term, though short-term fluctuations will be driven by data surprises. Technically, gold is trading in a defined range between 3,438 resistance and 3,245 support. Before the NFP release, traders might consider volatility plays, like buying straddles, to profit from a breakout in either direction. Until that happens, price movements are likely to stay contained. In the short term, the 3,350 level is a key pivot point. If prices dip toward this level in the coming days, it could be a buying opportunity for tactical traders looking to purchase short-dated call options, expecting a bounce. However, if prices break below this level, it would signal weakness and open the door for a move down to the main 3,245 support. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 26 ,2025

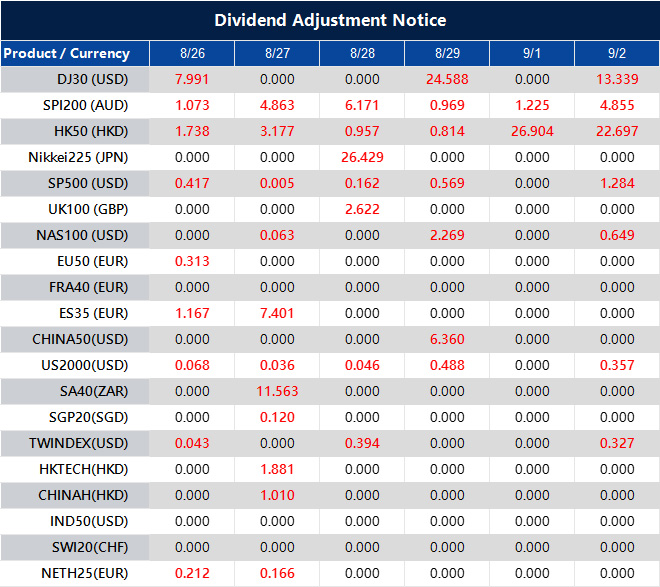

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].