European stocks fall as caution rises before month-end, with UK markets closed today

A busy week ahead with important data releases affecting global markets and economic forecasts

Economic Indicators and Predictions

In the U.S., the forecast for new home sales is 635K, up from 627K the previous month. However, sales are still about 7% lower than last year due to high mortgage rates. Core durable goods orders are expected to rise by 0.3% month-over-month, while overall durable goods orders may drop by 3.8%. High borrowing costs and uncertain trade policies remain hurdles for large investments, causing further declines in business equipment spending. In Australia, July’s CPI is projected to rise to 2.3% year-over-year from June’s 1.9%. This increase reflects higher electricity prices expected after earlier discounts. Japan’s Tokyo core CPI is anticipated to decrease to 2.6% from 2.9%, mainly due to lower energy prices, although food prices remain high. In the U.S., the core PCE price index is expected to be 0.3% month-over-month, while personal income and spending are both predicted to rise by 0.4% and 0.5%, respectively. Signs of stability in U.S. consumer spending are evident, with retail consumption increasing by 0.5%. Personal income is also expected to rise by 0.5%, driven by wage growth and longer working hours. Nevertheless, inflation pressures are likely to increase, especially as core PCE rises, which will challenge the Fed as it navigates slow growth and ongoing inflation. This week, our main attention is on Friday’s U.S. Core PCE inflation report, which will significantly shape expectations for a Fed rate cut in September. Currently, markets estimate about a 60% chance of a 25-basis-point cut, a notable change from the more conservative outlook earlier in 2025. If inflation remains high, this could quickly shift market sentiment, leading to volatility.Market Strategies and Considerations

Ahead of Friday, we will monitor preliminary data like durable goods orders and consumer confidence for clues about economic momentum. Ongoing weakness in business investment, a trend developing since late 2024, highlights the case for potential rate cuts. However, traders should remain cautious, as the Federal Reserve continues to focus on persistent inflation. This uncertainty before the PCE release makes options strategies appealing. The VIX has been steadily rising from the low teens seen earlier this summer to about 17, indicating that traders are seeking protection against sharp market movements. This environment favors long volatility positions, such as straddles on the S&P 500, to capitalize on significant market movements following Friday’s data. Outside the U.S., Australian inflation data on Wednesday provides a key chance in forex markets. After a surprisingly low reading in June, a rebound to 2.3% is expected, which would place inflation solidly within the RBA’s target range and could boost the Australian dollar. We are considering AUD/USD call options to benefit from a stronger-than-expected inflation result. In Japan, the inflation data is unlikely to trigger any policy changes from the Bank of Japan, which has kept its policy rate near zero during the global tightening phase of 2023 and 2024. The crucial “super-core” inflation is expected to stay steady but not high enough to compel a change from the BoJ this year. This policy divergence should keep supporting carry trades, like shorting the yen against the dollar. Ultimately, Friday’s U.S. PCE data will steer the market in the upcoming weeks. A core reading of 0.3% or above could challenge the rate cut narrative, likely strengthening the U.S. dollar and pressuring equities. On the other hand, a reading of 0.2% or lower would reinforce expectations for a rate cut in September, potentially stirring a rally in risk assets. Create your live VT Markets account and start trading now.The dollar weakened due to dovish comments from Powell affecting trader expectations and currency dynamics.

Japanese Yen and US Dollar Dynamics

The Japanese yen has gained strength due to these Fed expectations. More appreciation of the yen may depend on weak US data or high inflation in Japan. Increased government support could also raise inflation expectations. On the daily chart, USDJPY faced rejection at the 148.50 resistance level. Sellers are now focusing on the upward trendline around 145.50 for potential buying chances. The four-hour chart shows USDJPY has been moving sideways, while the one-hour chart indicates a slight upward trend, with buyers pushing towards resistance. Key upcoming events include US Consumer Confidence, US Jobless Claims, Tokyo CPI, and the US PCE price index. With the Fed’s dovish shift last Friday, we anticipate increased volatility in the USD/JPY pair. This uncertainty, especially ahead of the crucial Non-Farm Payroll (NFP) report next week, creates opportunities for options traders. Strategies such as straddles or strangles could be effective for capitalizing on significant price movements in either direction, without needing to predict the direction.Market Analysis and Historical Context

The market currently expects an 85% chance of a rate cut in September; however, recent data tells a different story. In July 2025, we observed a solid jobs report with +260,000 jobs added, while Core PCE inflation has stubbornly stayed above the target at 2.8%. This data contradicts the Fed’s softer tone, suggesting that a strong NFP print next week could lead to a sharp increase in USD/JPY. Historically, we recall major market shifts in late 2023 when traders misjudged the timing of the Fed’s policy changes. A similar situation may be developing now, where dovish statements clash with strong economic data. Therefore, buying out-of-the-money USD/JPY call options with a short-term expiry may offer a cost-effective hedge against a hawkish surprise from the upcoming jobs report. Conversely, a weak NFP report would support the Fed’s dovish stance, likely pushing USD/JPY down toward the 145.50 trendline. In that case, purchasing put options or setting up bearish put spreads would help us benefit from the downward trend. The goal is to be in a position that profits from the initial market reaction to the data release. For Japan, Tokyo’s Core CPI remains steady at around 2.0%, which isn’t high enough to drive the Bank of Japan into aggressive action. This situation echoes the gradual policy normalization process we saw in 2024. For now, the main factor influencing this currency pair is the outlook for US interest rates. This week, we will closely monitor figures for US Consumer Confidence and the PCE price index. Any signs of weakening consumer confidence or slowing inflation could reinforce the case for a September rate cut, likely adding downward pressure on USD/JPY even before the important NFP data is released. Create your live VT Markets account and start trading now.Jefferies raises its year-end S&P 500 target from 5,600 to 6,600

Market Pricing and Federal Reserve Policy

With the new target of 6,600 for the S&P 500, we think the market is expecting a more favorable policy from the Federal Reserve. This outlook is a direct response to last week’s dovish remarks indicating the Fed is ready to ease conditions. The latest CPI data from July shows inflation has slowed to 2.8%, reinforcing our belief that stocks are likely to rise. In the next few weeks, we recommend buying call options to take advantage of this expected upward trend. We’re focusing on out-of-the-money calls on the SPX with October and November 2025 expirations, especially around the 6,500 strike price. This strategy allows for leveraged gains in case of a year-end rally while keeping risks manageable. For traders who prefer to take on less risk, selling cash-secured puts or bull put spreads can be a good choice to earn premium. This approach benefits from both a rising market and the passage of time, based on the belief that the index won’t drop significantly from current levels. This method worked well during a similar Fed pivot in late 2023, leading to a strong market rally into the next year.Impact on Market Volatility

We also need to think about market volatility. The CBOE Volatility Index (VIX) is currently near 14, and we expect it to decrease further as the Fed’s dovish position reduces uncertainty. This makes short-volatility trades, like selling straddles, more appealing for those betting on a steady rise rather than sudden jumps. However, the main risk to this outlook is a surprisingly strong economic report, such as the upcoming August jobs data, which could prompt the Fed to change its dovish tone. Because of this, we suggest structuring any bullish positions with defined risk, like using spreads. This can help protect against a quick change in market sentiment. Create your live VT Markets account and start trading now.Today, UK markets are less active because of a bank holiday and few significant announcements, including the German IFO.

Powell’s Ongoing Impact

Fed Chair Powell’s gentle approach is likely to keep influencing the markets this week, as effects from Friday carry on. There isn’t much significant economic data coming out this week, with only the US Jobless Claims on Thursday being noteworthy. Next week will be more eventful with the US Non-Farm Payroll (NFP) report scheduled for September 5th. The Federal Reserve is closely watching the labor market, as its strength or weakness can greatly impact interest rate expectations. Today’s market feels sluggish because of the UK holiday, and the German IFO is the only significant data point. This morning, the IFO Business Climate index came in at 87.5, slightly below expectations. This confirms the weak manufacturing PMI trend we observed last week. Overall, this doesn’t change the outlook for European interest rates, and the focus remains on the US. The dovish remarks from Fed Chair Powell at the Jackson Hole symposium last Friday continue to steer market sentiment. His comments about a cooling labor market have led to increased bets on a weaker dollar and stronger stock prices. With only the US Jobless Claims on Thursday as the major data for this week, this trend seems likely to continue.Anticipating the US NFP Report

The upcoming US Non-Farm Payrolls report on September 5th is the key event to watch. July’s report showed job growth slowing to 185,000 with the unemployment rate steady at 4.0%. The Fed has emphasized that it’s focusing on the labor market. A weak NFP report could strengthen expectations for a rate cut, while a surprisingly strong report could cause significant market shifts. In the coming days, traders may lean towards short-dated call options on equity indices like the S&P 500 to capitalize on the current positive sentiment. As we approach the NFP report, we expect the implied volatility (VIX) to rise from its current low of around 14. This increase could make buying options after the NFP release, such as straddles on currency pairs like EUR/USD, an effective strategy for profiting from expected price fluctuations. Create your live VT Markets account and start trading now.Eurostoxx futures drop slightly, while UK FTSE stays steady amid positive sentiment in early European trading

Market Consolidation After Rally

European futures paused on August 25, 2025, indicating a consolidation after last week’s strong rally. This rally was fueled by hints from the US Federal Reserve about a more relaxed interest rate policy, which lifted markets worldwide. The current stability suggests that traders are evaluating whether these new highs can be maintained. Market volatility is at multi-year lows, with the VSTOXX index for Euro Stoxx 50 options around 14. This low level means option premiums are relatively cheap—a situation not seen since before the significant rate hikes began in 2022. This low cost offers traders a chance to buy protection or position for future moves without significant upfront costs. The strength in European stocks is backed by easing inflation, with the latest inflation figure for the Eurozone in July 2025 at 2.1%, close to the ECB’s target. This environment supports the record highs in the UK and the near two-decade peaks in Spain and Italy. However, German futures show slight weakness, reflecting recent manufacturing PMI data for August, which indicates the sector is barely expanding at a reading of 50.5.Strategies For Record Levels

With indices at or near record levels, it’s a smart time to think about protective strategies. Purchasing put options on the Euro Stoxx 50 or DAX can provide inexpensive insurance against a possible 5-10% correction in the coming weeks. This approach allows traders to keep their profitable stock positions while managing downside risk. On the other hand, the dovish stance from central banks continues to support stocks. For those who believe the market is just experiencing a short pause, starting bullish positions like bull call spreads could be beneficial. This strategy enables traders to profit from a gentle rise while keeping their costs defined and limited. We observed similar market behavior during the recoveries in 2023 and 2024, where brief pauses typically led to further gains. The focus will be on the upcoming economic data in early September. Any signs that economic growth is weakening more than anticipated could quickly introduce volatility back into the market. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 25 ,2025

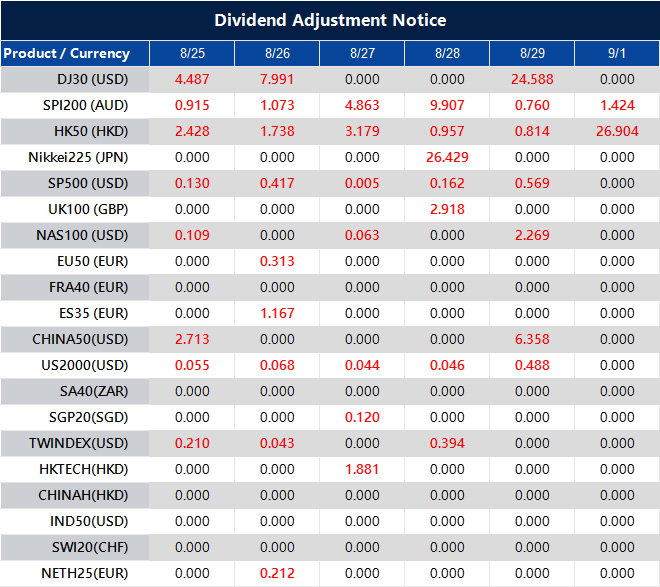

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].