After a dovish shift from the RBNZ, AUDNZD nears key resistance at 1.1030

EURNZD rises above 1.9900 after a dovish RBNZ, facing resistance at 2.00.

Mixed Market Signals

Today’s market signals are mixed. European stocks are struggling, and the USDJPY is waiting for important comments from Powell. Recent inflation data from the UK is increasing pressure on the Bank of England. Foreign exchange trading carries high risk due to leverage and the potential for losses. Investors are advised to only invest what they can afford to lose and to seek advice when necessary. Remember, past performance does not guarantee future results. InvestingLive is not an investment advisor and shares information for educational purposes only. Clients should evaluate all market information based on their own situations and be cautious about relying solely on online information.Psychological Resistance Level

The RBNZ’s recent dovish shift, including talks of a large rate cut, has weakened the Kiwi dollar significantly. This has pushed EURNZD past the 1.9900 mark as the market adjusts interest rate expectations for New Zealand. New data shows that overnight index swaps indicate about a 70% chance of a 25 basis point cut at the RBNZ’s meeting in October. Meanwhile, the Eurozone’s inflation flash estimate for July 2025 stands at 2.4%, keeping the European Central Bank on a more cautious track. This difference in policies strengthens the Euro against the NZD. We are nearing the key psychological resistance level at 2.0000. Historically, we haven’t seen the pair hold above this level since the early 2020 pandemic shock. This area is crucial for a potential breakout or reversal. Given the current high implied volatility, buying standard call options for more upside could be costly. A better strategy might be to use bull call spreads. This approach can lower the initial trade cost while still allowing for profits as we move toward the 2.01-2.02 range, thus managing risk in a volatile market. However, it’s essential to recognize that the market is currently stretched and trading far outside its usual daily range. Any unexpectedly hawkish comments from central bankers at the upcoming Jackson Hole symposium could trigger a sharp pullback. Therefore, we must be careful with our position sizes over the next few weeks. Create your live VT Markets account and start trading now.NZD drops significantly to its lowest since April after OCR expectations are downgraded

Current Market Conditions

Right now, the NZDUSD has fallen below major support at the 0.8550 level. It’s now at its lowest since April. The Reserve Bank’s unexpected downward revision of the OCR path signals a weaker Kiwi dollar. The mention of a possible 50 basis point cut indicates that further easing might be coming. As a result, traders should prepare for potential declines in the upcoming weeks. This cautious stance is supported by recent data showing Q2 inflation dropped to 1.8%, well within the bank’s target range. This suggests the RBNZ may have room to cut rates again before year-end. The current economic weakness makes selling NZD futures attractive.Global Policy Divergence

In contrast, the US Federal Reserve seems set on maintaining steady rates, as recent minutes from their August meeting raised concerns about steady services inflation at 3.5%. This growing gap between a cutting RBNZ and a strong Fed strengthens the case for a lower NZDUSD. Hence, buying NZDUSD put options becomes a smart strategy to profit from this divergence. With the NZDUSD breaking the important 0.8550 support level, we’re noticing a rise in market volatility. One-month implied volatility has increased from about 9% in July to over 12% now, showing more uncertainty. For traders, buying put options with strike prices near 0.8400 or 0.8350 is a sensible way to gain downside exposure while managing risk. We can look back to the policy shift in late 2021 for a historical perspective on what might happen next. After that change, the Kiwi dollar entered a downtrend over several quarters as the market adjusted to a new easing cycle. A similar pattern might be emerging now, reinforcing a bearish outlook for the currency. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 20 ,2025

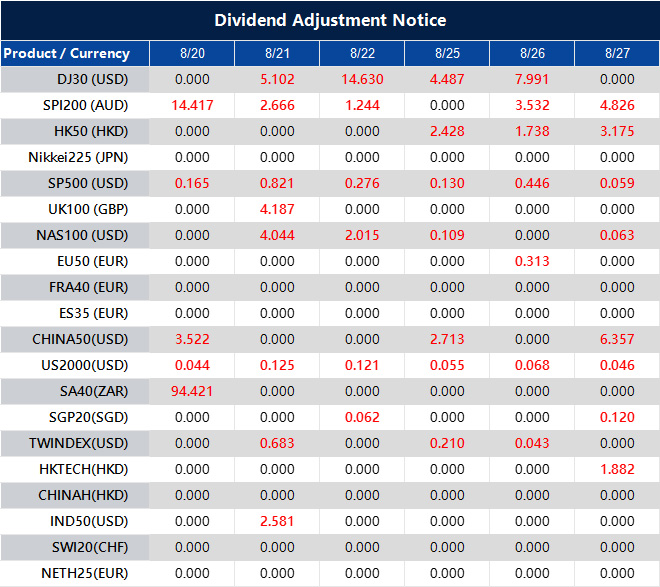

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].