Bowman suggests that small crypto investments could improve Fed staff’s understanding of financial products

European traders start the week quietly amid unfolding geopolitical and market influences.

Cryptocurrency Movements

Cryptocurrencies are fluctuating, particularly Ethereum, which has dropped to $4,320. This is the first time it has fallen below key hourly averages in two weeks after failing to break through $4,800. Today’s European trading is expected to be quiet in terms of data. However, attention will turn to the RBNZ meeting, Fed minutes, and UK CPI and PMI data. These events, along with the upcoming Jackson Hole symposium, are likely to impact the market. With a quiet start to the week, we should monitor for signs of increased market volatility related to the upcoming meeting between Trump, Zelensky, and European leaders. Geopolitical tensions, similar to when the VIX index soared over 30 during uncertainty in early 2022, can lead to unpredictable market moves. Traders might consider buying VIX call options or puts on broad market indices as protection against a negative outcome from these discussions.Fed Minutes And Market Implications

It’s essential to focus on the Fed minutes and the Jackson Hole symposium, especially since markets are scaling back expectations for a rate cut. The CME FedWatch Tool now indicates less than a 20% chance of a rate cut by year-end, down from over 50% last month. This suggests we should be ready for hawkish signals, which could strengthen the dollar. Traders might consider selling out-of-the-money call options on EUR/USD. Earnings reports from major retailers like Walmart and Target will provide insight into the health of US consumers. Last month’s retail sales showed a modest 0.2% increase, while the University of Michigan Consumer Sentiment survey dropped to 65.5, indicating growing consumer anxiety. An options straddle, which profits from significant price movements in either direction, might be a smart strategy to trade these stocks during their earnings reports. Looking ahead, the week is filled with market-moving data that could disrupt the current calm in currency markets. With UK inflation data expected this week and predictions that the core rate will stay above 3.5%, we may see increased volatility in the GBP/USD pair. We can prepare for this by considering short-dated options to capture any sudden price changes after the release. The evident weakness in Ethereum, as it falls below important technical levels, offers a direct opportunity for crypto derivatives traders. After failing to lift past the $4,800 resistance, momentum has clearly shifted, and the Crypto Fear & Greed Index has dipped back into “Fear” territory with a value of 38. We view this as a cue to explore buying put options or setting up bearish call spreads on crypto-related assets. Create your live VT Markets account and start trading now.Navarro criticizes India’s oil trade with Russia and calls for alignment with US strategic interests

Rising Geopolitical Tension

We see this as a clear sign of increasing geopolitical tension, which will likely raise energy market risks. This rhetoric specifically targets India’s energy policy, crucial for stabilizing global crude demand. Traders should prepare for more volatility in Brent and WTI crude futures in the coming weeks. The most immediate effect will be on oil prices, so we should consider positioning ourselves for potential price increases. Looking back at how the markets responded to supply threats in early 2022, even small disruptions pushed oil prices up by $5 to $10 per barrel. We advise buying near-term call options on oil ETFs or crude futures to take advantage of this potential. This pressure could also weaken the Indian Rupee against the US dollar. If tensions escalate, we may see capital flowing out of Indian stocks. Data shows that the USD/INR exchange rate is very sensitive to geopolitical developments. Traders might want to use currency futures or options to hedge against, or profit from, a possible decline in the rupee from its current level of about 84.5.India’s Strategic Importance

India’s role in the oil market is crucial, as it has been one of the largest buyers of Russian seaborne crude since 2023, often importing over 1.5 million barrels per day. This supply has helped the Indian government control inflation, which the Reserve Bank of India has kept below 5% for the last quarter. A forced cut in these purchases would tighten global supply and severely impact India’s economy. The stakes are very high. The US-India trade relationship has strengthened, with bilateral trade surpassing $200 billion in 2024. This statement raises questions about that economic partnership, creating uncertainty that is likely to increase the India VIX volatility index. Traders should closely monitor any further communications from Washington and New Delhi, as these will drive market movements. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 19 ,2025

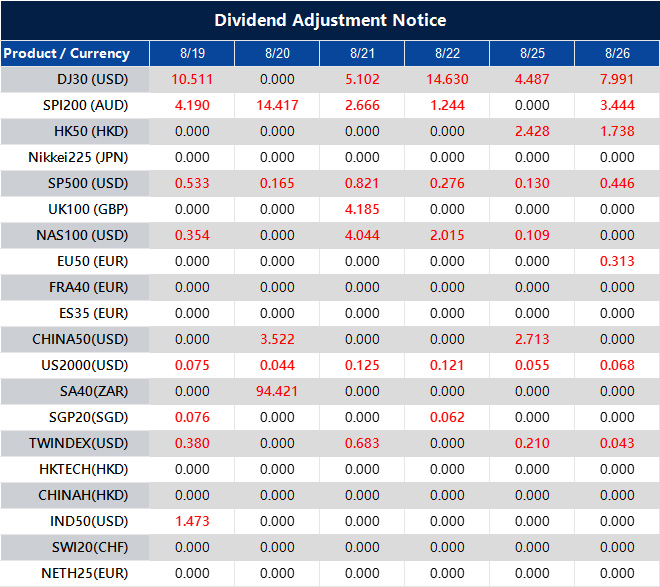

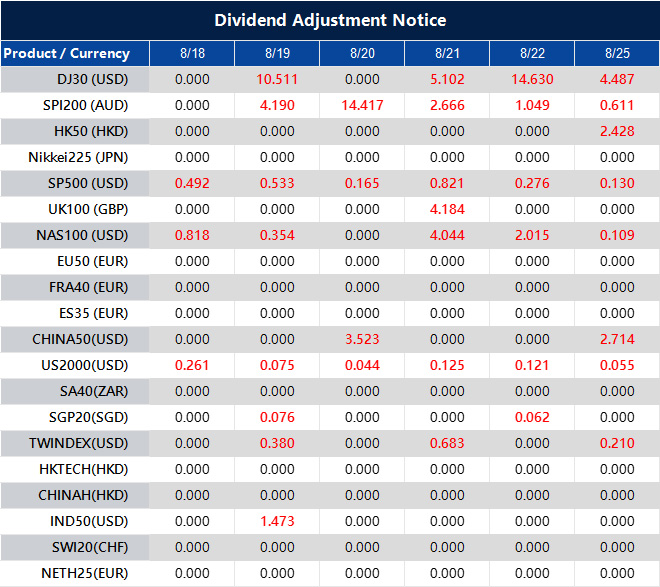

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

Week Ahead: Ethereum’s Turning Point

Ethereum’s journey in 2025 has unfolded as a tale of reinvention. Not long ago, the asset was written off amid dwindling retail enthusiasm, tightening regulation, and a noticeable lack of institutional appetite. Fast forward to today, and ETH has reclaimed a central role in the digital asset conversation.

Standard Chartered’s decision to raise its year-end price target from $4,000 to $7,500 is a striking marker of that shift. More eye-catching still, the bank now expects ETH to climb to $25,000 by 2028 – tripling its previous long-term forecast. Such projections reflect a combination of evolving market structures, favourable policy winds, and Ethereum’s economic transformation.

Institutional Inflows And Regulatory Tailwinds

One of the clearest drivers has been the influx of institutional money. Ether-backed ETFs have already attracted more than $12 billion in net inflows during the first half of August 2025 alone. This is no longer the territory of speculative punts, but more towards mainstream portfolio allocation.

A fresh regulatory framework has strengthened this dynamic. The passing of the GENIUS Act in July imposed stringent but transparent requirements on stablecoin issuers, including full 1:1 reserves and routine audits. As over half of all stablecoins circulate on Ethereum, the legislation has reinforced its standing as the primary infrastructure for digital dollar flows.

With commercial banks and corporates now building directly on Ethereum, the network’s reputation as a messy frontier market is giving way to one of being firmly embedded in the architecture of global finance.

Corporate Treasuries And Supply Dynamics

This shift is mirrored in corporate balance sheets. A case in point is BitMine Immersion Technologies, which has quietly acquired over one million ETH, worth around $5 billion, with the stated aim of capturing up to 5% of total circulating supply.

The move recalls early strategies seen in Bitcoin but adds a new layer of institutional credibility to Ethereum itself. From a market perspective, the locking away of such large holdings reduces the volume of ETH available for trading, dampens the risk of erratic sell-offs, and reinforces the story of scarcity.

That scarcity is already evident in Ethereum’s tokenomics. The Merge in 2022 cut daily issuance by 90%, from 13,000 ETH under proof-of-work to just 1,700 ETH under proof-of-stake – slashing annual supply growth to below 1%. This, coupled with EIP-1559’s burn mechanism that permanently destroys tokens whenever network activity is elevated, has tilted Ethereum into a deflationary regime.

Since the Merge, 1.71 million ETH has been burned compared with only 1.36 million newly created, producing a net contraction of 346,000 ETH, worth around $1.2 billion. The supply, which peaked at 120.5 million ETH, has begun trending lower. At present, annual supply is shrinking by about 0.16%, a stark contrast to the 3% growth that would have persisted under proof-of-work.

Staking And Market Behaviour

Staking strengthens this scarcity further. Nearly 30% of all ETH is now locked in validator contracts, earning yields of 3–5% annually. This takes coins out of liquid circulation while turning ETH into a yield-bearing instrument. The effect is a market squeeze where the float is thinner, and prices are more sensitive to inflows. Scarcity, combined with institutional accumulation, reshapes how ETH behaves. Instead of being prone to violent 30% daily swings, as seen in past cycles, ETH now trades with greater maturity. Professional market makers, ETF arbitrage, and regulated custody have helped pull volatility into a narrower band, where 5–10% moves are more common extremes. Crypto shocks can still cut deep, but the presence of larger, steadier holders offers a buffer against chaos.

That brings the debate to five-figure Ethereum. Fundstrat has pointed to a range of $10,000 to $15,000 in the near term if momentum and adoption continue. Standard Chartered sees a staged rise to $12,000 in 2026, $18,000 in 2027, and $25,000 by 2028. The arithmetic behind these calls is straightforward. At 120 million ETH in circulation, $10,000 puts its market cap at $1.2 trillion, on par with Alphabet and just shy of Amazon. $15,000 scales to $1.8 trillion, placing Ethereum above Saudi Aramco. At $25,000, the cap reaches $3 trillion, within striking distance of Apple. These comparisons show that such valuations are not fanciful outliers but serious discussions of Ethereum as a peer to the largest global assets.

The cautious view is that while $10,000 is possible on the present trajectory, higher targets depend on both utility and fresh inflows. Ethereum’s usage as a platform must keep expanding, transaction volumes must grow, and stablecoin reliance must deepen. Competitors remain a threat, liquidity cycles can turn, and hype can push prices beyond sustainable levels. Momentum alone can take ETH to new highs, but sustained five-figure pricing requires Ethereum to solidify its role as the financial infrastructure of digital markets.

Market Movements Of The Week

The new week has opened with pressure building on the US dollar, commodities struggling to find footing, and equity indices facing renewed questions of momentum. Across currencies and asset classes, price structures are sending mixed signals, keeping traders attentive to both technical zones and macro catalysts.

The US dollar index tested 98.30 before sliding lower. The move carried an impulsive tone, suggesting sellers are firmly in control. If price action breaks beneath 97.424, the path toward 97.00 opens, a level that could act as the next inflection point. With Powell set to speak later this week, the dollar’s direction will remain tied to speculation over the timing of rate cuts.

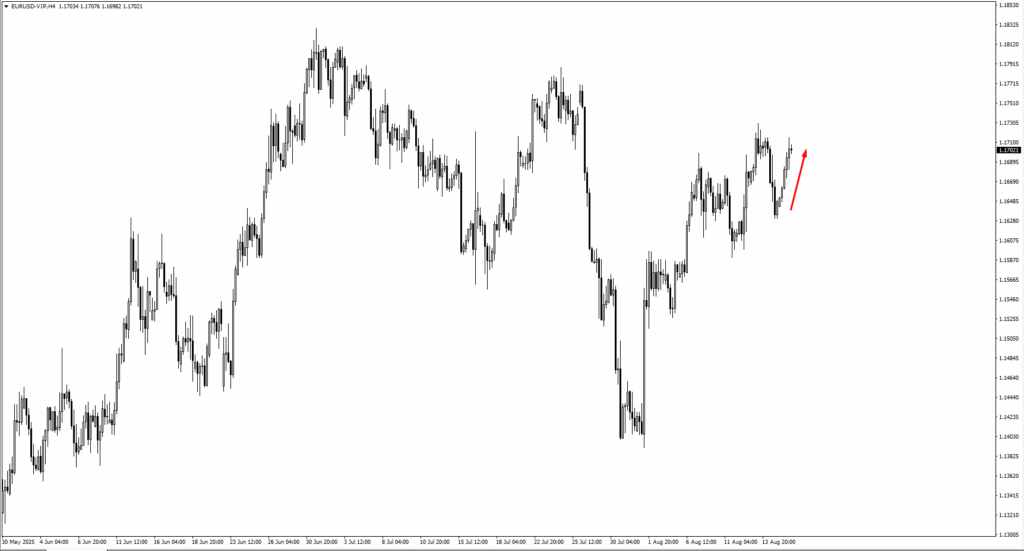

EURUSD has recovered from the 1.1610 zone, and the market now eyes a possible break of 1.17297. Should buyers push through, the next checkpoint sits at 1.1755. European data remains fragile, with German PMI readings expected to soften, yet the pair’s structure indicates buyers are prepared to test higher ground if the dollar weakens further.

GBPUSD found firm support at 1.3500 and rebounded. A breach of 1.35943 would invite a climb toward 1.3605 and possibly 1.3625. With the Bank of England’s next communication due later in August, traders are using technical levels as guides until clearer policy signals emerge.

USDJPY retreated from the 147.90 area, bringing focus toward the 146.208 swing low. A decisive break here would put 144.50 on the radar. Risk aversion is underpinning yen strength, though elevated US yields may blunt the pace of further appreciation.

USDCHF moved lower but stopped short of testing the 0.8115 zone. Attention now turns to 0.80213 as the first line of support, with 0.7955 beyond that. Trade frictions and tariff disputes continue to support the franc’s safe-haven profile, keeping downward pressure on the pair.

AUDUSD nearly broke its 0.64812 low before staging a rebound, with 0.6550 the next upside marker. Commodity demand and stabilising Chinese data are supportive, but the pair remains tied to shifts in global sentiment. NZDUSD, meanwhile, fell through 0.59123 but has shown signs of a rebound. A move to 0.5970 is possible, though the Reserve Bank of New Zealand’s expected rate cut later this week could cap gains.

USDCAD climbed from 1.3775 but faces resistance at 1.3819. If the pair fails to clear this, momentum could reverse toward 1.3750. The upcoming CPI release, forecast at 3.0%, will be key in shaping the Canadian dollar’s path, with traders cautious of volatility.

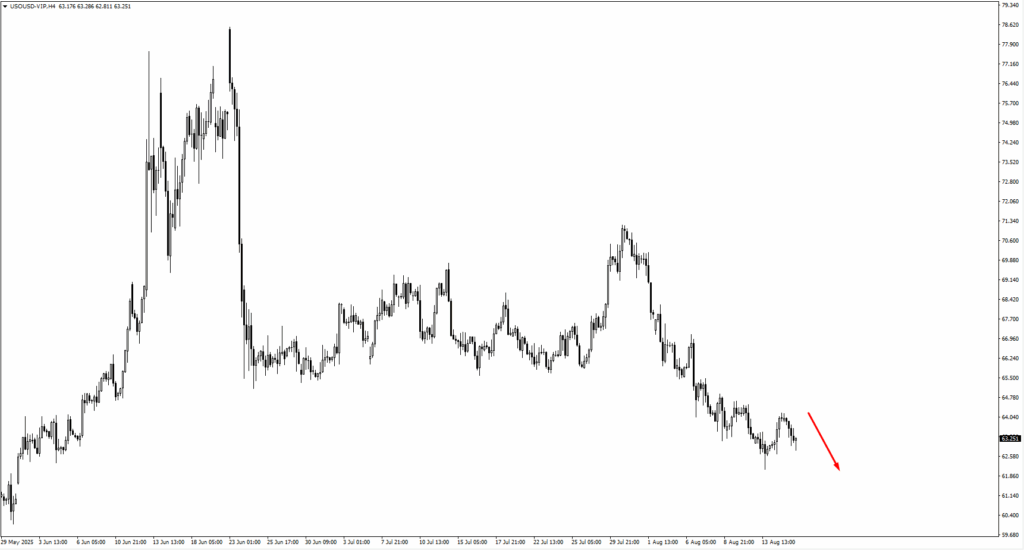

US oil has struggled to attract sustained buying, with $61.15 now in view should sellers regain control. OPEC+ rhetoric and global demand forecasts will dictate direction, but the reluctance of bulls to step in at higher levels hints at hesitancy over demand prospects.

Gold risks a dip toward $3,329.78 before the potential for another upward push. If the $3,320 area holds, it may act as a springboard for renewed strength, particularly as expectations build for a September Fed cut that would weigh on the dollar.

The S&P 500 encountered resistance at 6,489. A break beneath 6,434.57 would set the stage for a deeper retracement, while upside extensions to 6,630 and 6,730 remain in play. The index reflects a market caught between optimism over looser policy and caution about slower global growth.

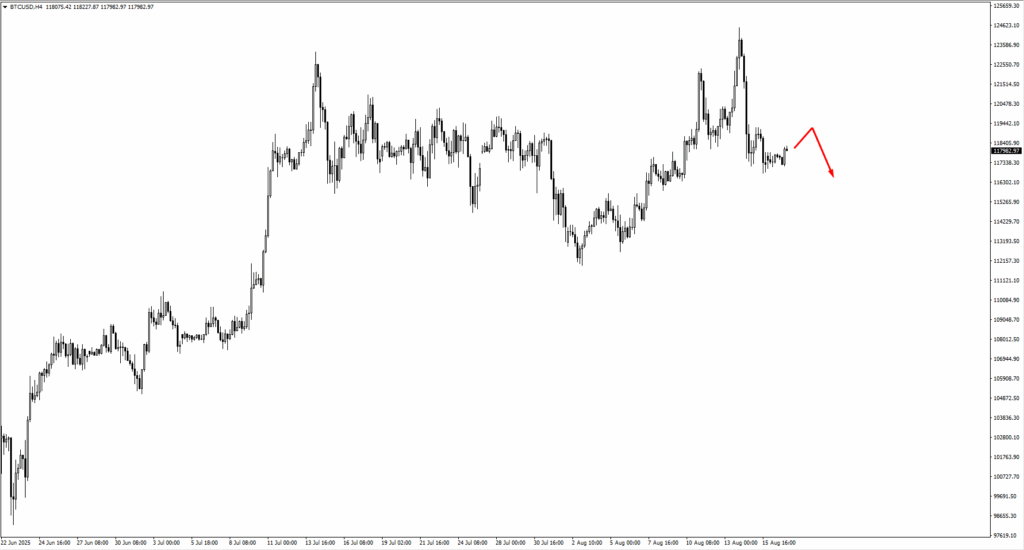

Bitcoin held support at 116,750, though buying conviction remains thin. Traders are watching 118,900 and 119,222 for potential bearish setups, though any impulsive move higher would force a reassessment. The lack of clear momentum shows a market waiting for its next catalyst.

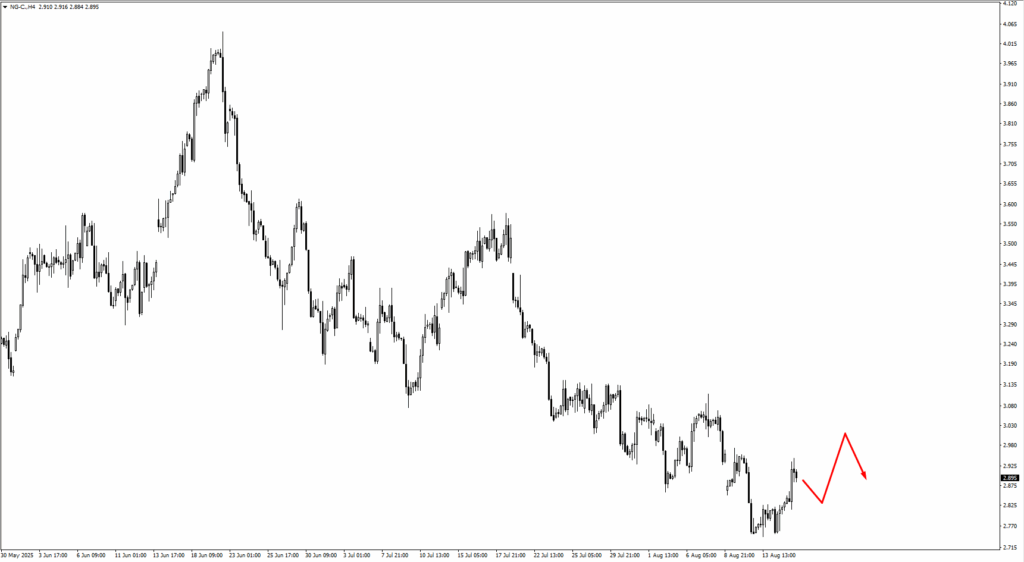

Natural gas remains range-bound, with 2.83 acting as the first bullish zone on dips and 3.04 providing resistance. If selling extends further, 2.55 may come into play. Seasonal storage builds and shifting demand expectations are keeping trade in tight ranges for now.

Key Events Of The Week

The calendar is relatively quiet, but several high-profile events have the potential to steer sentiment as traders position into month-end.

The week begins midstream on Tuesday, 19 Aug, with the Canadian inflation. CPI is forecast to hold steady at 3.0%, unchanged from the prior reading. Traders will be watching USDCAD around the 1.3819 level, where price could either break higher before reversing or retreat directly from current levels. A softer inflation outcome would reinforce expectations for the Bank of Canada to remain cautious, supporting CAD strength. Conversely, if CPI surprises to the upside, the loonie could weaken as policy tightening risks resurface.

Wednesday, 20 Aug, attention shifts to the Reserve Bank of New Zealand, with markets expecting a cut from 3.25% to 3.0%. Traders will be alert for NZDUSD to show an upward consolidation before selling opportunities emerge. A cut in line with expectations would likely cap upside for the kiwi, while a surprise hold could spark short-term gains before sellers reassert control.

It will be a busy session on Thursday, 21 Aug, for PMI data across three major economies. For the euro area, German manufacturing is forecast at 48.8, down from 49.1 previously, while services are seen at 50.5, compared with 50.6. In the UK, the manufacturing PMI is expected to be 48.2, up from 48.0, while the services sector edges up to 51.9 from 51.8. Across the Atlantic, US manufacturing PMI is projected at 49.9 versus 49.8, while services slips to 53.3 from 55.7.

These readings will provide a comprehensive snapshot of global economic momentum. Broad weakness would reinforce slowdown fears and weigh on risk sentiment. Stronger-than-expected data, particularly from the US, could lend the dollar short-term support.

The week closes with Jerome Powell’s remarks at Jackson Hole. Traders will be listening closely for clues on whether the Fed is preparing to deliver its first rate cut of 2025 in September. A dovish message would likely push the dollar lower and support gold, while a firmer tone pushing back against easing could spark a short-term bounce in the greenback.

Dividend Adjustment Notice – Aug 18 ,2025

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].