Is Forex Trading Legal in Malaysia?

Forex trading, or foreign exchange trading, represents a significant opportunity for investors in Malaysia and globally, allowing individuals to speculate on currency value fluctuations. Despite its popularity, questions about its legality often arise among potential traders in Malaysia. This guide seeks to clarify the legal status of Forex trading in Malaysia, outline who is permitted to trade, detail the regulations governing it, discuss associated risks, and offer practical trading tips for Malaysians.

Who Can Legally Trade Forex in Malaysia?

Malaysian residents are permitted to engage in Forex trading through two primary channels: licensed onshore banks and approved offshore brokers, including those regulated by Bank Negara Malaysia (BNM), Malaysia’s central bank. Additionally, offshore brokers located in Labuan, a Malaysian federal territory, are regulated by the Labuan Financial Services Authority (LFSA) and are authorized to accept clients from Peninsular Malaysia, provided they adhere to the stipulated leverage limits of 1:50 and ensure trading occurs via properly licensed platforms.

Overseas Forex Brokers

Trading with internationally licensed brokers from jurisdictions such as the UK, Europe, Australia, or Singapore is also legal for Malaysian residents. It’s crucial for traders to verify these brokers’ regulatory compliance in their respective jurisdictions and confirm that client funds are protected through segregated accounts.

When selecting the best forex broker, traders should prioritize those offering robust customer support, transparent trading conditions, and educational resources to enhance their trading experience and success.

Unregulated Entities

It’s important to note that trading Forex through unregulated entities or unauthorized money changers in Malaysia is illegal. Bank Negara Malaysia strongly advises against engaging in Forex trading through such channels due to the high risk of fraud and loss.

Forex Trading Regulations in Malaysia

Malaysia enforces specific regulations regarding Forex trading, particularly concerning leverage and risk management:

- Leverage Limitations: BNM caps leverage at 1:50 for retail clients, a restriction designed to mitigate excessive risk.

- Mandatory Risk Disclosures: Brokers must thoroughly disclose the risks associated with Forex trading, ensuring clients are well-informed about leverage, margin requirements, and the potential for significant losses.

- Segregated Accounts: All licensed brokers are required to maintain client funds in segregated accounts with reputable financial institutions, safeguarding traders’ capital even in the event of broker insolvency.

Risks Involved in Forex Trading

While Forex trading is legal and regulated in Malaysia, it’s not without risks:

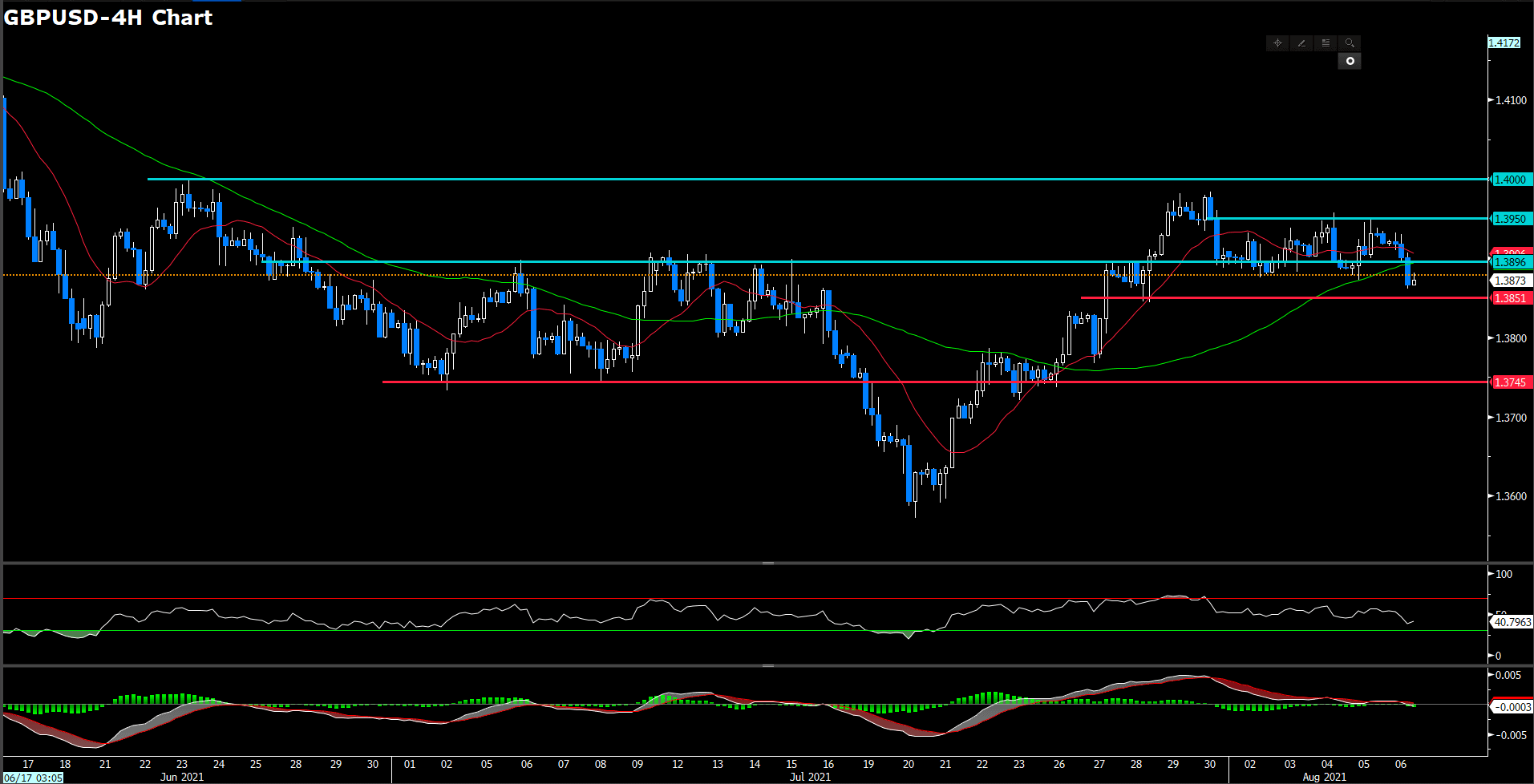

- Market Volatility: Sudden price shifts can quickly result in margin calls or significant losses.

- Counterparty Risk: Issues with withdrawals can emerge if a broker encounters financial difficulties, particularly with unregulated entities.

- Leverage Risks: The allowed 1:50 leverage can amplify losses as well as gains, potentially exceeding initial deposits.

Adhering to strict risk management practices and choosing regulated brokers are essential steps in mitigating these risks.

Tips for Forex Trading in Malaysia

For Malaysians venturing into Forex trading, here are some strategies for success:

- Select a Regulated Broker: Ensure your broker is regulated in Malaysia or a reputable jurisdiction.

- Start Small: Begin trading with smaller amounts to familiarize yourself with the high leverage and market dynamics.

- Fundamental Analysis: Stay informed on economic indicators and geopolitical events that influence currency values.

- Risk Management: Establish clear risk management protocols before engaging in leveraged trading.

- Record Keeping: Maintain accurate records for potential tax reporting, even though Forex profits are not currently taxed in Malaysia.

Alternatives to Forex Trading

Malaysians interested in diversifying their investment portfolio can explore alternatives such as the stock market, ETFs, peer-to-peer lending, and equity crowdfunding, which generally involve lower leverage and risks compared to Forex trading.

The Verdict: Forex Trading’s Legal Status in Malaysia

Forex trading is indeed legal in Malaysia, provided that transactions are conducted through regulated channels. By adhering to the guidelines set forth by BNM and LFSA, Malaysian traders can engage in Forex trading securely and legally. As with any investment, thorough research, careful risk management, and continuous education are key to navigating the Forex market successfully.

Your Trusted Partner in Legal Forex Trading – VT Markets

VT Markets Malaysia stands out as a beacon for traders seeking a reliable and regulated platform for Forex trading in Malaysia. We are committed to providing a transparent and secure trading environment, along with an array of advanced trading tools, educational resources, and dedicated support to empower traders at every level of currency trading. By choosing VT Markets Malaysia, traders can benefit from competitive spreads, leverage options tailored to individual needs, and access to a wide range of markets.

Start your Forex Journey with us here!