On Wednesday, stocks saw a decline as investors awaited an important inflation report due later in the week, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all experiencing losses. Notable decliners included UnitedHealth, Intel, Alphabet, and Urban Outfitters, the latter due to disappointing quarterly results. The market’s attention is now on January’s forthcoming personal consumption expenditure (PCE) data, a crucial inflation indicator for the Federal Reserve. This anticipation comes amid mixed movements in the currency market, where the dollar index made slight gains while investors closely monitor upcoming inflation reports from the U.S. and the eurozone. These reports are pivotal for future monetary policy and interest rate expectations, especially with predictions leaning towards rate cuts by the Federal Reserve and the European Central Bank (ECB) within the year, amidst contrasting inflationary trends in the U.S. and eurozone.

Stock Market Updates

Stocks experienced a decline on Wednesday as the market anticipated an important inflation report set to be released later in the week. The S&P 500 dropped slightly by 0.17%, closing at 5,069.76, while the Nasdaq Composite experienced a more significant fall of 0.55%, ending at 15,947.74. The Dow Jones Industrial Average also saw a minor decrease, losing 23.39 points, or 0.06%, to close at 38,949.02, marking its third consecutive day of losses. Among the notable decliners were UnitedHealth, which fell nearly 3%, and tech giants Intel and Alphabet, which dropped 1.7% and 1.8%, respectively. Additionally, Urban Outfitters saw a significant decrease of 12.8% following its announcement of weaker-than-expected fourth-quarter results.

The market’s focus is now on the upcoming personal consumption expenditure reading for January, a critical inflation measure closely watched by the Federal Reserve. This report is highly anticipated as investors and analysts gauge the potential for continued economic growth and the impact of inflation on monetary policy. The market’s recent performance has been less robust, with the major indexes on track for their second negative week in the last three, despite having reached record highs recently. The downturn, especially in the tech sector, has sparked debates about the durability of the market rally, which has been partly driven by enthusiasm over advancements in artificial intelligence.

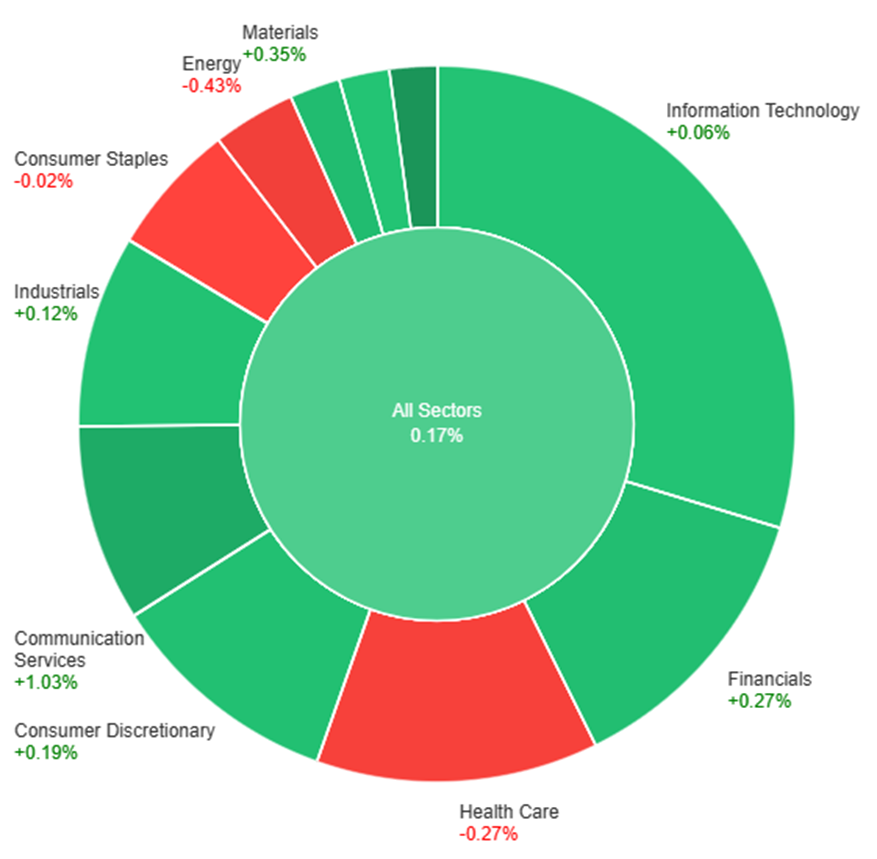

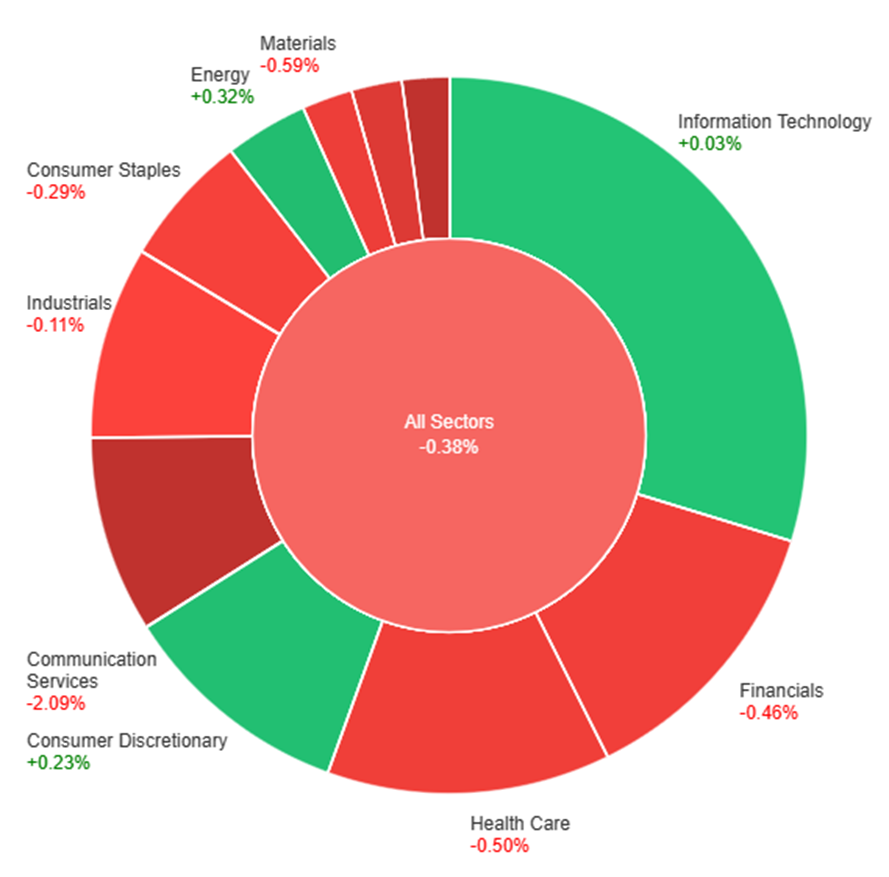

Data by Bloomberg

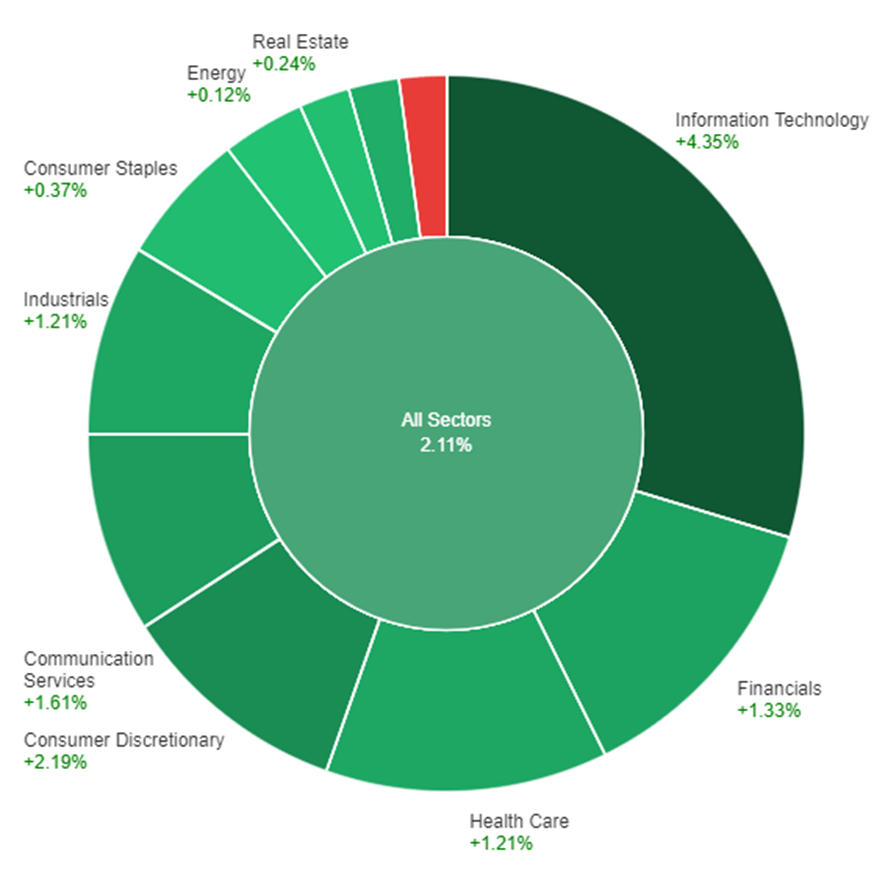

On Wednesday, the overall market experienced a slight downturn, with all sectors combined seeing a decrease of 0.17%. Despite this general downtrend, several sectors managed to post gains, led by Real Estate, which saw a notable increase of 1.28%. Other sectors that experienced growth included Financials, Consumer Discretionary, Utilities, Industrials, Materials, and Consumer Staples, with increases ranging from 0.09% to 0.35%. On the flip side, some sectors faced declines, with Energy, Health Care, Information Technology, and Communication Services witnessing drops between -0.20% and -0.92%, indicating a mixed performance across different areas of the market.

Currency Market Updates

The currency market is currently experiencing nuanced movements as investors anxiously await inflation reports from the U.S. and eurozone, which could significantly influence the trajectory of risk-sensitive currencies. The dollar index saw a slight increase of 0.1%, though it retreated from its early Wednesday highs, indicating a cautious stance among traders. The EUR/USD pair dipped marginally by 0.05%, recovering after testing key support levels amid a broad-based rise in the dollar earlier in the day. The focus now shifts to Thursday’s release of the U.S. core PCE and eurozone CPI reports, which are expected to play a critical role in determining whether the recent reduction in anticipated Fed rate cuts for 2024—and the consequent support this has lent to the dollar—will continue or come to a halt.

Market expectations are leaning towards the Federal Reserve beginning to cut rates by June, with a total of 81 basis points of easing anticipated by the end of the year. Similarly, a June rate cut by the ECB is fully priced in, with expectations of 90 basis points of cuts throughout the year. These developments come as core PCE in the U.S. is forecasted to rise, contrasting with December’s figures, and with the euro zone’s overall and core CPI also set for release, offering further insights into inflationary trends. Amidst this backdrop, the USD/JPY pair has seen a slight increase, attempting to continue its upward trend as markets digest varying signals from Fed speakers and global economic indicators, highlighting the interconnectedness of global financial markets and the significant impact of central bank policies and economic data on currency valuations.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Faces Downward Pressure Amid Economic Indicator Discrepancies

The EUR/USD pair experienced a decline early Friday, pressured by disappointing sentiment indicators from Europe and a significant disparity in US GDP figures that maintained the currency pair’s position within a familiar range midweek. With a packed schedule, Thursday’s focus shifts to German Retail Sales and CPI data, alongside the US Personal Consumption Expenditure (PCE) Price Index inflation figures. The week will conclude with Friday’s release of the pan-European Harmonized Index of Consumer Prices (HICP) inflation data and the US ISM Manufacturing PMI for February, providing critical insights into economic health and potential currency movement directions.

On Wednesday, the EUR/USD moved slightly lower and was able to reach the lower band of the Bollinger Bands. Currently, the price is moving just below the middle band, suggesting a potential upward movement to reach above the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 51, signaling a neutral outlook for this currency pair.

Resistance: 1.0858, 1.0896

Support: 1.0823, 1.0783

XAU/USD (4 Hours)

XAU/USD Steady Amid Economic Expansion and Fed Remarks

Gold prices remained stable near $2,030 on Wednesday, achieving a modest increase of 0.17% as the US economy showed signs of expansion according to the latest BEA report. Despite the US GDP for the last quarter of 2023 slightly missing expectations and mixed retail and wholesale inventory data, a fall in US Treasury bond yields has supported gold prices, keeping them near monthly and weekly highs, just below the 50-day SMA. Meanwhile, comments from Federal Reserve Regional Presidents, Susan Collins and John Williams, about potentially easing policy later in the year while still not meeting the core inflation goal of 2%, have influenced market sentiment, alongside a cautious Wall Street trading mostly in the red.

On Wednesday, XAU/USD moved slightly higher to reach the upper band of the Bollinger Bands. Currently, the price is moving just below the upper band, suggesting a potential higher movement to reach above the upper band and reach the resistance level. The Relative Strength Index (RSI) stands at 57, signaling a neutral but bullish outlook for this pair.

Resistance: $2,042, $2,056

Support: $2,030, $2,017

Economic Data

| Currency | Data | Time (GMT+8) | Forecast |

|---|---|---|---|

| EUR | German Prelim CPI m/m | All day | 0.5% |

| CAD | GDP m/m | 09:30 | 0.2% |

| USD | Core PCE Price Index m/m | 09:30 | 0.4% |

| USD | Unemployment Claims | 09:30 | 209K |