Despite the S&P 500, Dow Jones, and Nasdaq reaching new peaks amidst the consumer price index (CPI) rising as anticipated, the market remains divided in response. Analysts note both bullish and bearish sentiments, with investors bracing for potential strategic investment opportunities. Oracle’s 12% decline and Macy’s 8% drop affect sector dynamics, while currency markets respond subtly to the CPI data, keeping the dollar index down. The Fed’s impending policy announcement and cues from Jerome Powell’s commentary are anticipated, influencing future rate adjustment speculations. Meanwhile, diverse currency pairs show varied movements, indicating nuanced market shifts, while attention turns to forthcoming events like US retail sales and central bank meetings impacting currency markets’ cautious stance.

Stock Market Updates

The stock market saw a continued climb as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all rose, hitting new 52-week highs. This growth occurred despite the consumer price index (CPI) rising 3.1% year over year in November, matching economist predictions. However, the month-over-month CPI increase aligned with expectations, maintaining a steady inflation trajectory. Analysts noted that while both bullish and bearish sentiments exist about the CPI figures, the market largely responded in a manner consistent with expectations, with many investors anticipating a potential dip for strategic investments.

Investors are eagerly awaiting the Federal Reserve’s upcoming policy announcement, anticipated to maintain steady interest rates. However, the market is keenly attentive to cues from Chair Jerome Powell’s commentary, seeking indications about potential future rate adjustments. Amidst this market climate, Oracle shares dropped by over 12% due to lower-than-expected fiscal second-quarter revenue, while Macy’s declined by 8% following a downgrade to sell from Citi, impacting the market’s sectoral dynamics.

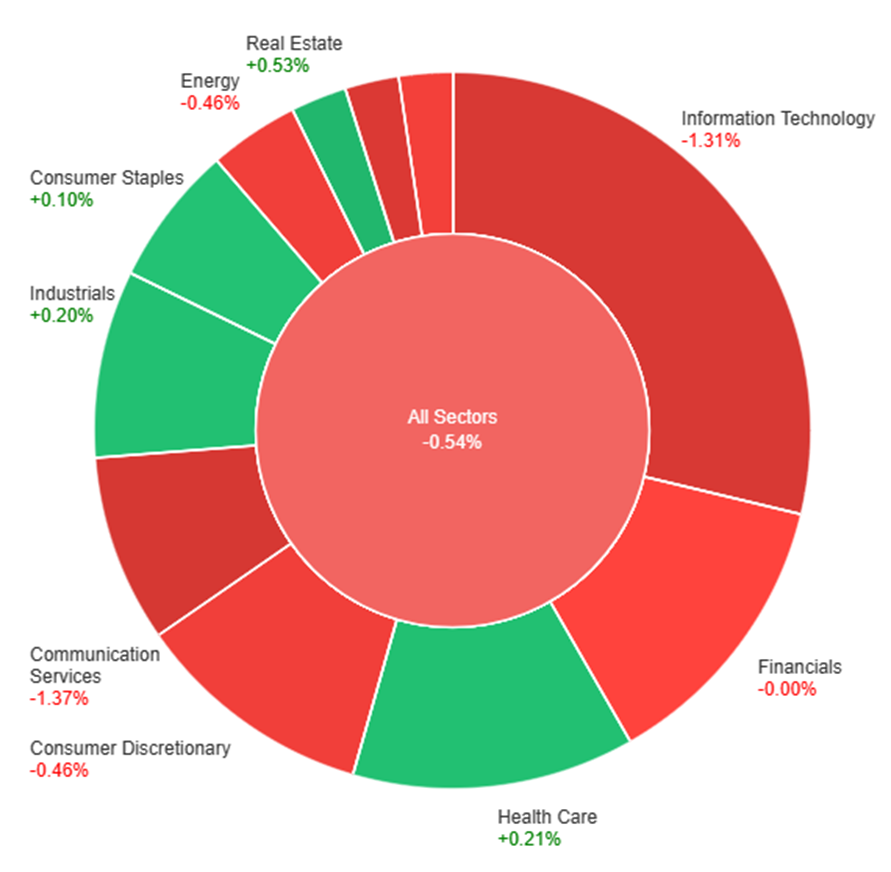

Data by Bloomberg

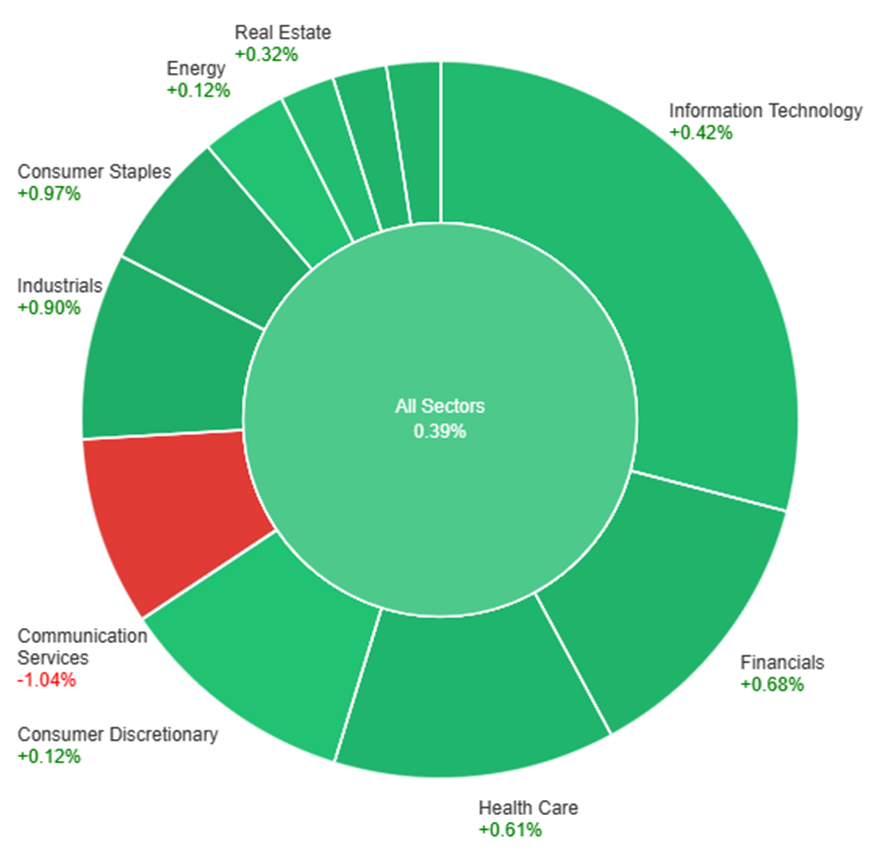

On Tuesday, most sectors experienced gains, with the overall market rising by 0.46%. The Information Technology sector led the gains with an increase of 0.83%, followed by Financials at 0.71% and Materials at 0.57%. Health Care and Industrials also saw positive movement, each rising by 0.47% and 0.46%, respectively. However, sectors like Energy, Utilities, and Real Estate faced declines, with Energy notably dropping by 1.35%. Utilities and Real Estate experienced smaller decreases of 0.41% and 0.05%, respectively, marking a mixed day across various sectors.

Currency Market Updates

The recent currency market updates reveal a nuanced response to the US CPI data, maintaining the dollar index down by 0.22%. Core inflation figures persisting at 4% year-on-year hindered a dovish Fed pivot signal, despite real weekly earnings experiencing a significant 0.5% surge in the month. This upturn in earnings, especially in super core services minus shelter costs, influenced Powell’s outlook, contributing to a marginal rise in Treasury yields and the dollar post-CPI.

EUR/USD witnessed a 0.24% uptick, benefiting from a weaker dollar, declining energy prices, optimistic indicators in Germany’s ZEW expectations index, and tightened bund treasury yield spreads. However, the currency pair is seeking support above specific moving averages to solidify its sizable speculative long position. Meanwhile, USD/JPY experienced a 0.4% drop from recent lows, navigating towards equilibrium after a notable November-December plunge, a portion of it attributed to an exaggerated Fed rate cut and unrealistic BoJ rate hike expectations. The overall trend remains in favor of shorts unless key resistance at 147.76 is breached, considering the historical context of a double-top formation from 2022/23 and the anticipated reversal of the Fed rate hike cycle.

The sterling remained relatively stagnant amid concerns over decelerating UK wage growth and domestic political uncertainty. Looking ahead, market attention shifts to upcoming events such as US retail sales and the ECB and BoE meetings, viewed as preludes to anticipated rate adjustments by March and June, respectively, maintaining a cautious stance in the currency markets.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Struggles Below Key Levels Amid Fed and ECB Decision Expectations

The EUR/USD made a modest ascent, yet failed to sustain levels above 1.0800, lingering below the 200-day SMA. The US Dollar’s mixed sentiment post-US inflation figures and in anticipation of the Federal Reserve’s upcoming decision fuel cautious movements. Despite the CPI aligning with expectations and the USD initially weakening, the currency regained ground. Eyes are on the Fed’s probable unchanged rates and Chair Jerome Powell’s tone. The market eyes the dot plot for 2024 projections, influencing interest rate expectations. With the ECB decision looming and expectations of a non-event, EUR/USD struggles persist amid over 50% odds of a rate cut by March, impeding potential rebounds.

On Tuesday, the EUR/USD moved slightly higher and able to reach near the upper band of the Bollinger Bands. Currently, the price moving slightly below the upper band, suggesting a potential lower movement, potentially reaching the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 50, signaling a neutral outlook for this currency pair.

Resistance: 1.0817, 1.0885

Support: 1.0747, 1.0664

XAU/USD (4 Hours)

XAU/USD Stable Amidst Inflation Data and Fed Anticipation

Gold prices, reflected in XAU/USD, held steady at around $1,980.00, showing marginal movement despite the US Dollar’s early softness due to Asian equity gains. Investor caution prevailed ahead of the US Consumer Price Index (CPI) release, which reported in line with expectations – a monthly increase of 0.1% and an annual rate of 3.1%, slightly down from the previous 3.2%. Although the initial response saw XAU/USD touch $1,996.68 post-news, the Greenback recovered swiftly, leading to speculation on the Federal Reserve’s upcoming monetary policy announcement. As investors anticipate the Fed’s stance on rate adjustments, the steady inflation figures have partially tempered expectations of immediate rate cuts, contributing to short-term concerns and favoring the USD.

On Tuesday, XAU/USD moved slightly lower. Currently, the price is moving between the lower and middle bands of the Bollinger Bands which creates a possibility that XAU/USD might move lower and try to reach our support levels. The Relative Strength Index (RSI) stands at 28, indicating bearish sentiment as it’s in the oversold area.

Resistance: $1,995, $2,016

Support: $1,973, $1,956

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | GDP m/m | 15:00 | -0.1% |

| USD | Core PPI m/m | 21:30 | 0.2% |

| USD | PPI m/m | 21:30 | 0.0% |

| USD | Federal Funds Rate | 03:00 (14th) | 5.50% |

| USD | FOMC Statement | 03:00 (14th) | |

| USD | FOMC Press Conference | 03:30 (14th) | |

| NZD | GDP q/q | 05:45 (14th) | 0.2% |