US data boosts USD ahead of Powell’s address, while EURUSD remains range-bound

The 2025 Finance Magnates Awards recognize excellence in innovation and service among finance industry leaders.

UK manufacturers saw a decline in orders, dropping to -33, which is lower than expected and previously reported.

UK Economy Losing Momentum

Today’s manufacturing data signals that the UK economy is losing momentum faster than expected. The significant drop in total orders suggests that businesses are cutting back on spending, confirming a trend seen since the second quarter. This report is particularly alarming when combined with recent economic stats. July’s inflation rate was stubbornly high at 3.4%, and Q2 GDP growth was nearly flat at just 0.1%. This mix of slowing activity and ongoing cost pressures hints at a tough stagflationary environment. The Bank of England is in a difficult position ahead of its September meeting. With clear signs of weakened demand, we believe the likelihood of another interest rate hike is virtually zero. The market will likely start considering rate cuts in early 2026.Bearish Outlook on British Pound

Our analysis supports a bearish outlook on the British pound. We see potential in buying GBP/USD puts with strike prices below 1.2350, as a breakdown of this support seems likely in the coming weeks. Selling sterling futures is another direct way to express this opinion. The outlook for UK-focused equities, particularly the FTSE 250 index, has also worsened. Squeezed margins and reduced output will lead to weaker corporate earnings reports later this year. We should think about buying put options on this index to protect against or speculate on a drop toward its year-to-date lows. We also expect market volatility to rise as economic uncertainty continues. This situation is favorable for purchasing options to profit from larger price swings. The current market setup reminds us of late 2022, when similar stagflation fears caused significant declines in both the currency and domestic stock markets. Create your live VT Markets account and start trading now.USD strengthens as Powell takes a hawkish stance, while GBP/USD trends downward with market fluctuations

Inflation Concerns and Technical Analysis

Inflation is still a major concern for central banks, even with signs of weakness in the labor market. Core inflation remains above 3%, making it tough to reach the 2% target. On the technical side, GBPUSD is trading lower, with sellers focusing on the 1.3368 level, while buyers may aim to push back to 1.3590. The 4-hour chart shows a slight downward trend that supports ongoing bearish momentum. The 1-hour chart doesn’t provide much new information, but traders are looking for rejections or breaks to determine the next direction. Important upcoming data includes US Jobless Claims, Flash PMIs, and Powell’s speech at the Jackson Hole Symposium. With a cautious mood leading into the Jackson Hole event, the US dollar is gaining strength. Recent data hasn’t prompted Federal Reserve Chair Powell to indicate a rate cut. We expect this careful sentiment to persist until his speech offers more clarity. The latest economic data supports a patient Federal Reserve, leading to increased interest in the dollar. For example, last week’s US jobless claims were solid at 215,000, and July’s CPI showed inflation rise to 3.6%. Consequently, market expectations for year-end rate cuts have decreased.Divergent Inflation Stories

In the UK, inflation remains persistently high, with July’s CPI surprising at 4.2%, significantly above the Bank of England’s target. This ongoing inflation, particularly with core figures above 3% since 2021, prevents the BoE from adopting a dovish stance. This difference in inflation narratives is crucial for the currency pair. For derivative traders, the high uncertainty leading up to tomorrow’s speech suggests elevated implied volatility. This makes buying options a smart strategy to manage risk while preparing for a significant move. We might consider buying puts with strikes near the 1.3368 support level, speculating that a hawkish Powell could push the pair lower. If Powell’s tone is more aggressive than expected and confirms market concerns, the path toward the 1.3368 level could become clearer in the coming weeks. On the other hand, if hints of dovish surprises arise, it could break the current downward trend on the four-hour chart. In that case, call options targeting a rebound towards 1.3590 would become appealing. Remember that Powell’s hawkish speech at Jackson Hole last year caused significant market changes, so the risk of sharp movements is real. Therefore, it’s wise to use strategies that limit potential losses. The key technical levels of 1.3368 and 1.3590 provide excellent guidance for setting option strike prices around this critical event. Create your live VT Markets account and start trading now.Major currencies in Europe see sluggish trading due to cautious market sentiment and upcoming events

Cautious Atmosphere in Equities

A cautious mood is present in the equities market, which affects currency trading. Traders are closely watching Fed Chair Powell’s speech, as it could influence market trends. Other upcoming factors that might affect the market include Walmart earnings, US jobless claims, PMI data, and comments from Fed officials. For now, European trading is peaceful, typical of a summer day. For the week, notable changes in dollar pairs include EUR/USD down by 0.4% and USD/JPY up by 0.4%. GBP/USD fell by 0.5%, while USD/CHF dropped a bit by 0.1%. USD/CAD increased by 0.4%, whereas AUD/USD and NZD/USD faced bigger drops of 1.2% and 1.5%, respectively. The declines in both Australian and New Zealand dollars are mainly due to a cautious market outlook and the Reserve Bank of New Zealand’s surprise decision to adopt a dovish stance. The current market calm feels like the quiet before the storm as everyone awaits Powell’s speech at Jackson Hole. This low-volatility atmosphere, with the CBOE Volatility Index (VIX) resting at a low 14, presents a unique opportunity for options traders. We see this as a chance to purchase volatility through strategies like straddles, as a significant price movement in the dollar is expected after the Fed provides clarity. Powell’s speech tomorrow is crucial, and we expect a reaction in the US dollar. The last US Core CPI figure for July 2025 was persistently high at 3.1%. If he adopts a hawkish tone, the dollar could rise sharply. Reflecting on Powell’s impactful speech in August 2022, which caused the S&P 500 to drop over 3% in one day, it’s clear that unexpected announcements can trigger swift and significant market changes.ECB Policy and Market Reactions

The European Central Bank appears satisfied with keeping rates steady for now, especially after recent solid PMI results. This decision creates a clear difference from the Federal Reserve, which continues to tackle ongoing inflation. We think this difference makes buying put options on the EUR/USD a smart strategy against a strong dollar in the upcoming weeks. We are also monitoring the Australian and New Zealand dollars, which have shown notable weakness this week. The unexpected dovish shift from the Reserve Bank of New Zealand yesterday highlights their fragility in a cautious market environment. If Powell hints at maintaining higher rates for a longer period, these commodity-linked currencies will likely decrease further against the dollar. Create your live VT Markets account and start trading now.Notification of Server Upgrade – Aug 21 ,2025

Dear Client,

As part of our commitment to provide the most reliable service to our clients, there will be maintenance this weekend.

Maintenance Details:

Please note that the following aspects might be affected during the maintenance:

1. The price quote and trading management will be temporarily disabled during the maintenance. You will not be able to open new positions, close open positions, or make any adjustments to the trades.

2. There might be a gap between the original price and the price after maintenance. The gaps between Pending Orders, Stop Loss, and Take Profit will be filled at the market price once the maintenance is completed. It is suggested that you manage the account properly.

3. During the maintenance period, VT Markets APP will not be available. It is recommended that you avoid using it during the maintenance.

4. During the maintenance hours, the Client portal will be unavailable, including managing trades, Deposit/Withdrawal and all the other functions will be limited.

The above data is for reference only. Please refer to the MT4/MT5 software for the specific maintenance completion and marketing opening time.

Thank you for your patience and understanding about this important initiative.

If you’d like more information, please don’t hesitate to contact [email protected].

Société Générale highlights Jackson Hole’s focus on labor market discussions amid Fed’s internal debates

UK’s flash services PMI surpassed predictions at 53.6, while manufacturing PMI declined below expectations

Payroll Numbers Decline

Payroll numbers are down due to weak order books and worries about rising staff costs tied to the autumn Budget. These issues contribute to ongoing inflation pressures, which reached 3.8% in July. The prospects for further interest rate cuts this year are unclear, as we need more data to assess the sustainability of growth and inflation. The economic data from August shows unexpected growth at its fastest pace since last year, mainly thanks to the services sector. This makes us reconsider the likelihood of the Bank of England lowering interest rates again this year. The key takeaway is that policy may remain tighter for longer than we initially thought. The Bank of England has cut its main interest rate twice since spring 2025, bringing it down to 4.0% to stimulate the economy. However, this recent report, following July’s inflation figure of a stubborn 3.8%, challenges expectations for another rate cut before winter. This suggests that speculations about immediate price cuts in short-term interest rates may need to be revised.Currency Traders and the Pound

For currency traders, this unexpected strength might support the pound. As the chance of another rate cut decreases, sterling may perform better against currencies from central banks still expected to ease policy. Options strategies to protect against a sharp drop in GBP or position for modest gains may now be more suitable. The outlook for UK stocks has become more complex, indicating higher volatility. While stronger economic growth is beneficial for company earnings, the ongoing weakness in manufacturing and reports of significant job cuts are concerning. With the UK unemployment rate already at 4.5% in Q2 2025, this tension between a robust service sector and a fragile industrial base could lead to unpredictable market movements, making volatility-focused options on the FTSE index more appealing. We must heed the report’s warnings about weak demand and sharply falling goods exports. Since early 2025, UK goods exports to the EU have declined by over 5%, significantly affecting manufacturers. As such, any investment strategies should be tactical, as the upcoming official inflation and labor market reports will be crucial in determining if this economic strength can be maintained. Create your live VT Markets account and start trading now.In August, manufacturing thrived, enhancing the eurozone economy, while services showed consistent growth trends.

Manufacturing Output Improvement

The manufacturing output index improved, hitting a 41-month high, even as cost pressures in the services sector increased. Despite challenges like U.S. tariffs and uncertainty, economic activity is gaining momentum, with both manufacturing and services experiencing growth. Germany is at the forefront of this manufacturing increase, while France seems to be stabilizing after facing difficulties. Trade policies are impacting foreign orders in the manufacturing sector, which declined for the second month in a row. Both Germany and France are grappling with foreign demand challenges, despite some signs of recovery. The unexpected strength in manufacturing is making the overall economy look better than expected. This may pose risks for those betting against European stock indices like the DAX. The robust manufacturing performance, the best in over three years, could be a good reason to consider buying call options or selling put spreads.Implications for the European Central Bank

The rise in price pressures, especially in services, complicates the European Central Bank’s (ECB) outlook. Expectations for near-term interest rate cuts may need to be reconsidered, as the ECB remains focused on wage growth. Eurozone core inflation dipped to 2.8% last month in July 2025, but this report suggests it could become sticky, making interest rate swap markets interesting. The outlook for the euro is mixed, which is ideal for traders seeking volatility. Strong domestic data boosts the currency, but the decline in foreign orders linked to U.S. trade policy and the aftermath of the 2024 election cycle pulls it down. This situation hints that buying straddles or strangles on EUR/USD could be a smart strategy for potential big moves in either direction. It’s important to watch the gap between Germany and the rest of the Eurozone. With German manufacturing reaching a 38-month high, derivative plays favoring German industrial stocks over the broader Euro Stoxx 50 index may perform well. This aligns with Germany’s surprisingly strong factory orders data from June 2025, indicating relative strength that can be leveraged. Create your live VT Markets account and start trading now.Dividend Adjustment Notice – Aug 21 ,2025

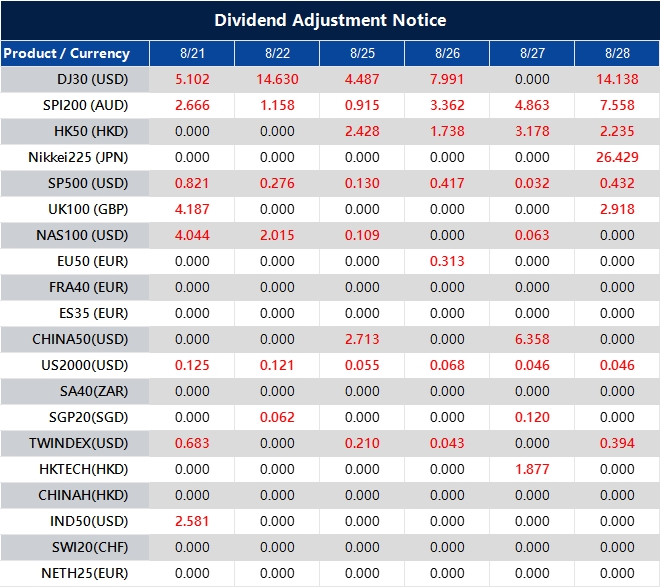

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].