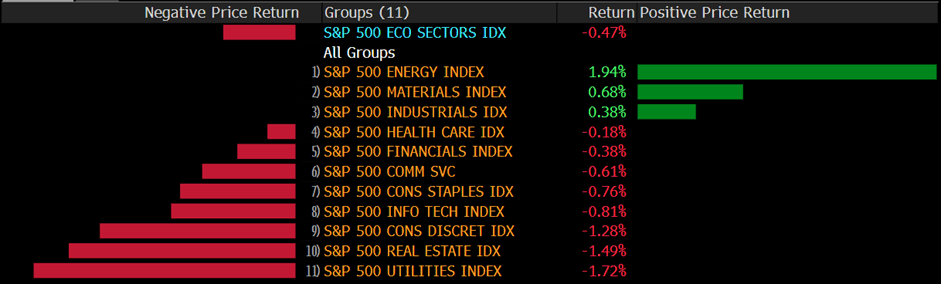

US stocks managed to snap a three-week losing streak following Friday’s rally. Market sentiment remained upbeat despite a report showing resilience in the service sector, as more investors wagered the impact of the Fed’s hikes on the economy would be delayed. Bond yields rose for the week though Treasuries rallied on Friday, with the 10-year yield hovering around 3.96%. A dollar benchmark had its worst week since mid-January, ending four consecutive weeks of gains.

All eyes will be on the non-farm payrolls report next week for clues on whether the economy can handle more rate hikes. Data this week showed continued labor-market resilience in the US, supporting the case for the Fed to stick to its tightening policy. This theme had pushed almost every major asset into the red in February. In the benchmark, the Nasdaq 100 scored its best day since early February and all sectors of the S&P500 stayed in positive territory on Friday. Especially for the Information technology, Consumer Discretion, and Communication Services, sectors recorded more than 2% gains on a daily basis. Apart from this, the Dow Jones Industrial Average rose 1.2%, the Nasdaq 100 rallied by 2%, and the MSCI world index edged higher by 0.4% on Friday.

Main Pairs Movement

On Friday, the US dollar fell 0.48% against a basket of major currencies as investors increasingly bet that the Fed would hold off on raising interest rates, despite a report showing resilience in the service sector. The DXY index remained bearish throughout the day, closing below the key level of 104.530, even with the strong-than-expected labor report.

In contrast, the GBPUSD saw strong upward momentum, surging above the 1.2040 level, buoyed by the weaker US dollar. The pair closed the day with a 0.75% gain. The EURUSD also recovered, rising 0.36% on Friday, supported by the falling US dollar.

Meanwhile, gold rallied dramatically with a 1.12% gain on Friday, marking its first weekly gain in five weeks as buyers cheered the softer US dollar. The XAUUSD was surrounded by strong bullish momentum, closing above the $1855 mark on the last day of the week.

Technical Analysis

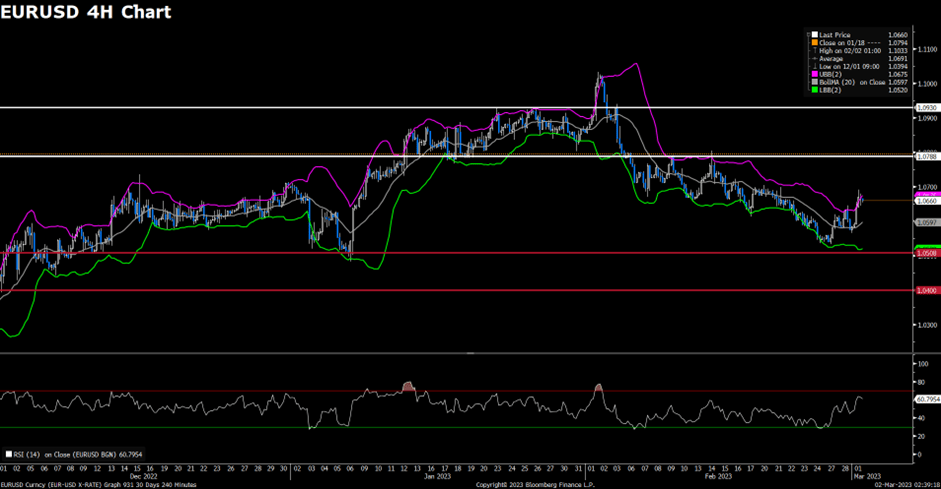

EURUSD (4-Hour Chart)

On Friday, the EURUSD saw a rally above the 1.0600 level in the middle of the American trading session. The US ISM Non-Manufacturing PMI for February was 55.1, which was slightly lower than the previous month’s 55.2, but it exceeded market expectations of 54.5, indicating that business activity is still strong. However, the Prices Paid Index subcomponent, which is looked at by investors for inflationary pressures, increased to 65.6, above estimates of 64.5, acting as a tailwind for the US Dollar. In the Eurozone, ECB Vice-President De Guindos suggested that headline inflation should fall below 6% at some point in mid-year. He also reiterated that decisions on future rate hikes will remain data-dependent and that the economy of the region is doing better than expected.

From a technical perspective, the four-hour scale RSI indicator rallied to the neutral region at 51 figures, suggesting that the pair currently has no obvious tendency. As for the Bollinger Bands, the pair was pricing around the 20-period moving average, showing that the pair now needs some fuel to help decide the direction.

Resistance: 1.0788, 1.0929

Support: 1.0508, 1.0400

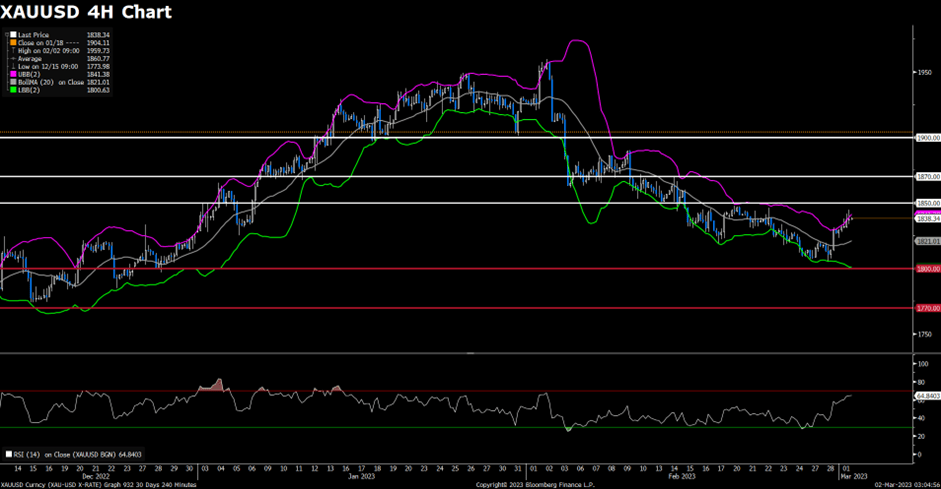

XAUUSD (4-Hour Chart)

Despite the ISM Services PMI strengthening the US Dollar, gold prices rebounded toward the $1850 level on Friday. Additionally, the benchmark 10-year US Treasury bond yield remaining below 1.4% at the time of writing further supported the XAUUSD’s upward movement. The latest round of Federal Reserve (Fed) talks has renewed speculation about a policy pivot and combined with mixed US data, put downside pressure on the US Dollar and Treasury bond yields. However, cautious sentiment ahead of top-tier data/events and concerns about the Sino-American tussle over China’s ties to Russia is limiting XAU/USD’s immediate upside potential. Investors should focus on next week’s Fed Chairman Jerome Powell’s testimony and the monthly US jobs report for February.

From a technical standpoint, the four-hour RSI indicator has risen into the overbought zone at 72, indicating strong bullish momentum for the pair, and investors should be cautious of potential corrective pullbacks. Regarding the Bollinger Bands, the pair continues to price along the upper band, but the distance between the upper and lower bands has decreased, indicating that the upward trend may not be sustainable for an extended period.

Resistance: 1850, 1870, 1900

Support: 1820, 1800

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Construction PMI (Feb) | 17:30 | 49.1 |

| CAD | Ivey PMI (Feb) | 23:00 | 55.9 |